The usage of crypto in 2025 assumed a fairly sensible dimension. Whereas institutional funding contributed to progress within the U.S. and Europe, rising markets turned digital belongings into instruments for on a regular basis finance, enabling remittances, hedging in opposition to inflation, and creating new financial alternatives. Stablecoins turned the worldwide spine of cross-border remittances, driving transactions throughout platforms on a world scale.

This report exhibits a world map of crypto adoption, revealing which markets, customers, and applied sciences outlined adoption, and why the actual narrative shouldn’t be about hype however about utility, entry, and structural integration into the worldwide monetary system.

Asia Strikes Once more!

If one area outlined crypto adoption in 2025, it was Asia. No different a part of the world matched its mixture of retail scale, financial incentives, stablecoin dependence, and fast-maturing coverage environments. Chainalysis knowledge reinforces this pattern: In 12 months ending June 2025, Asia-Pacific (APAC) recorded a 69% year-over-year surge in on-chain exercise, with whole transaction quantity rising from $1.4 trillion to $2.36 trillion. India, Vietnam, and Pakistan had been among the many main engines of this progress.

Taken collectively, the numbers present that Asia is now not only a high-population area dabbling in crypto; it’s the world’s most energetic, structurally vital crypto hall.

India: The middle of gravity

India held onto its #1 place in 2025, pushed by a uncommon mixture of scale, digital readiness, and rising home sophistication. An enormous, tech-native inhabitants continues to undertake crypto by mobile-first fintech platforms, whereas a rising class of retail merchants participates in each spot and derivatives markets. India’s vibrant Web3 developer ecosystem additionally provides structural depth to adoption, attracting international consideration and funding.

Additionally Learn: India’s Grassroots Crypto Surge: A Beacon for Monetary Inclusion or a Regulatory Dilemma?

Pakistan: excessive demand + significant coverage shifts

Pakistan’s rise into the worldwide prime tier mirrored the aggressive mixture of client want and coverage modernization. Stablecoins and crypto rails turned important for remittance-heavy households and a younger inhabitants going through restricted entry to conventional monetary companies. The federal government’s institution of a nationwide crypto council and a devoted digital-asset regulator in 2025 marked a turning level, sending sturdy alerts to each home customers and worldwide buyers. These coverage shifts helped speed up grassroots adoption, producing way more home on-chain exercise than in earlier years and demonstrating how regulatory readability can catalyze actual utilization fairly than suppress it.

Vietnam, Philippines, Indonesia: Southeast Asia’s second wave

Southeast Asia continued a long-running adoption pattern in 2025, however at a scale and depth far past earlier years. In line with TRM Labs’ 2025 international crypto adoption rankings, the Philippines (#4), Indonesia (#6), and Vietnam (#7) shaped the core of this regional acceleration.

In all three markets, gig staff, freelancers, and on-line earners rely closely on stablecoins for quick, low-cost funds. Remittances more and more transfer by stablecoin rails and native exchanges that supply cheaper and quicker alternate options to financial institution corridors. Fintech apps throughout the area additionally started integrating crypto infrastructure within the background, permitting customers to transact with out essentially realizing they’re utilizing blockchain expertise.

The U.S. Grew Strongly However Didn’t Dominate the Adoption Story

America retained #2 place in international adoption rankings in 2025, supported by strong digital-asset infrastructure and a rising presence of conventional finance. Not like areas the place crypto is embedded in on a regular basis monetary life, the U.S. revival was overwhelmingly institution-led, fairly than pushed by grassroots adoption. Transaction volumes rose by roughly 50% from 2024 to mid-2025, exceeding $1 trillion, fueled partially by practically $15 billion in internet inflows into spot Bitcoin ETFs.

An establishment-led increase

The profile of American crypto customers in 2025 mirrored this institutional tilt. Bitcoin accounted for round 41% of all fiat-to-crypto purchases, highlighting the affect of ETF-driven demand and the continued desire for BTC as the only publicity for regulated buyers. Hedge funds expanded their digital-asset allocations, company treasuries experimented with stablecoins and early tokenized debt devices, and pension funds examined small-scale diversification applications.

