At this time, we’re analyzing & summarizing CoinGecko’s 2025 Q1 Crypto Trade Report for our readers right here at 99Bitcoins.

The crypto market noticed unprecedented features following the 2024 U.S. elections. “What moved Bitcoin & Altcoins” was a query on everybody’s thoughts. The bullish momentum continued into 2025, pushing Bitcoin to a brand new all-time excessive (ATH) of $109,588 on January 20, 2025. Nevertheless, bullish momentum weakened by the top of Q1 2025, reflecting a shift in broader crypto market tendencies. The overall market cap fell 18.6% through the first quarter, reaching $2.8 trillion by the top of March.

Regardless of the pullback, the cryptoverse continued to develop, remodel, and mature. Bitcoin dominance reached an April 2021 excessive, and Solana-based decentralized exchanges (DEXs) noticed extra traction. On the identical time, the fading hype round meme cash and a slowdown in decentralized finance (DeFi) exercise signaled a broader market shift towards consolidation and stability. Nevertheless, April noticed the broader market recovering at an affordable pace.

A variety of things formed Bitcoin’s efficiency in Q1 2025. Let’s break down the primary influences on Bitcoin and altcoins within the first quarter and what they could sign for the rest of the 12 months in line with CoinGecko.

Crypto Market Evaluation Q1 2025: Abstract

In Q1 2025, the crypto market confronted important volatility, with Bitcoin hitting a brand new all-time excessive earlier than retreating, whereas Ethereum erased all its 2024 features. Meme coin exercise plummeted after the controversial Libra incident, resulting in a 56.3% drop in every day token launches on Pump.enjoyable. In the meantime, Solana dominated on-chain decentralized trade (DEX) trades, accounting for 39.6% of the market, and multichain DeFi TVL shrank by 27.5%, shedding almost $49 billion. The crypto market was clearly making its means because the geopolitical tensions unfolded.

Key Takeaways

The crypto market dropped 18.6% in Q1 2025, falling from a YTD excessive of $3.8T to $2.8T, marking a slowdown after the 2024 bull run.

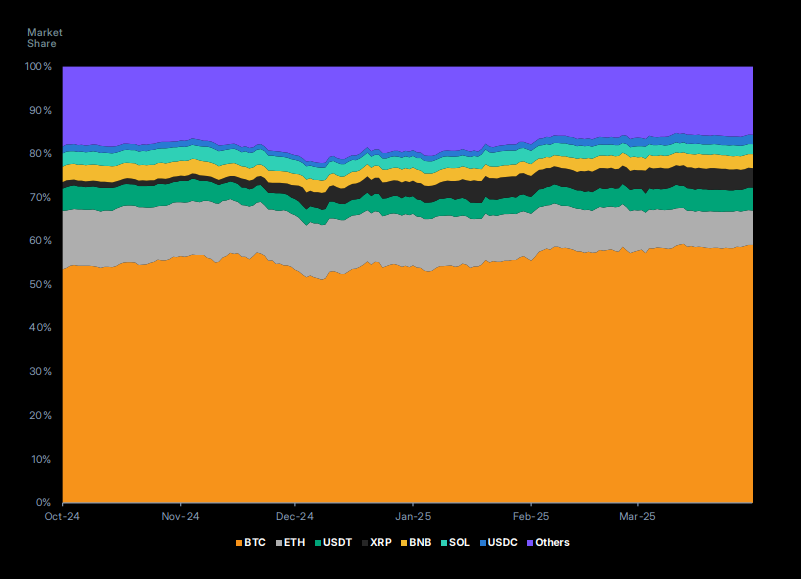

In Q1 2025, Bitcoin’s dominance grew to 59.1% of the market cap, as altcoins confronted challenges and traders leaned in the direction of extra steady belongings.

Ethereum skilled a pointy drop (in Q1 2025) of -45.3%, falling from $3,336 to $1,805 and wiping out all its features from 2024.

Meme cash and token launches noticed an enormous drop in Q1 2025. Each day token launches on Pump.enjoyable fell by -56.3% after the controversial Libra incident.

Spot buying and selling on centralized exchanges (CEX) dropped by -16.3% in Q1 2025. Binance remained the chief, however its buying and selling quantity fell to $588.7 billion by March.

The overall worth locked (TVL) in multichain decentralized finance dropped by -27.5% in Q1 2025, dropping $48.9 billion. Ethereum noticed the most important decline in its TVL dominance.

