Understanding what to anticipate relating to crypto taxes is vital for anybody coming into the crypto area. As cryptocurrencies and digital belongings develop in reputation, tax authorities worldwide are updating laws to make sure people pay their fair proportion. Failing to correctly report cryptocurrency transactions may end up in penalties and extra tax legal responsibility.

That’s why we’re going to offer you a full breakdown of how cryptocurrency taxes work, how you find yourself owing, and the way a lot chances are you’ll must pay. Then we’ll get into what sort of paperwork and recordkeeping it’s best to anticipate, earlier than supplying you with some actionable methods for minimizing your taxes whereas staying absolutely compliant.

What are Cryptocurrency Taxes?

Cryptocurrency taxes check with the tax obligations that come up while you have interaction with digital belongings like Bitcoin, Ethereum, or different digital currencies. In lots of jurisdictions, tax authorities deal with crypto as capital belongings, just like shares, bonds, or actual property.

Which means beneficial properties or losses from buying and selling, promoting, or exchanging cryptocurrencies could also be topic to capital beneficial properties taxes. In the meantime, sure different actions—corresponding to mining, staking, or receiving crypto as fee—can create taxable revenue.

As a result of cryptocurrencies are thought-about property for tax functions, their tax therapy differs from easy foreign money transactions. Every taxable occasion, together with promoting crypto for fiat foreign money or utilizing it to purchase items, might set off a calculation of acquire or loss primarily based on the honest market worth on the time of the transaction.

Not solely that, however sure transactions might fall underneath totally different tax classes, from unusual revenue tax to long-term capital beneficial properties charges, relying on how lengthy you’ve held the asset. In the end, cryptocurrency taxes make sure that any earnings from digital belongings are reported to the suitable tax authorities, conserving the tax system honest and clear. Understanding these guidelines helps you keep on the best facet of tax companies and keep full compliance.

How Do Cryptocurrency Taxes Work?

Cryptocurrency taxes hinge on a couple of key rules. First, tax authorities often take into account cryptocurrencies as property, not foreign money. This classification signifies that every transaction involving crypto is usually a taxable occasion, relying on what you do along with your belongings.

When you purchase a digital asset and later promote or commerce it at a better worth, you typically have a capital acquire, and also you’ll owe taxes on that revenue. Conversely, promoting at a loss can typically offset different beneficial properties, lowering your general tax legal responsibility.

Your price foundation is central to calculating your acquire or loss. That is the quantity you initially paid for the asset, together with charges. Whenever you promote, commerce, or in any other case get rid of the crypto, evaluate the honest market worth on the time of the transaction to your price foundation. The distinction determines whether or not you’ve gotten a acquire or loss. Positive aspects could be topic to short-term capital beneficial properties tax charges if held for lower than a 12 months, or long-term capital beneficial properties charges if held longer.

Along with buying and selling, different actions like mining, staking, or receiving crypto as fee for companies usually rely as unusual revenue on the time you obtain them. Tax authorities anticipate you to report these quantities in your tax return.

Varieties of Cryptocurrency Taxes

Cryptocurrency taxes fall into a number of broad classes, every reflecting totally different sorts of transactions and revenue sources. Have a look.

Capital Positive aspects Taxes: Whenever you promote, commerce, or change a cryptocurrency for a price larger than your unique price foundation, you notice a capital acquire. When you held the asset for greater than a 12 months, chances are you’ll qualify for long-term capital beneficial properties charges, which are sometimes decrease than unusual revenue tax charges. Holding for lower than a 12 months usually leads to short-term capital beneficial properties, taxed at your common revenue tax bracket.

Bizarre Revenue Taxes: Some crypto actions generate taxable revenue on the time you obtain the asset. For instance, mining or staking rewards rely as digital asset revenue, with the honest market worth of the cash acquired on the date you acquire management handled as unusual revenue. Equally, when you settle for crypto as fee for items or companies, that worth is taken into account taxable revenue, topic to your normal revenue tax charges.

Different Capital Property Remedy: Changing one cryptocurrency to a different additionally triggers a taxable occasion. Although you’re not changing to fiat, the tax authorities take into account it as “disposing” of 1 asset and buying one other. The distinction in honest market worth between the 2 belongings on the time of the transaction determines your acquire or loss.

