Bearish sentiment is at certainly one of its highest ranges since 2000 regardless of shares’ minor dip from report highs. The Every day Breakdown digs in.

Friday’s TLDR

Sentiment is extremely bearish

Can the market backside?

Bonds discovering a groove

The Backside Line + Every day Breakdown

We’re nearly two months into 2025 and it’s been a bumpy experience. The S&P 500 is about flat on the yr and down about 2% over the previous three months. The sugar excessive we noticed instantly after the election has worn off as shares, client confidence, and sentiment have all come beneath stress.

Talking on that final observe — sentiment — we’ve seen fairly an fascinating improvement. There are a couple of sentiment readings on the market, just like the NAAIM, the CNN “Concern & Greed” Index, and the AAII survey. (Be happy to bookmark these for the long run, too).

For at present’s dialogue, I’ll be specializing in the bull and bear sentiment surveys from AAII, beginning with the bulls:

Since 2000, the bottom bull studying was 15.8, whereas this week rang in at 19.4. Readings under 20 have a tendency to return into play close to a trough in sentiment.

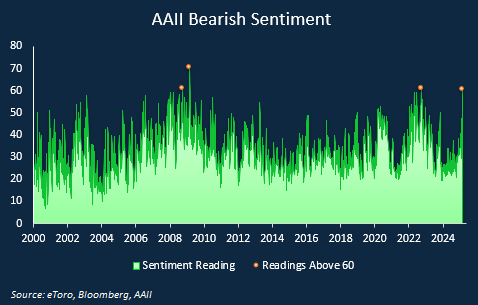

On the flip aspect, bearish sentiment tends to spike throughout instances of uncertainty. Discover how prior spikes above 60 occurred close to the depths of the monetary disaster, the lows of the 2022 bear market…and proper now:

Sentiment extremes are inclined to act as contrarian indicators. Which means that when we’ve got a “washout” in sentiment — the place bullish readings are actually low and bearish readings are actually excessive — shares are inclined to kind a backside.

(The other will be true on the upside, too. When bullish readings get towards an excessive excessive and bearish readings close to an excessive low, markets are inclined to prime and pull again).

The fascinating factor right here is, the S&P 500 was about 3% off its all-time excessive when this week’s survey was launched. That’s not one thing we are inclined to see when sentiment is that this low.

Making Sense of the Mindless

It’s laborious to say what precisely is driving this response, however a couple of issues stick out. First, though 9 of the S&P 500’s 11 sectors are constructive on the yr, the 2 sectors which might be decrease — tech and client discretionary — are main holdings for buyers.

In the event that they’re doing dangerous, in fact sentiment is taking successful.

Second, financial coverage uncertainty is hovering. Within the US, this measure is at its third highest stage since 2000, with solely the monetary disaster and Covid coming in greater. Globally, it’s the best it’s been since Covid…and it’s near surpassing that determine proper now.

The back-and-forth tariff threats are carrying on buyers, even when they’ve been extra bark than chunk up to now.

The Backside Line

With sentiment nearing an excessive, regulate markets to see if shares and crypto can discover their footing. If they’ll, let’s see what kind of rally develops. If they’ll’t, it’s doable that sentiment stays dampened and creates a type of self-fulling prophecy by way of decrease costs.

Wish to obtain these insights straight to your inbox?

Enroll right here

The setup — Bonds

One of the vital-traded bond ETFs is the TLT, which has been in demand in current buying and selling. In reality, it’s up about 4.5% to this point this yr and has had some current pep in its step after breaking out over downtrend resistance.

That mentioned, there’s no sugarcoating it: The TLT has struggled over the long term and is down nearly 2% over the previous yr. Be aware that the TLT continues to be under its 200-day transferring common (in pink).

As yields have come beneath stress, rate-sensitive belongings like bonds, dividend shares, and REITs have loved current beneficial properties.

Some energetic buyers might desire a minor pullback first — which is ok — however as long as TLT can keep above the $87 to $88 space, bulls may preserve current momentum. For sustained momentum although, they’ll have to see TLT regain the 200-day transferring common.

On the draw back, a break of $87 to $88 may open up TLT to extra promoting stress.

Choices

For some buyers, choices could possibly be one various to invest on TLT. Keep in mind, the chance for choices consumers is tied to the premium paid for the choice — and shedding the premium is the complete danger.

Bulls can make the most of calls or name spreads to invest on additional upside, whereas bears can use places or put spreads to invest on the beneficial properties petering out and TLT rolling over.

For these trying to study extra about choices, take into account visiting the eToro Academy.

Disclaimer:

Please observe that resulting from market volatility, a few of the costs might have already been reached and eventualities performed out.