Pakistan has formally introduced the creation of a nationwide blockchain regulatory authority aimed toward overseeing and guiding the nation’s blockchain and cryptocurrency ecosystem. This transfer comes amid rising world momentum as governments worldwide search to determine clearer guidelines and frameworks for blockchain know-how and digital belongings.

The core query now’s whether or not this new Pakistan blockchain regulation physique will foster innovation and create a supportive atmosphere for blockchain improvement, or whether or not it’d introduce advanced rules that might sluggish development and add bureaucratic challenges for startups and traders.

Targets Behind Creating the Regulator

Pakistan’s latest institution of the Pakistan Digital Property Authority (PDAA) marks a big step towards regulating its burgeoning digital asset sector. This transfer aligns with the nation’s broader technique to foster blockchain adoption, guarantee client safety, and preserve compliance with worldwide requirements.

Authorities’s Said Objectives:

Fostering Blockchain Adoption: The Pakistan blockchain regulation goals to advertise using blockchain know-how throughout numerous sectors, enhancing transparency and effectivity in public companies. Defending Customers: By regulating digital asset platforms, the authority seeks to safeguard traders from potential dangers related to unregulated markets.Guaranteeing Compliance: The institution of the PDAA is consistent with the Monetary Motion Job Pressure (FATF) suggestions, making certain that Pakistan’s digital asset actions meet world anti-money laundering requirements.

Strategic Targets:

Attracting Fintech Startups: The regulatory framework is designed to create a conducive atmosphere for fintech improvements, encouraging startups to determine and increase their operations in Pakistan.Constructing Investor Confidence: Clear rules and oversight are anticipated to reinforce belief amongst traders, each home and worldwide, in Pakistan’s digital asset market.Aligning with World Tendencies: Pakistan’s method displays a dedication to integrating with world blockchain and cryptocurrency developments, positioning the nation as a aggressive participant within the digital financial system.

As Pakistan strikes ahead with the PDAA, the main target will probably be on balancing innovation with regulation to harness the total potential of blockchain know-how whereas mitigating related dangers.

Potential Advantages of Pakistan’s Blockchain Regulatory Authority

The Pakistan blockchain regulation authority marks a big step towards shaping the nation’s digital financial system and crypto house.

Reduces uncertainty for companies:

A transparent and official regulatory framework provides blockchain and crypto companies authorized certainty, which is essential for long-term planning and funding. With out ambiguous guidelines, corporations can confidently develop merchandise, search partnerships, and increase operations figuring out they’re compliant with the regulation.

Encourages native innovation and entrepreneurship:

Clear and supportive rules create a fertile floor for startups and innovators. Entrepreneurs usually tend to make investments time and assets into growing blockchain options once they perceive the principles and really feel protected against arbitrary restrictions or enforcement, which helps develop Pakistan’s home blockchain ecosystem.

Helps fight fraud and illicit actions:

By introducing oversight and compliance necessities, the regulator can considerably scale back fraud, scams, cash laundering, and different unlawful actions that always plague unregulated crypto markets. This safeguards shoppers, builds belief in blockchain applied sciences, and improves the sector’s general status.

Attracts overseas funding:

Worldwide traders and fintech companies favor markets with clear regulatory requirements and sturdy enforcement. Establishing a blockchain regulator positions Pakistan as a reputable and secure vacation spot for overseas capital, fostering cross-border partnerships and accelerating development in its know-how sector.

