The tip of 2024 is marked by a powerful attraction to US inventory markets, notably by means of S&P 500 and MSCI World ETFs. Whereas we can not but converse of a speculative bubble within the strict sense, a number of indicators recommend irrational exuberance and the necessity for elevated warning. The present state of the US inventory market, characterised by excessive valuations and a focus of features on a restricted variety of corporations, raises issues about its sustainability.

A Worrying Focus of Beneficial properties

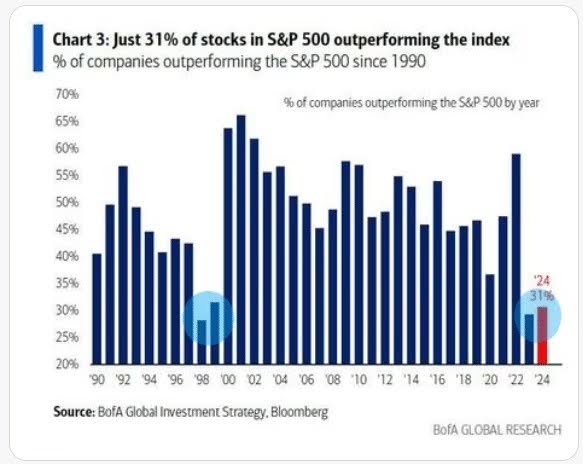

One of the vital important warning indicators lies within the focus of efficiency on a small variety of corporations. In 2024, solely 31% of the businesses comprising the S&P 500 index outperformed the index itself. That is the third-lowest determine recorded within the final 50 years. This example is eerily harking back to the years previous the bursting of the dot-com bubble, the place a handful of expertise shares drove your complete market. This focus of features makes the index notably weak to a reversal of fortune for these few corporations. If these leaders have been to expertise difficulties, the impression on your complete market might be appreciable.

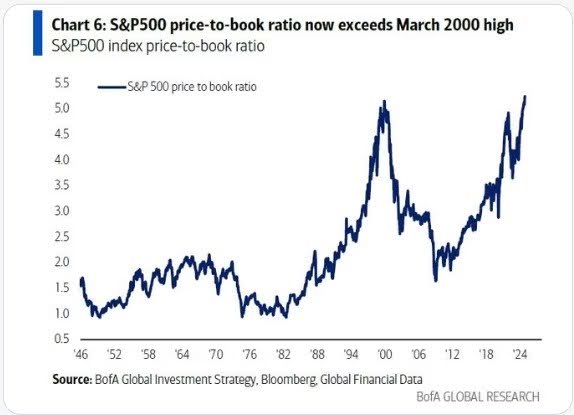

Valuations at Historic Highs

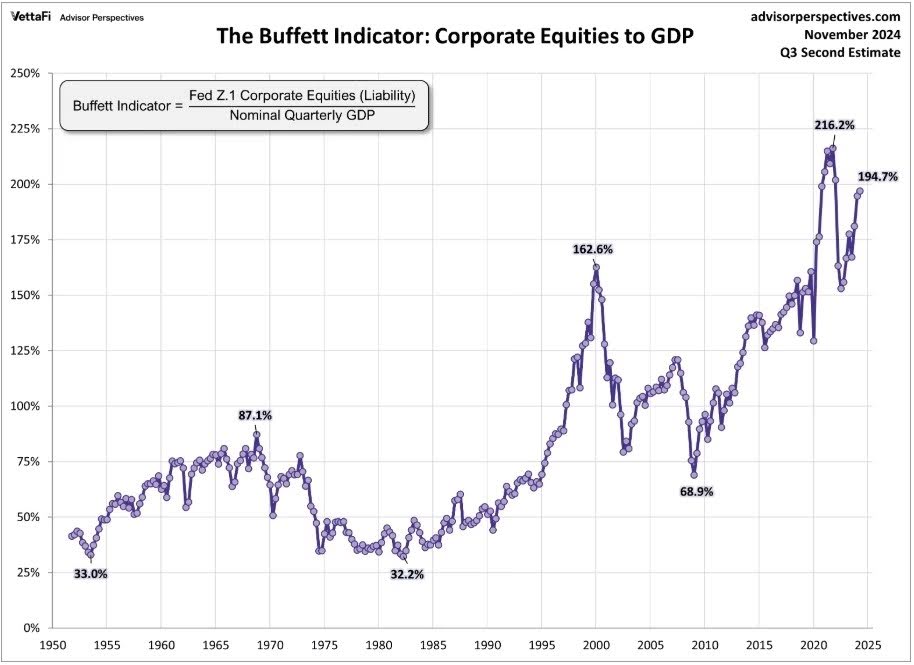

Alongside this focus of features, valuations of US corporations are reaching traditionally excessive ranges.

