In latest days, we’ve taken a peek into the portfolios of the world’s most profitable buyers. Every quarter, establishments managing greater than $100 million “present their hand” by a kind 13-F, which paperwork what they purchased and offered previously three months.

These reviews present perception into their considering and present the place the so-called “good cash” is shifting. However they don’t function a step-by-step, extra like a compass that helps skilled buyers spot traits, establish alternatives and rethink their methods.

Warren Buffet is Including to the Money Pile

“The Oracle of Omaha” Warren Buffett wants no introduction. As a price investor, he seeks out basically sturdy firms with a aggressive benefit which might be buying and selling under their intrinsic worth. Buffett is legendary for his long-term holdings of shares, which confirms his perception in proudly owning high quality firms. He has held American Categorical inventory since 1984, Coca-Cola since 1988, and Moody’s since 2000.

His most important transfer lately has been constructing an enormous place in Apple, which has develop into Berkshire’s largest holding. In latest quarters, nonetheless, Buffett has begun to promote Apple, stoking fears of slowing innovation and progress. When Buffett strikes, buyers observe.

Warren Buffet High 10 Holdings (dataroma.com)

In This fall, Buffett decreased his holdings in monetary shares. He decreased Financial institution of America, one among his largest holdings, and fully offered Capital One Monetary and Citigroup. Nevertheless, he saved American Categorical, which makes up 16.8% of Berkshire’s portfolio.

By way of purchases, Buffett continued to snap up his favourite, Occidental Petroleum. Outdoors of the vitality sector, Buffett shocked with investments in client shares. He practically doubled his stake in Domino’s Pizza and elevated his stake in Pool Corp. by 50%. New additions to Berkshire’s portfolio additionally embrace Constellation Manufacturers, the large behind manufacturers like Corona, Modelo and different fashionable drinks.

What’s attention-grabbing recently, nonetheless, will not be what Buffett is shopping for, however slightly that he’s not shopping for. Berkshire Hathaway’s money reserve has grown to a report $371.8 billion!

Take a look at Warren Buffett’s portfolio on eToro!