A market outlined by regulatory readability

This institution-driven progress was strengthened by one of many clearest regulatory years in U.S. crypto historical past. The GENIUS Act was handed, and the Home authorized the CLARITY Act, signalling bipartisan recognition that digital belongings are a everlasting fixture of the monetary system. New steering on custody, asset classification, and disclosure requirements offered long-awaited authorized certainty for institutional gamers.

Sturdy progress, however restricted retail adoption

Regardless of the size of institutional exercise, the U.S. didn’t emerge as the worldwide middle of on a regular basis crypto utilization. Retail participation grew, however not on the depth seen in areas like Asia, Africa, or Latin America markets, the place crypto addresses pressing, sensible wants similar to inflation hedging, remittances, casual FX entry, and fintech-enabled funds. In distinction, U.S. adoption remained largely investment-driven, concentrated amongst higher-income customers and professionally managed funds, fairly than on a regular basis customers.

Additionally Learn: Is the U.S. Nonetheless Behind in Crypto as 40% of American Adults Now Personal Digital Belongings?

Latin America Grew to become the Most Numerous Adoption Area

Between July 2022 and June 2025, Latin America processed practically $1.5 trillion in crypto transaction quantity, solidifying its place as one of many world’s most dynamic and multifaceted crypto areas. The area’s distinctive mix of excessive inflation, forex volatility, and tight capital controls pushed thousands and thousands towards stablecoins as each a monetary refuge and a sensible software for day-to-day transactions. On the similar time, Latin America’s function as a world remittance hub accelerated crypto utilization for quick, low-cost cross-border transfers, giving the area a distinctly utilitarian adoption profile.

Additionally Learn: Crypto in Latin America: Adoption Booms as Media Visibility Falls

