The second week of 2026 lastly delivered the primary actual fireworks we’ve seen shortly, with Bitcoin breaking out of its multi-month buying and selling vary and Ethereum staking hitting all-time highs amid softer inflation knowledge and renewed institutional flows. From macro reduction to altcoin surges like Monero’s privateness breakout, the market confirmed indicators of life after the Vacation season’s uneven value motion—although regulatory hurdles just like the delayed CLARITY Act will preserve merchants on edge.

Key Takeaways

Macro Reduction: Decrease-than-expected core inflation (2.6%) has boosted market confidence that the Fed can shift towards easing in 2026 with out the fast risk of a recession.

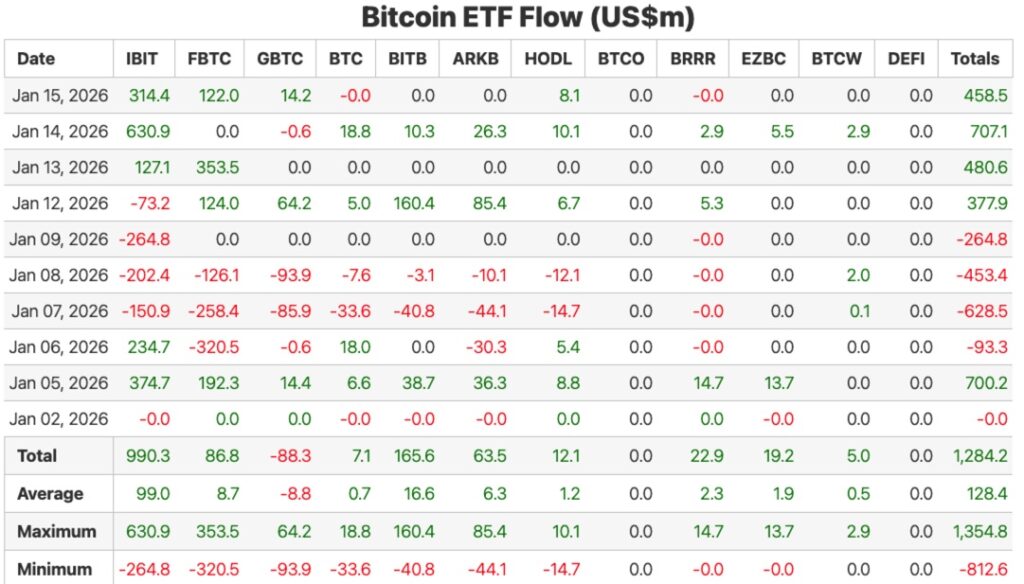

Bitcoin’s Breakout: After months of sideways buying and selling, Bitcoin decisively cleared resistance at $94,000, fueled by $1.7 billion in ETF inflows; analysts now view $100,000 as the following main affirmation degree.

Ethereum Staking Milestone: Ethereum hit a file with 30% of its provide now staked, supported by large institutional bets (like BitMine’s $6 billion place) and a shifting narrative towards ETH outperformance.

