Indian crypto trade WazirX has revealed the date for a creditor revote that, if handed, may pave the way in which for the long-awaited fund distribution.

WazirX Has Revealed The Creditor Revote Timeline

In a publish on X, WazirX has shared an replace on the scenario relating to person crypto distribution. The trade fell prey to an notorious hack one yr in the past, by which attackers linked with the North Korean Lazarus Group made away with virtually $235 million in digital asset funds.

The platform closed its deposits and withdrawals in response to the assault, and to today, it hasn’t been capable of resume operations. Because of this the remainder of the unique $500 million in person funds, round $265 million, are nonetheless caught in limbo.

Latest developments, nevertheless, have lastly set issues in movement. In June, WazirX’s dad or mum firm, Zettai PTE LTD, a Singapore-based entity that was accountable for dealing with person crypto, went to the Singapore Excessive Court docket with a distribution proposal that had overwhelming assist from the collectors behind it.

This plan, nevertheless, had ended up discovering rejection. Earlier this month, the corporate once more went to court docket with a revised proposal, and this time, the court docket ended up giving it a inexperienced gentle. Alongside the announcement of the court docket listening to resolution, WazirX had mentioned one other creditor vote might want to occur earlier than the proposal can transfer ahead.

Now, the trade has formally introduced a date for it: July thirtieth. This revote will stay dwell till August sixth. “If the requisite majority of collectors vote FOR the Scheme as soon as once more, the token distribution will begin inside 10 enterprise days after the Scheme is efficient, simply as deliberate,” famous WazirX within the publish.

Because of this for the primary time on this saga, customers lastly have a possible timeline for distribution. Alongside the distribution course of, the trade additionally plans to restart operations.

Nischal Shetty, CEO of WazirX, has additionally talked in regards to the course of in an X publish. “A restart may even assist us work in direction of producing earnings and distributing it again to all collectors,” mentioned Shetty.

The court docket had beforehand rejected the plan resulting from considerations about compliance with Singapore’s Monetary Companies and Markets Act (FSMA) and the involvement of Panama-based Zensui within the distribution course of. The greenlight got here as Zanmai Labs, the Indian firm behind the trade, was as a substitute tasked with dealing with the funds.

It now stays to be seen whether or not collectors will vote in favor of the amended proposal, as they did for the final one, and doubtlessly permit for an finish to the lengthy saga.

Bitcoin Has Seen A Sharp Revenue-Taking Spree Not too long ago

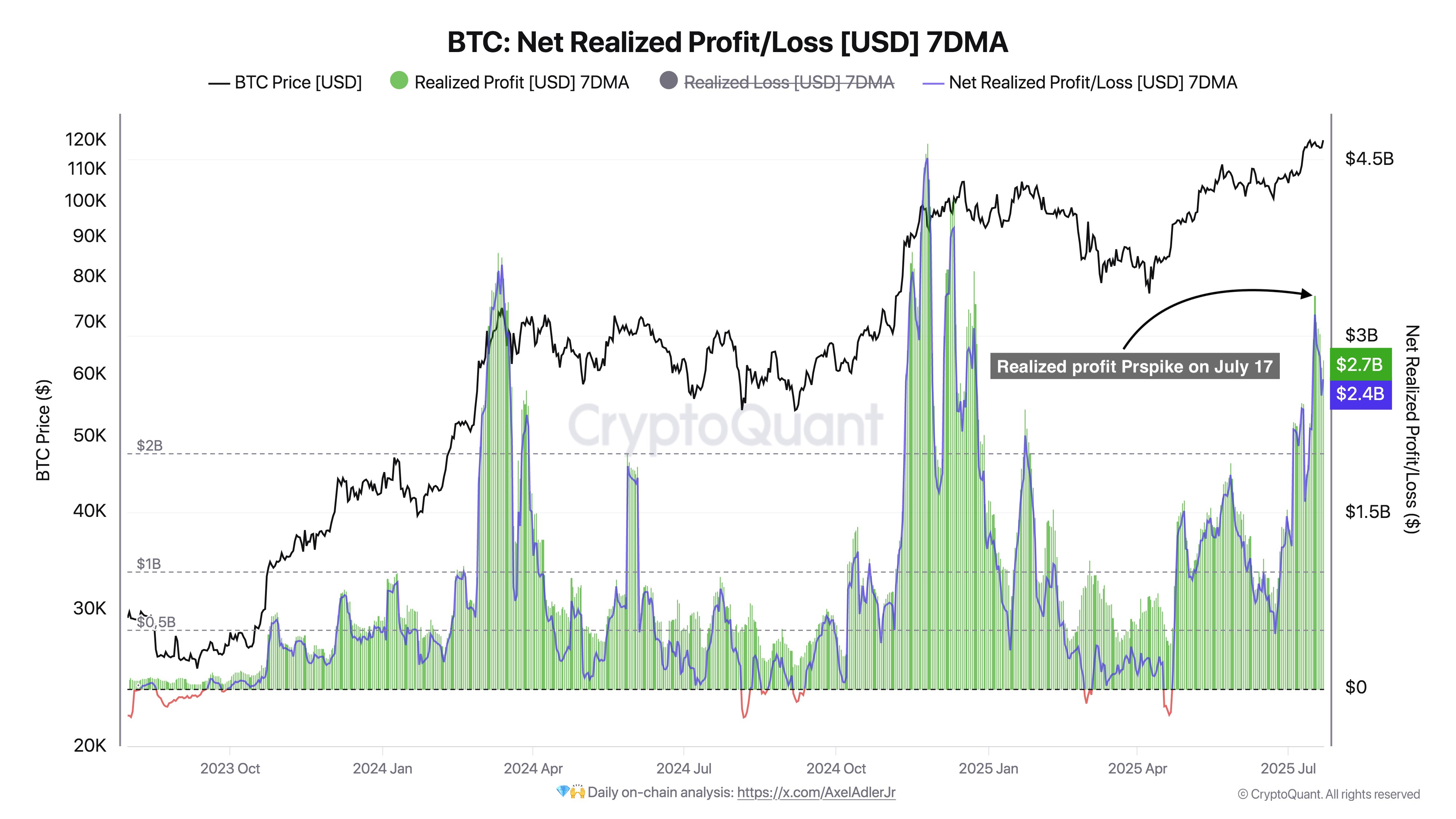

Bitcoin buyers have participated in peak revenue realization amounting to a whopping $3.3 billion just lately, as CryptoQuant creator Darkfrost has identified in an X publish.

The development within the 7-day MA of the Bitcoin Realized Revenue | Supply: @Darkfost_Coc on X

Since this selloff, Bitcoin has been locked in sideways motion, with its value nonetheless floating across the $118,300 mark immediately.

Appears to be like like the worth of the coin has been unable to discover a path | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.