Brazil: The area’s anchor and breakout chief

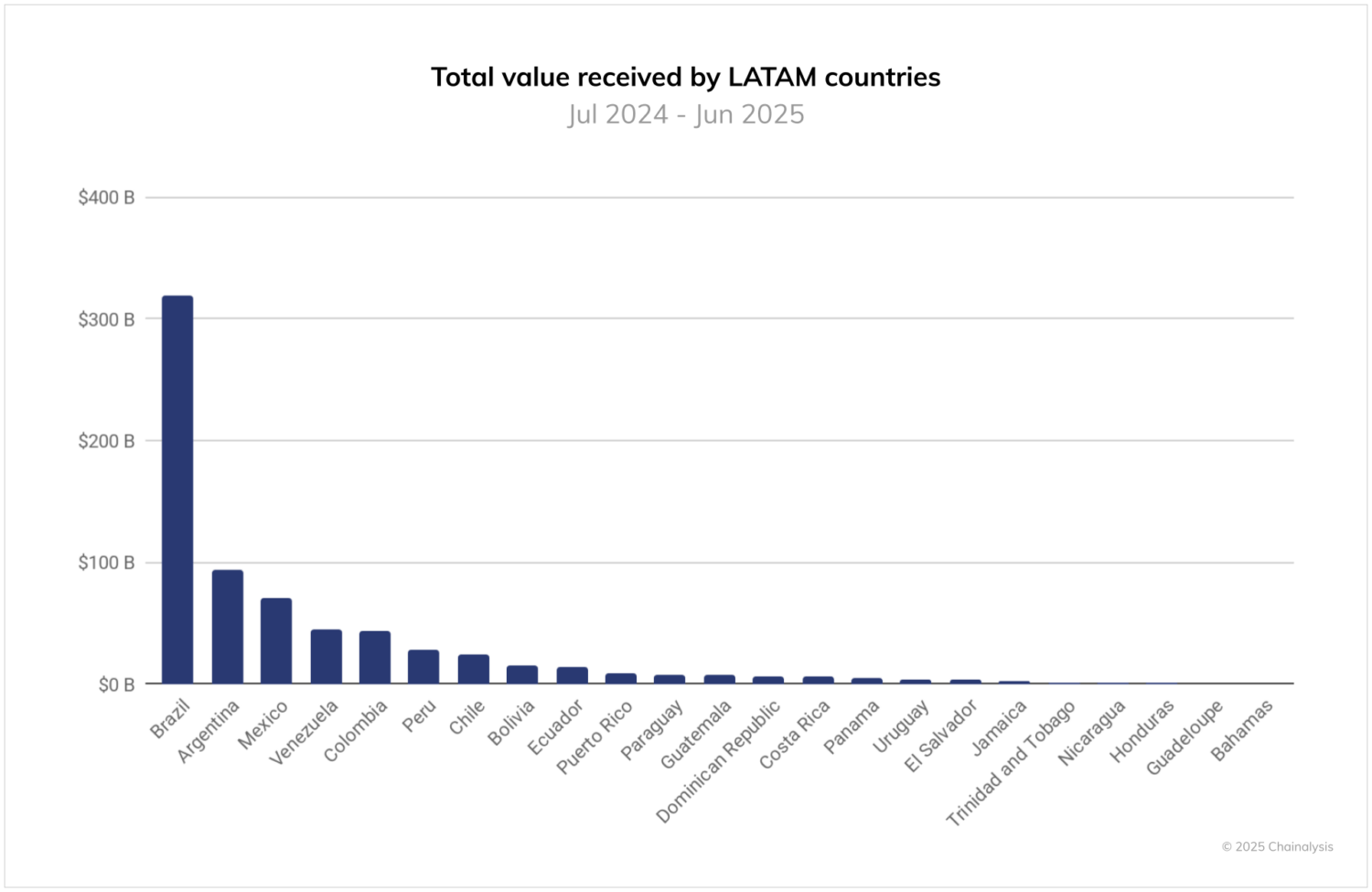

Brazil unquestionably dominated Latin America’s crypto panorama. In line with Chainalysis, the nation obtained $318.8 billion in on-chain worth, practically one-third of all exercise within the area. With a staggering 109.9% year-over-year progress price, Brazil emerged as LATAM’s most dynamic and influential crypto financial system.

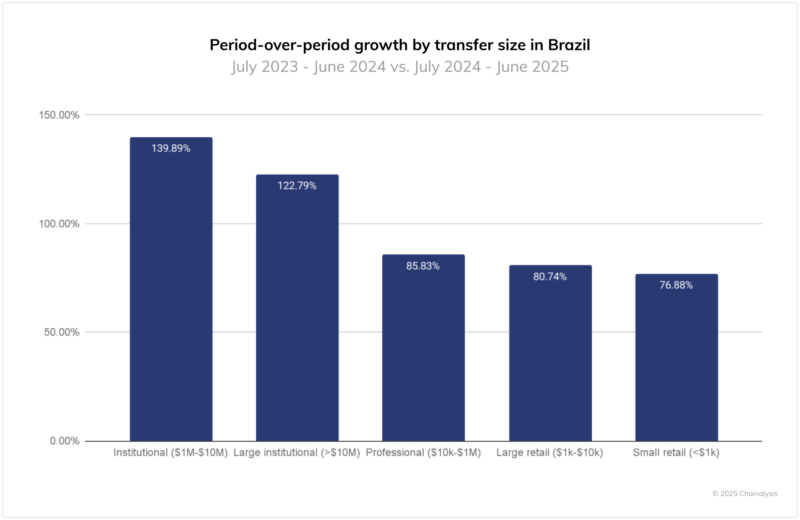

Brazil’s progress was broad-based, spanning all switch sizes from retail purchases to large-scale institutional flows. Whereas each phase expanded meaningfully, institutional and high-value transfers stood out, every rising by greater than 100%, highlighting the nation’s rising prominence in professionalized crypto markets.

The power of Brazil’s adoption was additionally evident in local-currency fiat-to-crypto transactions, which grew quicker than in Argentina, Mexico, or Colombia. Throughout the nation, customers more and more engaged by centralized exchanges and fintech apps, with a big, energetic buying and selling group underpinning progress. Youthful contributors particularly contributed to the rise of DeFi utilization, increasing past easy buying and selling to take part instantly in decentralized protocols.

A large hole after Brazil

Following Brazil’s dominance, the following tier of Latin American crypto markets illustrates the area’s financial variety and the vary of adoption drivers.

Argentina

Argentina recorded $93.9 billion in crypto transaction quantity, pushed largely by crisis-oriented components. Inflation and forex instability created a distinctly survival-focused crypto ecosystem, the place customers relied on stablecoins for dollar-equivalent financial savings, peer-to-peer buying and selling, casual funds, and enterprise settlements. Argentina’s political reset in 2025 additional intensified public debate round digital asset regulation, pulling crypto deeper into mainstream monetary conversations. Over the previous three years, cell pockets utilization in Argentina has elevated sixteenfold, clearly indicating the fast integration of crypto into on a regular basis monetary life.

