Stablecoins are quickly turning into one of many dominant use instances linking crypto and tradfi.

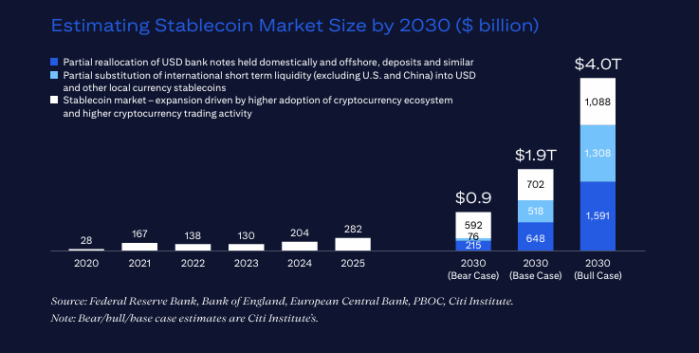

Current forecasts, institutional strikes, and regulatory efforts counsel the sector is reaching an inflection level. And now, at the least one evaluation believes the stablecoin market cap alone may attain $4 trillion by 2030.

That’s twice the present dimension of all the crypto financial system in stablecoins alone.

Forecasting a Stablecoin Increase

That projection originates from Citi, whose analysts now estimate a base case of $1.9 trillion in stablecoin issuance by 2030, up from earlier forecasts. In a bullish state of affairs, the financial institution predicts issuance reaching $4 trillion.

If stablecoins had been to be built-in in every single place, the analysts counsel they may help as a lot as $100T of annual transaction quantity, a scale dwarfing at this time’s markets.

The largest actual alternative is in cross-border settlement, the place inefficiencies nonetheless exist. Even so, Citi highlights that tokenized financial institution deposits might surpass stablecoins in utilization by 2030.

Financial institution tokens are tokenized deposits, deposit tokens, and different bank-issued tokenized belongings. They supply the belief, familiarity, and regulatory safeguards of financial institution cash, and lots of companies desire them over stablecoins.

The ultimate takeaway from the report highlights simply how massive the market could possibly be. Nonetheless, simply how a lot progress stays – even in a bullish case of $100T in funds yearly, stablecoins could be a small share of the $5T-$10T main banks ship and obtain day by day.

The present stablecoin market grew from round $200B in early 2025 to almost $280B, regardless of experiencing important market swings. Governments and regulators are actively discussing methods to regulate the issuance, backing, and redemption of those asset devices.

Past market danger, stablecoins carry macro and geopolitical stakes.

If dollar-pegged stablecoins preserve dominance, capital flows and funds globally might more and more favor U.S. affect.

The extra stablecoins proliferate, the extra issuers will doubtless maintain U.S. Treasuries as reserve backing.

This creates a strategic vulnerability for Europe: a overseas digital forex may undermine home financial management.

Europe’s Transfer: Consortium for a Euro-Backed Stablecoin

In response, 9 European banks — together with UniCredit, ING, CaixaBank, SEB, and Raiffeisen — have teamed as much as launch a euro-denominated stablecoin, aiming for a debut in late 2026.

Included within the Netherlands, the initiative will function underneath a regulated license framework, with room for added individuals.

The aim is greater than technological innovation; it’s a part of a broader technique for European cost sovereignty within the midst of issues over a rising US stablecoin lead.

The stablecoin challenge aligns with the enforcement of the EU’s MiCA regulation and enhances efforts by the European Central Financial institution to push ahead a digital euro.

There’s a little bit of urgency to the challenge – the dominance of U.S. greenback tokens may erode financial management and expose Europe to exterior leverage. U.S. stablecoin incumbents like Tether ($USDT) and Circle ($USDC) already command huge community results and liquidity.

For the European challenge to succeed, it should overcome regulatory obstacles, construct belief, and supply liquidity – and quick.

Greatest Pockets Token ($BEST) – The Greatest Non-Custodial Pockets for Stablecoins and Crypto Presales

Greatest Pockets Token ($BEST) is the newest providing in a rising, highly effective Greatest Pockets ecosystem. On the core, there’s a non-custodial Web3 pockets the place customers can safely retailer, swap, and ship their tokens.

Subsequent comes the $BEST utility token. With $BEST, traders get decrease transaction charges and better staking yields. There’s additionally entry to the most effective crypto presales, the place traders can discover a curated choice of upcoming tasks. Analysis and buy tokens immediately inside the app.

What’s Greatest Pockets token? It’s the important thing to powering up a vibrant wallet-based suite of instruments. The upcoming Greatest Card will make it even simpler to spend your crypto. Within the meantime, learn to purchase $BEST and see why our worth prediction thinks the token may attain $0.72,

Go to the Greatest Pockets token presale web page for the newest info.

The approaching years might effectively resolve whether or not stablecoins turn out to be pillars of a hybrid monetary future or stay area of interest infrastructure. Citi’s forecasts trace on the scale and ambition of stablecoins, and Greatest Pockets provides traders the instruments they should navigate a stablecoin future.

Authored by Bogdan Patru on Bitcoinist — https://bitcoinist.com/stablecoins-$4-trillion-by-2030-best-time-to-try-best-wallet

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.