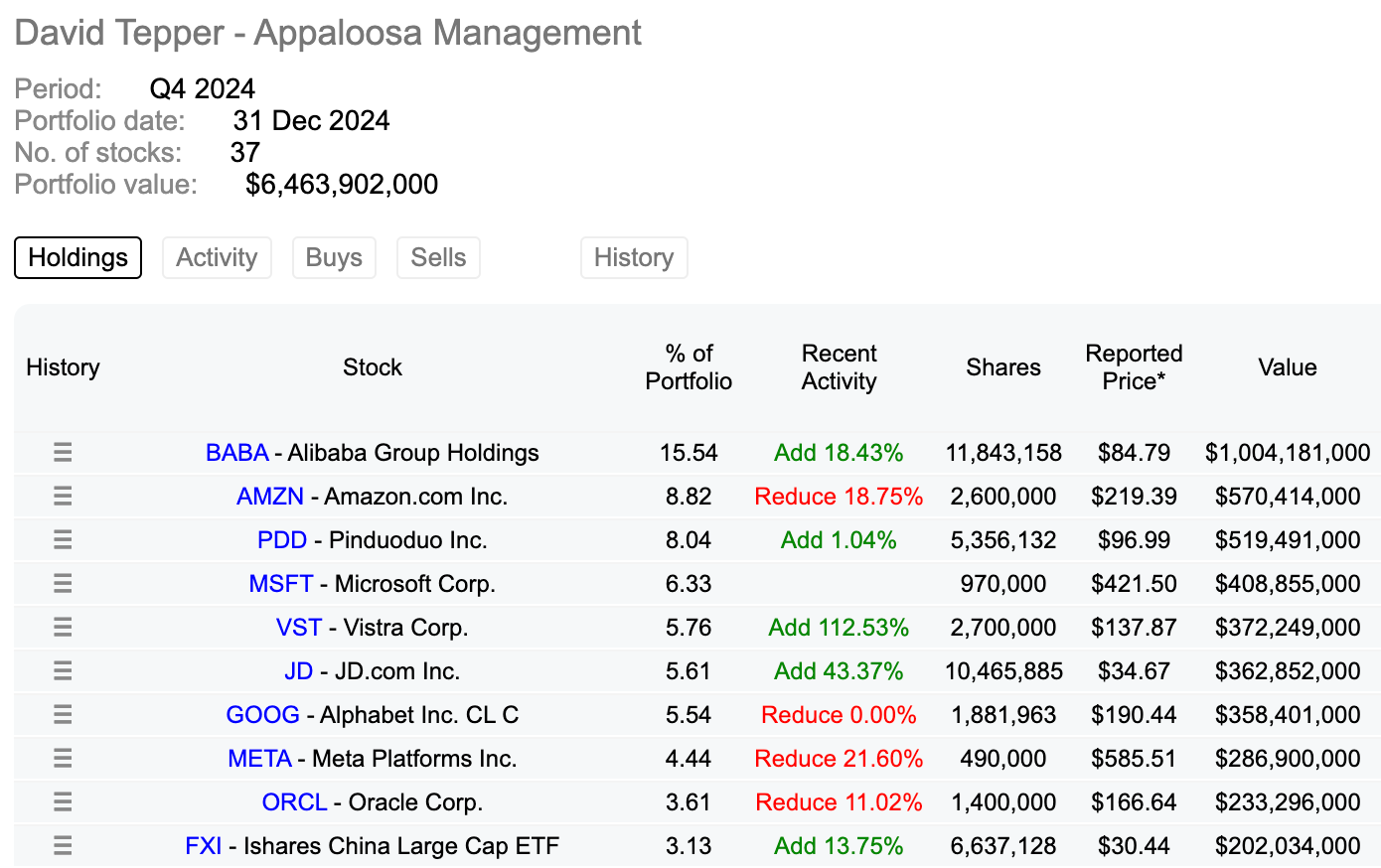

David Tepper Doubles Down on Chinese language AI

Tepper is the billionaire founding father of Appaloosa Administration, a hedge fund identified for its aggressive funding fashion. His technique combines deep elementary evaluation with a macroeconomic method. He usually makes daring bets on sectors or firms that different buyers keep away from. This makes him some of the revered buyers on Wall Avenue.

David Tepper High 10 Holdings (dataroma.com)

David Tepper could be very bullish on AI-and his portfolio proves it. 9 of his high ten positions are associated to the AI revolution. In This fall, Tepper elevated his place in Vistra, a serious vitality provider in Texas, which has develop into a key space for information middle development.

He’s betting huge on China – the place Alibaba is his largest place. He upped it by 18%, pushing it previous the $1 billion mark. Alibaba is investing closely in AI and just lately introduced that its newest mannequin, Qwen2.5-Max, can outperform each GPT-4o and DeepSeek-V3-a daring declare that underscores its ambitions within the AI race.

Tepper additionally doubled his stake in ASML, the Dutch chipmaking trade big. He additionally considerably elevated his investments in NRG Power and Develop Power, additional bolstering his bullish guess on vitality infrastructure for AI improvement.

However, Tepper partially decreased stakes in Amazon and Meta, however added to Nvidia. Does this imply the potential of the “Magnificent 7” is altering?

Tepper’s latest offers present a powerful concentrate on AI, vitality and China, suggesting he sees a giant alternative within the AI revolution.

