Final up to date on December twenty eighth, 2025 at 12:28 pm

In 2025, stablecoins stopped being simply the quiet workhorse of crypto. They’ve grow to be, for hundreds of thousands of individuals, the easy, go-to strategy to ship cash, particularly throughout borders. Stablecoin utilization is now much less of “let’s check this factor if it really works,” and extra “that is how we do issues now”. At sure factors this yr, the worth shifting via stablecoins on-chain rivaled (and in some stretches even topped) conventional cost rails like Visa, which has made it even tougher to dismiss what was taking place as simply one other crypto storyline.

What’s fascinating is how shortly it spilled outdoors the crypto bubble. Policymakers began taking it significantly. Establishments obtained extra severe, sooner. The expansion stored pointing again to 1 irrefutable truth: stablecoins have been fixing on a regular basis cost complications, at scale. Because the yr closes, it’s honest to name them what they’re—a severe drive in their very own proper.

From Narrative to Stable Infrastructure

For a very long time, stablecoins sat in that awkward “many individuals prefer it, however no person takes it significantly” zone. They have been utilized in sheer volumes for commerce, shifting cash, and dodging volatility, however public discourse stored treating them like a “possibly sometime” product.

As this yr flew by, that disconnect has grow to be not possible to maintain pretending away as a result of stablecoins at a frenzied tempo are enabling crypto buying and selling, on the spot settlements, and cross-border transfers…sooner and infrequently cheaper than conventional techniques. Nothing in regards to the tech modified, extra persons are simply inevitably paying consideration. Stablecoins are getting due recognition for what they’ve grow to be: sturdy monetary infrastructure embedded within the circulation of worth.

The numbers stroll the speak. Stablecoins processed roughly $46 trillion in transaction quantity over the previous yr (+106%). Even after adjusting for bot-driven or synthetic exercise, quantity was round $9 trillion over the past 12 months (up 87% from the earlier yr). That places stablecoins at greater than half of Visa’s quantity and greater than 5 occasions PayPal’s…progress at a tempo conventional cost rails merely haven’t skilled in a long time.

Though a lot of this exercise displays wholesale monetary motion slightly than on a regular basis retail spending, the implication stays important: stablecoin throughput is bumping shoulders with giants and step by step closing in on techniques like ACH—one of many core settlement layers of the U.S. banking system”

TRM Labs reported that stablecoins accounted for 30% of all crypto transaction quantity between January and July 2025. This realization of simply how extensively individuals used stables got here with on the spot outcomes; establishments largely stopped debating whether or not stablecoins matter and began figuring out the way to combine them. Retailers started sizing them up as a strategy to receives a commission sooner from anyplace. Freelancers noticed a sensible escape hatch from cross-border cost friction. Builders more and more handled stablecoins because the default rails to construct on. And extra monetary platforms began experimenting with shifting {dollars} as tokens—slightly than routing all the things via legacy middlemen. All arduous proof that stablecoins have moved past narrative and hypothesis, quietly crossing the road from an thought to important monetary infrastructure.

The $300B+ Milestone That Modified Every part

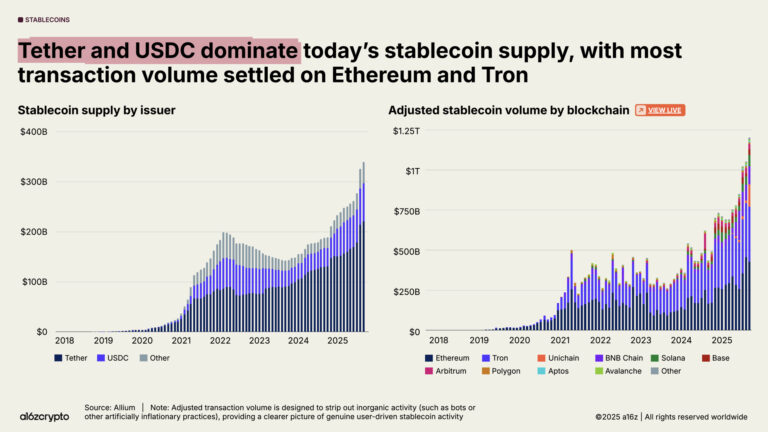

On the time of writing, CoinGecko had circulating stablecoin provide above $313 billion, ticking up quarter after quarter as utilization expanded throughout funds, buying and selling, DeFi, and real-world commerce. Between fiat-backed tokens, artificial {dollars}, crypto-backed variations, and deeper integrations throughout platforms you’ve obtained extra customers, thicker liquidity, and (for what it’s value) a gentle inflow of institutional capital.

