For the primary time this 12 months, the USA Federal Reserve slashed rates of interest to the +4% to +4.25% vary. This determination was extremely anticipated and got here, to some extent, from political stress. But, with falling fund charges, there are excessive expectations that decentralized cash markets, together with Aave crypto, will shine. Because of this, the focus has been on AAVE USD.

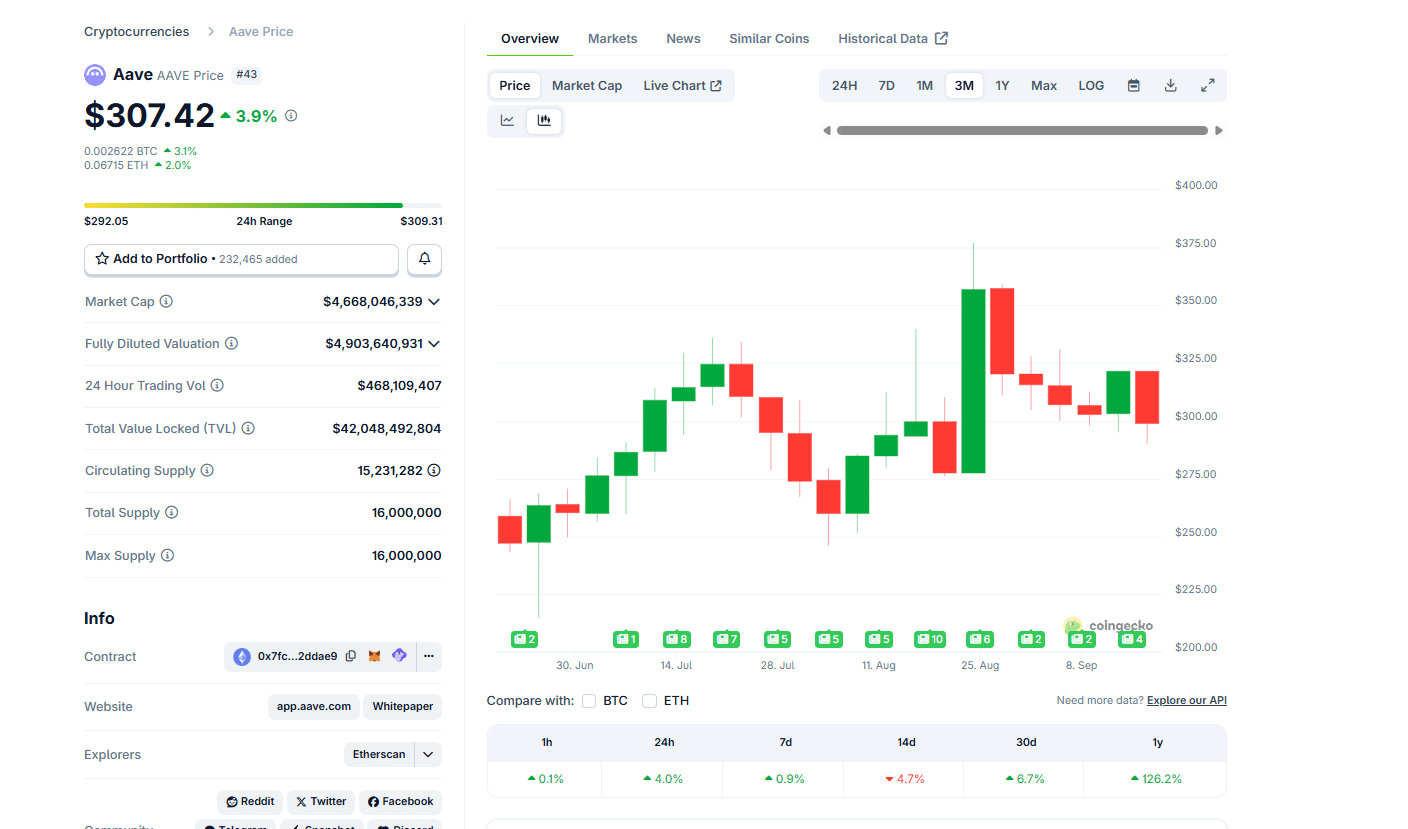

Based on Coingecko, the Aave worth is up +126% year-to-date and agency up to now month, including an honest +7%. But, regardless of the optimism round crypto, with analysts portray bullish initiatives, together with posting stable Aave worth prediction posts, AAVE USDT is steady within the final week of buying and selling, including roughly +1%.

