Financing a brand new enterprise used to imply pitching venture-capital corporations or navigating a prolonged preliminary public providing that already required a sure degree of multinational and success. Blockchain tasks utterly modified that, flipping the script in 2013 when the primary preliminary coin providing let a brand new challenge generate capital raised immediately from promoting newly minted tokens.

Since then, ICOs have supported billion-dollar ventures alongside monumental flops, all on the primary stage of crypto finance. They’ve helped increase cash for all the pieces from metaverse video games to decentralized platforms like exchanges, whereas providing early contributors a stake in both future utility or governance.

In the event you’re inquisitive about becoming a member of an ICO or launching your individual, it’s essential to grasp how these token gross sales work, the dangers they carry, and the way they stack up in opposition to conventional fundraising. On this simple however detailed information, we’ll take the thriller out of ICOs, take a look at earlier ICO marketing campaign occasions, and take a look at a guidelines for evaluating alternatives on their very own deserves.

What Is an Preliminary Coin Providing (ICO)?

An preliminary coin providing, or ICO, is a technique of crowdfunding a blockchain challenge. An ICO helps increase capital by promoting tokens as an alternative of issuing fairness like a standard startup. The dev group mints a set provide of crypto belongings, sometimes from the utility or governance allotment, on a smart-contract platform akin to Ethereum, BNB Chain, or Solana.

Early consumers can change established cryptocurrencies like ETH, BNB, and USDC for the brand new asset at a particular new token value. These purchases fund growth whereas buying an asset which will recognize if the challenge finally ends up succeeding.

ICOs will normally occur earlier than the challenge is totally constructed, so contributors can guess on future factors of utility, like entry to decentralized storage, discounted buying and selling charges, governance votes, staking rewards, and extra. This fundraising mannequin has roughly change into the usual since tasks like Filecoin and Bancor raised tens of millions within the blink of a watch.

Though regulatory scrutiny has since tightened, particularly in america, the place many tokens danger classification as unregistered securities, ICOs stay standard in jurisdictions that embrace innovation.

The important thing options of ICOs embrace rising the entire world attain of the challenge (since primarily anybody with web entry can take part), speedy settlement through present good contract networks, and funding transparency searchable on public blockchains.

That stated, with minimal gatekeeping comes the elevated danger of scams, overpromised roadmaps, and poorly audited code. Profitable ICOs steadiness daring imaginative and prescient with verifiable progress, detailed tokenomics, and clear authorized disclosures.

How Does an ICO Work?

Within the easiest sense, an ICO follows a quite simple sequence of occasions. First, the group publishes their white paper, deploys a smart-contract sale contract, and collects crypto in change for newly minted tokens.

Behind that fast course of rundown, nonetheless, is a posh array of transferring components like authorized vetting, ongoing advertising and marketing campaigns, group discussions and engagement, and large-scale liquidity planning. These are usually the elements that may in the end decide the destiny of the challenge.

White Paper Launch

The white paper is the beating coronary heart of any ICO and serves a number of audiences directly: potential traders, regulators, auditors, and future group members. An excellent doc begins with an govt abstract that explains the real-world drawback and why blockchain is the optimum resolution, written in language clear sufficient for non-technical readers. It then dives right into a technical structure part, laying out consensus mechanisms, knowledge constructions, and interoperability layers. Diagrams, sequence charts, and gas-usage benchmarks assist builders confirm feasibility.

Subsequent comes tokenomics. Right here, the dev group should specify complete provide, preliminary circulating provide, vesting cliffs, inflation schedules, and burn mechanics. Clear formulation present that the group has stress-tested incentives in opposition to edge instances like whale dominance or governance gridlock. Tasks additionally define fund allocation: what share of raised capital goes to R&D, advertising and marketing, audits, liquidity, or authorized reserves, usually accompanied by Gantt-style timelines and quarterly milestones.

A reputable white paper features a danger disclosure part, candidly addressing smart-contract exploits, regulatory shifts, and market volatility. Groups bolster belief by publishing code repositories and commissioning third-party safety audits, linking hash-verified PDF stories immediately within the doc. Authorized evaluation is more and more commonplace; respected tasks append memoranda explaining why the token is a utility token beneath Swiss FINMA or Singapore MAS pointers, or how U.S. purchasers are geo-fenced to keep away from securities violations.

