Cryptocurrencies could exist within the digital ether, fortified by encryption and blockchain know-how, however the dangers surrounding them have gotten more and more tangible. As digital defences develop extra refined, criminals are adapting, shifting from on-line hacks to real-world violence in pursuit of crypto property. What as soon as felt like a purely digital danger has developed right into a bodily menace with actual penalties.

Not like conventional financial institution accounts, that are protected by institutional safeguards, crypto wallets rely solely on non-public keys recognized solely to the holder. As soon as these keys are compromised, funds could be transferred immediately and irreversibly. Mixed with the pseudonymous nature of blockchain transactions, this degree of management makes crypto buyers particularly enticing targets for criminals looking for high-reward, low-reversal alternatives.

Learn Additionally: Safety of Crypto Exchanges and Wallets

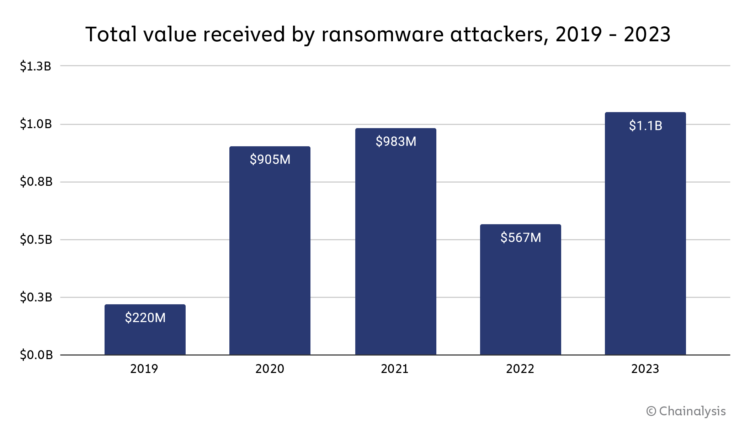

Understanding this rising menace isn’t only a matter of warning—it’s turning into important for anybody navigating the digital asset house, whether or not you’re a seasoned dealer or a newcomer chasing monetary freedom. In 2023 alone, ransomware gangs extorted over $1.1 billion in cryptocurrency funds, based on blockchain analytics agency Chainalysis, a stark indicator of how felony methods are evolving alongside crypto’s mainstream rise.

Excessive-Profile Bodily Assault Circumstances

Whereas the digital world of crypto affords immense monetary freedom, it additionally comes with real-world dangers that stretch past screens and servers. Listed below are some unsettling examples:

Household of Paymium Co-Founder Focused – Might 2025

In a dramatic broad-daylight assault in Paris, the daughter and grandson of Pierre Noizat, co-founder and CEO of the French crypto trade Paymium, narrowly prevented abduction. This Paymium CEO household kidnapping try concerned three masked males making an attempt to drive them right into a van within the bustling eleventh district. In a daring act of defiance, Pierre Noizat’s daughter managed to disarm one of many assailants, reportedly tossing his gun apart within the warmth of the wrestle.

En plein Paris, un homme a été violenté par des individus cagoulés, habillés tout en noir. Ils tentaient de l’enlever. Un homme a surgi, extincteur à la foremost, pour les faire fuir. →https://t.co/P0qV6PR40v pic.twitter.com/9f4r2Gi7ho

— Le Figaro (@Le_Figaro) Might 13, 2025

Bystanders shortly stepped in, forcing the attackers to flee. All three victims have been taken to the hospital with accidents, and the incident is now a high-priority case for French authorities.

Paris Abduction – Might 2025

In one other chilling case, the daddy of a distinguished French crypto investor was kidnapped proper off the road. His captors demanded a ransom of €5-7 million and, in a brutal escalation, reduce off one among his fingers to strain his household into complying. Luckily, French police managed to find and rescue him, arresting 5 suspects within the course of. This case provides to the rising variety of crypto kidnapping circumstances reported globally and serves as a grim reminder that even the households of crypto buyers can discover themselves within the crosshairs.

