In crypto buying and selling, the place feelings typically outweigh logic and volatility guidelines the charts, misleading methods can simply slip by means of the cracks. One such tactic is spoofing, a type of market manipulation that misleads merchants, distorts value traits, and undermines market integrity.

However what’s spoofing in funding phrases, particularly on the subject of the crypto market? How does it work, and what may be executed to keep away from it? This text will break all of it down—simplified, insightful, and full of all the pieces that you must know.

Definition and How Spoofing Works

At its core, spoofing in funding is a manipulative buying and selling technique the place a dealer locations giant purchase or promote orders with no intention of executing them. The goal? To create a false sense of provide or demand, affect market sentiment, and manipulate the value in a beneficial course.

Right here’s how spoofing is finished in buying and selling: A spoofer begins by inserting a big purchase order slightly below the present market value, creating the phantasm of robust demand. This huge order isn’t meant to be executed; as a substitute, it serves as bait. Different merchants, decoding this as a sign that costs are about to rise, shortly bounce in to purchase. Simply earlier than the big order will get crammed, the spoofer cancels it and takes benefit of the briefly inflated value to promote their very own belongings at a revenue.

The identical tactic may be reversed: the spoofer locations pretend promote orders to generate panic, triggering a value drop. As soon as costs fall, they purchase in cheaply. How spoofing is finished usually depends on the speedy placement and cancellation of those misleading orders utilizing bots or superior buying and selling software program, permitting spoofers to remain one step forward of detection and manipulate markets in actual time.

