For a very long time, individuals noticed cryptocurrency and regulation as opposites; innovation on one facet and management on the opposite. However this black-and-white view misses a vital level: regulation doesn’t must be the dangerous man in crypto’s story. If guidelines are designed thoughtfully and may adapt, they will truly information innovation and endurance. As an alternative of simply setting limits, good guidelines construct belief, entice long-term buyers, and assist entrepreneurs create lasting options. Nicely-crafted frameworks can rework uncertainty into confidence and make oversight the driving pressure behind accountable development.

How Regulatory Frameworks Can Channel Innovation

For a very long time, the connection between cryptocurrency and regulation was framed as a battle. Regulators had been usually portrayed as roadblocks standing in the best way of progress. However that narrative ignores a deeper fact: when regulation is sensible and adaptable, it may act much less like a brake and extra like a steering wheel.

As an alternative of stopping innovation, regulation can channel it, pushing entrepreneurs and buyers towards safer, extra scalable, and reliable outcomes. Clear guidelines create a roadmap. They assist innovators know what’s allowed, what’s dangerous, and the place alternatives actually lie. When designed with collaboration quite than confrontation in thoughts, regulation turns into a instrument for redirection quite than restriction.

By setting outlined requirements, policymakers can change chaos with readability, entice institutional capital, and guarantee innovation prospers responsibly. The main target of the crypto-regulation story shouldn’t simply be about limiting danger but additionally about unlocking potential. If frameworks are constructed to information quite than confine, blockchain know-how can evolve into one thing that strengthens monetary techniques, expands inclusion, and protects shoppers with out dulling its inventive edge.

World Examples of Professional-Innovation Frameworks

Throughout the globe, many governments are starting to point out that cryptocurrency and regulation can work collectively as an alternative of colliding. Moderately than viewing guidelines as limitations, they’re utilizing them as launchpads for innovation. Nations like Singapore, the United Arab Emirates (UAE), and Hong Kong have confirmed that readability and progress can coexist and even complement one another.

Take Singapore, as an illustration. Its central financial institution, the Financial Authority of Singapore (MAS), has taken a cautious however forward-thinking method. It believes innovation and supervision should develop collectively. The MAS launched its FinTech Regulatory Sandbox in 2016, giving startups room to experiment with new monetary applied sciences beneath managed circumstances. This setup lets innovators take a look at merchandise safely whereas defending shoppers and the broader system. Coupled with the Cost Providers Act (PSA) and Digital Cost Token (DPT) regime, Singapore has constructed a system that emphasizes compliance, transparency, and client safety.

Whereas this method could appear sluggish in comparison with less-regulated markets, it has earned Singapore a fame as one of the trusted and secure crypto environments on the planet. By balancing experimentation with accountability, it exhibits that cryptocurrency and regulation can coexist and even thrive.

The UAE, however, has taken a quicker and extra formidable route. Its Digital Belongings Regulatory Authority (VARA) in Dubai was among the many first businesses globally to create a authorized framework devoted solely to digital belongings. The outcomes communicate for themselves: between July 2023 and June 2024, the UAE reportedly attracted over $30 billion in crypto inflows, with DeFi participation rising 74% year-on-year and DEX exercise leaping from $6 billion to $11.3 billion, in accordance with Chainalysis. Clear and predictable regulation has made the UAE a magnet for each innovation and funding.

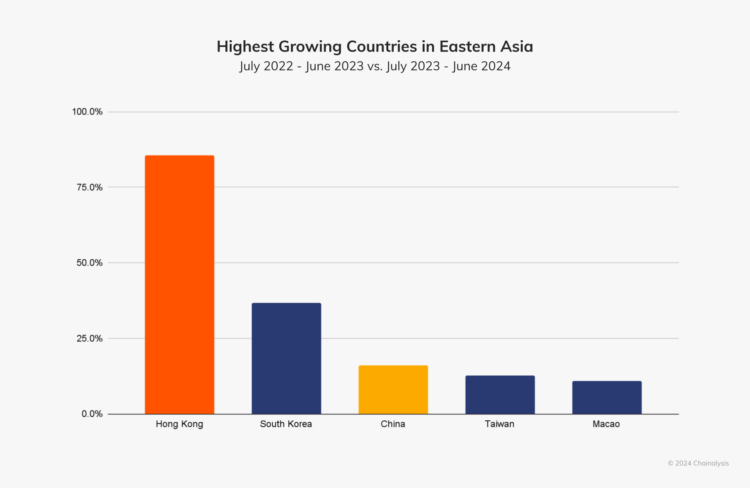

In the meantime, Hong Kong is making a powerful comeback as a worldwide crypto hub by way of its ASPIRe roadmap, centered on Entry, Safeguards, Merchandise, Infrastructure, and Relationships. A 2024 Chainalysis report revealed that crypto exercise in Hong Kong soared by 85.6%, the quickest development charge in Jap Asia. By prioritizing construction over hypothesis, Hong Kong is proving that stability and innovation can go hand in hand.

Collectively, these circumstances spotlight a strong perception: the way forward for digital finance gained’t be pushed by deregulation, however by considerate, cryptocurrency and regulation frameworks that promote innovation, construct belief, and create markets sturdy sufficient to final.

Additionally Learn: The World Crypto Hub Race: Who Will Dominate—Hong Kong, UAE, Or Singapore?

