DAOs (Decentralized Autonomous Organizations) are entities ruled by good contracts the place token holders suggest, vote, and resolve the way forward for protocols. In idea, voting in DAO ecosystems was designed to be open, clear, and democratic. Everybody with tokens had a say.

However the actuality tells a distinct story.

A Crypto analyst, Ignas, reported {that a} person often known as hitmonlee.eth spent 5 ETH (via Foyer Finance to amass voting rights tied to 19.3 million ARB tokens. With a number of clicks and a modest sum (by crypto whale requirements), this person gained outsized affect in Arbitrum’s governance.

The previous DAO mannequin is in shambles:

Final weekend, hitmonlee.eth paid 5 ETH (~$10k) on @lobbyfinance to purchase 19.3M ARB (~$6.5m) voting energy.

That’s extra votes than skilled DAO delegates like Wintermute or L2Beat have.

All votes had been solid for @CupOJoseph for Arbitrum’s… pic.twitter.com/QRgeom9Otq

— Ignas | DeFi (@DefiIgnas) April 8, 2025

This isn’t an remoted incident; it’s a symptom of a deeper flaw. Moderately than decentralization, token-weighted voting usually concentrates energy within the palms of the rich, turning governance right into a high-stakes sport for individuals who can afford it.

So, the place does that depart the common DAO member? And what does this say about the way forward for decentralized governance?

On this piece, we’ll discover how token voting works, why it’s structurally flawed, and what different fashions are rising to make sure that DAOs dwell as much as their authentic democratic beliefs.

READ ALSO: Past Hype: How Decentralized Governance Can Safe the Way forward for Memecoins

How Token-Primarily based Voting Works in DAOs

Immediately, most DAOs use token-based voting: the extra governance tokens you maintain, the extra voting energy you might have. In easy phrases, proudly owning 1% of the whole token provide sometimes means you wield 1% of the voting energy. This method borrows closely from conventional company shareholder voting, aligning affect with monetary stake. It’s straightforward to implement, scales properly, and incentivizes funding, however it comes with a elementary contradiction.

In contrast to companies, DAOs are speculated to be decentralized, clear, and community-first. Token-based voting, nevertheless, usually undermines these beliefs. It opens the door to governance seize by rich people, funds, or insiders who can merely purchase extra affect. This transforms what needs to be a participatory ecosystem right into a pay-to-play mannequin the place energy doesn’t essentially replicate contribution, dedication, or experience, however capital. The result’s a system that seems decentralized on the floor however can replicate the identical hierarchies that DAOs had been meant to disrupt.

ALSO READ: DAOs and The Coordination of Human Endeavour

Focus of Energy Amongst Whales

Regardless of their promise of decentralization, many DAOs face a troubling focus of energy within the palms of some. Token-based governance usually ends in “whales” wielding disproportionate affect over choices that have an effect on complete ecosystems. This centralization of management echoes the very dynamics DAOs had been designed to disrupt.