Bitcoin & Altcoin Market Evaluation Q1 2025

Q1 is over, so why do you have to care about it? Easy – understanding previous tendencies might help you make smarter strikes. Historical past doesn’t all the time repeat, but it surely typically leaves clues. We noticed a number of key patterns in Q1 that may information crypto traders in avoiding losses and making higher choices.

Whole Crypto Market Capitalization: Jan-March 2025

The cryptocurrency market noticed a big correction within the first quarter of 2025—an indication of moderation following the late 2024 surge. In keeping with CoinGecko’s Q1 2025 Crypto Trade Report, the whole worth of the market dropped 18.6%, closing the quarter at $2.8 trillion. The report acknowledged,

“Common every day buying and selling quantity in Q1 additionally plummeted, falling -27.3% Quarter-on-Quarter (QoQ) to $146.0 billion. 2024 This autumn buying and selling quantity stood at $200.7 billion.”

Following the broader market decline, Bitcoin’s value fell 11.8% in Q1 2025, but its market share grew to 59.1%, reinforcing its dominance. This rise in dominance urged a shift in investor desire towards Bitcoin, seen as a extra steady asset in comparison with riskier altcoins.

In keeping with DeFiLlama, the whole worth locked (TVL) throughout main blockchains noticed a slight decline by the top of Q1, indicating that the market was in a holding sample, ready for consumers to regain confidence and push out the sellers.

Bitcoin, Altcoins & Stablecoins: Q1 2025 Efficiency Evaluation

We all know that the general crypto market shrank in Q1 2025. Nevertheless, every important asset had a novel narrative to inform. From Bitcoin’s relative stability to Ethereum’s precipitous decline and altcoins’ inconsistent efficiency, the quarter revealed growing volatility and the consistently altering funding panorama.

Bitcoin’s dominance surged to 59.1% in Q1 2025, its highest degree since late 2020, reflecting its function as a relative protected haven amid broader market turmoil. Regardless of a pointy value drop of greater than -11.8% from its YTD peak of 109,588 to $82,514 by quarter-end, Bitcoin nonetheless managed to seize a bigger share of the general crypto market.

Whereas it underperformed conventional belongings like gold (try gold value prediction), which gained +18.0%, and lagged behind different safe-haven choices like U.S. Treasuries, Bitcoin’s growing hashrate signaled continued community confidence even in a cooling market.

Ethereum had a troublesome Q1 2025, with its value dropping 45.3% from $3,336 to $1,805, erasing all its 2024 features and bringing it again to 2023 ranges. It considerably underperformed in comparison with different main belongings like BTC, SOL, XRP, and BNB, which noticed smaller declines. Buying and selling quantity additionally took a success, falling from a every day common of $30 billion in This autumn 2024 to $24.4 billion in Q1 2025, with value drops typically coinciding with quantity spikes.

Amid a market decline, stablecoins’ market cap elevated by $24.5 billion in Q1, reaching a brand new all-time excessive of $226.1 billion on the finish of the quarter.

USDC, which elevated its market cap by $16.1 billion, was primarily accountable for the stablecoin market cap development. USDT and USDS additionally contributed $6.4 billion and $2.7 billion, respectively. Curiously, Ethena’s USDe was surpassed by USDS (previously DAI) after rising by 50.8%, the most important upswing following a protracted decline since 2022.

Asset

Worth Change in Q1 2025

Market Influence

Key Insights

Bitcoin (BTC)

-24.71% (from $109,588 to $82,514)

Elevated dominance to 59.1%

Ethereum (ETH)

-45.3% (from $3,336 to $1,805)

Erased 2024 features, returned to 2023 ranges

Stablecoins

+$24.5 billion (Whole market cap reached $226.1B)

Elevated market cap in Q1

Centralized vs. Decentralized Exchanges: A Pattern Evaluation

The general market slowdown was mirrored in buying and selling exercise on each centralized (CEX) and decentralized exchanges (DEX), with adjustments in person habits throughout chains and a lower in buying and selling volumes. Even amid the broader market decline, centralized exchanges (CEXs) remained essential for cryptocurrency buying and selling in Q1.

Listed below are the notable factors –

Spot buying and selling volumes reached $5.4 trillion, reflecting a 16.3% drop from the earlier quarter, as each institutional and retail participation slowed as a result of bearish market circumstances and important value drops in Ethereum and Bitcoin.