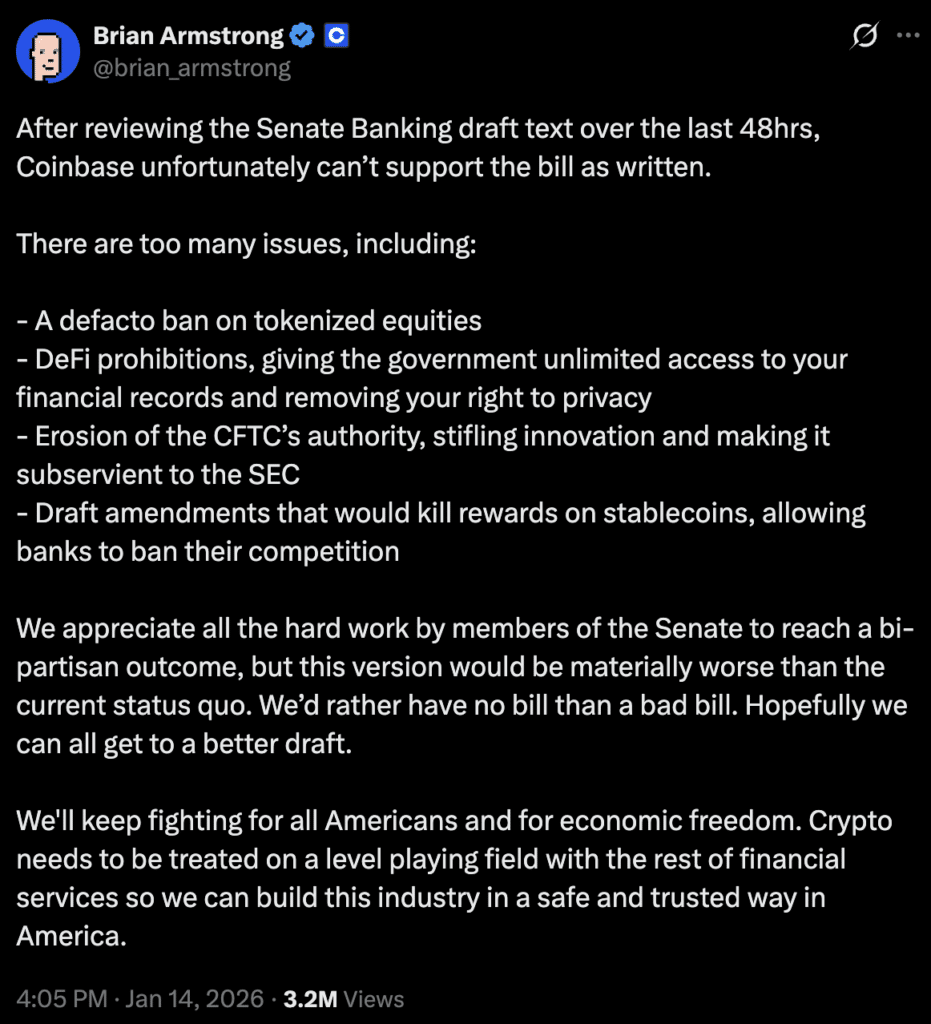

Regulatory Turmoil: The CLARITY Act, probably the most vital piece of crypto laws, was delayed to late January after Coinbase withdrew its assist, citing issues over stablecoin and DeFi restrictions.

Privateness & Safety Shifts: Whereas Monero (XMR) surged to all-time highs on privateness demand, main safety breaches at Belief Pockets and Ledger served as a stark reminder of persistent self-custody dangers.

Markets exhaled after December core CPI printed softer at 2.6% year-over-year (versus 2.7–2.8% anticipated), reinforcing the disinflation progress and regular demand through tame producer costs and retail gross sales, which collectively bolster Fed easing odds with out signaling recession dangers.

Bitcoin’s decisive upside break, its first actual transfer in over a month, got here alongside $1.7 billion in spot ETF inflows over three days, although pullbacks examined new assist ranges.

Ethereum dominated narratives with staking highs, institutional bets like BitMine’s $6 billion place, and analysts forecasting altcoin rotation because the ETH/BTC ratio grinds larger. Monero surged to new all-time highs on privateness demand amid international reporting guidelines. Nonetheless, safety stays precarious: Belief Pockets’s $8.5 million worm assault (totally reimbursed) and Ledger’s knowledge publicity tied to outdated LastPass flaws reminded customers of persistent pockets dangers.

Regulation noticed the SEC launch Undertaking Crypto for clearer token/DeFi guidelines, however confronted Democratic pushback over perceived softness, whereas the CLARITY Act markup obtained delayed to late January after Coinbase withdrew assist. Subsequent week’s Fed audio system, $2.2 billion BTC/ETH choices expiry, and industrial manufacturing knowledge set the stage for volatility as BTC eyes $100k affirmation.

Let’s dive in deeper.

Macroeconomic and Institutional Panorama

This week’s macro story was all about whether or not disinflation continues to be on monitor and the way a lot room that offers the Fed to ease later this yr.

