On-chain knowledge reveals the Ethereum MVRV Ratio has seen a notable decline not too long ago. Right here’s what this might imply for the value, in accordance with historical past.

Ethereum MVRV Ratio Has Fallen To A Comparatively Low Stage Lately

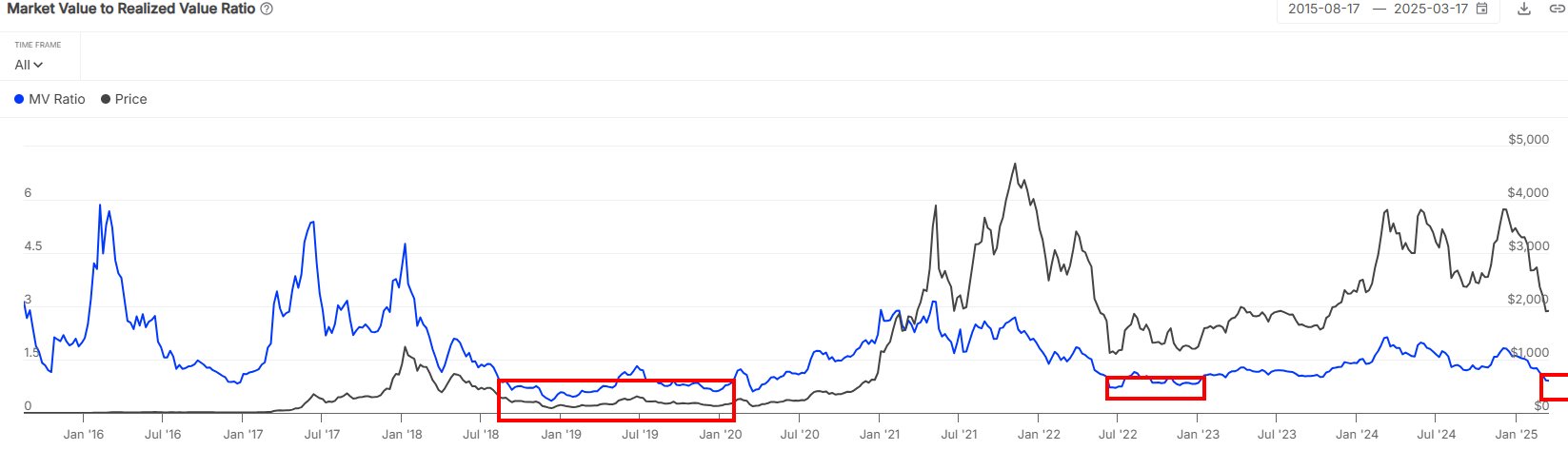

In a brand new publish on X, the market intelligence platform IntoTheBlock has mentioned concerning the newest pattern within the Market Worth to Realized Worth (MVRV) Ratio of Ethereum. The MVRV Ratio refers to an on-chain metric that measures the ratio between the market cap and realized cap of ETH.

Briefly, what this indicator tells us is how the worth held by the traders as a complete compares in opposition to the funding that they initially made to buy their cash.

When the MVRV Ratio is bigger than 1, it means the typical holder might be assumed to be carrying a internet unrealized revenue. However, the metric being underneath the cutoff suggests the general market is underwater.

Now, right here is the chart for the indicator shared by the analytics agency, that reveals the pattern in its worth for Ethereum over the previous decade:

The worth of the metric seems to have been sliding down in current days | Supply: IntoTheBlock on X

As is seen within the above graph, the Ethereum MVRV Ratio has gone down not too long ago and crossed under the 1 mark, implying the ETH traders at the moment are in internet loss. The explanation behind this shift available in the market naturally lies within the worth crash that the cryptocurrency has confronted as a part of a sector-wide downturn.

At current, the ETH MVRV Ratio has a price of 0.9. IntoTheBlock has famous that the indicator doesn’t attain this degree usually, with typically solely the bear markets having the ability to power it this low.

An fascinating sample emerges when trying on the previous worth trajectory that adopted intervals of the indicator sitting at such lows. “Traditionally, MVRV ratios under 1 have coincided with favorable entry factors for ETH,” says the analytics agency.

One thing to notice, nevertheless, is that whereas the MVRV Ratio falling into this zone has certainly confirmed to be bullish for Ethereum, the impact doesn’t are usually quick, with the cryptocurrency often having to remain for prolonged intervals within the area earlier than a rebound happens.

In another information, IntoTheBlock has identified in one other X publish how a significant on-chain help block exists for ETH between the $1,843 and $1,900 ranges.

The associated fee foundation distribution throughout the varied worth ranges | Supply: IntoTheBlock on X

In on-chain evaluation, the energy of any help degree is measured on the premise of how a lot of the provision was final bought by traders at it. The aforementioned worth vary is especially dense by way of provide, as 3.56 million tokens of the asset had been purchased by 4.64 million addresses inside it.

“This accumulation suggests strong help, but when ETH slips under this vary, the chance of capitulation grows, as demand seems notably weaker past this degree,” says the analytics agency.

ETH Value

Ethereum is at the moment retesting the on-chain help zone as its worth is buying and selling round $1,877.

Appears to be like like the value of the coin has gone stale not too long ago | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, IntoTheBlock.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.