Binance held its lead as the highest trade by buying and selling quantity, regardless of going through regulatory challenges in some areas. In the meantime, rivals like Coinbase and OKX managed to take care of their person bases. Notably, HTX was the one prime 10crypto trade to see development, with an 11.4% improve in quantity, whereas Upbit skilled the most important decline, with a 34.0% drop.

Trying forward, CEXs are anticipated to consolidate because the market shrinks. Bigger platforms could strengthen their positions by diversifying providers and enhancing compliance, whereas smaller exchanges with decrease liquidity or restricted geographic attain could face growing strain.

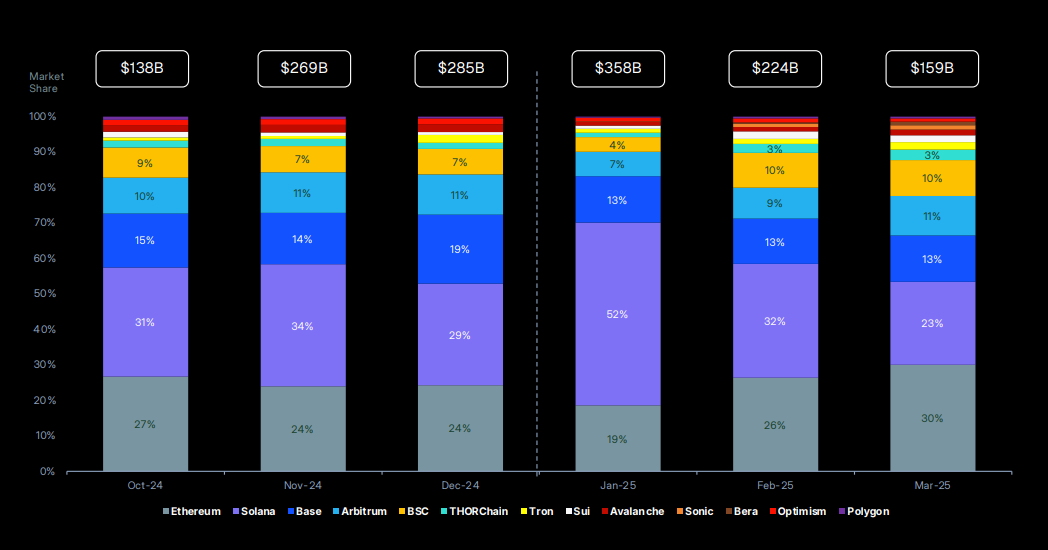

So far as the DEX panorama was involved, Solana solidified its dominance. With 39.6% of complete on-chain spot commerce quantity, Solana continued to be probably the most energetic Layer 1 blockchain for decentralized trade (DEX) actions. How so? The recognition of Solana-native meme cash and platforms similar to Jupiter and Raydium helped to help this.

Ethereum continued to dominate developer exercise even after ETH’s value fell sharply. Nevertheless, due to heightened competitors from extra scalable networks, its DEX commerce quantity decreased marginally to 33.4% in Q1. Coinbase’s Layer 2 answer considerably elevated developer curiosity and person exercise due to its efficient transaction processing and increasing ecosystem of consumer-focused dApps. Its ascent demonstrates a pattern towards Layer 2 acceptance as customers search for cheaper and faster alternate options to the Ethereum mainnet.

The use and commerce volumes of different important chains, similar to Arbitrum and BNB Chain, decreased in Q1. These adjustments indicate that liquidity was redistributed to platforms offering extra inventive or economical options.

DeFi Panorama of Q1 2025

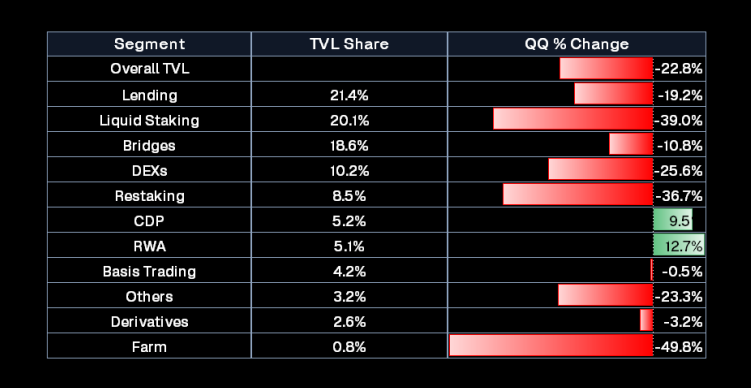

No crypto report is full with out DeFi. The DeFi panorama noticed a pointy decline in TVL within the first quarter of 2025. The multichain TVL fell by $48.9 billion, a 27.5% fall from the earlier quarter. Within the context of broader market falls, this decline displays waning investor confidence and capital flight.

