In recent times, China’s digital forex ambitions have drawn world consideration and never with out purpose. From launching its personal central financial institution digital forex (CBDC) to encouraging the creation of yuan-backed stablecoins, China is actively laying the groundwork for a brand new monetary order. The underlying query stays: is that this a real push for market innovation, or a strategic transfer within the ongoing geopolitical energy wrestle?

Let’s discover out the motivations, mechanisms, and implications of China’s yuan stablecoin initiative and its broader push into digital forex.

What Is the Digital Yuan and How Does It Work?

Earlier than we glance into the emergence of China’s yuan stablecoin, it’s essential to grasp the inspiration on which this digital forex technique is constructed. Following its ban on decentralized cryptocurrencies, China has channelled its focus into growing the digital yuan, also referred to as e-CNY.

The digital yuan is the official China CBDC, issued and controlled by the Individuals’s Financial institution of China (PBOC). In contrast to decentralized cryptocurrencies that depend on mining and permissionless networks, e-CNY operates as a centralized digital forex, basically a digitized model of bodily money. Its distribution is managed by the state by means of business banks and permitted digital wallets, making certain that each unit of digital forex in China stays inside the boundaries of nationwide oversight.

Since its pilot launch in 2020, the digital yuan has seen fast adoption. As of June 2024, the digital yuan had achieved important adoption, with transaction volumes reaching CNY 7 trillion (roughly $986 billion) throughout 17 provinces.

China’s digital yuan (e-CNY) continues to be the most important CBDC pilot on the planet.

In June 2024, e-CNY transactions reached 7 trillion yuan ($986 billion) in 17 provinces, and is getting used throughout sectors equivalent to training, healthcare, and tourism. pic.twitter.com/EKFty11ua2

— Atlantic Council GeoEconomics Middle (@ACGeoEcon) September 17, 2024

By providing a managed but environment friendly cost methodology, China’s digital yuan displays the nation’s ambition to modernize its monetary infrastructure whereas laying the groundwork for broader world engagement.