Lastly, main white papers will lay out a go-to-market technique that particulars partnership pipelines, change itemizing plans, and group incentive applications. Clear KPIs like month-to-month lively wallets or TVL targets assist traders extra simply observe execution, post-ICO.

What it actually comes all the way down to is {that a} white paper isn’t only a advertising and marketing or publicity asset. An intensive white paper is a technical blueprint, monetary prospectus, and authorized affidavit rolled into one, offering the transparency vital for knowledgeable participation.

ICOs vs. Conventional Fundraising Strategies

Conventional fundraising routes, like angel rounds, enterprise capital, and IPOs, all require in depth due diligence, board approvals, and sometimes months of negotiation. In addition they impose geographic and accreditation boundaries, limiting entry to institutional cash and accredited traders.

ICOs flip that script by automating issuance and settlement by means of good contracts, enabling tasks to lift tens of millions in days from a worldwide contributor base. Charges are decrease, and founders retain extra fairness as a result of they difficulty tokens reasonably than shares.

On the flip facet, ICO traders obtain no possession stake and restricted authorized protections, so if the challenge fails or founders disappear, recourse is minimal. Regulatory certainty is stronger for IPOs, the place underwriters and the SEC implement disclosure requirements, whereas ICOs function in a patchwork of worldwide jurisdictions, rising authorized danger for each issuers and members.

Who Can Launch an ICO?

Theoretically, any particular person, startup, or DAO with a compelling or fascinating sufficient thought and the technical experience for execution can launch an ICO. Virtually, the group wants smart-contract builders to write down the token contract, authorized counsel to navigate securities legal guidelines, advertising and marketing specialists to domesticate the group, and auditors to vet code.

This implies listening to jurisdiction, because it issues probably the most for getting a token off the bottom with an ICO. Switzerland, Singapore, and the Cayman Islands provide clearer token pointers, whereas america and China impose stricter guidelines.

An ICO launch additionally requires a strong treasury capability for treasury administration. There must be multisig pockets setup, creation of vesting contracts, and deciding on liquidity methods for post-sale buying and selling.

Launch an ICO: Step-by-Step

In the event you’ve been itching to begin a brand new cryptocurrency challenge, launching a public or personal ICO goes to require a couple of steps. Let’s check out what you’ll want to consider and attain with a view to launch an ICO.

First is the idea validation. You want to begin with a transparent worth proposition, the place you’ll be able to determine a real market hole and decide why a token is foundational to your resolution. Do a competitor evaluation, construct out a tough prototype, and get suggestions from consultants within the area to make sure there’s sufficient demand for the answer earlier than committing to authorized and advertising and marketing spend.Now comes the jurisdictional resolution and authorized structuring. Have interaction skilled counsel to map regulatory danger. Select a crypto-friendly headquarters the place you’ll be able to incorporate an entity to deal with the token issuance. Draft your authorized opinions surrounding token utility, KYC/AML insurance policies, and any investor accreditation necessities.Right here’s the place you actually get into the heart of how issues are going to work. To your tokenomics, it is advisable design provide, distribution, and incentive mechanics that align long-term person development along with your general treasury sustainability. Write and intensely check ERC-20 or different chain-specific contracts, and use them to combine time-locked vesting, multisig admin controls, and upgradeability safeguards. Be certain you fee a minimum of one impartial audit and publish these findings to domesticate confidence with traders.With all the main points mapped out, it’s time to create your white paper and official web site. Right here’s the place you’ll have your roadmaps, group bios, audit hyperlinks, and authorized disclosures all out there to the general public, and the place you’ll declare your official social channels. You must create a content material calendar so you’ll be able to preserve clear communication.Subsequent comes your personal and pre-sale rounds. Right here, you’re conducting a sale restricted to strategic companions, VCs, angel traders, and so forth., normally with longer vesting to maintain pores and skin within the sport. Properly-structured pre-sales increase essential capital for advertising and marketing, whereas additionally displaying the demand potential.Public sale mechanics are going to matter, so take into consideration whether or not you’ll be promoting with fixed-price, Dutch public sale, or dynamic cap. Combine KYC gates if required, set contribution caps to mitigate whale accumulation, and configure smart-contract limits to pause the sale when hard-cap or deadlines are met. Present real-time dashboards for traders to trace funds raised in the course of the ICO.At all times put aside a portion of funds and tokens for preliminary DEX liquidity swimming pools or negotiate centralized-exchange listings. Announce itemizing timelines prematurely to stop misinformation and coordinate with market-making companions to stabilize early buying and selling.

