Canada’s monetary system has lengthy been thought-about a mannequin of stability, however beneath the floor, frustration is constructing. Based on Coinbase’s Canadian nation director, Lucas Matheson, 86% of Canadians imagine their monetary system may use an replace, 80% see it as essentially unfair, and 76% really feel it’s in pressing want of modernization. This isn’t only a fleeting sentiment – it indicators a deep-rooted dissatisfaction with a system struggling to maintain tempo in a quickly digitizing world.

With requires transparency, quicker transactions, and decrease charges rising louder, the query arises: may cryptocurrency be the reply? Let’s break it down.

Ballot Outcomes and Monetary Dissatisfaction

The numbers are telling. An estimated 5 million Canadians already personal cryptocurrency, reflecting a major urge for food for alternate options to conventional finance. This isn’t shocking provided that Canada’s stance on cryptocurrency has advanced considerably, with growing curiosity in digital property and rising debates about the right way to regulate the Canadian crypto market development successfully. Coinbase’s Canadian nation director, Lucas Matheson, not too long ago warned that with out swift regulatory motion, Canada dangers changing into much less built-in into the worldwide digital economic system, probably stifling innovation and limiting monetary choices for its residents.

The rising urge for food for change isn’t nearly chasing earnings or leaping on the most recent tech pattern, it’s about equity, accessibility, and monetary empowerment. For a lot of Canadians, the standard monetary system appears like an unique membership, designed to learn the few whereas inserting pointless burdens on the bulk. Excessive charges, gradual processing occasions, and strict eligibility necessities are only a few of the challenges that go away thousands and thousands underserved. This frustration is especially acute for these counting on pricey remittance providers or residing in rural areas with restricted entry to bodily banking infrastructure. For them, cryptocurrency adoption in Canada provides not simply an funding alternative however an opportunity to bypass these roadblocks and take part absolutely within the digital economic system.

How Crypto Aligns with Reform Calls for

As Canada pushes for digital transformation throughout numerous sectors, cryptocurrency suits seamlessly into this broader modernization technique. The rise of digital wallets, blockchain-based id techniques, and tokenized property aligns intently with the federal government’s push for a extra linked, data-driven economic system. This makes crypto not only a monetary software however an important element of Canada’s digital future.

Briefly, the rise of crypto in Canada isn’t nearly speculative buying and selling or tech enthusiasm. It displays a deeper, extra elementary shift in how folks wish to handle and transfer their cash. For a rustic trying to modernize its monetary panorama, this might be the disruptive drive that lastly breaks the mould.

If there’s one factor Canadians have made clear, it’s that they need their monetary system to evolve. The present system, marked by excessive charges, gradual processing occasions, and restricted transparency, feels more and more outdated in a world pushed by digital innovation. So, the place does crypto match into this demand for reform?

To start with, the numbers inform a compelling story. Based on Chainalysis, Canada has seen a gentle rise in crypto adoption in Canada, shifting from twenty sixth within the World Crypto Adoption Index in 2021 to twenty second in 2022, and climbing additional since then. This isn’t only a minor shift, it displays a rising urge for food for alternate options to conventional banking. Canadian engagement with crypto ATMs, decentralized exchanges, and centralized platforms surged almost 213% between 2019 and early 2023, pushed largely by curiosity in DeFi, a sector that guarantees monetary autonomy with out the bureaucratic overhead.