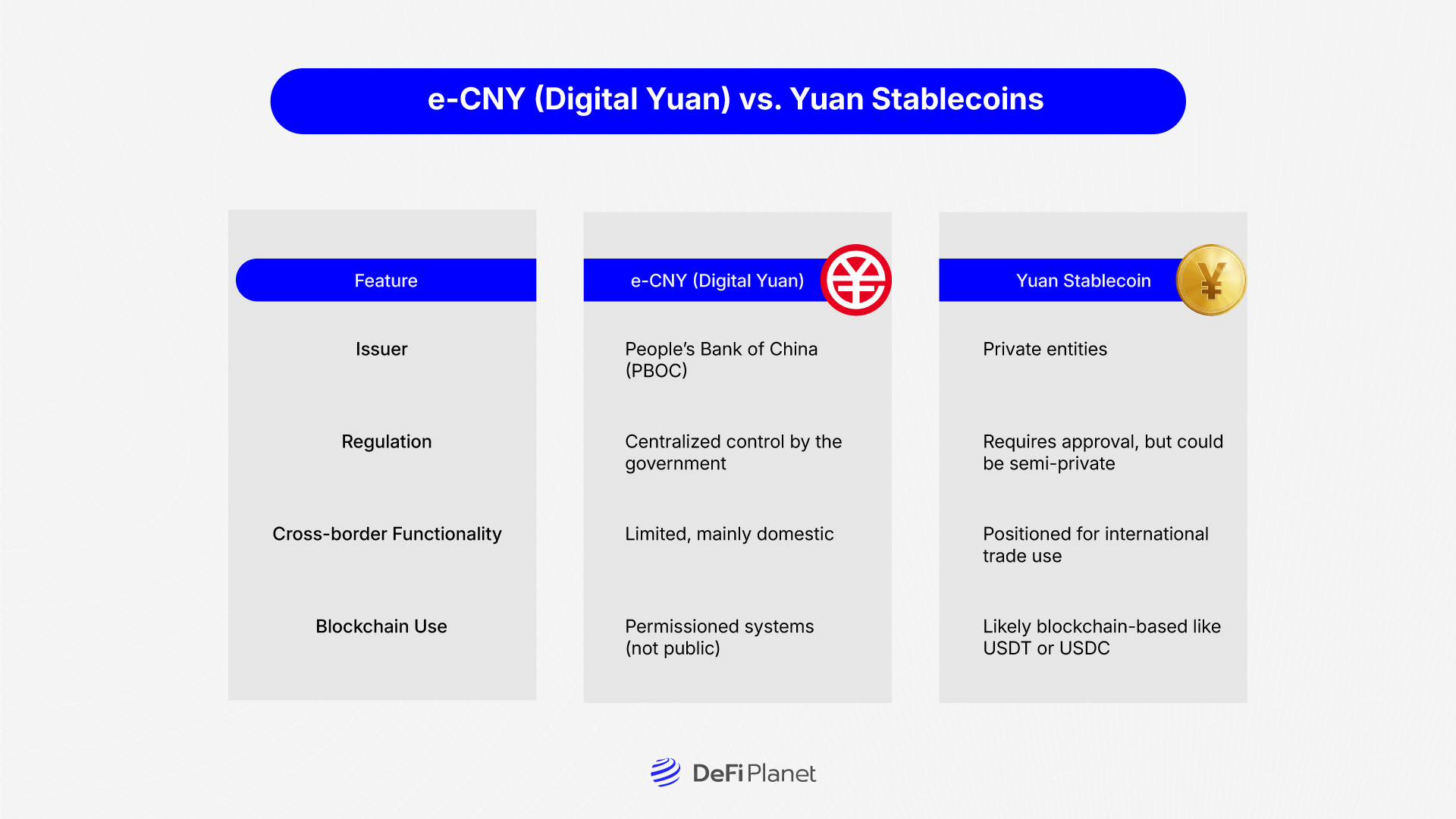

Nevertheless, the idea of a yuan stablecoin introduces a unique mannequin. In contrast to e-CNY, which is immediately issued by the central financial institution, a yuan stablecoin could be created by non-public establishments and backed by reserves—mirroring how USDC is tied to the U.S. greenback. Whereas e-CNY stays centered on home use underneath strict regulation, yuan stablecoins intention to serve worldwide markets and crypto platforms, offering flexibility and attain {that a} sovereign digital forex might not totally obtain.

e-CNY (Digital Yuan) vs. Yuan Stablecoins

The yuan stablecoin push is primarily for offshore use, particularly in Hong Kong, making it extra suited to cross-border commerce than the home e-CNY.

Why Is China Taking Curiosity in Yuan Stablecoin? Commerce, Sanctions, and Greenback Rivalry

China’s rising curiosity in launching a yuan stablecoin is not any coincidence; it’s a strategic transfer on the intersection of commerce, monetary autonomy, and geopolitical competitors. For many years, China and the U.S. have been financial rivals, however now the battleground is shifting into the digital forex area. Because the U.S. greenback continues to dominate world finance, China seems to be accelerating its de-dollarization efforts, and digital forex is rising as a crucial instrument in that mission.

Over the previous few years, Chinese language banks have more and more shifted their lending to rising markets from the U.S. greenback to renminbi (RMB) lending, whereas additionally selling bilateral commerce settlements in yuan. In January 2025, China introduced a large $100 billion initiative to assist companies in Hong Kong entry yuan-denominated financing, a transparent sign of its intent to spice up China’s digital yuan liquidity and utilization past its borders.

In the meantime, stablecoins equivalent to Tether (USDT) and USD Coin (USDC) have gained dominance within the world crypto market, facilitating billions of {dollars} in day by day transactions. Nevertheless, this dominance has additionally cemented the greenback’s digital stronghold, inadvertently extending U.S. monetary affect into the decentralized area. In truth, round 99% of all stablecoins are at present pegged to the U.S. greenback, reinforcing the dollar’s grip on digital forex ecosystems.

To counter this, China is pushing again, with the event of its cryptocurrency taking middle stage. Whereas the e-CNY, or digital yuan, has made notable strides domestically, the nation sees yuan stablecoins as a strategic extension of its world forex ambitions, significantly in crypto and worldwide commerce.

Associated: Stablecoins vs. CBDCs: Why Governments Are Choosing Sides within the Way forward for Cash

As of Could 2025, the U.S. greenback nonetheless accounts for 48.46% of world funds, whereas the yuan lags behind at simply 2.89%, based on SWIFT information. To shut this hole, China is betting on stablecoins to assist internationalize the China CBDC framework with out compromising home capital controls.

The technique is multifaceted:

Commerce effectivity: Chinese language exporters usually use USDT for sooner cross-border settlements. A yuan stablecoin might provide a local, sovereign different.

Sanctions resistance: As geopolitical tensions rise, a digital yuan stablecoin might assist China scale back its publicity to the U.S.-dominated monetary system and navigate round sanctions.

Foreign money internationalization: Whereas the digital yuan is concentrated on home use, yuan-backed stablecoins permit China to advertise world use of the yuan in a extra versatile and market-driven means.