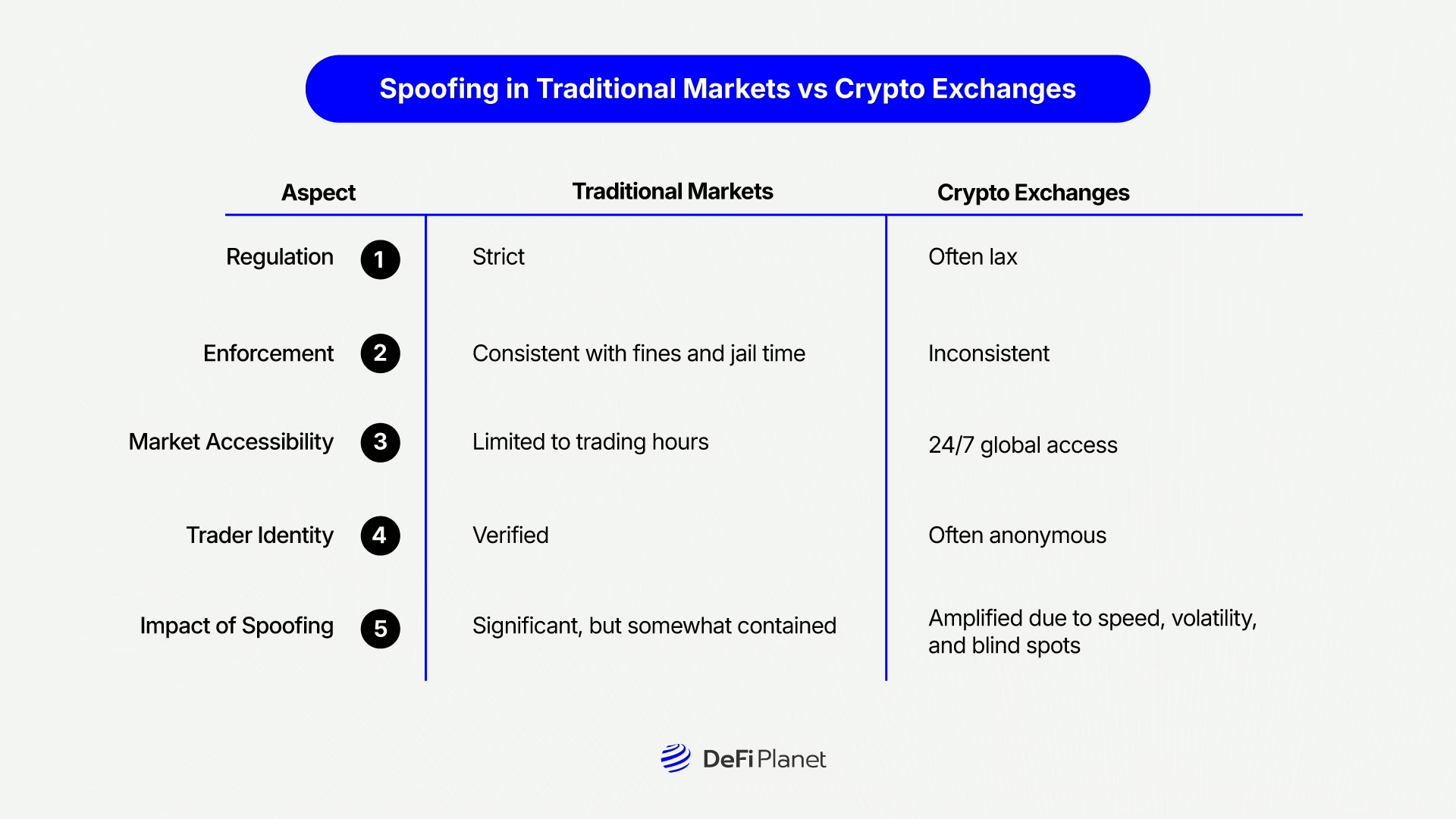

Spoofing in Conventional Markets vs Crypto Exchanges

Spoofing in Conventional Markets vs Crypto Exchanges reveals a story of two very completely different regulatory worlds. Spoofing isn’t a brand new trick—it first emerged in conventional monetary markets resembling inventory and futures exchanges. There, it has confronted robust regulatory pushback. Regulators just like the SEC and CFTC have cracked down laborious on spoofers in conventional markets, implementing strict guidelines, imposing heavy fines, and even pursuing legal convictions. These markets are below tight regulatory oversight, with superior surveillance techniques designed to detect and penalize manipulation in real-time.

In distinction, crypto exchanges, notably these which are unregulated or offshore, nonetheless function in authorized gray zones. This lack of uniform regulation permits spoofers to thrive. Not like conventional markets, many crypto platforms lack real-time spoofing detection techniques, creating blind spots for manipulation.

The anonymity and accessibility of crypto buying and selling additional widen this hole. Many platforms have minimal or no KYC (Know Your Buyer) protocols, permitting dangerous actors to function behind pseudonyms with little accountability. Mixed with crypto’s 24/7 international accessibility, this creates a fertile floor for spoofing.

What’s extra, the velocity and volatility of crypto markets intensify spoofing’s influence. Trades execute in milliseconds, and each people and bots are fast to react to misleading indicators—typically earlier than they will even confirm them.

So, is spoofing in buying and selling unlawful? Sure, in jurisdictions just like the U.S. and U.Ok., it’s unequivocally unlawful, with penalties starting from hefty fines to jail time. Nonetheless, on the subject of crypto, enforcement stays inconsistent, leaving a loophole that manipulators proceed to take advantage of.

Comparability Desk: Spoofing in Conventional Markets vs Crypto Exchanges

How Spoofing Impacts Market Sentiment and Pricing

How Spoofing Impacts Market Sentiment and Pricing is rooted in its potential to take advantage of human psychology—notably feelings like FOMO (Concern of Lacking Out) and FUD (Concern, Uncertainty, and Doubt). Image this: you’re watching the order e-book, and abruptly it’s flooded with huge purchase orders. Naturally, you assume a rally is coming. You bounce in. The value begins to rise. However then, these giant purchase orders disappear. The value crashes. You’ve simply been spoofed.

This type of manipulation doesn’t simply mislead particular person merchants—it disrupts your entire market. Spoofing influences short-term value course, creating synthetic momentum that tips others into reacting. It additionally erodes dealer confidence and belief, as members grow to be uncertain of whether or not the indicators they see are actual. Past that, spoofing impacts market liquidity and volatility, typically draining liquidity after luring it in below false pretences. Even algorithmic buying and selling behaviour is thrown off, since many buying and selling bots are designed to reply immediately to order e-book exercise, making them straightforward targets for manipulation.