Core U.S. inflation for December got here in barely softer than anticipated, with core CPI round 2.6% yr‑on‑yr versus forecasts nearer to 2.7–2.8%, easing fears of a renewed value spike and giving markets extra confidence that the Fed can finally shift towards gradual coverage easing later in 2026. Headline CPI continues to be above the Fed’s 2% goal, however the clear downtrend from the publish‑pandemic peaks reinforces the concept that the “final mile” of disinflation is progressing, simply extra slowly than in 2024–2025.

On the similar time, producer costs and retail gross sales are pointing to regular however not overheating demand, which, mixed with cooling inflation, helps equities and crypto whereas strengthening the narrative that the U.S. is in a gradual‑development, disinflationary however not outright recessionary surroundings.

Way forward for Readability Act Not So Clear

The Digital Asset Market CLARITY Act hit its largest political velocity bump but this week. After months of buildup and a protracted‑deliberate January 15 markup, Senate committees abruptly delayed their classes to the tip of the month amid final‑minute opposition from key trade gamers and lingering partisan disagreements over stablecoin yields, DeFi oversight, and the SEC–CFTC cut up.

Coinbase’s CEO, Brian Armstrong, pulled his assist on the eve of the Senate Banking Committee debate, warning that the newest draft might cripple core income strains, whereas state regulators and a few Democrats argued the invoice nonetheless weakens investor protections, forcing management to postpone moderately than threat a failed vote that would push complete U.S. crypto market‑construction reform off the 2026 agenda completely.

There was main pushback from the banking trade (unsurprisingly), who need to handicap stablecoin yields and DeFi permissions. It’s unclear precisely how issues will play out. The CLARITY act stays the one most pivotal piece of crypto regulation thus far, and has the potential to both present large assist or hurt to the trade.

Bitcoin and Ethereum Deep Dive

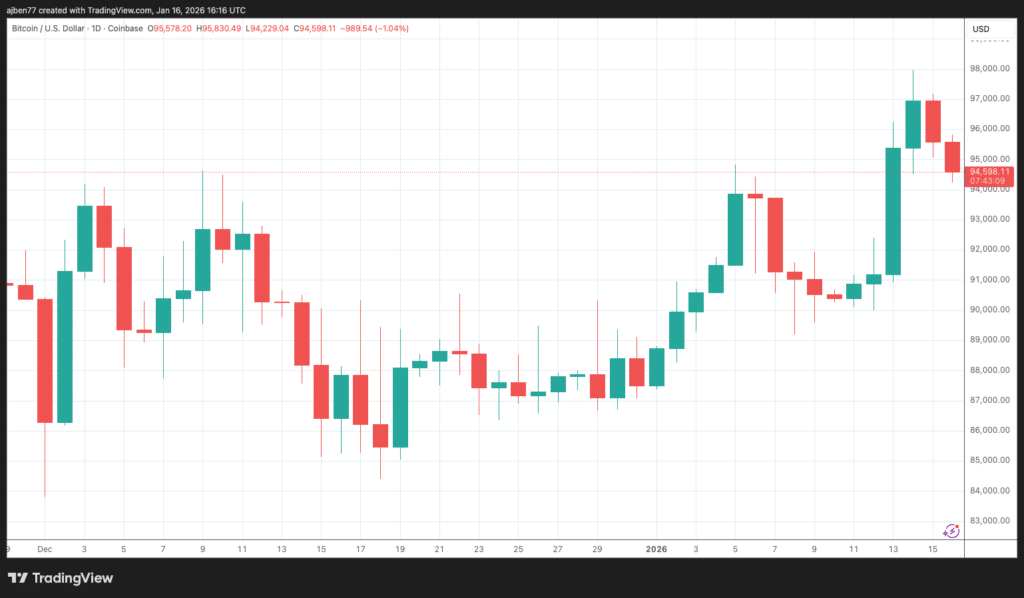

When you observe our weekly newsletters, you’ll know that I’ve been speaking about our crypto market leaders buying and selling ranges. Each Bitcoin and Ethereum have been caught in a sideways buying and selling vary since late November, failing to interrupt out a number of occasions. Properly… Bitcoin lastly broke out of its buying and selling channel earlier this week.

BTC managed to interrupt above that ~$94,000 degree on Tuesday, earlier than reaching a weekly excessive of just below $98,000. Now it did find yourself retracing a bit these final two days, however it’s nonetheless buying and selling at $94,500 – outdoors of its earlier vary.