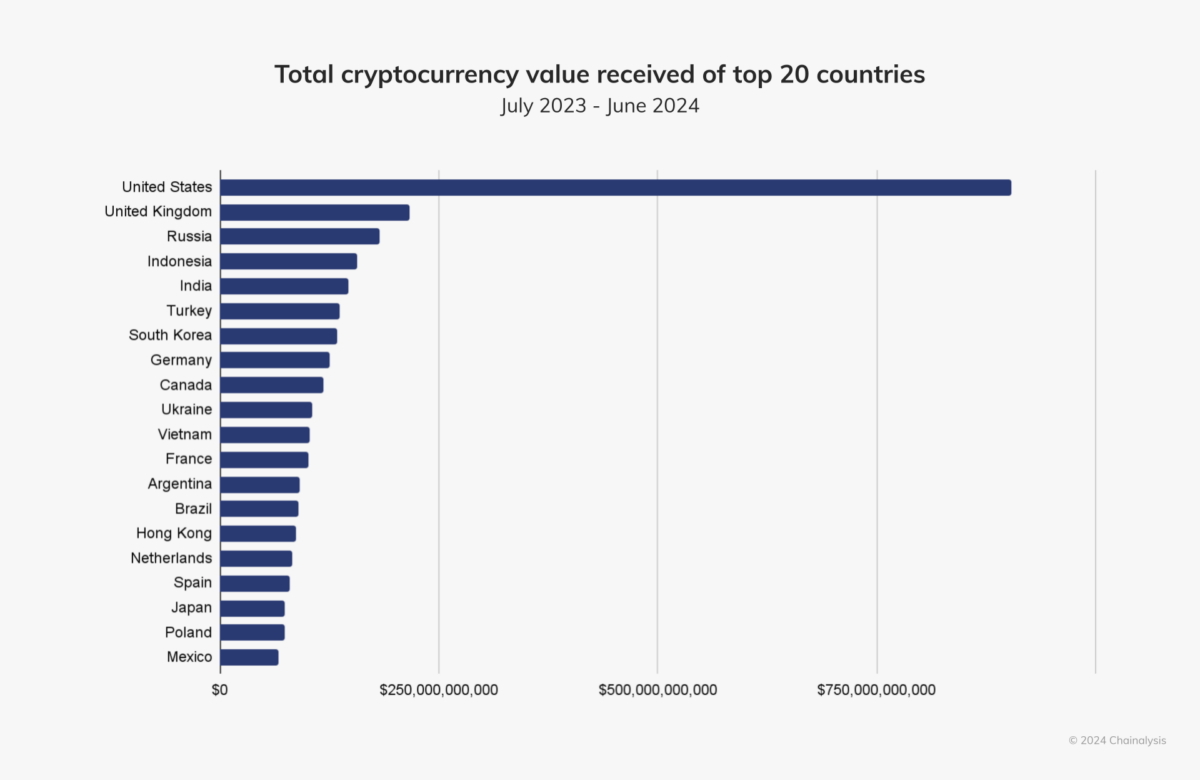

North America as an entire stays a powerhouse within the world crypto scene, receiving roughly $1.3 trillion in on-chain worth between July 2023 and June 2024, accounting for about 22.5% of worldwide exercise. Canada performs a major position on this market, receiving roughly $119 billion in worth over the identical interval, though smaller than its U.S. counterpart.

It is a clear signal that Canadians aren’t simply interested in crypto—they’re actively participating with it as a monetary different.

What makes this shift much more fascinating is how intently it aligns with the reforms Canadians are calling for. Cryptocurrencies deal with lots of the ache factors that frustrate customers within the conventional banking system. For example, their decentralized nature cuts out the middlemen, lowering transaction charges and dashing up processing occasions. In a world the place financial institution transfers can nonetheless take days, crypto networks provide near-instant settlement, 24/7 availability, and borderless transactions.

Moreover, good contracts maintain the potential to remove pricey intermediaries in all the things from actual property offers to complicated monetary derivatives. These contracts are trustless, automated, and tamper-proof, providing a stage of transparency and effectivity that conventional monetary techniques battle to match.

Briefly, the rise of crypto in Canada isn’t nearly speculative buying and selling or tech enthusiasm. It displays a deeper, extra elementary shift in how folks wish to handle and transfer their cash. For a rustic trying to modernize its monetary panorama, this might be the disruptive drive that lastly breaks the mould.

Boundaries to Adoption: Belief, Schooling, and Regulation

Regardless of the thrill surrounding crypto and its potential to rework finance, mainstream adoption in Canada nonetheless faces important hurdles. If the promise of a decentralized monetary future is to be realized, these obstacles should be addressed head-on. They’ll broadly be grouped into three foremost challenges: belief, training, and regulation.

Belief and NotionWith regards to cash, belief is all the things. But, cryptocurrencies typically battle to encourage confidence, and for good cause. One of many greatest hindrances is their infamous volatility. For a lot of, this unpredictability makes crypto really feel like a high-stakes gamble relatively than a dependable retailer of worth.

Associated: Does Cryptocurrency Encourage a Playing Mentality in Investments?