Venezuela

Venezuela mirrored Argentina’s crisis-driven adoption patterns. With $44.6 billion in quantity, residents turned to crypto to safeguard wealth from hyperinflation, conduct casual commerce, and preserve entry to dependable cost rails amid a collapsing native forex. Stablecoins, particularly, turned important for each households and companies navigating excessive volatility.

Mexico

Mexico recorded $71.2 billion in quantity, showcasing a distinct adoption sample centered on cross-border and commerce-driven wants. The nation has emerged as a fast-growing remittance hall, with U.S.-linked flows more and more routed by stablecoins. Small companies and retailers have adopted crypto cost options, fintech apps challenge crypto-linked debit playing cards, and SMEs use stablecoins for import/export settlements, reflecting sensible, real-world use fairly than hypothesis.

Colombia

Columbia recorded $44.2 billion in quantity and exhibited cyclical adoption patterns influenced by native financial pressures. Regardless of fluctuations, crypto remained a dependable software for cross-border funds, small-business transactions, and remittances, highlighting the area’s reliance on digital belongings as a practical answer to monetary inefficiencies.

Peru

Peru equally demonstrated commerce-driven adoption, leveraging stablecoins and crypto infrastructure to facilitate remittances, service provider funds, and small-business operations. Throughout Mexico, Colombia, and Peru, crypto adoption was firmly rooted in sensible, transaction-oriented use instances fairly than speculative buying and selling.

Collectively, these 5 international locations account for almost all of Latin America’s crypto exercise exterior Brazil, illustrating a area outlined not solely by quantity however by the varied and economically nuanced motivations behind crypto adoption, from crisis-driven survival methods in Argentina and Venezuela to remittance- and commerce-focused adoption in Mexico, Colombia, and Peru.