Important outflows occurred from Ethereum, which continues to be the most important DeFi chain by TVL, since participation was deterred by excessive fuel costs and falling yields. Though Solana’s energetic ecosystem saved it considerably resilient, each Arbitrum and Solana, which had gained traction in late 2024, suffered setbacks.

Most DeFi tokens took a big hit in Q1, with Uniswap‘s UNI struggling the most important loss at -54.8%. It was adopted by AAVE (-48.3%) and HYPE (-46.2%). Notably, HYPE’s drop was linked to the controversy round Hyperliquid’s choice to delist the JELLY token and settle open futures contracts at a set value after suspected market manipulation. Learn extra about Hyperliquid crypto drama.

Capital locked in lending, liquid staking, and yield farming declined as liquidity mining incentives dried up. Nevertheless, innovation continued, with ongoing testing of cross-chain interoperability instruments, modular DeFi elements, and restaking protocols, hinting at long-term development potential. Regardless of current challenges, DeFi stays a important space for crypto innovation, although now with a sharper focus and extra cautious optimism.

NFT Market Overview in Q1 2025

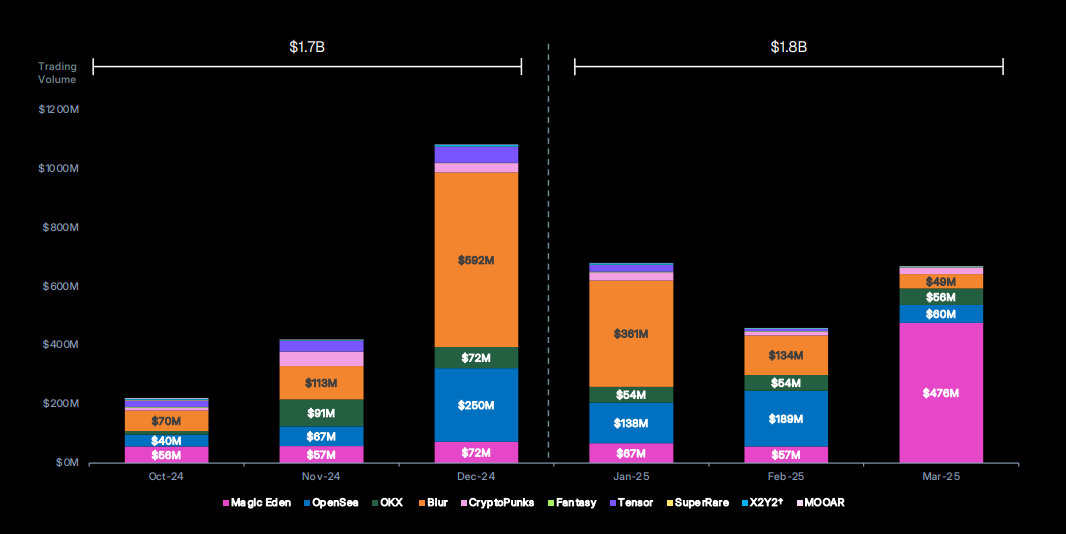

Q1 noticed a pointy decline within the NFT trade, with buying and selling volumes falling to $1.2 billion – A 65% drop from the earlier quarter. A wider downturn within the crypto scene and a lower in speculative curiosity may very well be blamed for this dip.

Some collections, similar to Bored Ape Yacht Membership and CryptoPunks, continued to dominate the market regardless of the overall downturn, holding greater than 60% of the whole worth. On the identical time, newer initiatives like Milady and Pudgy Penguins gained traction, reflecting a shift in collector preferences.

Blur remained the most important NFT market with a 40% share, adopted by OpenSea at 30% and Magic Eden at 15%. Bitcoin community exercise additionally surged, pushed by the rise of Bitcoin Ordinals NFTs, highlighting the increasing panorama past simply Ethereum.

Regardless of the difficult Q1 for the NFT market, the continued demand for premium collections and the expansion of latest platforms trace at potential restoration and long-term development.

How Did AI Tokens & Meme Cash Carry out?

Q1 2025 indicated clearly that traders love synthetic intelligence (AI) tokens and that meme cash proceed to achieve reputation.