Much less Frequent Tax Conditions: Sure actions, like receiving airdrops, onerous forks, or collaborating in liquidity swimming pools, might carry their very own distinctive tax penalties. Every situation requires evaluating the honest market worth and figuring out whether or not it counts as unusual revenue, capital acquire, or one other type of taxable exercise.

How a lot is cryptocurrency taxed?

The quantity of tax you pay on cryptocurrency relies on a number of components: how lengthy you’ve held the asset, your general revenue stage, and your nation’s tax legal guidelines. Typically, when you maintain crypto for greater than a 12 months earlier than promoting, any acquire you notice is topic to long-term capital beneficial properties tax charges, which are sometimes decrease than short-term capital beneficial properties charges. In some jurisdictions, long-term charges could be as excessive as 20%, relying in your tax bracket and submitting standing. When you maintain the asset for lower than a 12 months, the acquire is often handled as short-term capital beneficial properties, taxed at your unusual revenue tax fee. This might imply larger tax charges (could possibly be as much as 37%), particularly when you already earn a considerable wage or produce other revenue sources.

Relating to unusual revenue, the tax fee equals your common revenue tax fee. For many individuals, this corresponds to their revenue tax bracket, which may vary anyplace from 10% to 35%, relying on whole earnings.

Your particular tax legal responsibility additionally relies on any accessible deductions, credit, or offsets. For example, when you expertise capital losses on different trades, you would possibly be capable of scale back your whole capital beneficial properties. Moreover, holding crypto for greater than a 12 months can considerably decrease your tax burden.

What it actually comes right down to, is that figuring out how a lot you’ll pay requires cautious calculation of every transaction’s price foundation, the honest market worth at disposal, and the related charges. Consulting a tax skilled or utilizing dependable crypto tax software program may also help make sure you apply the right tax charges to your distinctive circumstances.

When do I owe tax on cryptocurrency?

Capital beneficial properties tax

You typically owe taxes on cryptocurrency everytime you notice a taxable occasion that produces a acquire or revenue. One of the vital frequent triggers is promoting your crypto for fiat foreign money at a better worth than your unique price. For instance, when you purchased some Bitcoin for $1,000 and offered it later for $2,000, you’ve gotten a $1,000 capital acquire, which is then taxable.

Nevertheless, taxable occasions prolong past simply promoting for money. Exchanging one cryptocurrency for one more might also create a tax obligation. If the crypto you’re buying and selling away has appreciated because you acquired it, you’ll owe taxes on the acquire, though you by no means transformed it into fiat. Utilizing crypto to buy items or companies is one other situation the place you would possibly owe taxes, as you’re successfully disposing of an asset with a sure honest market worth.

Extra conditions, like swapping crypto for NFTs or stablecoins, can even set off taxes if the unique belongings have appreciated.

Revenue tax

Receiving crypto as fee for freelance work, mining rewards, or staking revenue is taken into account taxable revenue on the time you obtain it. In these circumstances, you’ll be taxed primarily based on the coin’s worth when it enters your pockets. Even gifting crypto to somebody past sure thresholds or donating it to charity can contain reporting necessities and potential tax implications.

Airdrops and onerous forks that give you new tokens at no quick price might also rely as unusual revenue, subjecting you to tax on the time of receipt. Every of those occasions requires cautious documentation to find out the extent of your legal responsibility.

When do it’s good to report your crypto taxes?

Reporting your crypto taxes usually follows the identical timeline as submitting your annual tax return. Within the US, the tax 12 months ends on December 31, and you have to report all taxable occasions that occurred throughout that interval by the usual tax submitting deadline of April 15. It’s essential to verify the precise deadlines to your location, nonetheless, as dates will differ from one jurisdiction to a different.

You could report everytime you’ve had a taxable occasion. This consists of capital beneficial properties or losses from promoting, buying and selling, or utilizing crypto to purchase items, in addition to any taxable revenue from staking, mining, or receiving crypto as fee. Even when you solely made a couple of trades, the web beneficial properties or losses should seem in your tax return.