Africa’s Story Was About Utility, Not Hypothesis

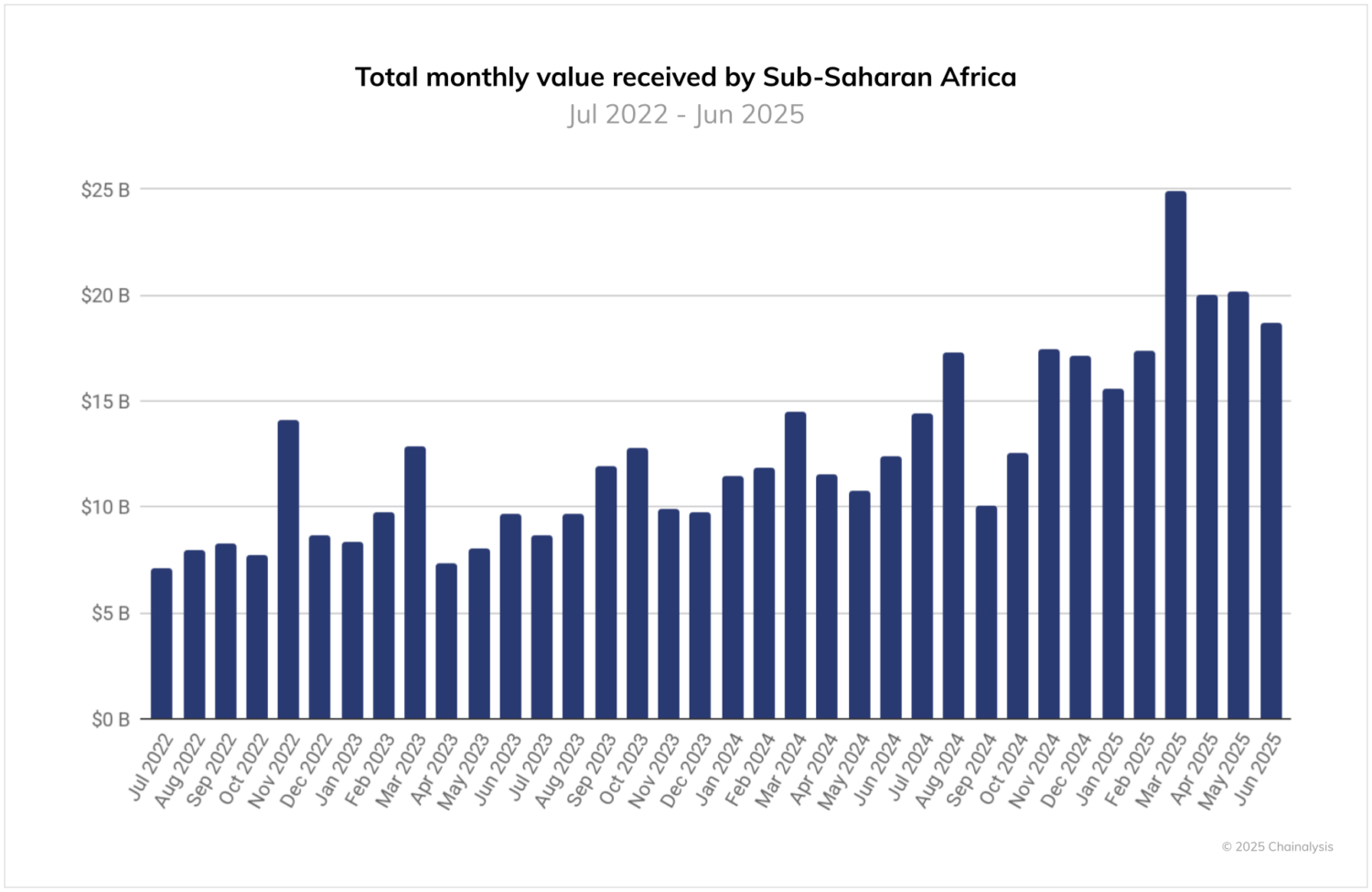

Sub-Saharan Africa (SSA) entered 2025 with one of many world’s most utility-driven crypto ecosystems. Between July 2024 and June 2025, the area obtained greater than $205 billion in on-chain worth, a 52% year-over-year enhance.

What makes Africa stand out shouldn’t be the dimensions of its volumes however how the expertise is used. Over 8% of all worth transferred in SSA between July 2024 and June 2025 consisted of small transactions under $10,000, in comparison with 6% globally. That hole tells a deeper story: crypto in Africa is intimately linked to monetary inclusion, not hypothesis. This exhibits that crypto has turn into a pure extension of the continent’s digital monetary evolution.

Additionally Learn: Inside Africa’s Monetary Reinvention: The Surge of Stablecoin Adoption

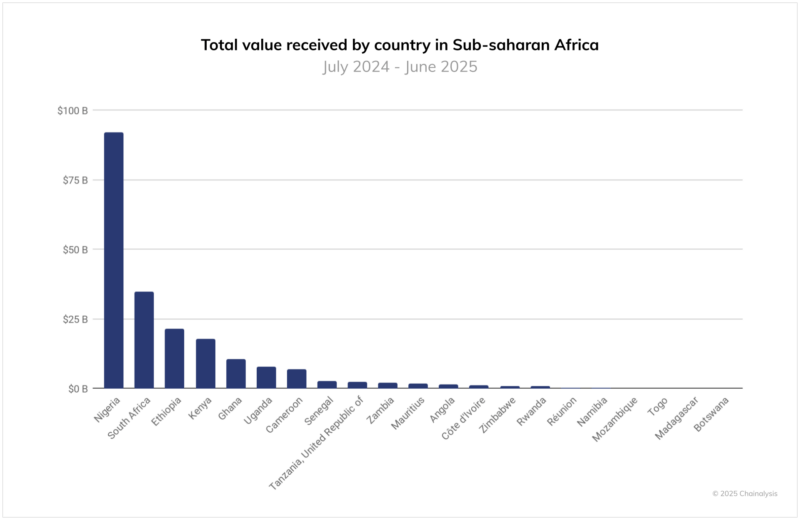

Nigeria led the area—powered by stablecoins and financial stress

In 2025, Nigeria firmly cemented its place because the main crypto market in Africa, receiving over $92 billion in on-chain worth.

This dominance was fueled by a mix of financial pressures and a inhabitants more and more turning to crypto for each sensible and protecting monetary functions.

A sudden devaluation of the naira in early 2025 performed a central function, driving residents to hunt refuge in digital belongings as a hedge in opposition to inflation. Such forex shocks have a twin impact: they enhance the variety of folks coming into crypto, notably stablecoins, and concurrently inflate transaction volumes in native forex phrases, because it takes extra naira to accumulate the identical quantity of tokens.