In essence, the rise of China’s yuan stablecoin initiative displays each a technological shift and a geopolitical recalibration, one which goals to reshape the way forward for cash on China’s phrases.

JD.com and Ant Group: Driving the Business Case for Yuan Stablecoins

Behind China’s digital forex evolution, two highly effective business forces are aligning: JD.com and Ant Group. These tech giants, lengthy on the forefront of China’s digital financial system, are actually entering into a brand new position: champions of the yuan stablecoin motion.

JD.com, certainly one of China’s largest logistics and retail platforms, and Ant Group, the operator behind the Alipay cost community, have each amassed huge person bases and transaction volumes. Now, they’re turning their consideration past home borders, in direction of Hong Kong, a world monetary hub and regulatory testing floor.

By proposing the launch of yuan stablecoins pegged to the offshore yuan (CNH) in Hong Kong, these firms are aiming to carve out new monetary rails that join China’s financial affect with world digital markets. By this avenue, JD.com and Ant Group might facilitate sooner, lower-cost cross-border funds for retailers and shoppers, broaden monetary choices to underbanked markets, and combine cryptocurrency of China into rising digital ecosystems.

Whereas the digital yuan (or e-CNY) stays the sovereign instrument for home retail use, yuan-backed stablecoins launched by trusted company gamers might unlock worldwide adoption at a scale that authorities channels alone might wrestle to attain.

On this gentle, JD.com and Ant Group should not simply individuals; they’re catalysts. Their push for yuan stablecoin authorization displays a transparent recognition: within the race to form the way forward for cash, velocity, scale, and private-sector agility matter as a lot as state oversight. And with China aiming to rival the digital dominance of the U.S. greenback, its position may very well be pivotal in turning ambition into actuality.

A New Period of Stablecoin Competitors

The worldwide stablecoin market is rising quickly, with projections estimating it might attain a staggering $2 trillion by 2028. Whereas the area is at present dominated by U.S. dollar-pegged tokens like USDT and USDC, the emergence of China digital yuan-linked stablecoins alerts the start of a brand new chapter in digital forex competitors.

The introduction of yuan stablecoins might provide exporters, retailers, and monetary establishments better selection in how they settle digital transactions. Fairly than relying solely on dollar-backed property, companies might go for digital yuan-based stablecoins, particularly in areas with robust financial ties to China. This shift holds specific promise for rising markets, the place greenback dominance usually introduces volatility and dependency. A secure, accessible, and reserve-backed cryptocurrency from China might current a compelling different.

In Asia, the approval of yuan stablecoins in hubs like Hong Kong might additionally affect the trajectory of crypto adoption. Market individuals might more and more pivot towards China CBDC-aligned property, drawn by the familiarity of the forex and the regulatory confidence provided by regional frameworks., Because the digital forex of China steps onto the worldwide stage by means of stablecoin integrations, the steadiness of energy in digital finance might start to tilt away from a singular greenback customary and towards a extra pluralistic, aggressive ecosystem the place the China digital yuan performs a central position.

READ MORE: What the Stablecoin Ecosystem Seems to be Like At present and The place it’s Heading Subsequent

Strategic Innovation or Political Maneuvering?

China’s yuan stablecoin initiative embodies a dual-purpose technique, positioned as each a daring step in monetary innovation and a calculated geopolitical transfer. Whereas the e-CNY strengthens the nation’s home cost infrastructure by providing a state-controlled digital different to money, the introduction of yuan stablecoins expands this imaginative and prescient to the worldwide enviornment. These privately issued, blockchain-based tokens function devices to speed up yuan internationalization, giving the Chinese language digital forex a broader presence in cross-border finance and crypto ecosystems.

By offering a secure, digital forex of China as an alternative choice to dollar-pegged tokens, this initiative additionally challenges the longstanding dominance of the U.S. greenback within the crypto area. But in contrast to decentralized currencies, yuan stablecoins retain parts of oversight and management, permitting China to take care of regulatory authority whereas nonetheless embracing the efficiencies and suppleness of blockchain infrastructure.

Whether or not this transfer in the end disrupts the worldwide monetary system or just sparks a wave of aggressive fashions from different nations will rely on a variety of components, together with real-world adoption, the readability of worldwide laws, and the belief it will probably construct throughout world markets. As the road between strategic innovation and political maneuvering continues to blur, the success of the China CBDC and its stablecoin counterparts might reshape how digital worth is exchanged on a world scale.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein needs to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of economic loss. At all times conduct due diligence.

If you wish to learn extra market analyses like this one, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”

The publish Is China’s Yuan Stablecoin a Energy Transfer or Innovation? appeared first on DeFi Planet.