Crypto AI cash took heart stage, capturing 35.7% of investor curiosity worldwide. As traders positioned bets on the convergence of blockchain and synthetic intelligence, giant inflows have been seen in main initiatives similar to Render (RNDR), Fetch.ai (FET), and SingularityNET (AGIX). These cash gained momentum primarily as a result of real-world partnerships and developments in AI expertise, somewhat than merely hypothesis. Regardless of total market warning, confidence was bolstered by elevated developer exercise in AI-related protocols, in addition to the launch of beta variations of decentralised AI marketplaces and computing networks by a number of firms.

Meme cash took a serious hit in Q1, with Pump.enjoyable—a Solana-based meme token launchpad—seeing a 56.3% drop in every day token deployments after the Libra token crash triggered a short market panic and tighter oversight of low-cap tokens.

Nevertheless, meme cash stay well-liked, capturing 27.1% of investor curiosity. Excessive-profile releases just like the Solana-based $TRUMP and $MELANIA tokens, launched forward of Donald Trump’s inauguration, shortly reached market caps of over $13 billion every, proving that the meme coin craze was removed from over.

Donald Trump’s Affect on Crypto in Q1

President Trump likes to place his title on issues, and crypto isn’t any exception. Trump’s more and more pro-crypto statements considerably influenced the market temper in Q1 2025.

He portrayed digital belongings as devices of monetary liberation by publicly opposing CBDCs and supporting cryptocurrency donations. The expectation of a extra crypto-friendly regulatory surroundings underneath his administration contributed to pleasure and market motion, particularly for Bitcoin and meme cash with political themes.

Many analysts suppose the Trump presidency would possibly see Bitcoin constantly making new all-time highs. However many crypto consultants oppose this view. If you wish to understand how crypto holders will probably be affected within the coming months, learn our devoted article on Influence of Donald Trump’s Presidency on Your Crypto Portfolio.

Because the crypto trade expands, so do the worldwide regulatory wants, emphasising anti-money laundering (AML), shopper safety, and countering the funding of terrorism (CFT). Q1 noticed fairly just a few noteworthy developments on the regulatory entrance:

The EU’s Markets in Crypto-Belongings (MiCA) framework superior towards adoption, paving the way in which for extra exact rules pertaining to service suppliers and stablecoins.

Within the meantime, Hong Kong saved up its aggressive licensing makes an attempt to ascertain itself as a crypto hub.

In the USA, growing political consideration, notably from the Trump administration, urged a extra optimistic future crypto surroundings.

On the identical time, regulators have begun to take discover of AI-integrated crypto initiatives. Unregulated AI tokens will most likely come underneath additional scrutiny inside the frameworks that at the moment govern information safety, algorithmic transparency, and monetary compliance.

Trade watchers anticipate that the upcoming introduction of MiCA and associated initiatives in Asia could in the end set up extra exact classifications for AI-driven digital belongings.

Conclusion

The crypto market had a tough begin in 2025, with its complete worth dropping almost 19% within the first quarter. Buying and selling exercise slowed, DeFi platforms noticed their locked worth plummet, and spot volumes on centralized exchanges fell sharply. Meme cash and dangerous tokens have been hit arduous, particularly after the Pump.enjoyable platform incident. Regardless of this, Solana remained a frontrunner in decentralized buying and selling, and Bitcoin held up higher than most digital belongings.

The market stays unsure, looking forward to Q2 2025. Traders are looking forward to adjustments in rates of interest, new EU rules like MiCA, and broader financial tendencies. Whereas challenges persist, sturdy fundamentals and ongoing innovation might assist the trade bounce again within the coming months.

See Additionally:

High 16 Greatest Crypto to Purchase Now in Could 2025

Greatest Crypto to Purchase At this time for Lengthy Time period: A 2025 Listing

References

CoinGecko. 2025 Q1 Crypto Trade Report. CoinGecko, https://www.coingecko.com/analysis/publications/2025-q1-crypto-report

Bitcoin’s TradingView Chart. TradingView, https://www.tradingview.com/chart/UucHJNRp/

DeFiLlama Ethereum. DeFiLlama, https://defillama.com/chain/Ethereum

“What Are Digital Belongings?” Coinbase, https://www.coinbase.com/en-in/study/crypto-basics/what-are-digital-assets

“Meme Cash and Their Influence on the Crypto Trade.” Binance, https://www.binance.com/en/sq./put up/17535298074977

The put up CoinGecko Report Evaluation: What Moved Crypto in Q1 2025? appeared first on 99Bitcoins.