Within the battle for blockchain dominance, two titans are main the cost: Ethereum and Bitcoin. These networks have outlined the crypto business’s evolution since its inception. However as we sit up for the following decade, the important thing query emerges: Does Ethereum or Bitcoin have extra potential? Will Ethereum’s innovation outpace Bitcoin’s stability, or will the unique cryptocurrency keep its reign as essentially the most trusted blockchain?

This complete comparability explores their philosophies, applied sciences, market dynamics, and visions to find out which is best, Ethereum or Bitcoin—and which technique is extra prone to form the way forward for finance and decentralized infrastructure.

Ethereum’s Speedy Upgrades vs Bitcoin’s Conservative Growth

Ethereum has earned a repute because the experimental powerhouse of blockchain. From its transition to Proof of Stake, to the rollout of rollups, danksharding, and modular upgrades just like the Pectra replace, Ethereum’s tempo is relentless. These upgrades goal to unravel long-term issues—scalability, sustainability, and pace—making Ethereum greater than only a cryptocurrency.

In distinction, Bitcoin prioritizes minimalism and immutability. Modifications to the Bitcoin protocol are uncommon, totally debated, and conservative by design. Its growth ethos values stability, predictability, and resistance to alter, aligning with its core function as a digital retailer of worth.

This divergence raises a core debate in crypto: Which is best, Ethereum or Bitcoin? If you happen to worth innovation, Ethereum leads. If you happen to favor long-term reliability, Bitcoin stays the king.

Commerce-offs Between Flexibility and Belief

So, does Ethereum have extra potential than BTC? The reply lies in the way you weigh adaptability towards simplicity. Ethereum’s structure is inherently versatile, it powers good contracts, DeFi, NFTs, and Layer 2 ecosystems. It’s a vibrant, evolving digital economic system. However this flexibility doesn’t come free. It introduces added complexity in protocol design, a heavier dependence on third-party infrastructure like Infura and Alchemy, and a broader floor space for bugs, vulnerabilities, or centralization dangers.

Vitalik Buterin has overtly acknowledged that each Ethereum and Bitcoin have their strengths and trade-offs. He believes Ethereum at present leads in areas like censorship resistance and community safety. Nevertheless, he additionally factors out that Bitcoin has sure benefits—resembling less complicated code, fewer protocol modifications, a better variety of full nodes, and fewer reliance on exterior RPC providers.

> I imagine Ethereum is main by way of CR and safety.

There’s some facets of this the place bitcoin is forward imo

(eg. much less code complexity, decrease charge of protocol change, increased full node rely, much less dependence on RPCs)

— vitalik.eth (@VitalikButerin) June 3, 2025

Bitcoin’s simplicity is its biggest power, a lean, battle-tested community that prioritizes safety, reliability, and decentralization above all else. It doesn’t attempt to do every little thing. It does one factor exceptionally properly: retailer and switch worth securely.

If you happen to’re asking, can Ethereum beat Bitcoin in the long term, the reply is dependent upon your definition of “profitable.” Ethereum would possibly outpace by way of innovation and utility, however Bitcoin leads by way of predictability, decentralization, and long-term confidence.

Decentralization in Observe: Nodes, Staking, and the Wrestle for Trustlessness

One of the important distinctions between Bitcoin and Ethereum lies in how every community approaches decentralization, not simply as a precept, however as a lived actuality of their structure and participation fashions. At its core, Bitcoin stays the gold customary for community decentralization. With over 60,000 full nodes working globally, Bitcoin’s infrastructure is deeply distributed.

Its Proof of Work (PoW) consensus permits anybody with enough {hardware} and electrical energy to contribute to securing the community. This permissionless mannequin promotes accessibility and ensures that no single get together can simply exert management. Importantly, Bitcoin’s reliance on full nodes, not exterior providers, reinforces its self-verification mannequin, permitting customers to independently validate transactions with out third-party dependencies. It’s a system that values protocol purity and minimalism because the bedrock of belief.

Ethereum, in the meantime, has taken a special path. Its post-Merge shift to Proof of Stake (PoS) marked a foundational change in how the community operates. Somewhat than requiring computational effort, validators now safe Ethereum by locking up ETH. This mannequin is considerably extra energy-efficient and reduces the {hardware} barrier to entry, theoretically enabling broader participation. Nevertheless, it additionally introduces a wealth-based dynamic: the extra ETH one holds, the higher their affect on consensus.

Vitalik Buterin, Ethereum’s co-founder, has overtly addressed one of the vital nuanced challenges on this evolution: sustaining trustlessness and decentralization throughout Ethereum’s rising Layer 2 ecosystem. He cautions towards declaring interoperability and decentralization “solved” just because Layer 2 options exist. In his phrases,

“It’s not solved till cross-L2 actions could be as censorship-resistant, trustless, and intermediary-free as within-L2 actions.