Some exchanges might ship tax types that will help you summarize your transactions. Nevertheless, it’s in the end your accountability to make sure your reporting is correct and full. Utilizing crypto tax software program can simplify the method by aggregating your entire trades and calculating the required figures. Maintaining detailed information all year long, together with buy dates, price bases, and honest market values on the time of disposal, makes it simpler to report your exercise on time.

Briefly, try to be able to report crypto actions according to your common tax submitting schedule. Planning forward, sustaining good documentation, and understanding which occasions are taxable make sure you meet all of your reporting obligations promptly and accurately.

Tax types issued by cryptocurrency exchanges

Many cryptocurrency exchanges difficulty tax types that will help you report your crypto exercise. These types summarize your annual transactions and report the entire particulars for every one. In some nations, these types are despatched on to you and the tax authorities, making certain transparency and accuracy.

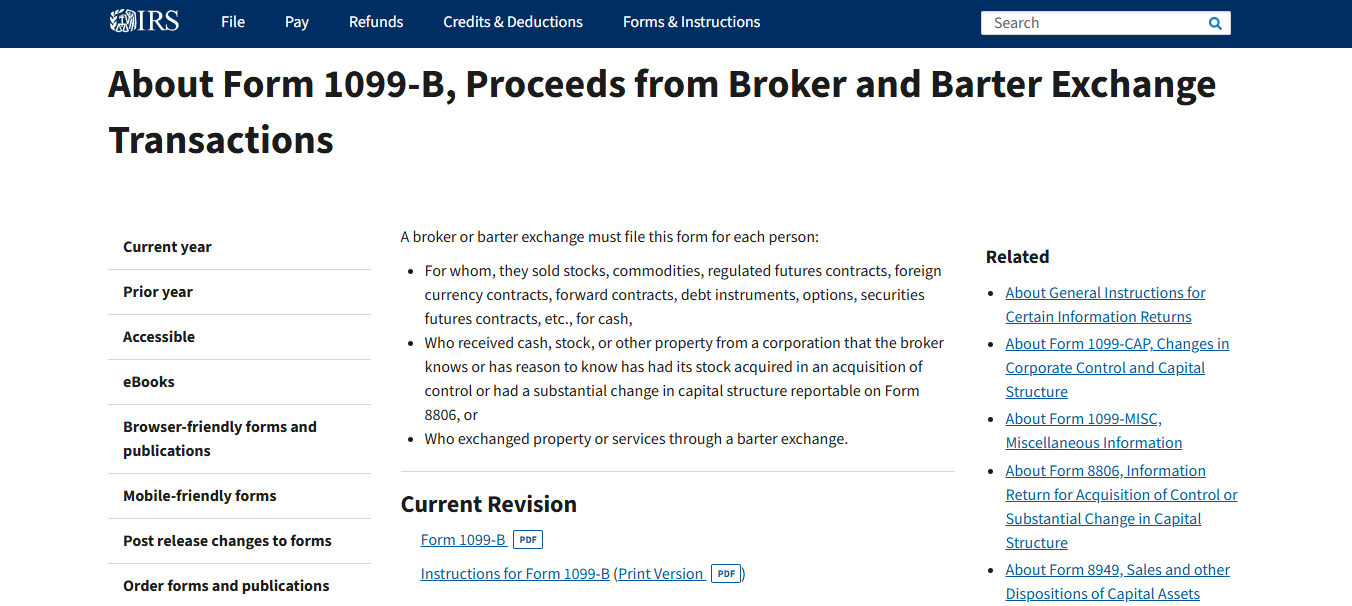

In america, for instance, exchanges might present types corresponding to a 1099-B or a 1099-Ok, relying on the character and quantity of your transactions. A 1099-B can element your capital beneficial properties and losses, making it simpler to calculate your tax legal responsibility.

In the meantime, a 1099-Ok studies gross transaction volumes moderately than revenue, so it’d require extra calculations in your half.

Be mindful, nonetheless, that not all exchanges difficulty these types. Smaller or foreign-based platforms might not ship tax paperwork, leaving you to assemble the required data out of your account historical past. In case your change doesn’t present a specialised tax type, chances are you’ll must depend on transaction histories, API integrations with crypto tax software program, or handbook record-keeping.