At its core, spoofing distorts the market’s pure equilibrium. Costs grow to be indifferent from real provide and demand, changed by an phantasm of exercise. It’s a con job dressed as much as appear to be extraordinary buying and selling.

So, is spoofing the identical as scamming? Not precisely. Whereas it’s not a rip-off within the conventional sense like phishing or rug pulls, spoofing is a misleading and unethical type of market manipulation, and in lots of jurisdictions, it’s unlawful.

How one can Detect Spoofing in Crypto

Detection continues to be a significant problem for regulators and merchants alike. That is primarily as a result of spoofers have grow to be more and more subtle of their ways. For instance, they typically use layered spoofing, inserting a number of pretend orders at completely different value ranges to create an phantasm of market depth. These orders are then cancelled inside milliseconds, making it tough for conventional monitoring instruments to register them. Moreover, spoofers benefit from change latency and weaknesses in surveillance expertise, particularly on platforms with restricted regulatory oversight.

For retail buyers, catching spoofing in actual time is even tougher. Nonetheless, there are key pink flags to look at for:

Giant orders that disappear abruptly as the value approaches them.

A excessive frequency of order placements and cancellations, notably with none execution.

Uncommon liquidity actions are seen by means of superior heatmaps or buying and selling dashboards.

Value jumps or dumps with none information catalysts, suggesting manipulation somewhat than natural exercise.

Why do merchants spoof? The reply is easy: revenue from value manipulation. By exploiting predictable behaviours of each human merchants and algorithmic bots, spoofers use misleading indicators to set off reactions, shifting the market of their favour earlier than reversing the commerce.

Though it’s tough, understanding how spoofing is detected and recognizing suspicious patterns helps scale back your threat.

How one can Shield Your self

Whilst you can’t totally stop spoofing, you can take proactive steps to cut back your threat:

Use restrict orders, not market ordersRestrict orders aid you keep away from shopping for or promoting at manipulated costs, providing you with extra management and lowering the prospect of reacting impulsively to misleading order e-book exercise.

Verify order books for patterns like repeated giant orders vanishing too quickSudden disappearances of massive purchase or promote partitions are a standard spoofing tactic. Look ahead to these repeated patterns as an indication that one thing suspicious could also be influencing the value.

Cross-check costs throughout completely different platforms and information retailers to confirm if strikes are naturalIf a significant value swing occurs with out corresponding information or consensus throughout exchanges, it might be the results of manipulation somewhat than real market sentiment.

Don’t commerce primarily based on the order e-book alone Relying solely on order e-book information is dangerous. Use it alongside technical evaluation, real-time information, and market sentiment instruments to make extra knowledgeable and balanced buying and selling selections.

So, are you able to stop spoofing completely? No. However consciousness and strategic buying and selling can considerably scale back your publicity to it.

Remaining Thought: Staying Good in a Manipulated Market

Spoofing within the crypto market isn’t only a intelligent trick—it’s a type of market manipulation that strikes on the coronary heart of what crypto claims to face for: decentralization, transparency, and equal entry. In an area already flooded with volatility, hypothesis, and emotion-driven selections, spoofing provides one other layer of chaos by creating false impressions of provide and demand. It misleads merchants, distorts value indicators, and erodes belief, particularly amongst new or retail members who could not spot the indicators till it’s too late.

Whereas conventional monetary markets have responded with stricter guidelines, surveillance techniques, and prosecution by businesses just like the SEC and CFTC, the crypto world continues to be catching up. Many platforms—notably smaller or unregulated exchanges—stay weak to spoofing and related schemes like wash buying and selling and pump and dump ways.

Till regulation and enforcement enhance throughout the board, your greatest defence is information. Realizing how spoofing is finished, why spoofers do it, and what pink flags to look at for—resembling sudden order e-book fluctuations that vanish in seconds can assist defend your capital. In crypto, hype may be loud and fast-moving, however your selections needs to be data-driven and deliberate. Staying knowledgeable isn’t simply sensible—it’s important.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein needs to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of monetary loss. All the time conduct due diligence.

If you wish to learn extra market analyses like this, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

“Take management of your crypto portfolio with Markets PRO, DeFi Planet’s suite of analytics instruments.”