Finally, the talk between Ethereum and Bitcoin usually circles again to this philosophical divide. Bitcoin prioritizes simplicity, self-sovereignty, and the integrity of a slow-moving however extremely resilient protocol. Ethereum embraces innovation and inclusion, constructing a extra expansive however complicated system that seeks to evolve with the wants of a rising digital economic system.

Future Positioning: World Funds vs Programmable Finance

Bitcoin and Ethereum are charting distinct paths towards the longer term, every optimizing for a special imaginative and prescient of what blockchain can turn into. For Bitcoin, the objective is evident: to function the world’s final peer-to-peer foreign money and a safe retailer of worth. It’s a digital various to money and gold, constructed for simplicity, resilience, and long-term belief.

Ethereum, in contrast, is establishing a full-stack infrastructure for programmable finance and decentralized purposes. Its imaginative and prescient goes far past funds. By means of good contracts, Ethereum permits DeFi protocols for lending, borrowing, and buying and selling; it powers NFTs, decentralized identification techniques, and DAOs; and it continues to scale via rollups and Layer 2 options that enhance throughput with out compromising on safety.

What’s the principal function of Bitcoin? Merely put: to function a digital, censorship-resistant foreign money and a long-term retailer of worth. Ethereum, in the meantime, is betting on programmability. It’s not only a cryptocurrency, it’s a complete monetary ecosystem.

With regards to evaluating which is “higher,” the reply in the end is dependent upon the meant use case. Bitcoin might lead in sovereign finance, providing a censorship-resistant financial base layer. Ethereum, then again, is prone to dominate within the realm of decentralized utility, the place complicated monetary logic and innovation thrive. Every blockchain performs a definite, important function in shaping the way forward for the digital world.

Provide, Shortage, and Financial Coverage

Shortage is one other key battlefield within the Ethereum vs Bitcoin dialog. On the coronary heart of Bitcoin’s worth proposition is its absolute shortage. With a set provide cap of 21 million cash and a halving occasion each 4 years, Bitcoin enforces a predictable, programmed financial coverage. Its deflationary nature is hardcoded, providing readability and certainty to traders and establishments alike.

Ethereum, then again, has embraced a extra versatile and adaptive financial mannequin. The introduction of EIP-1559 introduced a burn mechanism that completely eliminated a portion of transaction charges from circulation, counteracting new issuance. The shift to Proof of Stake (PoS) additional lowered Ethereum’s inflation charge, and during times of excessive community exercise, ETH provide can really turn into deflationary. This implies Ethereum’s shortage is tied to not a set cap however to the community’s utility and utilization.

This divergence has sparked an ongoing debate: Which asset has the stronger declare to digital shortage? Bitcoin’s exhausting restrict supplies unmatched predictability and belief in its financial coverage. But Ethereum’s evolving mannequin—pushed by community demand and actual financial exercise—presents a singular type of shortage that’s dynamic, utility-based, and more and more deflationary.

In the long run, Bitcoin embodies absolute shortage; Ethereum represents adaptive shortage. Each fashions carry worth—however in numerous methods for various sorts of customers.