Nigeria’s financial atmosphere additionally created fertile floor for stablecoin adoption. Persistent excessive inflation, restricted entry to U.S. {dollars}, and a major hole between official and parallel international change charges made USDT and different stablecoins indispensable. Households more and more used them for financial savings, small and medium enterprise imports and funds, casual cross-border commerce, and revenue from freelance or digital work. On

Bitcoin remained the overwhelmingly dominant asset, absorbing 89% of fiat-to-crypto purchases in Nigeria. For a lot of Nigerians, BTC serves as a well-recognized model, a dependable hedge in opposition to volatility, and a easy, trusted entry level into the crypto ecosystem.

South Africa: A extra institutional, regulated crypto ecosystem

South Africa’s crypto panorama presents a stark distinction to Nigeria’s, reflecting a market formed extra by institutional maturity than by speedy financial pressures. The nation boasts one of many continent’s most superior regulatory frameworks for digital belongings, with lots of of registered digital asset service suppliers (VASPs) working legally. This regulatory readability has created an atmosphere the place institutional gamers really feel assured to interact actively available in the market.

Patterns in fiat-to-crypto purchases additional illustrate the market’s sophistication. South Africans allocate a bigger share of their purchases to belongings like Ethereum and XRP in comparison with Nigeria, reflecting entry to deeper liquidity on centralized exchanges, extra diversified funding methods, and a better proportion of customers integrating crypto into broader portfolio administration. Bitcoin stays the dominant asset, however its function is much less about financial necessity and extra a part of a structured funding strategy.

East Africa: Crypto as a remittance and commerce rail

In East Africa, international locations similar to Kenya, Ethiopia, and Rwanda skilled regular crypto adoption pushed primarily by sensible, on a regular basis monetary wants fairly than speculative exercise. Residents more and more turned to digital belongings for low-cost cross-border remittances, service provider funds, and various entry to U.S. {dollars} by way of stablecoins. Youth-driven on-line buying and selling communities additionally contributed to the area’s rising engagement, creating vibrant ecosystems for studying, experimentation, and peer-to-peer change.

Ethiopia, particularly, emerged as a stunning progress story. Restricted entry to international change, mixed with rising fintech penetration, created very best circumstances for crypto utilization. These dynamics mirrored patterns seen in different high-restriction economies, the place expertise adoption meets real-world monetary necessity.

North Africa: Progress regardless of restrictions

Throughout North Africa, crypto adoption continued to rise even in international locations with vital authorized limitations, together with Egypt, Morocco, Algeria, and Tunisia. Regardless of restrictive frameworks, these markets constantly rank excessive in international adoption indexes, reinforcing a essential perception: bans don’t eradicate crypto exercise; they merely shift it to casual and underground channels.

In these contexts, digital belongings serve sensible functions. Residents depend on crypto as a workaround for capital controls, a software for remittances, and a way of accessing dollar-denominated stability. Whereas regulatory resistance persists, person demand stays strong, highlighting the resilience of crypto adoption in North Africa regardless of structural obstacles.