Key Variations Between ICO vs IPO

Regulation: IPOs endure a stringent evaluate by our bodies just like the U.S. Securities and Change Fee (SEC), requiring audited monetary statements and an in depth prospectus. ICOs survive in a patchwork of worldwide jurisdictions and sometimes depend on authorized opinions reasonably than formal approval, leaving members with fewer protections.Availability: ICOs are usually open worldwide to anybody with web and crypto funds, whereas IPO shares are normally supplied to accredited or institutional traders throughout book-building, with retail entry solely after itemizing.Time & Value: IPOs can take 6–18 months and tens of millions in underwriting, authorized, and road-show bills. However, ICOs can totally launch inside weeks with decrease prices.Transparency: ICO groups present white papers and audits, however not often face standardized accounting guidelines, making diligence variable and reasonably subjective. IPO corporations, nonetheless, publish in depth audited financials, danger components, and govt compensation.

Execs and Cons of ICOs

ICOs assist to democratize a challenge’s fundraising by permitting entrepreneurs to faucet a worldwide pool of crypto-savvy backers. Nevertheless, that very same openness can find yourself exposing members to larger ranges of danger. Being clear about expectations on each side of the fence may also help backers resolve whether or not to launch an ICO, and may also help traders measurement their funding and portfolio positions appropriately.

Execs of ICOs

International, frictionless capital: Anybody with an web connection and a crypto pockets can be part of, increasing the funding base far past Silicon Valley or Wall Road.Velocity to market: Sensible-contract gross sales shut in days or perhaps weeks, giving groups instant assets to construct with out prolonged VC negotiations.Early group engagement: Token holders change into evangelists, testing merchandise, offering liquidity, and driving community results from day one.Founder fairness preservation: As a substitute of promoting firm shares, founders difficulty utility tokens, retaining company possession whereas nonetheless elevating substantial capital.Programmable incentives: On-chain vesting, staking rewards, and burn mechanics can align long-term person conduct robotically, lowering reliance on authorized contracts.

Cons of ICOs

Regulatory uncertainty: In main markets akin to america, tokens danger classification as unregistered securities, exposing issuers and consumers to enforcement actions.Excessive rip-off frequency: Minimal gatekeeping attracts fraudulent groups that replicate code, spoof audits, and disappear post-raise, leaving traders with nugatory tokens.Data asymmetry: White papers aren’t standardized; lacking financials and unaudited claims make due diligence troublesome for retail members.Excessive volatility: Tokens can listing at 10× presale value and crash 90 % inside days, pushed by skinny liquidity and short-term hypothesis.Reputational danger: Failed milestones or hacks rapidly erode belief, miserable secondary-market worth and hindering future partnerships or regulatory approvals.