Because the pie grew, the “who does what” grew to become extra apparent. Tether stayed the anchor; deep liquidity, quick settlement, and an enormous purpose centralized exchanges preserve operating easily. However past exchanges, USDT’s affect unfold via casual financial networks—powering peer-to-peer commerce, service provider funds, and cross-border transactions in areas the place conventional banking entry stays restricted. In these markets, USDT more and more operated as a purposeful day-to-day greenback substitute.

USDC stored its status because the extra institution-friendly possibility, and newer gamers like USDe helped speed up DeFi-native adoption. By Q3 2025, CoinGecko mainly confirmed a transparent hierarchy: Tether above 70% market share, USDC above 20%, and the rest divided amongst DAI, TUSD, FRAX, and a small however increasing set of non-USD stablecoins. By market cap, the high 5 have been USDT, USDC, USDS, USDe, and DAI.

One thing value noting: for all of the “world” speak, stablecoins are nonetheless overwhelmingly USD-centric: greater than 99% of circulating provide was pegged to the U.S. greenback, with euro- and commodity-pegged tokens nonetheless marginal.

Settlement knowledge backs the purpose. In September, Ethereum and Tron processed a mixed $772B in adjusted stablecoin transfers, representing 64% of world stablecoin settlement quantity that month.

By December, DefiLlama knowledge confirmed Ethereum dealing with 54.29% of all stablecoin settlements, with Tron following at 26.07%.

For the primary time, roughly 1% of all U.S. {dollars} now exist as tokenized stablecoins. On the similar time, stablecoin issuers rose to grow to be the Seventeenth-largest holders of U.S. Treasuries worldwide, up from twentieth place only a yr earlier with over $150 billion in reserves backing circulating provide, verified via issuer attestations and intently monitored liquidity positions.

In sensible phrases, this positioned stablecoin issuers alongside mid-sized sovereign nations when it comes to Treasury publicity. Throughout commerce, payroll techniques, fintech platforms, gaming economies, and cross-border funds, stablecoins transitioned from non-obligatory instruments to default settlement infrastructure.

VISA’S Large Yr and Why It Nonetheless Misplaced The Narrative

Visa entered 2025 firing on all cylinders: $40 billion in internet income (up 11% YoY) and 257.5 billion transactions processed within the yr ending September 30, 2025 (up 10% YoY). By any regular customary, a powerful run. However the larger story was the place the business’s vitality was shifting to…and it drifted towards stablecoins.

The business’s focus moved towards stablecoins, not as a result of Visa faltered, however as a result of a brand new class of internet-native cost rails was rising sooner, scaling wider, and working at a velocity legacy techniques have been by no means designed to match. Stablecoins didn’t eclipse Visa by attacking its core enterprise; they outpaced it by increasing into corridors, person teams, and transaction varieties that card networks have been by no means designed to serve in actual time, throughout borders, and with out intermediaries.

Visa, to its credit score, didn’t resist this shift. As a substitute, it confirmed it. Over time, the corporate revealed simply how deeply it had already embedded itself throughout the crypto financial system. Since 2020, Visa has facilitated greater than $140 billion in crypto and stablecoin transactions, supported 130 stablecoin-linked card applications, and enabled banks to mint and burn digital belongings via its conversion platforms. By September 2025, Visa, taking a step additional, started piloting stablecoin prefunding, successfully weaving on-chain settlement rails immediately into its working stack. The message was clear: this was now not a contest between previous and new techniques, however a gradual convergence. Visa didn’t lose as a result of stablecoins changed it. It misplaced the narrative as a result of the market had already accepted that Visa itself, by adapting to the fastest-growing rails, would form the long run, and that established networks must evolve alongside them.

Stablecoins because the New Spine of World Funds

Playing cards nonetheless win on the checkout second as authorization is mainly on the spot. However velocity on the level of sale was now not sufficient. In lots of rising markets, card funds approved instantly, but settlement remained constrained by banking hours, batch processing, and multi-day clearing cycles. Stablecoins eliminated these limits solely. Funds settled 24/7, with finality achieved in minutes, on-chain, at any hour of any day.Value and entry are the opposite strain factors. Conventional rails layer charges—interchange, FX spreads, cross-border prices. Stablecoins transfer worth with fewer tolls, and infrequently solely require a pockets as a substitute of financial institution accounts all through the chain. That’s why adoption has surged in economies with unstable currencies and painful cross-border banking: not as a result of persons are in love with blockchain, however as a result of they want a system that works.