Europe’s Fragmented however Quick-Shifting Crypto Map

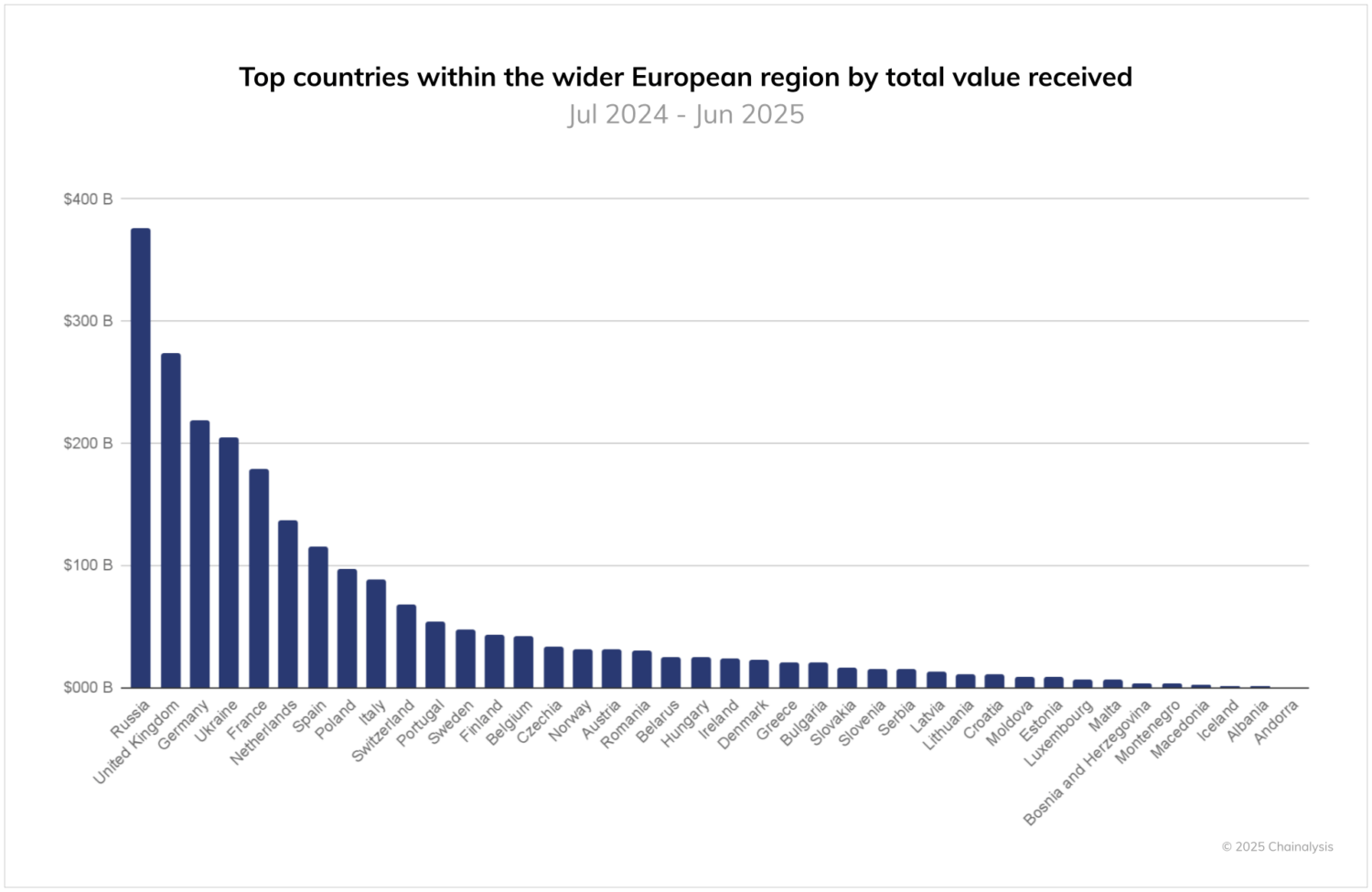

Between July 2024 and June 2025, Europe noticed a fancy adoption panorama, one formed not by a single unified pattern however by sharp contrasts between Western markets, institutional flows, and the unusually intense exercise rising from Europe.

Russia: The regional anchor

Russia solidified its place as Europe’s largest crypto market, receiving roughly $379.3 billion in transaction quantity, up sharply from $256.5 billion the earlier yr.

This exceptional progress was fueled by two key drivers. First, a surge in institutional-scale transfers, notably these exceeding $10 million, pushed exercise greater, with massive transactions rising 86% year-over-year, practically double the speed noticed throughout the remainder of Europe. Second, accelerating DeFi participation drew each people and organizations towards on-chain protocols, shifting a major share of exercise away from centralized platforms. Collectively, these dynamics positioned Russia on the prime of Europe’s crypto ecosystem, making it the continent’s most influential hub by absolute transaction quantity.

Japanese Europe: Small economies, huge crypto footprint

Adjusting for inhabitants tells a really completely different story; international locations like Ukraine, Moldova, Georgia, Armenia, Belarus, and Latvia constantly rank among the many world’s most crypto-active nations per capita. Their adoption is fueled by financial instability, regional battle, political uncertainty, and capital motion restrictions, making crypto a sensible retailer of worth and mobility software fairly than a speculative asset. The rise of cross-border work and gig markets additional deepened reliance on stablecoins and on-chain funds, giving these smaller economies an outsized function in Europe’s crypto map.