Examples of Preliminary Coin Choices

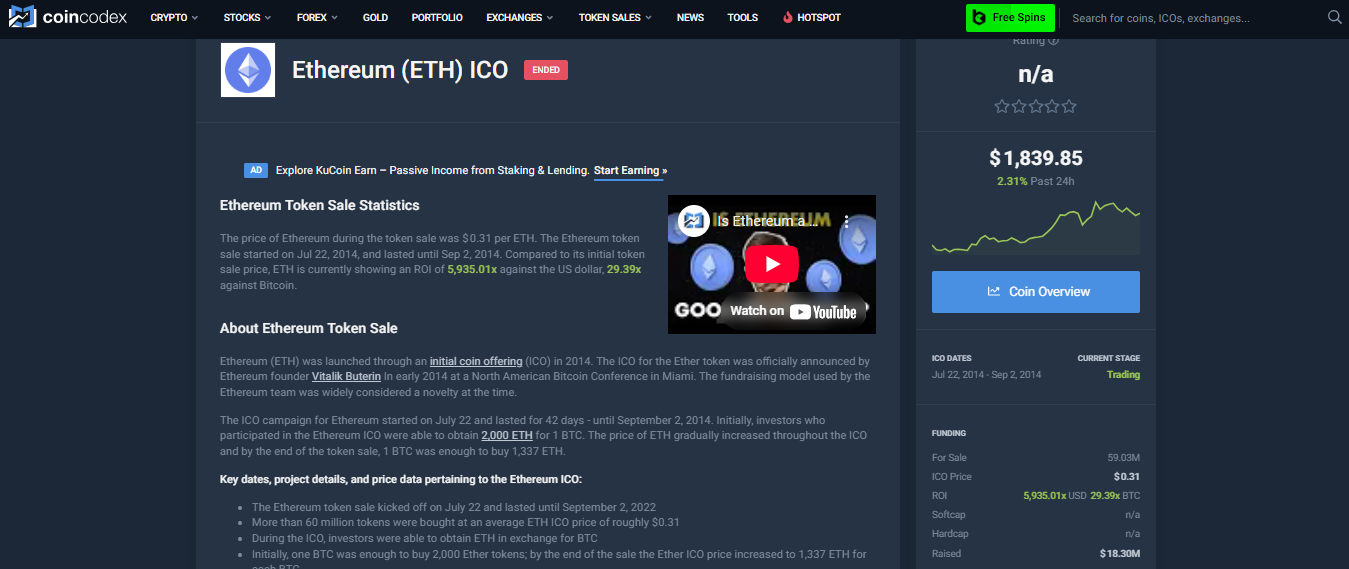

1. Ether (2014)

Supply: Coincodex

Raised about $18 million in BTC by promoting Ether at roughly $0.31. The ICO funded the launch of a programmable smart-contract platform that now underpins most DeFi and NFT exercise. Early members noticed exponential returns when ETH later traded above $4,000.

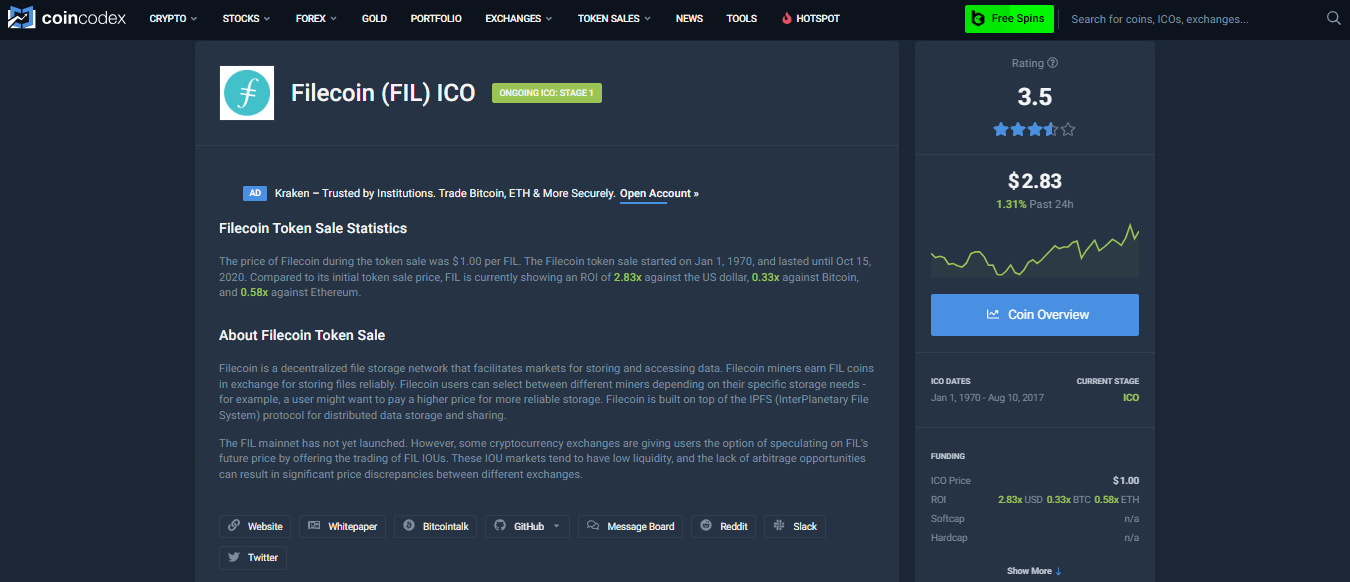

2. Filecoin (2017)

Supply: Coincodex

Secured $257 million through SAFT (Easy Settlement for Future Tokens), promising decentralized storage. Regardless of launch delays, Filecoin shipped mainnet in 2020, and FIL reached a $10 billion market cap peak.