Market Metrics and Actual-World Adoption

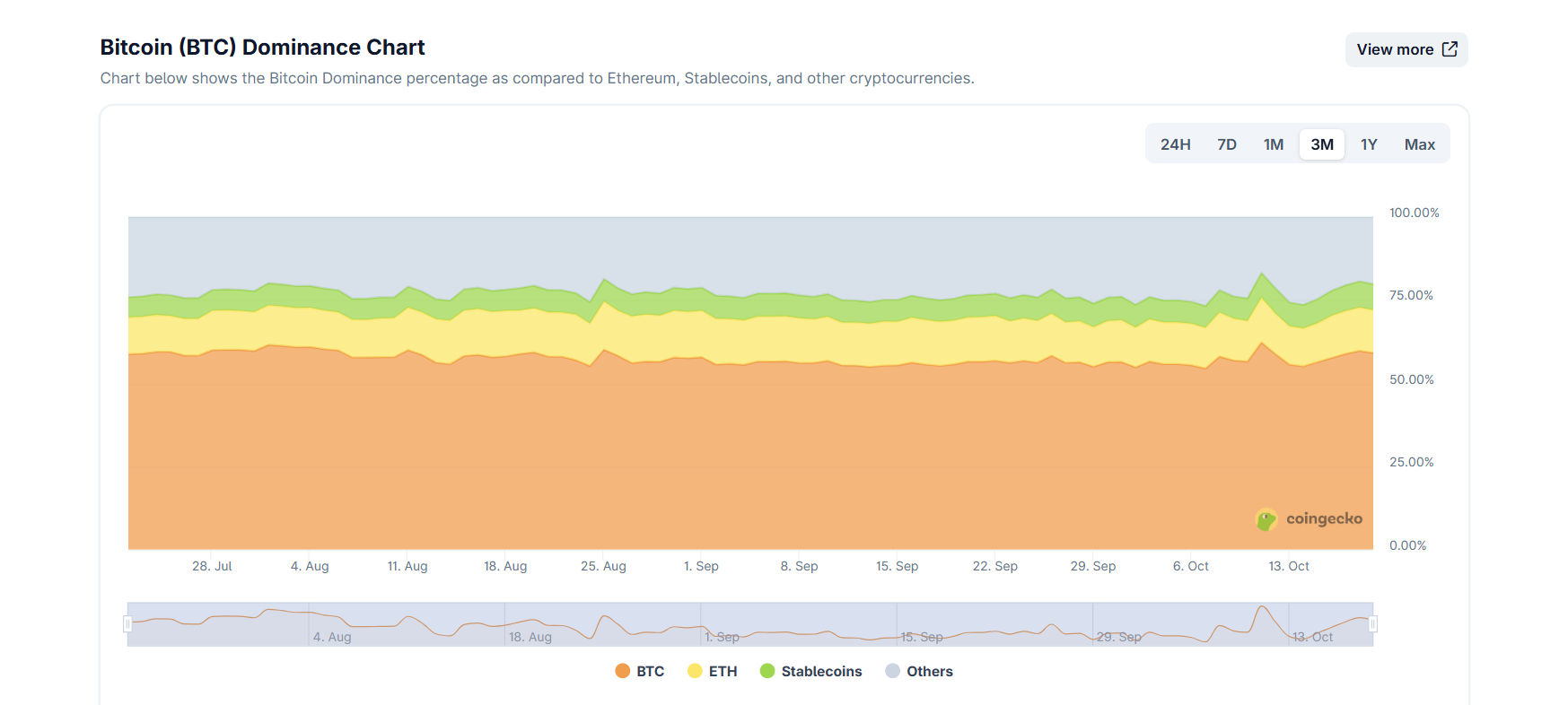

As of mid-2025, the panorama of crypto market metrics and real-world adoption continues to focus on the distinct roles of Bitcoin and Ethereum. Bitcoin maintains a dominant place, commanding over 60% of the entire cryptocurrency market capitalization.

This displays not solely its first-mover benefit but in addition its sturdy model recognition and perceived standing as a digital retailer of worth.

In the meantime, Ethereum processes considerably extra every day transactions and helps a broader vary of real-world purposes. From decentralized finance (DeFi) and non-fungible tokens (NFTs) to enterprise integrations and gaming platforms, Ethereum’s versatile structure has made it the go-to blockchain for builders and innovators constructing next-generation digital instruments.

Institutional adoption leans in favor of Bitcoin, significantly amongst conventional monetary establishments and company treasuries searching for a hedge towards inflation or a non-sovereign asset class. Nevertheless, Ethereum is steadily gaining floor, particularly in sectors like finance, gaming, and enterprise tech, because of its programmability and ongoing infrastructure upgrades.

So, does Ethereum or Bitcoin have extra potential to form the following part of digital finance? Ethereum leads in developer exercise, dApp integrations, and ecosystem growth, whereas Bitcoin holds unmatched belief, simplicity, and regulatory readability. The way forward for each belongings will rely on how these strengths proceed to evolve in parallel and in response to international demand.

Ultimate Verdict: Which Technique Will Win the Subsequent Decade?

The true query won’t be which one wins, however how each can thrive collectively. Bitcoin stays strong, safe, and singular in function—a digital financial base layer constructed for long-term worth storage and sovereign monetary independence. Its power lies in its stability, simplicity, and unmatched belief as a decentralized retailer of worth.

Ethereum, then again, is agile, adaptable, and unapologetically formidable. It positions itself because the foundational layer of a decentralized, programmable web—powering every little thing from DeFi and NFTs to DAOs and decentralized identification techniques. Its daring, tech-forward strategy is designed to evolve with the wants of a quickly altering digital world.

Finally, the talk between Ethereum and Bitcoin is not only about code—it’s about competing philosophies. Innovation versus resilience. Flexibility versus stability. The following decade might not yield a transparent victor, however reasonably a coexistence the place each networks serve distinct, important roles: Bitcoin because the bedrock of digital worth, and Ethereum because the engine of decentralized infrastructure. Collectively, they may form the way forward for finance in complementary, reasonably than aggressive, methods.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein needs to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of monetary loss. At all times conduct due diligence.

If you wish to learn extra market analyses like this, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Neighborhood.

“Take management of your crypto portfolio with Markets PRO, DeFi Planet’s suite of analytics instruments.”