A number of indicators, together with the well-known Warren Buffett indicator, attest to this example. The Buffett indicator, which compares complete market capitalization to GDP, is taken into account by the legendary investor as “most likely the very best single measure of the place valuations stand at any given second.” A excessive ratio suggests an overvaluation of the inventory market. Present ranges of this indicator mirror extreme investor confidence and a attainable disconnect between asset costs and financial actuality.

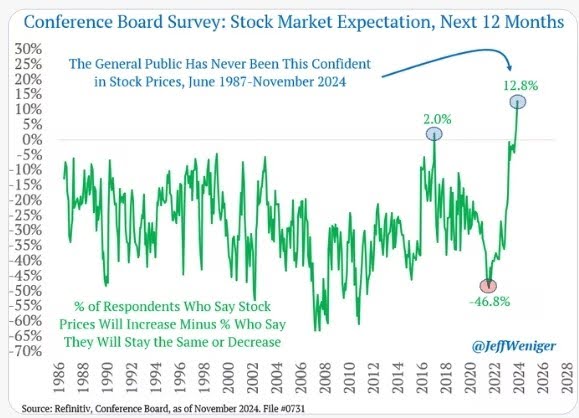

The Euphoria of US Traders

The morale of US traders is reaching peaks. Surveys from the Convention Board reveal an optimism not often noticed because the creation of this statistic in 1987. This ambient euphoria, whereas comprehensible given previous efficiency, is a threat consider itself. A way of overconfidence can result in irrational decision-making and gasoline a speculative bubble. When market sentiment reverses, the correction might be brutal.

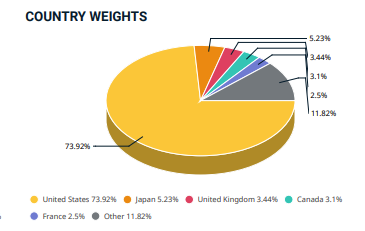

The Extreme Weighting of the USA within the MSCI World

The weighting of the USA within the MSCI World index is reaching file ranges, reflecting the present dominance of the US market. This overrepresentation of US equities in an index supposed to characterize the worldwide economic system raises questions on its actual diversification. Such geographical focus exposes traders to elevated threat within the occasion of financial difficulties particular to the USA.

Classes from the Previous and Future Prospects

The historical past of economic markets is punctuated by cycles of growth and contraction. The adage “timber don’t develop to the sky” reminds us that each interval of progress ultimately runs out of steam. Previous efficiency, nonetheless sensible, is not any assure of future efficiency. It’s subsequently essential to not succumb to euphoria and to arrange for a attainable slowdown, or perhaps a correction, of the market.

Statistics recommend that future efficiency of the S&P 500, and subsequently the MSCI World, could also be disappointing within the coming years. A number of situations are attainable. A inventory market crash can’t be dominated out, though it’s troublesome to foretell with certainty. A extra average correction, bringing valuations again to extra cheap ranges, can also be attainable. A protracted sectoral rotation, the place at present overvalued corporations expertise a interval of stagnation or decline, whereas different sectors battle to compensate, is one other speculation.

Warning and Diversification

Within the face of those uncertainties, warning is suggested. You will need to diversify investments and to not focus solely on S&P 500 and MSCI World ETFs. Investing in different asset courses, resembling bonds, actual property, or commodities, may also help scale back general portfolio threat.

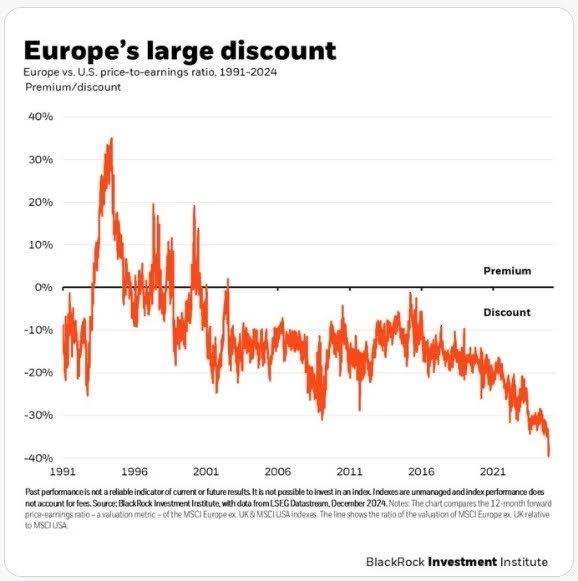

It’s also essential to notice that, alongside the overvaluation of US shares, valuations of European shares seem comparatively low. This might be an fascinating funding alternative for traders in search of geographical diversification.

In conclusion, whereas the attraction to S&P 500 and MSCI World ETFs is comprehensible given previous efficiency, a number of indicators recommend irrational exuberance and a rising threat. It’s essential to stay vigilant, diversify investments, and put together for a attainable market correction. Warning is suggested to navigate safely within the probably turbulent waters of the monetary markets.