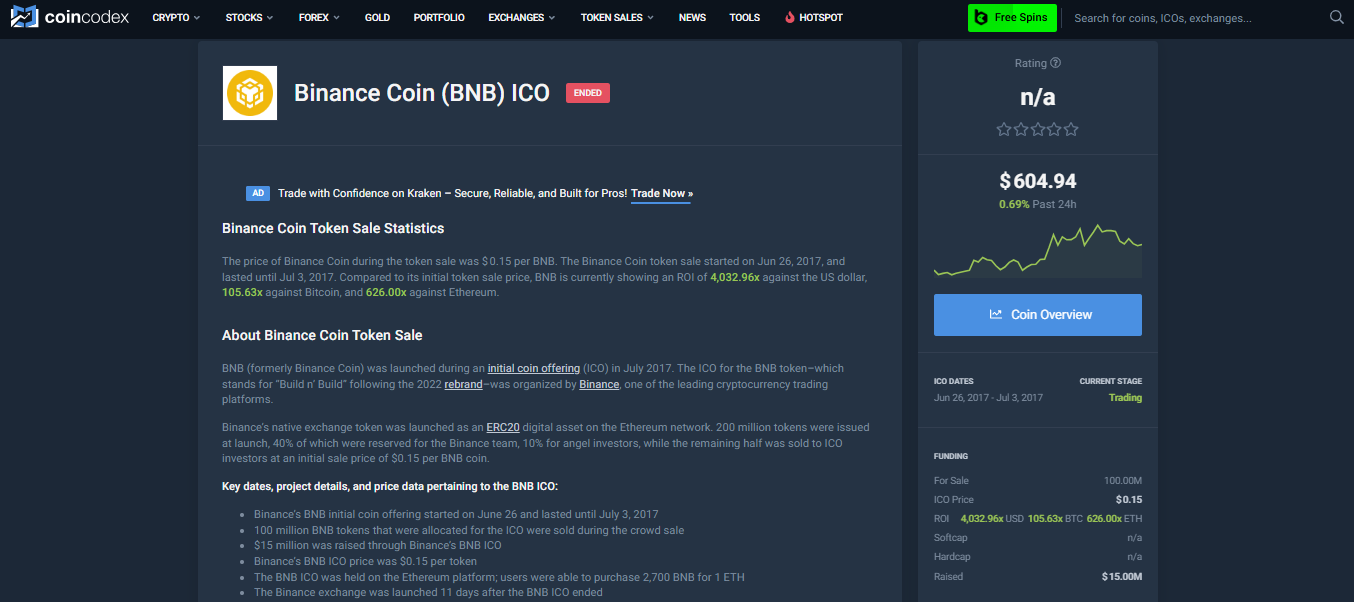

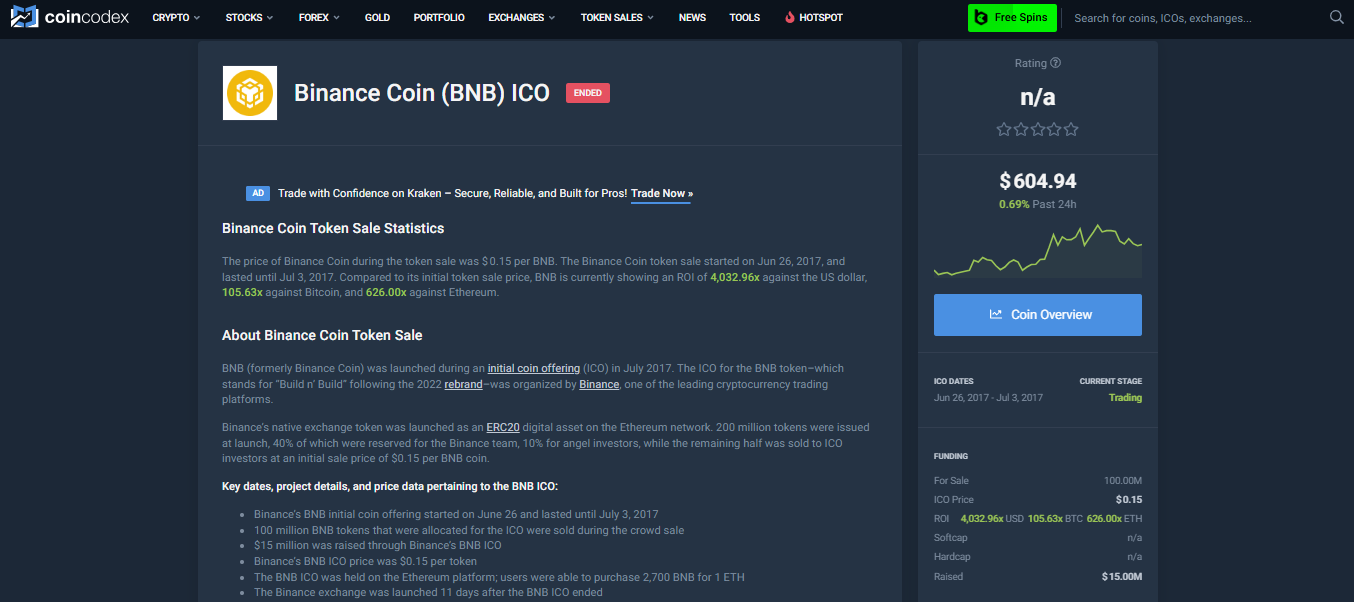

3. Binance Coin (2017)

Supply: Coincodex

Binance raised $15 million, utilizing BNB to supply trading-fee reductions and later to pay gasoline on BNB Sensible Chain. BNB grew to become a blue-chip utility token, climbing from $0.11 within the sale to over $600 in the course of the 2021 bull run.

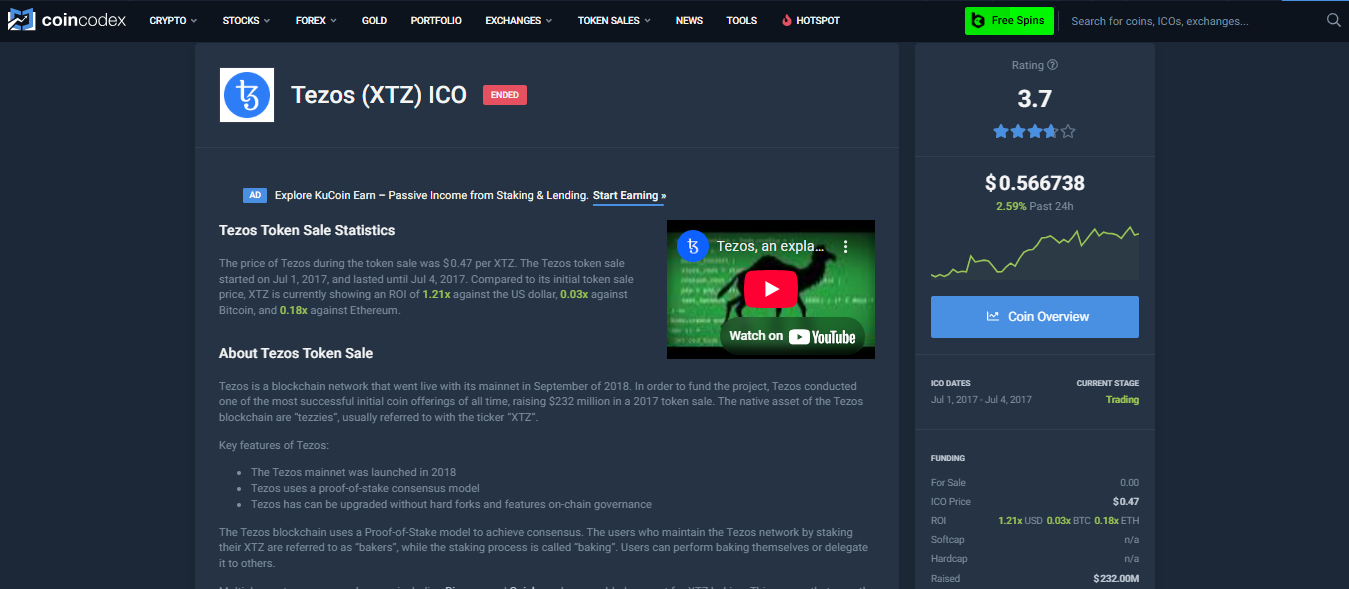

4. Tezos (2017)

Supply: Coincodex

Tezos initially collected $232 million, however inside governance disputes delayed the mainnet launch for roughly a 12 months. The consequence was Tezos DAO in the end deciding to implement on-chain self-amendment, permitting XTZ to stay an lively staking asset. Tezos additionally acts as an illustration of how bigger governance challenges might be solved with transparency and group.