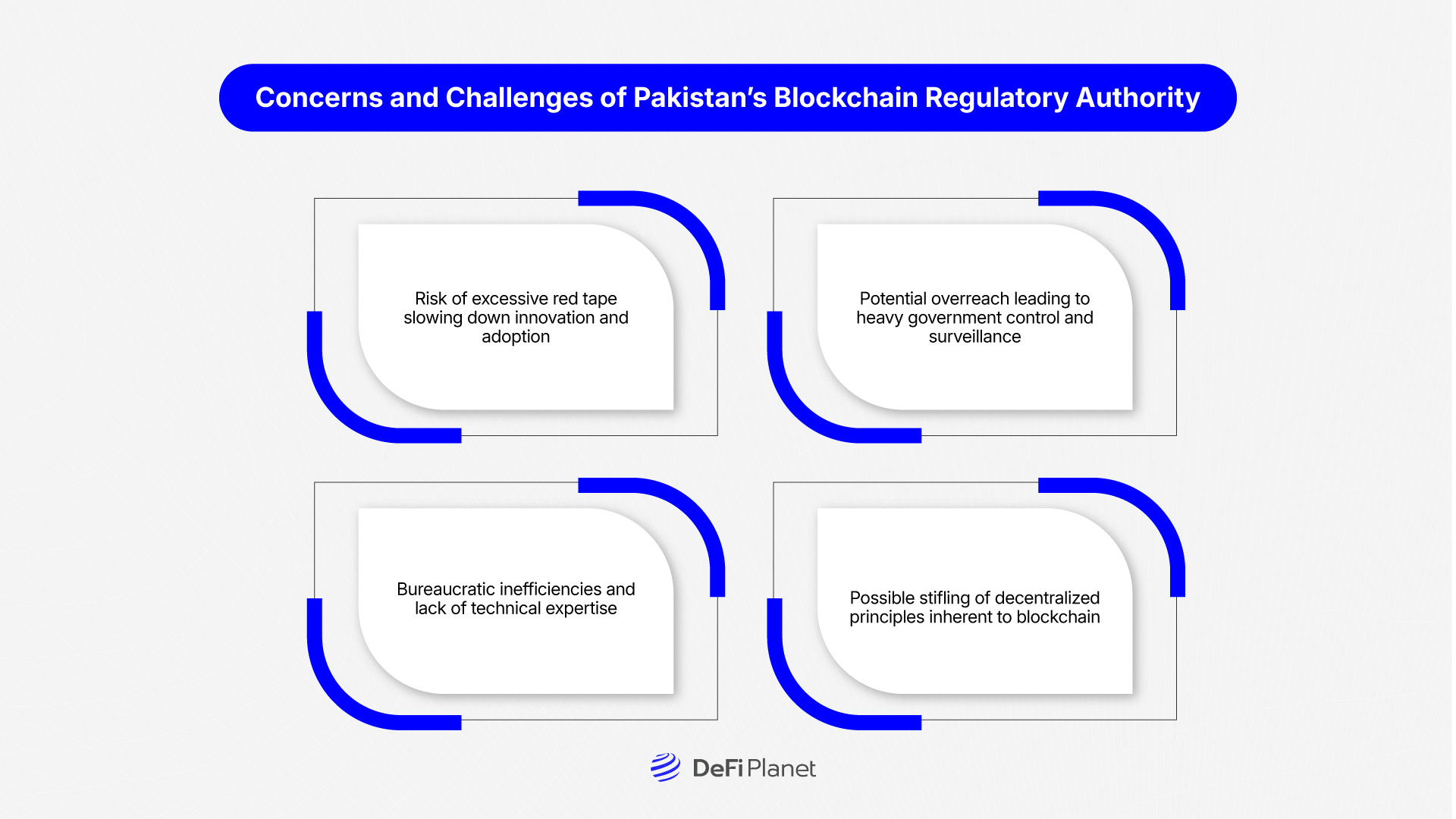

Considerations and Challenges of Pakistan’s Blockchain Regulatory Authority

Whereas establishing a regulator affords advantages, it additionally raises important considerations and challenges that might affect innovation and blockchain adoption.

Threat of extreme crimson tape slowing down innovation and adoption

Overly advanced rules and prolonged approval processes can create important limitations for blockchain startups and builders. This crimson tape could improve operational prices and delay the introduction of recent services and products.

In a fast-evolving trade like blockchain, sluggish regulatory responses may cause corporations to lose their aggressive edge or transfer operations to extra versatile jurisdictions, finally hindering Pakistan’s potential to grow to be a blockchain innovation hub.

Potential overreach resulting in heavy authorities management and surveillance

The regulator may impose stringent necessities for information assortment, transaction monitoring, and id verification that border on invasive surveillance. Such measures could infringe on person privateness and deter people and companies from totally participating with blockchain platforms.

Heavy authorities oversight dangers reworking a decentralized know-how right into a centralized system, contradicting the very nature of blockchain and probably limiting its adoption amongst privacy-conscious customers.

Bureaucratic inefficiencies and lack of technical experience

Creating and imposing efficient blockchain rules requires deep technical understanding and trade information. If the regulatory physique lacks adequate experience, it might produce ambiguous or impractical guidelines that confuse companies and traders.

This might result in inconsistent enforcement, compliance difficulties, and a lack of confidence amongst stakeholders, making Pakistan much less enticing to blockchain entrepreneurs and overseas traders.

Potential stifling of decentralized ideas inherent to blockchain

One in all blockchain’s key improvements is decentralization, which reduces reliance on central authorities and empowers customers. Heavy-handed regulation dangers pushing tasks in direction of centralized fashions to adjust to authorized necessities, thus undermining the know-how’s foundational advantages.

