GCC international locations such because the United Arab Emirates (UAE) and Bahrain have jumped out of the blocks with progressive crypto laws, attracting world expertise, investments, and cutting-edge blockchain initiatives. In the meantime, Saudi Arabia, the area’s financial heavyweight, appears to be hesitating, probably dropping floor on this digital dash.

This piece examines whether or not Saudi Arabia is falling behind because of the lack of unified GCC laws, exploring the financial, technological, and strategic implications of its cautious method.

Regulatory Fragmentation within the GCC – Understanding the Present Panorama

What’s the foremost function of GCC? The Gulf Cooperation Council (GCC), comprising Saudi Arabia, the UAE, Bahrain, Kuwait, Oman, and Qatar, was established to foster financial, political, and safety cooperation amongst its member states. Nevertheless, on the subject of cryptocurrency regulation, the GCC lacks a unified framework, resulting in fragmented insurance policies throughout the area.

Whereas the UAE has emerged as a worldwide crypto hub, due to its clear authorized framework and supportive regulatory surroundings, Saudi Arabia has taken a extra conservative stance. This cautious method contrasts sharply with the UAE’s proactive stance, which has resulted in important financial advantages. As an example, between July 2023 and June 2024, the UAE acquired over $30 billion in crypto, making it the third-largest crypto economic system within the Center East and North Africa (MENA) area and inserting it among the many high 40 world crypto economies.

Distinguished Saudi economist Ihsan Buhulaiga, a former member of the Shura Council, just lately emphasised the necessity for unified GCC cryptocurrency laws. He warned that with out coordinated insurance policies, cryptocurrency merchants may relocate their investments to extra beneficial environments just like the UAE or Bahrain, the place regulatory readability and tax incentives are extra enticing.

As an example, Dubai’s clear authorized framework, zero capital positive factors tax, and aggressive 9% company tax price have contributed to its rating as the highest world crypto enterprise hub for 2024, in response to a report by Social Capital Markets (SCM).

Is Saudi Arabia Crypto Pleasant?

Saudi Arabia, however, lacks particular laws governing cryptocurrencies. Is it authorized to commerce crypto in Saudi Arabia? At present, the Saudi Central Financial institution (SAMA) has issued a number of warnings towards digital property, reflecting the Kingdom’s cautious stance. Whereas it’s not explicitly unlawful to commerce crypto in Saudi Arabia, the absence of a complete regulatory framework creates uncertainty for each buyers and companies. This fragmented method may hinder Saudi Arabia’s means to draw blockchain startups and crypto-focused investments, probably ceding floor to its extra progressive neighbors.

Financial Impression of a Unified Crypto Framework – Boosting Funding and Innovation

A unified GCC crypto framework may considerably increase funding and innovation throughout the GCC international locations. The UAE’s proactive method has already attracted quite a few blockchain startups, crypto exchanges, and digital asset companies. For instance, Dubai’s VARA has established itself as a frontrunner in digital asset regulation, selling transparency and investor safety whereas decreasing the dangers of economic crime. This has made the UAE a most well-liked vacation spot for world crypto companies.

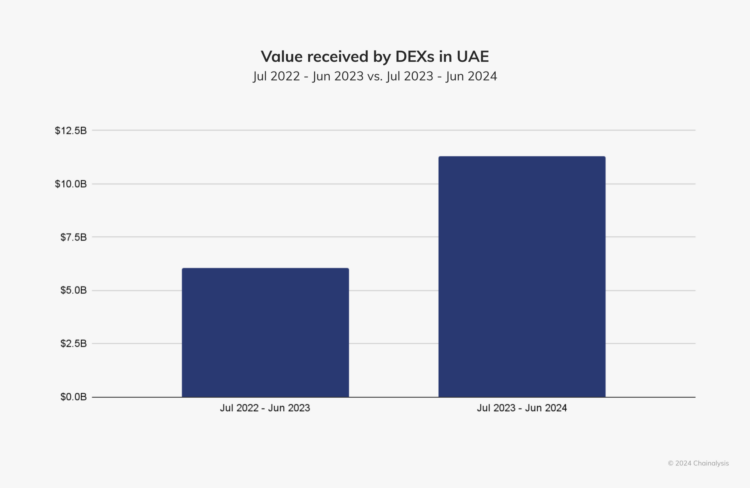

Moreover, the UAE’s progressive stance on decentralized finance (DeFi) has contributed to a 74% progress in whole DeFi worth acquired in 2024, with decentralized exchanges (DEXs) alone seeing an 87% improve, from $6 billion to $11.3 billion in 2023.

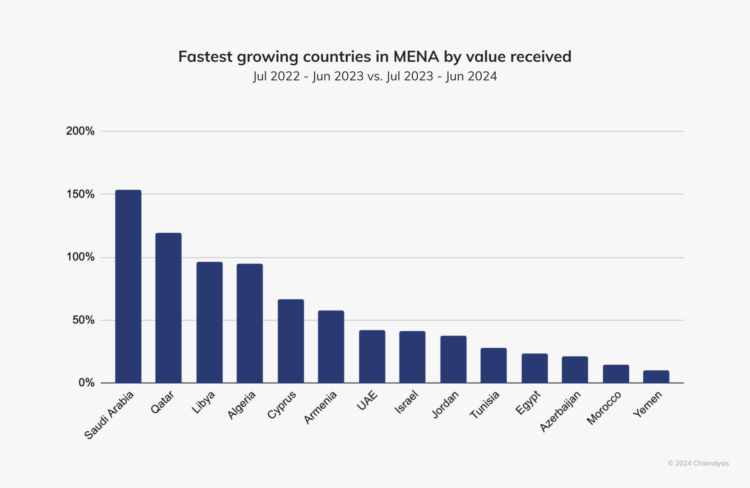

In distinction, Saudi Arabia, regardless of being the fastest-growing crypto economic system within the Center East and North Africa (MENA) area with a outstanding 154% year-over-year progress, dangers being left behind with no unified regulatory method.