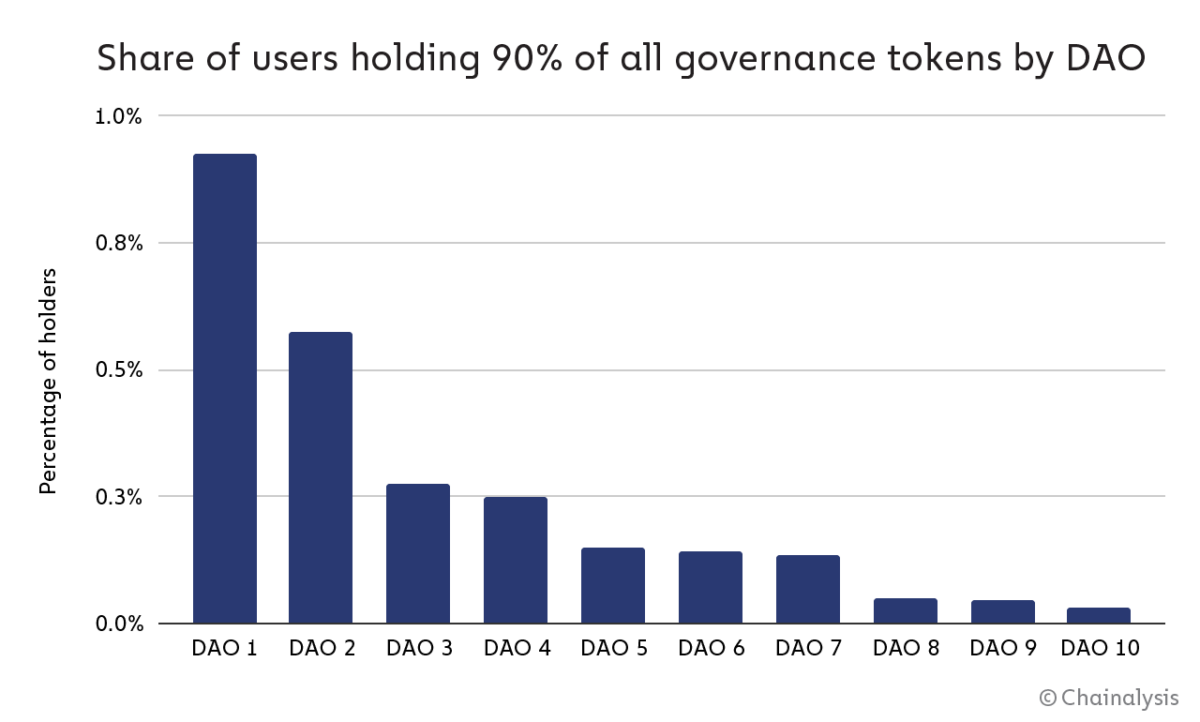

A revealing research by Chainalysis discovered that in ten main DAOs, lower than 1% of holders management practically 90% of the voting energy.

This imbalance permits a small group to steer governance, leaving smaller stakeholders with little significant voice.

The implications of this had been dramatically illustrated in June 2022 throughout a disaster involving Solend, a lending platform on Solana. A whale had taken on an enormous mortgage, and because the worth of SOL declined, their place risked liquidation. If the liquidation had occurred on the open market, it may have triggered a broader crash in Solana’s worth. To mitigate the fallout, the DAO authorities voted to quickly take management of the whale’s account and deal with the liquidation through over-the-counter (OTC) offers. The transfer sparked backlash not just for overriding decentralization rules, but in addition for displaying how one whale’s publicity may destabilize a whole protocol.

This isn’t an remoted case. Enterprise capital agency a16z, for instance, reportedly holds over 55 million UNI tokens, granting it vital management over Uniswap’s governance. In a single controversial occasion, a16z voted in opposition to deploying Uniswap v3 on the BNB Chain through the Wormhole bridge—a call seen by some as serving company technique over neighborhood profit.

The development extends additional. In Compound, one other outstanding DeFi platform, simply 10 voters held practically 58% of the whole voting energy. The truth is, it usually took fewer than three voters to move proposals, successfully sidelining the broader neighborhood.

The implications of whale dominance are far-reaching. Governance choices are likely to favour the pursuits of enormous holders, resulting in protocol bias that prioritizes capital safety over neighborhood development. Smaller token holders might turn into disillusioned, feeling that their votes carry no weight, a barrier to entry that erodes participation. Most regarding of all, stagnant innovation may end up, as whales resist modifications which may problem their affect, even when these modifications are essential for the ecosystem’s evolution.

In essence, whereas DAOs goal to democratize decision-making, the truth usually falls quick, elevating pressing questions on how DAOs can create fairer and extra inclusive governance fashions sooner or later.

RELATED: Past Tokens: How DAOs Are Diversifying Treasuries and Forming Alliances

Voter Apathy and the Phantasm of Participation

One of many clearest cracks within the facade of token-based governance is the rising voter apathy amongst DAO members. Whereas these methods promise open, democratic participation, the truth paints a far much less inclusive image. Most token holders stay disengaged, not out of ignorance, however out of disillusionment.

In line with knowledge from DeepDAO, solely round 3.3 million out of 11.8 million governance token holders throughout varied DAOs are actively voting or proposing. That’s a staggering over 70% of token holders who’re basically silent. The consequence? A small, energetic minority finally ends up steering the ship, usually comprising insiders or massive token holders with vested pursuits.

This isn’t only a participation downside; it’s an influence downside. When the identical few voices repeatedly dominate outcomes, it sends a transparent message to smaller holders: your vote doesn’t actually matter. Over time, this breeds a poisonous suggestions loop. Disenchantment results in apathy, which in flip results in a fair larger focus of affect.