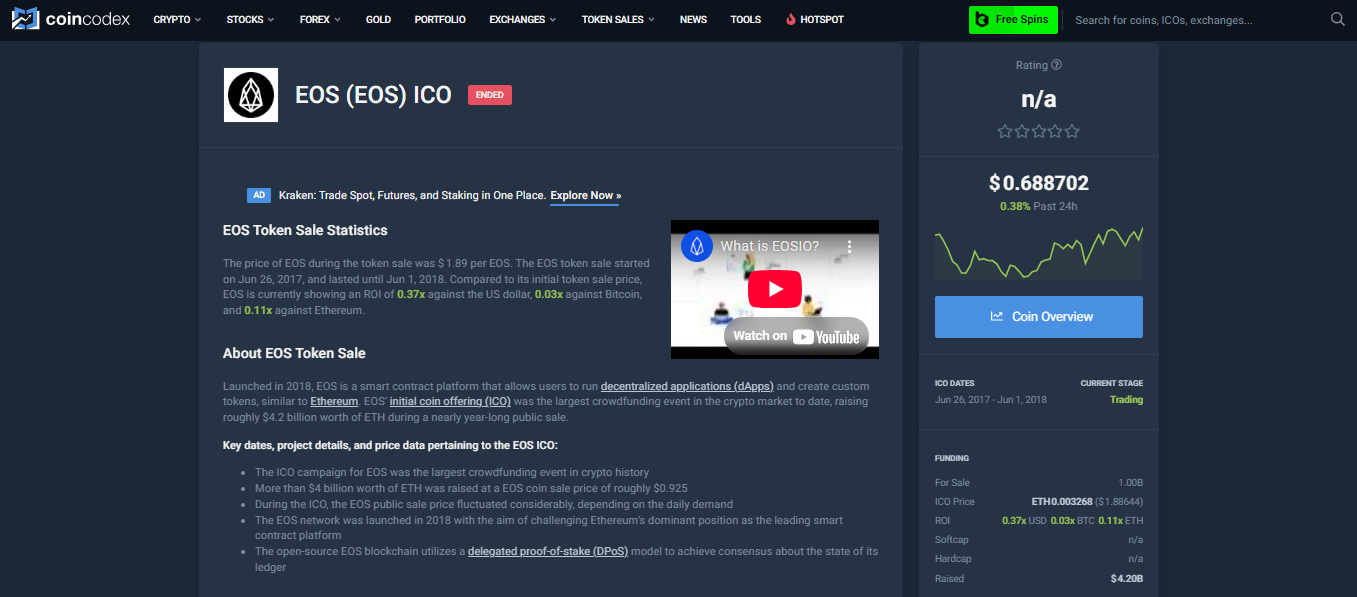

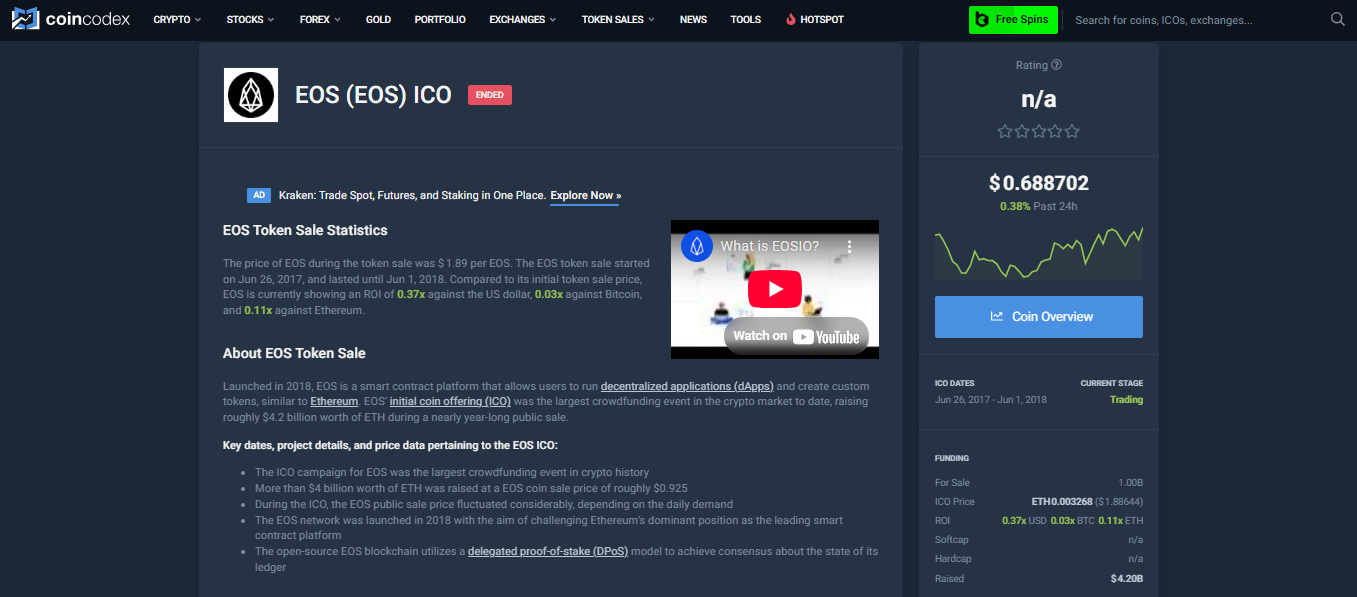

5. EOS (2018)

Supply: Coincodex

EOS ran a rolling ICO that raised greater than $4 billion. Whereas EOS itself delivered excessive throughput, long-term adoption failed largely as a consequence of criticism over centralized governance and SEC fines.

begin your individual ICO

We’ve proven you step-by-step what it takes to get an ICO off the bottom. It should takes greater than slightly programming and a few ambition.

You wants a cohesive marketing strategy, strong compliance, and relentless group constructing. At all times begin with regulation mapping, and get authorized opinions in a minimum of one crypto-friendly nation.Recruit a multidisciplinary core group that features good contract engineers, product managers, advertising and marketing groups, and auditors. You’re going to depend on them for accountability and competence. Publish an in depth white paper and open-source repositories so the group can examine code and milestones in actual time.Safe early momentum by means of a strategic seed spherical: allocate a modest token tranche to credible angels and crypto funds beneath strict vesting to align incentives. Concurrently, domesticate group throughout social channels with dev chats, AMAs, and bounty applications. At all times deploy a testnet earlier than mainnet rollout.For the general public sale, select a clear mechanism: fixed-price with per-wallet limits to keep away from whale dominance, or a Dutch public sale that lets value uncover demand organically.Pre-plan post-ICO liquidity with seeded DEX swimming pools, tier-one change listings, and create a six-month roadmap of transport objectives. Then make sure you meet these objectives for sustained success.