Ukraine: Europe’s per-capita outlier

Ukraine has remained one of many globe’s highest-engagement crypto markets since 2022, with utilization pushed by necessity fairly than funding. Crypto fills structural gaps, offering monetary entry, cross-border mobility, and transactional resilience, which retains Ukraine constantly on the prime of Europe’s population-adjusted adoption rankings.

United Kingdom: A mature, evolving institutional hub

Whereas the U.Ok. ceded the highest spot to Russia in whole quantity, it nonetheless recorded 32% year-over-year progress, reflecting a market that’s evolving, not shrinking. Retail customers more and more migrate to DeFi and various buying and selling venues, whereas institutional gamers proceed to depend on regulated centralized platforms. This dual-track behaviour positions the U.Ok. as one among Europe’s most balanced and structurally secure crypto markets.

Stablecoins Grew to become the Actual World Adoption Layer

In 2025, stablecoins quietly emerged because the spine of world crypto adoption. Throughout practically each area, they powered remittances, enabled financial savings in U.S. greenback equivalents, served as settlement rails for commerce, and have become the foundational asset for buying and selling and on-chain liquidity. Their utility prolonged past particular person customers, attracting institutional curiosity as a dependable infrastructure for funds and cross-border operations.TRM evaluation exhibits that stablecoins accounted for 30% of crypto transaction quantity between January and July 2025, with international transaction quantity surpassing $4 trillion by mid-year, an 80% year-over-year enhance.

By mid-2025, international stablecoin transaction quantity had surpassed $4 trillion, reflecting progress of greater than 80% year-over-year. Whereas USDT and USDC remained the dominant gamers, smaller newcomers similar to PYUSD, EURC, and varied domestic-currency-backed cash skilled fast adoption, demonstrating the rising variety of the stablecoin ecosystem.

The mixing of stablecoins into mainstream monetary rails additional accelerated their attain. Stripe, Visa, Mastercard, and a number of neobanks launched stablecoin cost merchandise, whereas retailers throughout Latin America, Africa, and Southeast Asia more and more accepted stablecoins for settlement by fintech apps. On the similar time, conventional banks explored issuing their very own stablecoins or tokenized deposits, signalling a rising convergence between digital belongings and standard finance.

READ ALSO: 5 Highly effective Charts, 25 Sector Drivers That Outlined Crypto’s $4Trillion Yr

What 2025 Tells Us Concerning the Subsequent Strikes in Crypto

1. Stablecoins will turn into the actual liquidity anchor

Stablecoins turned crypto’s settlement spine in 2025, powering remittances, financial savings, and institutional liquidity, and 2026 will lean even tougher on them. Builders must double down on stablecoin-native wallets and cost instruments, and policymakers will form the panorama as they roll out clearer guidelines for belongings that more and more behave like cross-border cash.

2. Institutional adoption will deepen by regulated merchandise

Regulated ETFs, clearer custody requirements, and tokenization pilots anchored institutional flows in 2025, setting the stage for deeper participation in 2026. Merchants ought to watch ETF and treasury inflows for shifts in danger urge for food, builders ought to increase regulated infrastructure like tokenized bonds and enterprise-grade wallets, and policymakers will hold mixing conventional finance guidelines with digital-asset oversight.

3. U.S. regulatory readability will funnel extra institutional capital, however not outline international adoption

As U.S. guidelines stabilize, institutional allocators will hold leaning on ETFs, tokenized treasuries, and compliant rails in 2026, but international adoption will nonetheless be formed elsewhere. Merchants can learn ETF flows as a barometer of institutional urge for food; builders ought to deal with U.S. compliance as crucial however inadequate for international scale; and policymakers worldwide will proceed crafting frameworks that matter simply as a lot.

4. The following wave of crypto progress can be pushed by perform, not hypothesis

The markets that grew in 2025 rewarded merchandise that truly moved cash, protected financial savings, or opened entry to credit score, signalling a purposeful shift that may outline 2026. Merchants will favour tokens tied to actual cost or credit score ecosystems, builders might want to ship instruments folks genuinely use, and policymakers will deal with frameworks that help sensible monetary entry, not hype cycles.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein must be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of monetary loss. All the time conduct due diligence.

If you wish to learn extra market analyses like this one, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Neighborhood.