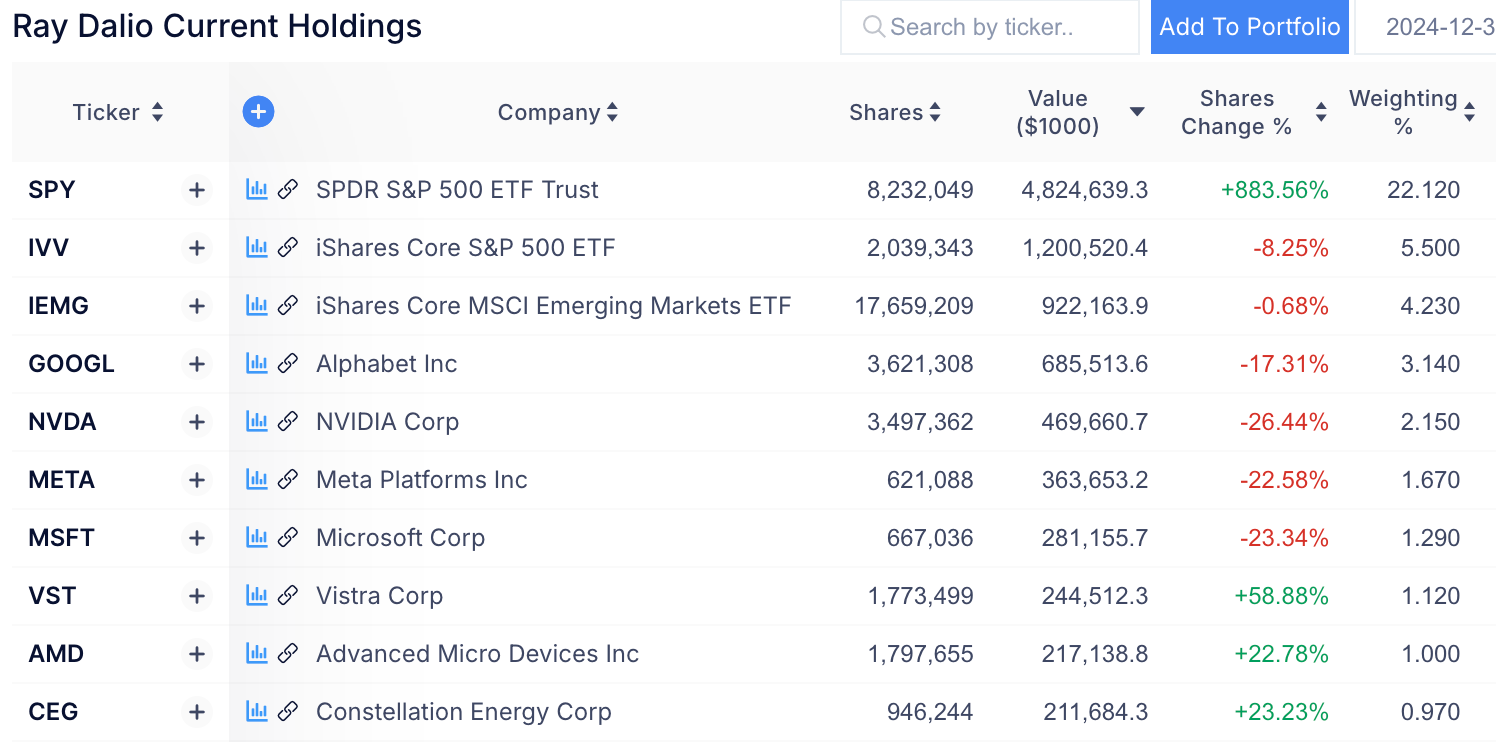

Ray Dalio’s Bets on Broad Progress

Ray Dalio is the founding father of Bridgewater Associates, one of many largest hedge funds on the planet. He employs a macro-focused, risk-balanced technique. He’s a giant believer in diversification and his views on international financial traits are extremely revered.

Ray Dalio High 10 Holdings (gurufocus.com)

Though he owns greater than 800 totally different shares in his portfolio, he has made some attention-grabbing adjustments.One of the vital notable bets this quarter is vitality. Dalio doubled his positions in Vistra and Constellation Power, doubtless shopping for the dip brought on by DeepSeek.