Ledger Co-Founder Assault – January 2025

Even trade insiders aren’t immune. David Balland’s kidnapping shook the crypto group when the Ledger co-founder and his spouse have been kidnapped in Vierzon, France. In a disturbing echo of different current circumstances, Balland was reportedly mutilated, with one among his fingers severed by his captors. After a large-scale investigation involving over 200 officers, police arrested 10 suspects, highlighting the intense bodily dangers that high-profile crypto figures can face.

Pascal Gauthier, chairman and CEO of Ledger, expressed reduction and gratitude for the protected launch of David and his spouse.

Las Vegas Host Turned Hostage – November 2024

Bodily crypto theft isn’t restricted to Europe. In a very nerve-wracking case, a crypto investor internet hosting a personal occasion in Las Vegas was kidnapped at gunpoint by three youngsters. They compelled him to switch $4 million in crypto earlier than abandoning him within the desert. The sufferer survived, however the case underscores a troubling development – as digital defences get stronger, criminals are more and more turning to bodily ways. This incident is likely one of the most talked-about Las Vegas crypto investor kidnap circumstances in current reminiscence, highlighting how susceptible even large-scale buyers could be.

As digital asset lawyer Sasha Hodder famous in a current X publish, this shift alerts a disturbing evolution in crypto crime: “It’s not simply social engineering or SIM swaps anymore.”

Nous sommes profondément soulagés d’apprendre la libération de David et sa femme et de les savoir sains et saufs. J’ai pris contact avec David, et nos pensées vont avec lui et sa famille. Nous partageons aussi l’émotion des membres de notre équipe, et en particulier de celles…

— Pascal Gauthier @Ledger (@_pgauthier) January 23, 2025

Criminals are transferring past purely digital ways, recognizing the potential for bodily coercion to achieve entry to precious property.

This evolving panorama requires heightened consciousness and strong safety measures to guard in opposition to such threats.

Why Crypto Holders Are Focused

Crypto holders are notably enticing to criminals for a number of causes:

Excessive Liquidity: Not like conventional property, similar to actual property or treasured metals, cryptocurrencies could be transferred immediately and globally with out intermediaries. Think about having a briefcase full of money which you can teleport to any nook of the world with a single click on – that’s the enchantment of crypto to criminals. The velocity and ease of those transactions make them a tempting goal for attackers in search of fast payoffs.

Anonymity and Irreversibility: As soon as crypto funds are transferred, they’re gone for good. Not like a bank card or financial institution transaction that may be reversed or disputed, blockchain transactions are closing. Which means if a thief will get entry to your non-public keys, the funds are completely misplaced, making crypto heists particularly enticing. It’s like handing over the one key to a protected that has no spare – as soon as it’s open, there’s no locking it again.

Lack of Institutional Oversight: Not like financial institution accounts, which have regulatory protections like insurance coverage and anti-fraud measures, crypto wallets rely solely on the holder’s vigilance. There’s no customer support hotline to freeze your funds if somebody tries to empty your pockets. This self-sovereignty, whereas empowering, additionally comes with a heavy accountability, making crypto holders extra susceptible to coercion.

Public Profiles and Flashy Life: Let’s face it, the crypto world loves to indicate off. Lamborghinis, luxurious watches, unique holidays – many high-profile buyers can’t resist the attract of displaying off their success. Sadly, this digital peacocking makes them prime targets for criminals. Publicly flaunting wealth, revealing costly purchases, and even casually mentioning positive factors on social media can appeal to undesirable consideration. It’s like lighting a flare in a darkish forest – you’re sure to draw predators. As one other observer bluntly famous, “Should you’re in crypto and nonetheless flaunting it on-line, you’re not simply silly, you’re placing your loved ones in peril.”

Private Safety Ideas for Crypto Traders

To cut back the danger of bodily assaults, take into account these sensible ideas:

Hold a Low Profile: You don’t have to cover within the shadows, however be aware about what you share. Bragging about your newest 10x crypto win would possibly really feel good within the second, nevertheless it’s additionally a neon signal to potential attackers. Hold your monetary triumphs non-public – your future self will thanks.