The Position of Sandbox Environments and Licensing Readability

Some of the sensible methods regulation can gas innovation is thru sandbox environments. These are managed areas the place firms can take a look at new enterprise concepts with much less strict oversight. Sandboxes let new gamers check out issues like token launches, decentralized apps, and new methods to retailer belongings with out dealing with all the standard guidelines. This versatile setup lowers each the associated fee and uncertainty of beginning new crypto merchandise.

Equally very important is licensing readability, which ensures that entrepreneurs perceive from the outset what compliance entails. When licensing classes and obligations are clearly outlined, the concern of regulatory ambiguity diminishes, empowering companies to innovate with higher confidence. Singapore’s MAS Sandbox programmes: Categorical, Common, and Plus, are sturdy examples of this method in motion. They permit firms to check stay merchandise with actual customers, obtain direct regulatory suggestions, after which scale efficiently inside a guided framework.

These sorts of packages are essential within the fast-changing world of crypto. The trade strikes so shortly that legal guidelines usually can not sustain. Builders who launch new tokens or DeFi initiatives usually have no idea if their work counts as a safety, a commodity, or a cost token. Sandbox and licensing packages assist by giving clear path and legitimacy to new concepts.

Nonetheless, efficient sandbox design requires steadiness. If activation prices or compliance necessities are extreme, these packages danger changing into limitations quite than enablers. The aim, subsequently, is a streamlined and adaptive sandbox mannequin, one that gives clear exit routes towards full licensing and sensible timeframes, guaranteeing that innovation can thrive whereas sustaining regulatory integrity.

Balancing Investor Safety and Entrepreneurial Freedom

It’s arduous to steadiness defending buyers and giving entrepreneurs room to take dangers. Regulators want to guard individuals from scams, hacks, and market manipulation, however not a lot that they cease new concepts. An excessive amount of safety can restrict creativity, whereas too little can break belief.

The collapse of massive exchanges like FTX made it clear that investor safety isn’t non-obligatory; it’s important. Clear guidelines on asset custody, licensing, AML/KYC compliance, and loss disclosure are essential to rebuild confidence. When buyers really feel safe, institutional cash follows, adoption accelerates, and innovation beneficial properties credibility.

But, defending buyers doesn’t imply punishing creators. Startups shouldn’t be buried beneath sky-high entry prices or ambiguous authorized classifications. They want respiratory room to check new concepts, be it new token fashions, interoperability options, or DeFi platforms, with out fearing sudden bans or complicated authorized shifts.

The reply lies in steadiness: a versatile cryptocurrency and regulation framework that scales primarily based on danger. Smaller initiatives might face lighter guidelines, whereas bigger, systemically necessary corporations face tighter scrutiny. Such proportional oversight ensures that each belief and creativity thrive. When regulation focuses on danger quite than restriction, the crypto trade evolves responsibly with out dropping its revolutionary spirit.

Additionally Learn: We Should Stability Innovation and Regulation for Crypto to Actually Thrive

Why is Crypto so Laborious to Regulate?

What are the challenges that regulators face in regulating the crypto trade? The principle problem is its very construction: decentralisation and anonymity. In contrast to conventional finance, crypto has no single authority; transactions occur throughout numerous nodes and borders, usually anonymously. That makes accountability extremely tough.

The cross-border nature of crypto provides one other layer of complexity. Digital belongings circulate freely throughout nations, permitting companies to relocate to friendlier jurisdictions, a observe often known as regulatory arbitrage. This makes international coordination practically unimaginable, as one nation’s strict coverage might be simply bypassed by one other’s leniency.

Then there’s the technology-speed hole. Blockchain innovation strikes quicker than most regulators can sustain with. New sensible contracts, token requirements, and DeFi protocols emerge each few months, leaving legal guidelines struggling to catch up. Many regulators nonetheless face the essential query: is a crypto asset a safety, a commodity, or one thing solely new? These blurred traces enhance authorized danger for firms and buyers alike.

Even when guidelines exist, imposing them might be powerful. Restricted entry to on-chain knowledge means regulators usually find out about fraud or collapse after the actual fact, not earlier than. Many businesses additionally lack the technical experience wanted to grasp advanced blockchain techniques deeply sufficient to manage them successfully.

Briefly, the challenges that regulators face in regulating the crypto trade stem from its decentralised, international, and quickly evolving nature. To maintain up, regulatory approaches should shift from inflexible and reactive fashions to adaptive, data-driven techniques that perceive innovation as an ally, not an adversary.

Turning Regulation Into the Engine of Accountable Innovation

The actual debate about cryptocurrency and regulation isn’t about management or freedom, however about path. Singapore, the UAE, and Hong Kong present that when guidelines information as an alternative of limit, innovation can develop.

Regulatory sandboxes and clear licensing guidelines flip uncertainty into confidence, serving to each innovators and buyers belief the system. Investor safety and entrepreneurial freedom can coexist if frameworks are versatile, risk-based, and clear.

It’s true that decentralization, international attain, and speedy change make crypto arduous to manage. However these identical options additionally supply possibilities for higher guidelines. Versatile, data-driven techniques can convey collectively compliance and creativity, making regulation a instrument for progress as an alternative of a barrier.

The way forward for cryptocurrency and regulation is dependent upon this partnership. If finished proper, it can form a crypto economic system that’s not solely revolutionary but additionally secure, inclusive, and sustainable.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein must be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of economic loss. At all times conduct due diligence.

Loved this piece? Bookmark DeFi Planet, discover associated matters, and comply with us on Twitter, LinkedIn, Fb, Instagram, Threads, and CoinMarketCap Group for seamless entry to high-quality trade insights.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”