We wish to see this transfer prolong to the $100,000 degree within the subsequent week to be able to verify it is a true breakout. Both manner, that is an encouraging signal of life from Bitcoin, and the primary actual decisive value transfer in over a month.

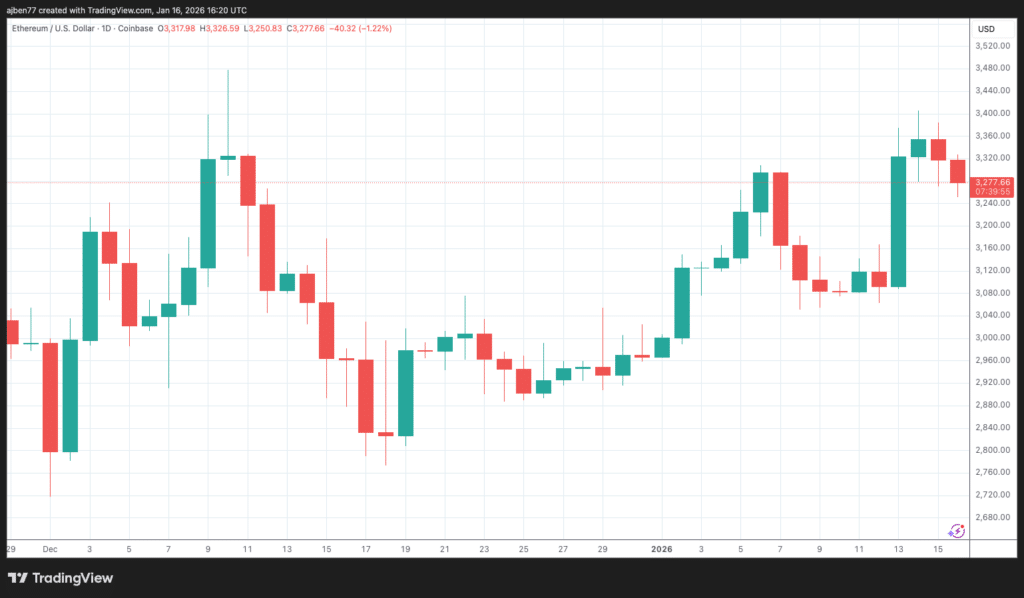

Ethereum additionally had a superb week and is up during the last 7 days. ETH is again buying and selling above $3,200 as soon as once more.

ETH managed to shut above its earlier excessive shut of $3,330 – the highest of its buying and selling vary. Nonetheless, it was unable to shut above that degree a number of occasions and didn’t decisively break and maintain above that resistance degree. It’s a bit too early to think about this a real breakout for ETH simply but… it wants one other push earlier than I really feel assured in calling it a real breakout of its buying and selling vary.

The timing of this surge in crypto costs aligns completely with softer CPI knowledge and renewed ETF inflows, suggesting institutional momentum is lastly kicking in after weeks of chop. Holding above these new ranges over the weekend shall be essential to maintain the bullish momentum into subsequent week’s macro knowledge.

Weekly Narrative Highlight

Ethereum’s staking milestone and outperformance narrative dominated headlines this week, because the community hit a staggering new file with almost 30% of its circulating provide, valued at over $120 billion, now locked in staking contracts. This surge was turbocharged by main strikes like BitMine Immersion Applied sciences boosting its ETH stake by one other $600 million to a complete of roughly $6 billion, underscoring how large-scale validators are doubling down on Ethereum’s proof-of-stake safety mannequin amid rising community exercise and yield alternatives.

Normal Chartered joined heavyweights like Fundstrat’s Tom Lee in declaring 2026 the definitive “yr of Ethereum,” citing a cocktail of tailwinds: explosive development in new pockets creation, stablecoin inflows on Ethereum Layer 1 and L2s, file spot ETH ETF inflows flipping Bitcoin’s for a number of classes, and a steadily bettering ETH/BTC buying and selling ratio that hints at capital rotation from BTC dominance into altcoin upside. The narrative framing ETH because the “actual play” on DeFi growth, tokenization, and Web3 infrastructure resonated extensively, with analysts pointing to Ethereum’s unmatched developer ecosystem, maturing rollups, and upcoming upgrades as structural benefits over opponents, positioning it to seize worth as crypto liquidity broadens past pure Bitcoin publicity.