This speedy progress is pushed by the Kingdom’s rising curiosity in blockchain innovation, central financial institution digital currencies (CBDCs), gaming, and fintech innovation. Nevertheless, with out clear and complete laws, Saudi Arabia may battle to draw the following wave of digital finance pioneers.

Critically, Saudi Arabia’s younger, tech-savvy inhabitants presents a big alternative. The Kingdom’s inhabitants is just not solely wanting to undertake rising applied sciences but in addition well-positioned to drive innovation within the digital finance sector. This demographic benefit could be a highly effective catalyst for the nation’s digital transformation, fostering a brand new era of crypto entrepreneurs and blockchain builders.

Furthermore, Saudi Arabia’s Imaginative and prescient 2030 plan, which goals to empower residents, entice world funding, and create a vibrant, diversified economic system, aligns completely with the expansion potential of the digital asset market. The worldwide digital coin market, projected to develop at a compound annual progress price (CAGR) of 15.20% from 2024 to 2031, presents a large alternative for the Kingdom to determine itself as a frontrunner on this area. Nevertheless, with no unified regulatory framework, Saudi Arabia dangers lacking out on important financial positive factors, as buyers and innovators might go for extra predictable and supportive markets, such because the UAE and Bahrain.

Finally, if Saudi Arabia goals to stay aggressive within the quickly evolving digital economic system, it should transfer past its cautious stance and embrace a unified, forward-looking crypto framework that fosters innovation, attracts world funding, and nurtures homegrown expertise.

Classes from the UAE and Bahrain – Its Gulf Neighbours

Saudi Arabia can draw beneficial classes from the UAE and Bahrain, each of which have developed strong regulatory frameworks to assist the expansion of their crypto sectors. These two GCC international locations have adopted a progressive method, specializing in innovation, compliance, and worldwide competitiveness, which Saudi Arabia can emulate to strengthen its place within the crypto market.

Bahrain was an early mover in crypto regulation throughout the GCC, introducing its Crypto-Asset Module in 2019 via the Central Financial institution of Bahrain (CBB). This framework covers licensing, buying and selling, supervision, and custody of digital property. It units clear pointers for Digital Asset Service Suppliers (VASPs) on points like Anti-Cash Laundering (AML) and Combating the Financing of Terrorism (CFT), making certain excessive requirements of transparency and client safety. The CBB’s method has attracted main world gamers like Binance, which obtained a Class 4 license in 2022, permitting it to function as a completely regulated crypto-asset service supplier in Bahrain.

The UAE has carried out each federal and emirate-specific laws, together with the Federal Decree-Regulation No. (20) of 2018 and Cupboard Decision No. (24) of 2022, which have been essential in shaping the nation’s digital asset market. These legal guidelines set up strict buyer due diligence, danger evaluation, and transaction monitoring necessities, making a safe surroundings for digital asset companies. For instance, the UAE’s Securities and Commodities Authority (SCA) regulates digital asset choices and buying and selling. On the similar time, the Abu Dhabi International Market (ADGM) and Dubai Worldwide Monetary Centre (DIFC) have developed their very own tailor-made crypto laws to draw world fintech companies.

Additionally Learn: Cryptocurrency Salaries and UAE’s Ambitions of Main The Digital Financial system Revolution

Balancing Safety and Innovation – Addressing Dangers Whereas Encouraging Development

Balancing safety and innovation is a essential problem for Saudi Arabia. Whereas considerations about monetary stability, cash laundering, and terrorist financing are legitimate, a very cautious method might stifle innovation. Saudi Arabia’s spiritual and cultural sensitivities additionally play a task, as Islamic monetary rules emphasize transparency and equity, probably conflicting with the speculative nature of cryptocurrencies.

Nevertheless, the UAE and Bahrain have demonstrated that we should stability innovation and regulation for crypto to essentially thrive. Their regulatory frameworks emphasize each safety and innovation, creating environments the place digital asset companies can thrive whereas minimizing monetary crime dangers. Saudi Arabia can undertake an analogous method.

Conclusion – The Path Ahead for Saudi Arabia

Because the world races towards a digital monetary future, Saudi Arabia can both seize the second, positioning itself as a regional powerhouse within the blockchain and crypto sectors, or danger being left behind as its GCC neighbours, just like the UAE and Bahrain, dash forward with supportive laws and thriving digital economies.

To remain aggressive, Saudi Arabia wants extra than simply cautious statement—it requires a daring, forward-thinking method that aligns with its Imaginative and prescient 2030 objectives of financial diversification and world management. A unified GCC crypto framework could possibly be a game-changer, decreasing regulatory fragmentation, attracting overseas funding, and fostering homegrown innovation. This isn’t nearly preserving tempo with regional rivals; it’s about creating an surroundings the place Saudi startups, builders, and digital finance entrepreneurs can thrive.

By collaborating on frequent requirements for digital property, the Kingdom can improve investor confidence, cut back compliance hurdles, and guarantee its younger, tech-savvy inhabitants has the instruments to form the following wave of economic innovation. In a world more and more outlined by digital property, Saudi Arabia’s selection is evident: lead, innovate, and develop, or danger being overshadowed by extra agile and bold economies throughout the GCC.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein must be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of economic loss. All the time conduct due diligence.

If you wish to learn extra market analyses like this one, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”