Use Pseudonyms and Safe Wallets: The extra nameless, the higher. Should you’re utilizing the identical deal with throughout platforms or attaching your actual identify to public addresses, you’re making it simpler for somebody to attach the dots. Think about using pseudonyms and devoted wallets for various functions so as to add an additional layer of separation.

Range Your Routine: Keep away from predictability. Altering your day by day habits, routes, and even the place you entry your wallets can disrupt potential surveillance efforts. Criminals love predictability – don’t give it to them.

Restrict Geotagging and Private Data On-line: Posting your luxurious trip or newest convention journey would possibly look nice on the ‘gram, nevertheless it additionally offers potential attackers a exact location. Hold your journey plans and costly purchases off the grid.

Put money into Private Safety Coaching: Enrolling in self-defence courses or buying private safety units could make a major distinction if you end up in a high-risk scenario. Consider it as an funding in your peace of thoughts, similar to your crypto portfolio.

Defend Your Household’s Privateness: When you’ve got family members who aren’t as security-conscious as you, it’s time for a household assembly. Guarantee they perceive the significance of sustaining a low profile, each on-line and offline.

Authorized Protections and Future Options

In relation to defending crypto buyers, the authorized panorama continues to be catching as much as the speedy tempo of digital innovation. Nonetheless, governments and legislation enforcement businesses worldwide are starting to acknowledge the real-world dangers that include digital wealth. Whereas it’s promising to see this shift, there’s nonetheless an extended method to go. Let’s discover some potential options:

Improved Authorized Protections – Think about if attackers confronted penalties as extreme as these for financial institution heists or high-stakes fraud. Stricter, crypto-specific legal guidelines may considerably deter would-be criminals. This would possibly embrace harsher punishments for bodily threats, extortion, and even using violence to achieve entry to digital property. In some areas, lawmakers are already pushing for more durable rules, however broader, globally coordinated efforts are wanted to make a very significant distinction.

Collaborative Legislation Enforcement Efforts – Crypto is a world phenomenon, however legislation enforcement typically operates inside strict nationwide boundaries. To fight cross-border crypto crimes, nations should collaborate, share intelligence, and coordinate crackdowns on refined felony networks. We’ve seen this occur in circumstances involving ransomware and cyber extortion – why not apply the identical coordinated effort to crypto-related bodily crimes?

Training and Consciousness Campaigns – Data is a strong defence. If extra buyers perceive the dangers and take proactive steps to guard themselves, the pool of straightforward targets shrinks considerably. This implies ongoing public consciousness campaigns, trade workshops, and clear, accessible steering on finest practices for crypto safety.

In the end, the street to safer crypto investing isn’t nearly higher tech – it’s about constructing a tradition of vigilance and resilience. In any case, the easiest way to outsmart the dangerous guys is to remain one step forward.

Finalizing Thought:

The promise of crypto has all the time been rooted in empowerment, giving individuals full management over their wealth, unbiased of conventional monetary techniques. However that very same management comes with a worth: accountability, and now, in some disturbing circumstances, real-world danger. As cryptocurrency continues to mature and combine into mainstream finance, buyers should additionally evolve, not simply in digital savvy, however in bodily vigilance.

This isn’t about residing in concern. It’s about understanding that the digital world doesn’t protect us from bodily threats—it amplifies them in new and unpredictable methods. From Paris to Las Vegas, the message is obvious: in case your property reside within the cloud, your safety have to be grounded in actuality.

In an area outlined by innovation, let’s innovate our security methods as fiercely as we do our monetary ones. As a result of on this planet of crypto, being your individual financial institution additionally means being your individual bodyguard.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein must be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of monetary loss. All the time conduct due diligence.

If you wish to learn extra market analyses like this one, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”

The publish When Crypto Goes Offline: The Rising Menace of Bodily Assaults on Traders appeared first on DeFi Planet.