Cryptocurrency Tax Data

Correct and thorough record-keeping is important when managing crypto taxes. Each taxable occasion, whether or not it’s a sale, commerce, use of crypto to buy items, or receipt of staking or mining rewards, have to be tracked. So, you may accurately calculate capital beneficial properties and losses, taxable revenue, and any relevant deductions.

Good information guarantee you already know your price foundation, the honest market worth on the time of every transaction, and the ensuing capital acquire or loss. Important particulars embody the date and time you acquired the asset, the quantity of crypto acquired. Additionally they cowl the acquisition worth or price foundation, in addition to the date and worth while you offered, traded, or disposed of it.

When you’ve got engaged in advanced actions corresponding to liquidity pooling, yield farming, or receiving airdrops, conserving much more detailed notes may also help make clear the tax implications. Correct documentation additionally makes it simpler to deal with audits, inquiries from tax authorities, and potential changes to earlier returns.

To streamline the method, think about using crypto tax software program that robotically imports your transaction historical past from a number of crypto exchanges and wallets. These instruments can deal with price foundation calculations, together with FIFO, LIFO, or particular identification, observe long-term and short-term capital beneficial properties, and create ready-to-file tax studies.

In case your crypto actions are important, searching for steerage from a tax skilled might assist guarantee full compliance and optimization of your tax technique. Staying organized all through the tax 12 months makes submitting your return simpler and reduces the danger of errors. With the best methods in place, you may confidently report your crypto actions, meet all of your obligations, and keep away from potential penalties or problems afterward.

Tax-free cryptocurrency transactions

Whereas many crypto actions set off tax obligations, sure transactions might qualify as tax-free or carry diminished tax legal responsibility. Understanding these situations may also help you handle your general tax burden and hold extra of your beneficial properties.

One instance is solely shopping for and holding crypto with out changing it, buying and selling it, or utilizing it for purchases. Merely holding an asset doesn’t create a taxable occasion. Regardless of how a lot your digital asset appreciates, you typically don’t owe taxes till you promote or in any other case get rid of it. This enables long-term holders to defer taxes whereas doubtlessly benefiting from favorable long-term capital beneficial properties charges later.

One other potential tax-free situation entails transferring crypto between your individual wallets or change accounts. Shifting your tokens from one private deal with to a different doesn’t rely as a disposal. Due to this fact, it doesn’t generate a acquire or loss. So long as possession stays with you, such a switch is often a non-taxable occasion.

Sure jurisdictions might provide extra alternatives, corresponding to holding crypto inside sure tax-advantaged accounts or leveraging native legal guidelines that exempt small crypto transactions underneath particular thresholds. Equally, some charitable donations of crypto could also be eligible for a tax deduction, relying on the foundations in your area. Whereas not strictly tax-free, these methods can decrease your taxes owed.

Merely put, figuring out tax-free transactions requires a transparent understanding of the foundations in your nation. By familiarizing your self with these situations and structuring your crypto actions accordingly, you may decrease tax publicity, scale back complexity, and optimize your long-term monetary outcomes.

How do you decrease your crypto taxes?

Decreasing your crypto taxes entails cautious planning, sensible methods, and an intensive understanding of the foundations in your jurisdiction. Whilst you can not keep away from taxes fully, you may take steps to scale back your tax legal responsibility and hold extra of your beneficial properties. Take into account a few of the following methods, and converse along with your most popular tax knowledgeable or monetary advisor about implementing those pertinent or relevant to your funding fashion and long-term objectives.

Maintain for the Lengthy Time period

One of the vital efficient methods to decrease your crypto taxes is by holding your belongings for greater than a 12 months earlier than promoting. Lengthy-term capital beneficial properties charges are sometimes considerably decrease than short-term charges, particularly when you fall into a better revenue tax bracket. This persistence may end up in substantial financial savings and enable you to hold a bigger portion of your earnings.

Use Capital Losses to Offset Positive aspects

When you’ve got skilled losses on sure cryptocurrency trades, you need to use these losses to offset your capital beneficial properties. By strategically promoting belongings which have declined in worth, generally known as tax loss harvesting, you may scale back the quantity of beneficial properties topic to tax. Remember the fact that you have to comply with the foundations in your nation associated to clean gross sales or comparable restrictions, as these forestall you from instantly rebuying the identical asset.