Overregulation additionally discourages open-source improvement and community-driven initiatives, limiting innovation and the broader socio-economic advantages that blockchain adoption may deliver to Pakistan.

Evaluating World Examples

Around the globe, a number of nations present helpful fashions for blockchain regulation that Pakistan can be taught from. Singapore stands out as a hit story, having developed a regulatory framework that balances innovation with investor safety.

It’s clear licensing regimes and open communication with blockchain corporations have attracted a thriving fintech sector, making Singapore a world crypto hub with out compromising oversight.

Equally, Switzerland’s “Crypto Valley” affords a wonderful instance of how versatile but clear rules can gas fast trade development. By fostering cooperation between regulators, startups, and monetary establishments, Switzerland has created a supportive atmosphere that encourages innovation whereas sustaining compliance with worldwide requirements.

Conversely, some nations illustrate the dangers of over-regulation. Heavy-handed or ambiguous guidelines in these locations have prompted blockchain companies to both cut back operations or transfer to friendlier jurisdictions, stunting native innovation and lowering investor confidence. These cautionary examples spotlight how extreme forms, unclear insurance policies, or restrictive controls can hamper the blockchain ecosystem’s potential.

For Pakistan, these world experiences underscore the significance of making a balanced regulatory framework that protects shoppers and the market with out imposing pointless burdens. By prioritizing readability, encouraging trade collaboration, and permitting room for technological development, Pakistan can construct a robust basis for blockchain adoption that draws funding and helps sustainable development.

What This Means for Pakistan’s Blockchain Ecosystem

Understanding the affect of the Pakistan blockchain regulation is essential to assessing the way forward for its blockchain ecosystem.

Brief-term affect on startups, traders, and customers

The instant results of introducing a Pakistan blockchain regulation could create a interval of adjustment and uncertainty. Startups could face new compliance hurdles and authorized necessities, which may decelerate their product launches or innovation cycles.

Traders, each home and worldwide, may grow to be extra cautious as they wait to know the total regulatory panorama. Customers may additionally expertise modifications in service availability or phrases as corporations adapt to new guidelines.

Nevertheless, this preliminary uncertainty may be mitigated if the regulator communicates clearly and supplies assist for the trade in the course of the transition.

Lengthy-term implications for Pakistan’s digital financial system and fintech status

Over time, a transparent and balanced regulatory framework can considerably improve Pakistan’s place within the world digital financial system. It could possibly appeal to higher overseas direct funding by lowering dangers related to authorized ambiguity and fraud.

This atmosphere encourages the expansion of fintech and blockchain startups, which may increase innovation, job creation, and technological development.

Efficiently integrating blockchain into sectors like finance, provide chain, and governance can enhance effectivity and transparency, finally strengthening Pakistan’s status as a progressive and tech-friendly financial system within the area.

The position of stakeholder engagement and regulatory transparency

For regulation to be efficient and sustainable, ongoing engagement with trade stakeholders, together with startups, traders, builders, and client teams, is important. Their enter ensures that insurance policies are reasonable, innovation-friendly, and aware of evolving applied sciences.

Transparency in regulatory decision-making builds belief and reduces fears of overreach or corruption. Open communication channels, public consultations, and clear tips assist create a collaborative ecosystem the place each regulators and market members work towards shared objectives of development, safety, and equity.

Ultimate Ideas

The Pakistan blockchain regulation may play a vital position in driving innovation and positioning the nation as a big participant within the quickly evolving world fintech and blockchain panorama. By offering a structured regulatory framework, the authority might help startups, traders, and customers function with higher confidence, fostering a safer and extra clear atmosphere that draws each native entrepreneurs and overseas funding.

Nevertheless, the potential advantages include necessary dangers. Extreme forms, overly strict compliance necessities, or a give attention to management fairly than collaboration may create hurdles that stifle innovation and sluggish the expansion of Pakistan’s blockchain ecosystem. With out cautious implementation, the regulator would possibly unintentionally push tasks and expertise to extra versatile jurisdictions, limiting the nation’s means to capitalize on rising alternatives within the decentralized know-how house.

For Pakistan to totally notice the promise of blockchain know-how, it’s important that the regulatory framework stays clear, adaptive, and knowledgeable by ongoing dialogue with trade stakeholders. A tech-savvy and versatile method will allow the regulator to evolve, making certain it helps innovation whereas defending shoppers. This balanced technique will probably be key to constructing a vibrant, resilient digital financial system and enhancing Pakistan’s status as a forward-looking hub for blockchain and fintech improvement.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein needs to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of monetary loss. All the time conduct due diligence.

If you want to learn extra articles like this, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”