In observe, many DAOs turn into democratic in identify solely. The veneer of decentralization masks a actuality the place governance is dictated by a handful of well-positioned members, whereas the broader neighborhood drifts into irrelevance. This imbalance not solely weakens the integrity of DAO decision-making but in addition threatens their long-term sustainability and innovation.

Token-based voting, because it stands, provides a system the place votes exist, however truthful illustration doesn’t.

Different Governance Fashions

Because the cracks in token-based governance turn into extra seen from whale dominance to widespread voter apathy, many within the crypto neighborhood are exploring different fashions that promise fairer, extra inclusive decision-making. Among the many most compelling of those are quadratic voting and reputation-based voting, two methods that goal to shift the steadiness of energy away from pure token possession and towards extra significant participation.

Quadratic voting: Prioritizing ardour over energy

Quadratic voting challenges the concept extra tokens ought to equal extra affect. As an alternative, it introduces a price curve the place every extra vote turns into more and more costly: the price of n votes equals n² tokens. So whereas casting one vote prices one token, casting three votes prices 9. This design discourages vote hoarding and encourages customers to vote solely on points they care deeply about.

This mannequin has already seen success in initiatives like Gitcoin Grants, the place it’s used to allocate funding for public items. By surfacing collective priorities as a substitute of favouring the loudest or wealthiest voices, quadratic voting helps give smaller stakeholders a significant seat on the desk.

Nevertheless, the system isn’t foolproof. Its largest problem lies in Sybil resistance—guaranteeing that one particular person equals one identification. With out sturdy identification verification, dangerous actors can sport the system by creating pretend accounts, undermining the very equity it goals to advertise.

Fame-based voting: Affect earned, not purchased

Whereas quadratic voting tweaks the worth of votes, reputation-based voting redefines what earns you a vote within the first place. Right here, governance energy stems from contributions, experience, and neighborhood belief, somewhat than token holdings.

Initiatives like Colony.io assign popularity scores based mostly on customers’ work high quality and consistency, whereas the Optimism Collective’s Residents’ Home empowers decision-making via verifiable contributions and identification, somewhat than simply pockets balances. These methods reward long-term involvement and discourage speculative governance participation pushed solely by monetary achieve.

The advantages are clear: deeper engagement, much less susceptibility to vote-buying, and a governance mannequin that extra carefully displays the precise builders and stewards of a neighborhood. Nonetheless, challenges stay, notably round measuring contribution high quality and creating sturdy, privacy-respecting identification layers to stop manipulation.

A step towards fairer DAOs

Neither mannequin provides an ideal repair, however they symbolize essential steps towards maturing DAO governance. Shifting past token counts, these methods discover what it actually means to construct truthful, decentralized communities: the place votes are earned, not purchased; the place participation is motivated by objective, not revenue; and the place governance energy displays dedication, not simply capital.

Within the quest for really decentralized governance, rethinking the voting mechanism in DAOs could also be a very powerful vote we solid but.

Ultimate Thought: Decentralization Deserves Higher

On the coronary heart of the DAO motion lies a strong thought: that communities, not companies, ought to form the way forward for decentralized platforms. However the actuality is proving way more difficult. Token-based voting, whereas environment friendly and acquainted, has largely recreated the very energy constructions it sought to remove. Wealth begets affect, whales dominate outcomes, and the common participant is commonly left watching from the sidelines.

This isn’t a failure of ambition; it’s a design flaw. One which displays how decentralization in idea can nonetheless fall prey to centralization in observe.

However there’s hope within the alternate options. From quadratic voting that prioritizes ardour over energy, to reputation-based methods that reward long-term contributors, DAOs are starting to experiment with governance fashions that transfer past mere token counts. These improvements received’t clear up each problem in a single day, however they do mark a shift towards fairer methods, ones the place affect is earned via participation, not bought with capital.

If DAOs really goal to fulfil their founding beliefs, they need to rethink what energy means in a decentralized world. The way forward for collective governance relies upon not simply on who will get to vote, however on whose voice truly counts.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein needs to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of economic loss. At all times conduct due diligence.

If you wish to learn extra market analyses like this one, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”

The publish Why Token-Primarily based Voting Doesn’t Equal Honest Governance appeared first on DeFi Planet.