FAQs

What’s the that means of ICO?

ICO stands for Preliminary Coin Providing. Preliminary coin choices are crowdfunding campaigns the place a blockchain challenge points newly minted tokens to lift capital earlier than its product is totally constructed. Contributors pay in established cryptocurrencies, and in return, they’re given governance or utility tokens tied to the challenge’s future ecosystem.

How Can I put money into an ICO?

First, vet the challenge’s white paper, audits, and group credentials. Verify authorized eligibility, since many ICOs geo-block U.S. residents. Create a suitable pockets, full any KYC, and fund it with the accepted foreign money. On the sale day, join your pockets to the challenge’s smart-contract interface or launchpad, specify the contribution quantity, and approve the transaction. At all times use a recent browser tab to keep away from phishing websites.

Why is ICO not allowed within the US?

The U.S. Securities and Change Fee usually classifies token gross sales as unregistered securities choices beneath the Howey Take a look at. Issuers would want to register or qualify for an exemption, which is a course of that tends to be time-consuming and cost-prohibitive. To restrict authorized publicity, ICOs will sometimes exclude US clients and limit American IPs from accessing the system.

What’s an ICO crime?

ICO-related crimes embrace market manipulation, insider dumping of unlocked tokens, promoting tokens that represent unregistered securities, and fraud. Fraud covers lots, together with elevating funds with no intention of constructing the promised product. Penalties vary from investor lawsuits to SEC enforcement actions, legal wire-fraud costs, asset freezes, and jail sentences for founders.