(Supply: Coingecko)

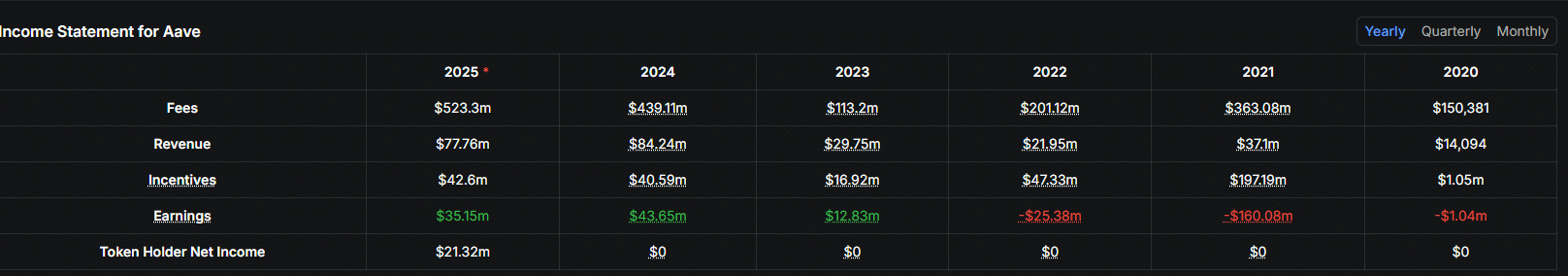

This fairly sluggish worth motion is when Aave is discovering huge adoption. Per DefiLlama, the decentralized cash market at the moment manages over $42Bn. Since 2020, the Aave whole worth locked (TVL) has been inching greater, translating to greater platform income. In 2020, Aave generated simply $150,000 in yearly income. Nonetheless, by the top of 2024, this had grown to over $84M.

(Supply: DefiLlama)

DISCOVER: Subsequent 1000X Crypto – Right here’s 10+ Crypto Tokens That Can Hit 1000x This Yr

Federal Reserve Slashes Charges To The +4% to +4.25% Vary

This income is anticipated to develop this 12 months. With three extra months to go, Aave crypto has generated over $77M in income, incomes $35M.

Taking a look at historic developments, the low-interest-rate setting in the USA now creates a good setting for crypto platforms. Just like the final 2020-2021 crypto increase, which was primarily pushed by DeFi and NFTs, DeFi protocols will possible appeal to extra capital.

In a publish on X, Stani Kulechov, the founding father of Aave, boldly claimed that the speed reduce now creates what he calls an “arbitrage alternative” for Aave USD yields. This, he provides, is as a result of they’re much less correlated with declining conventional USD yields.

At the moment The Federal Reserve lowered their rate of interest by 25 bps. From my perspective this is a rise for the arbitrage alternative for charges in Aave.

Over the previous 5 years Aave has been in a position to beat the us t-bill charges, providing dependable and uncorrelated yield.

My…

— Stani.eth (@StaniKulechov) September 17, 2025

At the moment, the 1-year Treasury invoice yields hover round 3.62%. Kulechov predicts that treasury yields will proceed declining with extra price cuts scheduled in This fall 2025, probably to the +3% to +4% vary by 2027. This dovish setting will make Aave USD yields, particularly on stablecoins like USDC, extra enticing.