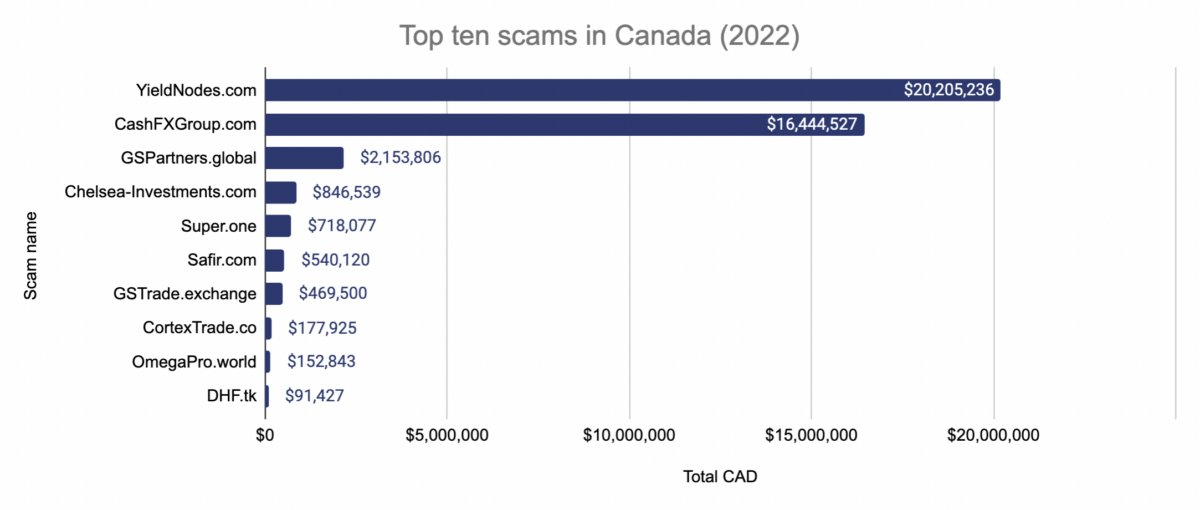

Then there’s the darker facet of digital property – their potential misuse for illicit actions. Regardless of the transparency promised by blockchain expertise, cryptocurrencies have sometimes been exploited for fraud and cash laundering. In 2022 alone, Canadians confronted a median publicity of roughly $1,144 CAD to illicit crypto actions for each 1,000 residents. Over the identical interval, this misuse collectively accounted for greater than $41.7 million CAD throughout Canada, highlighting the continuing challenges of securing the digital finance house.

This echoes broader issues about the influence of scams on crypto’s fame. These issues create a belief hole that the business should deal with if it hopes to realize mainstream acceptance.

Schooling and ConsciousnessInformation is energy, however in terms of crypto, it’s additionally a barrier. A good portion of the Canadian public nonetheless lacks a transparent understanding of blockchain expertise and its advantages. Based on Statistics Canada, solely 0.3% of Canadian companies utilised blockchain in 2021, underscoring the steep studying curve that stands between the typical client and their first cryptocurrency transaction.

Misinformation is one other main impediment. Scams are rampant, and with out correct training, newcomers usually tend to fall sufferer to too-good-to-be-true funding schemes. This not solely erodes belief but in addition provides to the already complicated fame that crypto has among the many basic public.

Furthermore, the expertise itself can really feel daunting. Not like the acquainted, user-friendly interfaces of conventional banking apps, managing digital property typically requires a better stage of digital literacy. This complexity can deter even probably the most enthusiastic would-be adopters. For monetary advisors, this hole in understanding presents each a problem and a chance, as highlighted within the article ‘Why Ignoring Crypto is No Longer an Choice for Monetary Advisors.’ With the correct steerage, they will play a essential position in bridging this data hole, serving to shoppers navigate the evolving world of digital property and make knowledgeable funding choices.

Regulatory UncertaintyLastly, there’s the regulatory elephant within the room. Canada crypto regulation stays a key concern, as policymakers grapple with the right way to stability innovation with client safety. Canada’s strategy to crypto regulation has been cautious and typically fragmented. For example, the Canadian Securities Regulators (CIRO) not too long ago tightened guidelines by excluding crypto funds from decreased margin eligibility, citing their excessive volatility and liquidity dangers. Strikes like these make leveraged buying and selling dearer and sign a usually cautious stance towards the sector.

In distinction to the clearer, although typically controversial, frameworks in the USA, Canada’s patchwork strategy creates uncertainty for companies and traders alike. This lack of regulatory readability can stifle innovation and gradual adoption.

Nonetheless, there are requires reform. Firms like Coinbase are advocating for a extra supportive regulatory setting, together with the institution of a government-led cryptocurrency activity drive, the creation of a Bitcoin reserve, and federal rules for stablecoins. Such measures may present the much-needed readability and confidence for the business to thrive whereas additionally defending customers.

Remaining Ideas: A Essential Crossroads for Canada’s Monetary Future

Canada stands at a essential monetary crossroads, with the alternatives it makes as we speak set to form its financial panorama for many years to return. The potential for innovation is immense, however with out clear rules, public belief, and widespread understanding, this promise dangers fading right into a missed alternative.

The demand for monetary reform is obvious. Canadians need quicker transactions, decrease charges, and better transparency – exactly the benefits that cryptocurrencies provide.

However the street forward isn’t with out its challenges. For crypto to maneuver from the fringes to the monetary mainstream, it should overcome essential obstacles: belief, training, and regulation. These aren’t small hurdles. Constructing confidence in digital property, demystifying blockchain expertise, and making a supportive but safe regulatory framework can be important.

As Canadians push for a monetary system that higher serves their wants, the query isn’t simply whether or not crypto can rise to the event – it’s whether or not the nation is able to embrace this digital revolution. One factor is for certain: the time for resolution is now.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein ought to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of economic loss. At all times conduct due diligence.

If you wish to learn extra market analyses like this one, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”