Optimize Your Accounting Methodology

Relying on native tax laws, you might have the choice to decide on totally different accounting strategies for monitoring the price foundation of your crypto trades. Strategies like ‘first-in first-out’, or FIFO, or particular identification can affect the scale of your taxable beneficial properties. Choosing the accounting technique that minimizes beneficial properties can result in decrease taxes over time.

Take into account Retirement and Tax-Advantaged Accounts

In some areas, sure retirement or tax-advantaged accounts mean you can maintain cryptocurrencies. By doing so, you may doubtlessly defer taxes till you withdraw the funds and even get pleasure from tax-free progress, relying on the account’s guidelines. Seek the advice of a tax skilled to find out if these choices can be found and helpful in your state of affairs.

Keep Organized and Use Tax Software program

Good record-keeping is important. Monitoring each transaction ensures that you simply precisely calculate beneficial properties, losses, and taxable revenue. Utilizing crypto tax software program can simplify these calculations. It helps you keep correct information, and ensures you don’t overlook deductions or credit. The extra correct your knowledge, the higher positioned you might be to attenuate pointless taxes.

Take into account Charitable Donations

Donating cryptocurrency to certified charities might yield tax advantages. In some jurisdictions, chances are you’ll obtain a tax deduction for the honest market worth of the donated crypto, and you don’t pay taxes on the related beneficial properties. This technique can help a trigger you care about whereas additionally lowering your taxable revenue.

Seek the advice of a Tax Skilled

Crypto tax guidelines might be advanced and differ broadly throughout totally different areas. A tax skilled skilled in cryptocurrency issues may also help you establish alternatives to decrease your tax invoice. They’ll guarantee compliance with native legal guidelines, and information you thru any regulatory adjustments that will have an effect on your technique.

Monitor Altering Laws

Tax companies often replace their steerage on digital belongings. Staying knowledgeable about evolving guidelines lets you regulate your methods accordingly. Usually reviewing your method and adapting to new laws may also help make sure that you constantly decrease your crypto taxes over the long term.

FAQs

How is crypto staking or mining taxed?

Staking or mining generates new cash which might be typically thought-about taxable revenue on the time you obtain them. The honest market worth of the cash on that day turns into your price foundation. Whenever you later promote, commerce, or convert them, chances are you’ll owe capital beneficial properties taxes on any improve in worth since acquisition.

How are crypto debit card funds taxed?

Utilizing a crypto debit card to purchase items or companies is taken into account disposing of a digital asset. If the crypto you spend has appreciated because you acquired it, you notice a taxable acquire. You owe taxes on the distinction between your price foundation and the honest market worth on the time of buy.

How are crypto items and donations taxed?

If you’re giving somebody the reward of crypto, you typically gained’t be making a taxable occasion for your self. Nevertheless, the individual you reward the crypto to will assume your price foundation. Donations to certified charities might present tax deductions equal to the crypto’s honest market worth on the time of donation. These guidelines differ by jurisdiction, so confirm native laws to make sure correct reporting.

How are NFTs taxed?

NFTs, or non-fungible tokens, are usually handled like another digital asset. So, promoting an NFT for revenue results in capital beneficial properties taxes. Nevertheless, creating and promoting NFTs on the first market could also be thought-about unusual revenue. Gross sales on the secondary market will typically pay taxes in keeping with the same old capital beneficial properties construction primarily based on will increase in worth over time.

How are change bankruptcies taxed?

If a crypto change goes bankrupt and also you lose entry to your funds, tax therapy relies on your jurisdiction’s guidelines. In some circumstances, you might be able to declare a capital loss if the belongings turn into nugatory. It’s vital to work with a tax skilled in conditions like this. Plus, keep information to help any claims associated to misplaced or inaccessible funds. These situations can take months, even years to determine, just like the ongoing FTX state of affairs.

How Do I Keep away from Crypto Taxes?

You can’t legally keep away from taxes fully, as a result of that’s generally known as tax evasion. Nevertheless, you may decrease them, and infrequently to a considerable diploma. Maintain belongings so long as doable, use losses to strategically offset beneficial properties, donate to charities for added deductions, and take into account tax-advantaged accounts. At all times adjust to native laws, keep detailed information, and seek the advice of a tax skilled for personalised steerage.