Additionally Learn: Inside Africa’s Monetary Reinvention: The Surge of Stablecoin Adoption

This yr, a number of companies began utilizing stablecoins in the identical sensible, no-drama method. One in 5 Fortune 500 executives now considers on-chain initiatives as important to competitiveness. Amongst crypto-aware small and medium-sized companies, 81% actively sought stablecoin integration, and 82% reported that tokenized {dollars} already solved actual issues, like settlement delays and unpredictable FX publicity.

A lot of this transformation occurred away from headlines. Retailers wished sooner payouts, suppliers wished fewer correspondent banking delays, payroll groups wished to chop multi-day lags and opaque conversion charges, and treasury groups wished to maneuver liquidity throughout borders in minutes—not days. Once more, no drama, simply companies utilizing stablecoins the place they labored higher.

Regulators Legitimize Stablecoins

In accordance to TRM Labs’ World Crypto Coverage Evaluate & Outlook 2025/26, stablecoins grew to become one of the crucial lively areas of world policymaking in the course of the yr, with greater than 70% of nations shifting ahead with new or up to date rules. After years of hesitation and watchful ready, governments started drawing clear boundaries, producing essentially the most coordinated wave of stablecoin oversight the business had seen.

In america, the GENIUS Act spelled out clear expectations round reserves, issuance requirements, disclosures, and ongoing supervision. Moderately than isolating stablecoins from the monetary system, the laws pulled them inward, treating them as devices that might coexist with conventional finance beneath well-defined guidelines. In doing so, the U.S. created a framework that shortly grew to become a reference level for regulators elsewhere.

Hong Kong’s Stablecoin Invoice formally acknowledged and supervised fiat-referenced tokens, positioning the area as a managed gateway for tokenized greenback flows. The European Union superior into full MiCA implementation, establishing one of many world’s most complete digital-asset regulatory regimes.

Elsewhere, the path was the identical even when the fashions differed. South Korea superior a consortium-based strategy to issuing won-denominated stablecoins, signalling a choice for structured, domestically anchored fashions. Thailand accepted USDT and USDC to be used in regulated digital-asset transactions, a transparent departure from earlier warning. Canada additionally introduced plans for a nationwide stablecoin framework, reinforcing its broader digital-assets agenda.

Additionally Learn:

Actionable Insights for 2026

1. For Merchants: Watch regulatory indicators, not hype cycles

The GENIUS Act, MiCA implementation, and new Asian frameworks will immediately affect stablecoin liquidity flows. Regulatory approval is changing into the first driver of quantity, not speculative markets. Comply with jurisdictions advancing issuance, reserve, and redemption guidelines; these will form actual demand.

2. For Builders: Construct for real-world frictions, not web3 echo chambers

The most important progress segments in 2025 have been payroll, remittances, service provider payouts, and SME treasury instruments. Merchandise that clear up settlement delays, FX ache factors, and liquidity routing will outline 2026.

3. For Coverage Watchers: Put together for institutional-grade stablecoins

Banks, fintechs, and cost corporations will enter issuance immediately. Count on bank-backed stablecoins, consortium fashions, and controlled tokenized deposit techniques to develop. The following wave of competitors will probably be between regulated issuers, not crypto-native vs. banks.

4. For Enterprises: Start operational migration now

2026 will see widespread company adoption. Treasury groups ought to put together for on-chain liquidity administration, automated cross-border settlements, and stablecoin-based payroll. Early adopters will achieve materials value and velocity benefits.

5. For Builders in Funds: Design multi-rail interoperability by default

Visa’s pivot reveals the place the market is heading: coexistence. New merchandise ought to routinely route throughout stablecoins, playing cards, ACH, and sooner cost techniques. The winners of 2026 will probably be purposes that deal with cost rails as interchangeable infrastructure layers.

Disclaimer: This piece is meant solely for informational functions and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein needs to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of monetary loss. At all times conduct due diligence.

If you want to learn extra articles like this, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Neighborhood.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.