On the similar time, he trimmed his investments within the “Magnificent Seven”-reducing his stakes in Google, Meta, Amazon, and Microsoft by about 20%.

Conversely, he doubled his holdings in PayPal and Salesforce and massively elevated his funding in AT&T by 400%- is he seeing hidden worth within the telecom? Past that, he guess on the tobacco sector. He elevated his stake in Altria by 85% and in British American Tobacco by as a lot as 260%.

Dalio’s trades affirm the narrative that vitality firms often is the hidden winners of the AI revolution. His discount of the “Magnificent Seven” can also be attention-grabbing.

Learn my evaluation of Vistra!

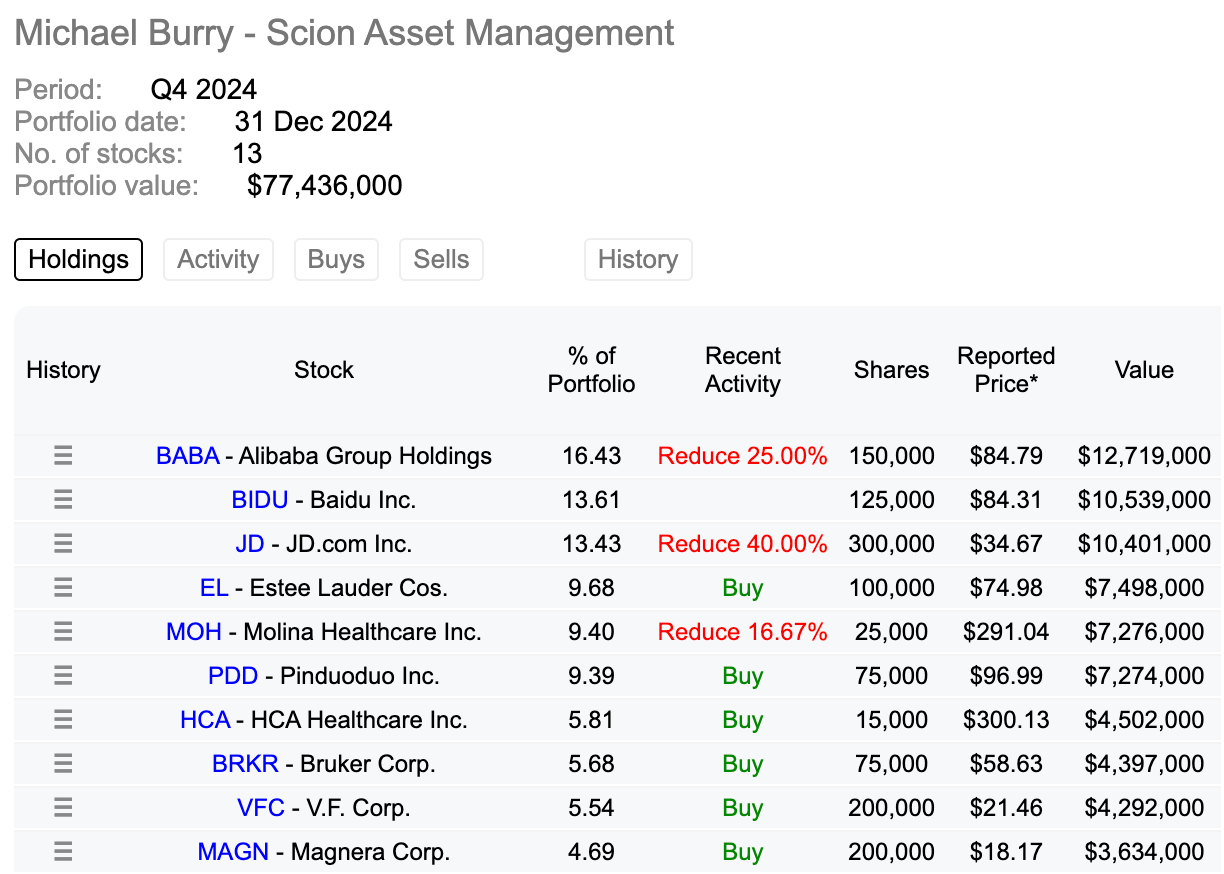

Michael Burry Exits Chinese language Bets

Michael Burry, finest identified for “The Large Quick”, gained worldwide consideration by predicting and benefiting from the 2008 actual property crash. Burry is a elementary investor specializing in undervalued and neglected property. His trades appeal to appreciable consideration due to his unconventional view of the market.