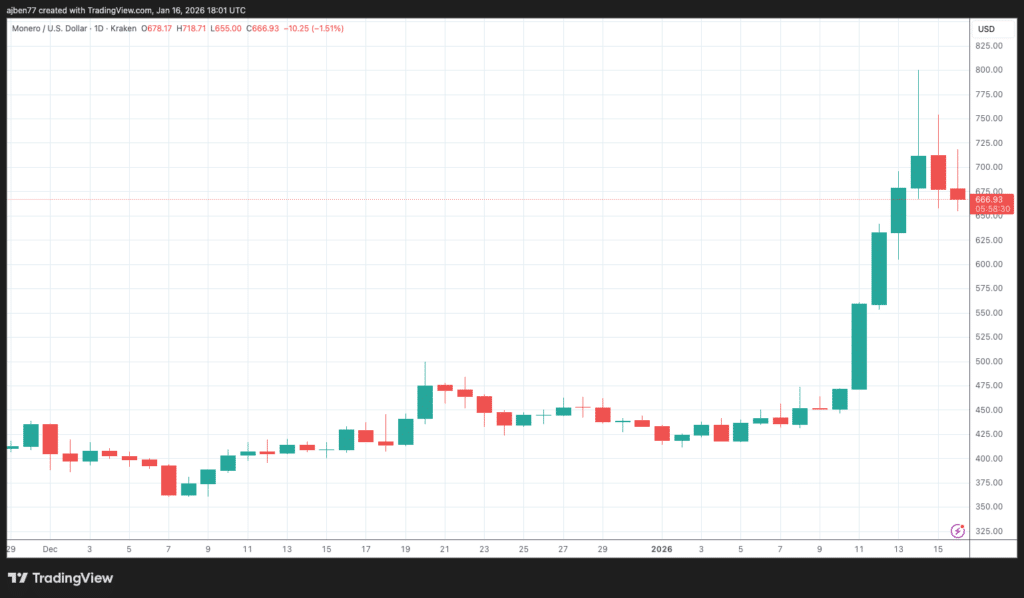

Moreover, privateness coin Monero (XMR) staged a pointy breakout this week, surging to new all-time highs of just below $800 after basically 5 years of consolidation.

This transfer was fueled by renewed retail curiosity in censorship-resistant property amid U.S. regulatory headlines and international stablecoin reporting mandates. On-chain metrics confirmed spiking transaction quantity and energetic addresses, whereas merchants cited XMR’s mounted provide issuance and battle-tested privateness tech as hedges in opposition to escalating surveillance traits, sparking speak of a “privateness renaissance” if macro circumstances favor threat property additional. This comes only a few months after Zcash’s (ZEC) large breakout, resulting in additional proof of a surge in privateness tech.

Regulatory and Safety Watch

Regulatory headlines this week have been dominated by the SEC’s rollout of Undertaking Crypto, a significant coverage shift underneath new management that introduces an “innovation exemption” and strikes away from pure enforcement towards clearer guidelines on token classification, custody, and DeFi compliance. These strikes might ease obstacles for establishments however drew fireplace from Home Democrats, who accused the company of going comfortable on circumstances involving Binance, Coinbase, and Tron’s Justin Solar.

On the safety entrance, Belief Pockets (Binance‑owned) confirmed a provide chain assault through a self‑replicating worm that drained about $8.5 million from 2,520 wallets, prompting full reimbursements, whereas Ledger disclosed a 3rd‑social gathering breach exposing buyer order knowledge (however no keys or funds) and ongoing crypto thefts traced again to the 2022 LastPass hack, underscoring persistent dangers in pockets ecosystems.

Why you’ll be able to belief 99Bitcoins

Established in 2013, 99Bitcoin’s workforce members have been crypto consultants since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Knowledgeable contributors

2000+

Crypto Initiatives Reviewed

Comply with 99Bitcoins in your Google Information Feed

Get the newest updates, traits, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now