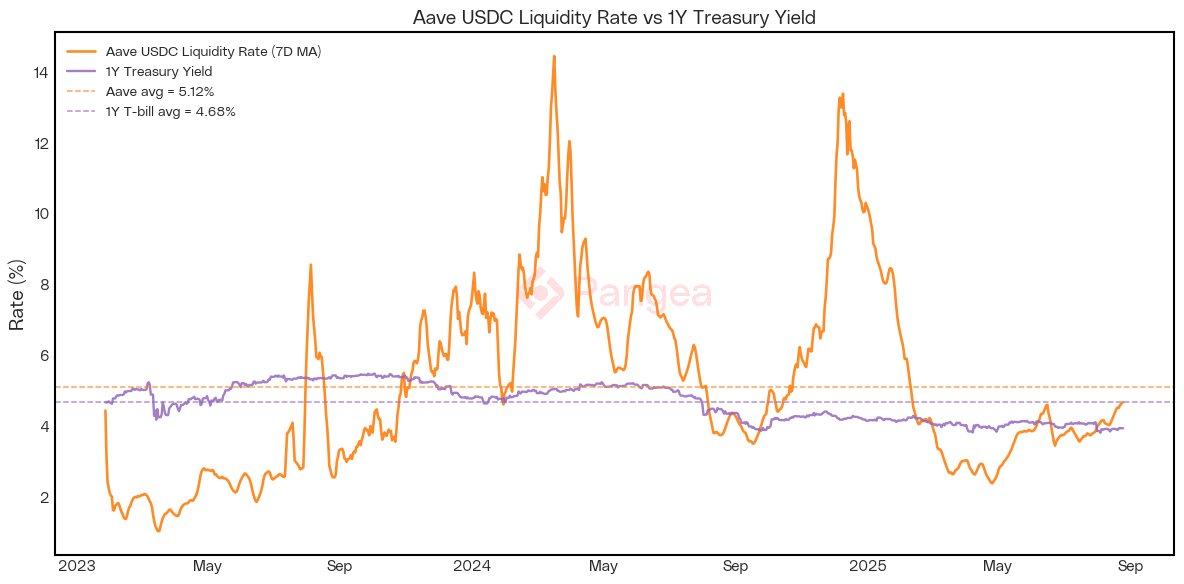

Traditionally, in a low fund price setting, the USDC liquidity price on Aave v3 has constantly outperformed Treasury invoice yields by a median of +0.44%. Analysis findings present that the yield additional spikes, particularly throughout heightened crypto volatility.

(Supply: Pangea)

As an illustration, in the course of the 2021 bull run, when AAVE USD rose to as excessive as $670, AAVE USD provide charges rose to +10%. Throughout that point, treasury payments yielded nearly zero following aggressive price cuts to include the consequences of the pandemic.

DISCOVER: Greatest Meme Coin ICOs to Spend money on 2025

Aave TVL Rising, Will AAVE USD Spike To $400?

With the Federal Reserve now forcing charges decrease simply when crypto momentum is choosing up and extra capital is being funneled to DeFi, AAVE USD might be the most important beneficiary.

AAVE derives its worth from protocol utilization. The extra inflows, the upper the likelihood of  AAVE ▲4.10% surging. Furthermore, with decrease charges in TradFi, the yields on DeFi platforms, largely Aave, are extra enticing. As such, extra customers are more likely to provide property, trying to find the excessive provide price on Aave.

AAVE ▲4.10% surging. Furthermore, with decrease charges in TradFi, the yields on DeFi platforms, largely Aave, are extra enticing. As such, extra customers are more likely to provide property, trying to find the excessive provide price on Aave.

24h7d1y

As leverage and borrow demand rise on Aave, its TVL will improve and so will its utility, pushing AAVE USD in direction of native resistances. Within the brief time period, the primary liquidation stage is $400.

One other catalyst supporting AAVE USD is the anticipated Aave V4, set for This fall 2025. The improve introduces a Hub-and-Spoke structure that would change DeFi liquidity, scale back prices, and increase the AAVE worth.

Aave v4 will launch a unified liquidity layer that aggregates property throughout a number of chains that use Chainlink’s CCIP.

DISCOVER: Greatest New Cryptocurrencies to Spend money on 2025

FOMC Drops Charges, Will AAVE USD Break $400?

FOMC drops fund charges to the 4-4.25% vary

Aave crypto TVL is quickly rising

Aave founder expects extra influx

Will AAVE USD breach $400 in three months?

Why you may belief 99Bitcoins

Established in 2013, 99Bitcoin’s staff members have been crypto consultants since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Professional contributors

2000+

Crypto Initiatives Reviewed

Observe 99Bitcoins in your Google Information Feed

Get the most recent updates, developments, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now