Michael Burry High 10 Holdings (dataroma.com)

Burry is thought for its speedy portfolio changes-and This fall was no exception. This time he considerably decreased his publicity to Chinese language shares Alibaba and JD, signaling a transfer away from firms he beforehand trusted.

Burry is thought for his rapid-fire portfolio adjustments—and This fall was no exception. This time, he massively decreased his publicity to Alibaba and JD, signaling a shift away from companies he had beforehand guess on.

As an alternative, he guess on Estée Lauder, China’s Pinduoduo, and HCA Healthcare. Burry’s trades are sometimes short-term, tactical bets geared toward making the most of market anomalies, slightly than long-term investments. Given his observe report of recognizing mispriced property—just like the notorious housing bubble quick—his strikes usually catch buyers’ consideration.

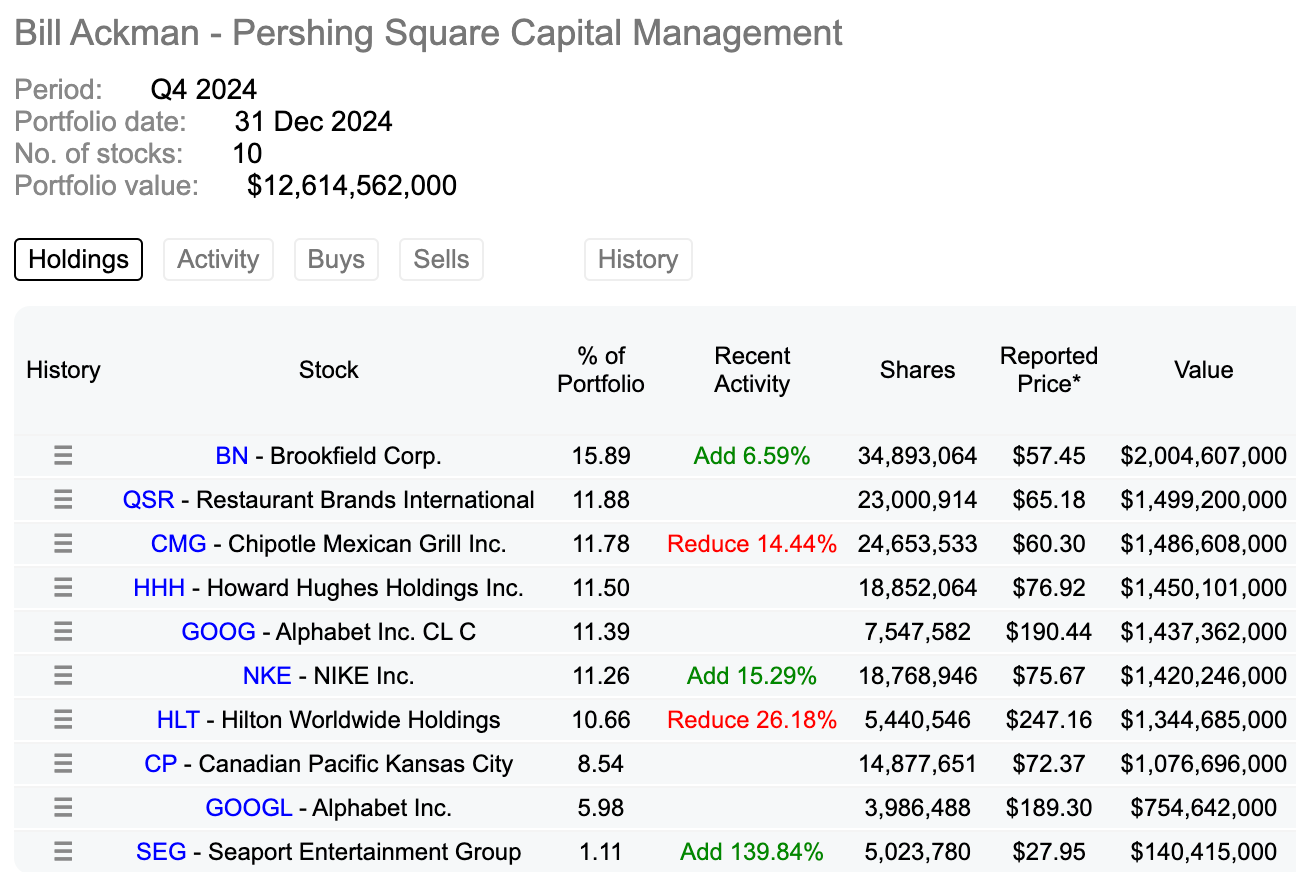

Invoice Ackmann Suprised Markets With Aggressive Bets

Invoice Ackman is an activist investor, that means he doesn’t simply purchase shares, he buys affect. His technique usually includes taking giant positions in firms and pushing for adjustments to enhance shareholder worth.

Invoice Ackman High 10 Holdings (dataroma.com)

In This fall, Ackman made some notable strikes, including to his stakes in BN, Nike, and Seaport whereas persevering with to trim his positions in Hilton and Chipotle—each of which have been large winners for him through the years.

However the largest headline? An enormous $2.3 billion stake in Uber. Ackman is bullish on the ride-hailing and supply big, calling it “one of many best-managed and highest-quality companies on the planet.” He believes Uber is buying and selling at a large low cost to its intrinsic worth.

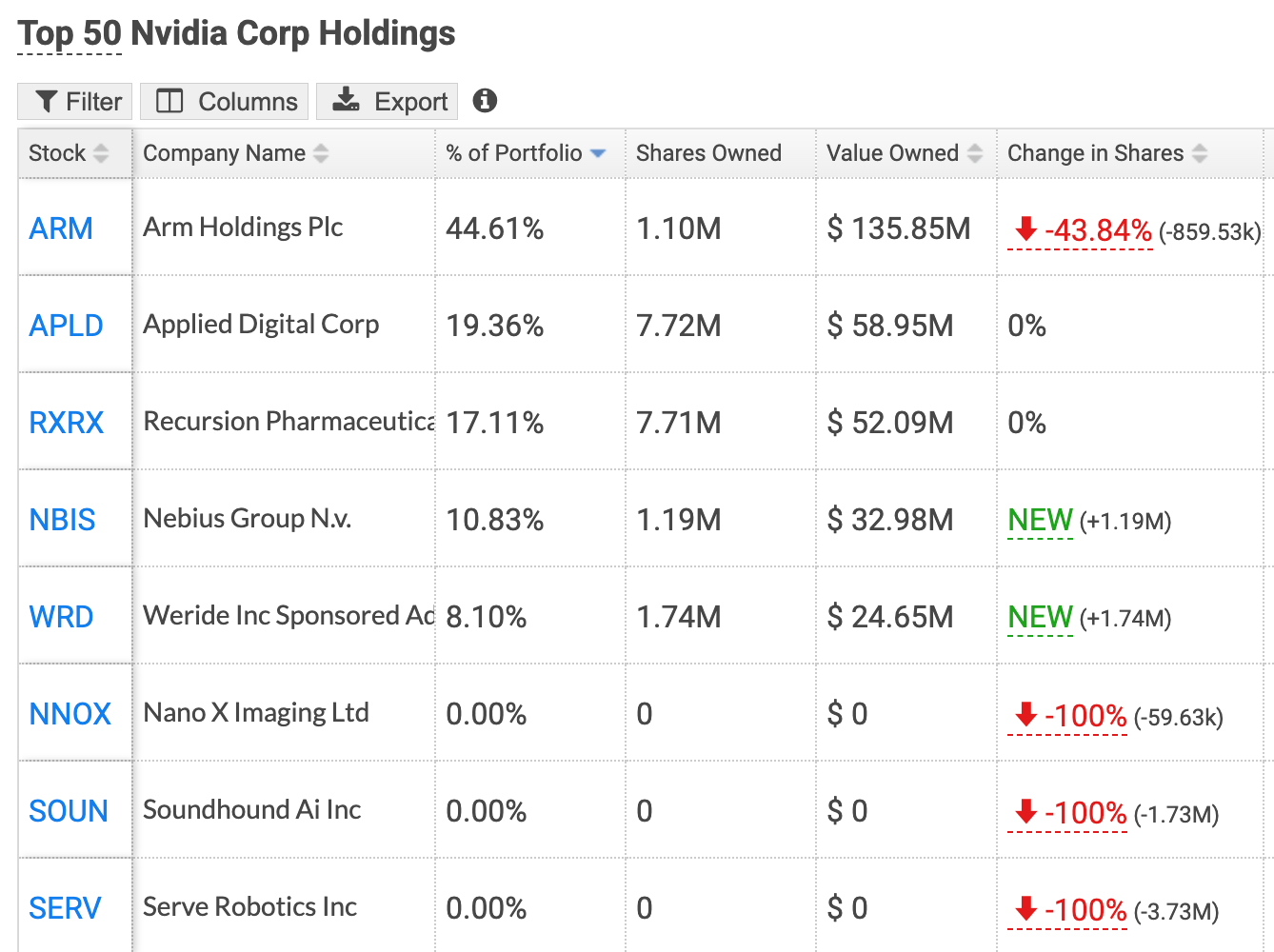

Nvidia Is Altering Course

Sure, you learn that proper—Nvidia isn’t simply promoting chips, but additionally actively investing. It’s strategically investing in small firms, particularly within the AI house. And when Nvidia adjustments course, the market takes discover – usually in a giant approach.

Nvidia High 10 Holdings (hedgefollow.com)

In This fall, Nvidia slashed its stakes in 4 AI firms:

ARM (-3% after the discharge)

SoundHound (-30% after the relese)

Nano-X (-12% after the relese)

Serve Robotics (-43% after the relese)

Every of those shares took successful after the information broke, however it’s price noting that they’d already skilled large rallies over the previous yr—SoundHound, for instance, had surged by tons of of p.c. Whether or not Nvidia is shedding curiosity of their enterprise fashions or just locking in earnings, the cuts sign a shift in its focus. So the place is Nvidia shifting its cash now? Self-driving know-how. The chip big made recent investments in:

Nebius Group, an AI infrastructure firm

WeRide, a Chinese language self-driving tech startup

With autonomous autos anticipated to be a $2 trillion trade by the top of the last decade, Nvidia appears to be positioning itself on the middle of this transformation. Whereas the corporate’s core enterprise stays in AI {hardware}, its funding strikes recommend a long-term guess on AI-driven mobility and transportation.

You understand what they are saying—”cash by no means sleeps,” and neither do these high buyers. With market tides shifting quickly in latest weeks, it’s extra vital than ever to judge your holdings and spot alternatives—or dangers—earlier than they unfold.

Whereas 13-F filings usually are not a step-by-step information, they provide a roadmap for the place a number of the sharpest minds in investing see worth. Whether or not it’s Buffett hoarding money, Tepper doubling down on AI, or Ackman making a daring transfer into Uber, these filings can present a place to begin to your analysis.

In any case, if the neatest cash within the recreation is shifting, shouldn’t we be paying consideration?

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any explicit recipient’s funding aims or monetary state of affairs, and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.