Fast Breakdown

Crypto sanctions just like the Twister Money case expose the strain between monetary privateness and regulation, elevating questions on whether or not governments can censor open-source code and the way a lot accountability builders maintain.Sanctions can affect decentralized networks from inside, as validators and platforms start censoring sure transactions to keep away from authorized threat, threatening blockchain’s beliefs of openness and censorship resistance.The way forward for privateness and compliance will depend upon new cryptographic options, clearer authorized frameworks, and group engagement, as regulation more and more shapes how customers, builders, and platforms work together in Web3.

Blockchain was invented to be open and clear, with each transaction recorded on public ledgers, seen to anybody with an web connection. This transparency helps hint the circulation of cash, but it surely additionally creates robust questions when governments begin implementing crypto sanctions.

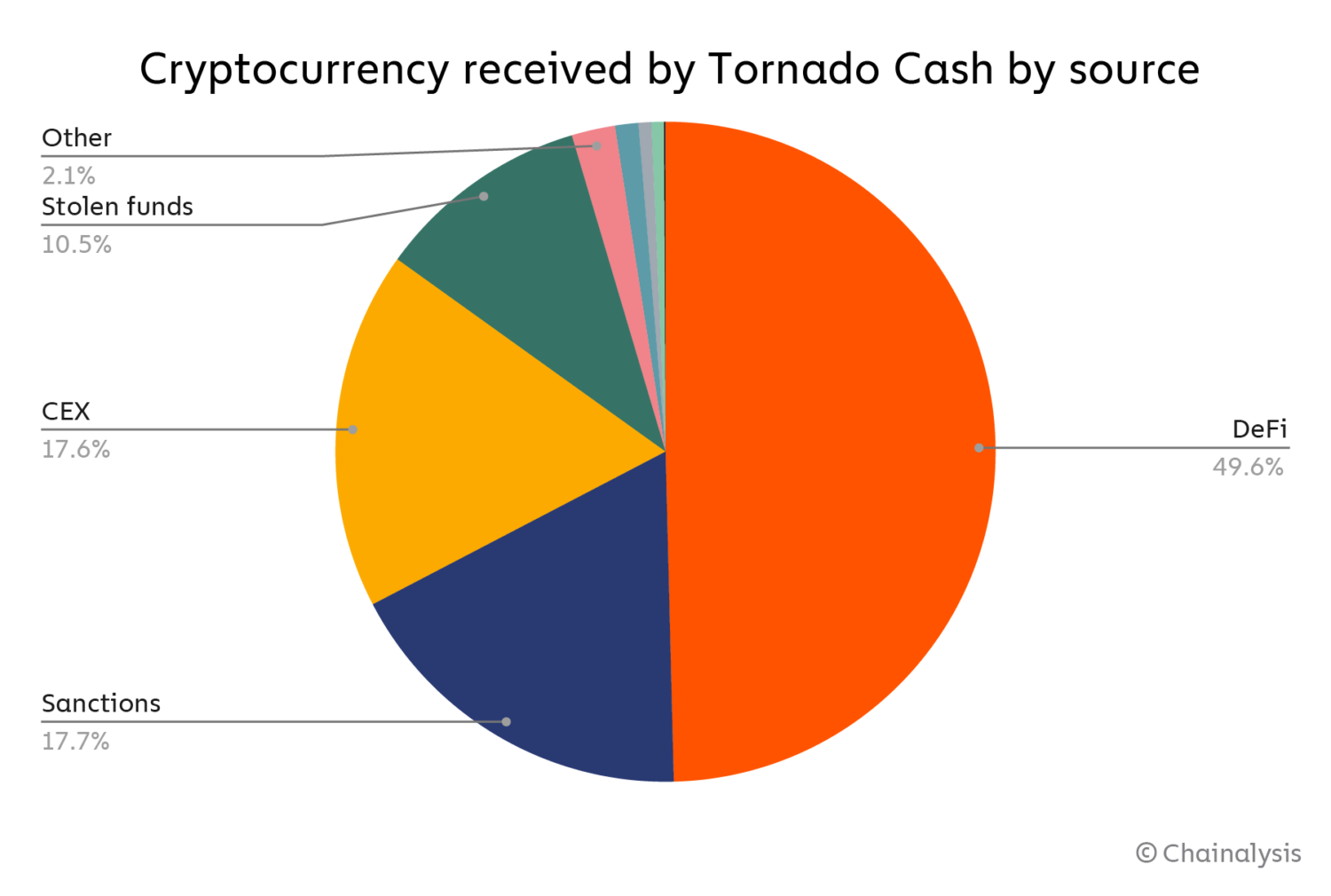

When the U.S. Treasury’s Workplace of Overseas Property Management (OFAC) sanctioned Twister Money, it made nationwide headlines as a result of Twister Money, as a instrument, mixes funds to enhance monetary privateness. Nonetheless, regulators have mentioned it additionally permits criminals to cover the place the cash got here from. OFAC claimed the mixer had helped launder greater than $7 billion and blocked its addresses below Government Order 13694. This sparked a significant debate, with some lawmakers seeing it as a victory within the struggle towards crime and lots of within the blockchain group fearing it as a step towards blockchain censorship, through which public transaction information are restricted, and regulators successfully ban complete companies.

😔💔 I’m Roman Storm. I poured my soul into Twister Money—software program that’s non-custodial, trustless, permissionless, immutable, unstoppable. In 31 days, I face trial. The DOJ desires to bury DeFi, saying I ought to’ve managed it, added KYC, by no means constructed it. SDNY is making an attempt to crush…

— Roman Storm 🇺🇸 🌪️ (@rstormsf) June 13, 2025

The Twister Money saga didn’t finish there, and its creators at the moment are on trial with Roman Storm, one of many founders, dealing with expenses together with compliance violations, cash laundering conspiracy, and working an unlicensed money-transmitting enterprise. His defence argues he merely wrote open-source code and had no management over how folks used it, a bit like a programmer who created a automobile however doesn’t drive it.

This case raises large questions: if somebody can get in authorized bother only for writing code, might different blockchain builders be subsequent? And if OFAC can ban a decentralized instrument by identify, is blockchain nonetheless actually open?

Blockchains are supposed to be impartial as they don’t care who’s sending or receiving cash, however when governments impose crypto sanctions, they drive platforms and customers to censor transactions with particular addresses or companies.

With Twister Money, OFAC demanded that U.S. firms block any interplay with its good contracts with validators, nodes, and wallets having to reject these transactions or threat punishment, an obvious affront to cryptoprivacy. This implies community operators should select between following blockchain’s open guidelines or obeying authorities orders, making a battle for builders and customers. Do you construct for whole openness, or comply with the legislation? As privateness advocates put it, monetary privateness is a proper, but governments say it helps criminals. For this reason Twister Money’s court docket battle has change into a critical speaking level in conversations round blockchain ethics and censorship.

Twister Money: Privateness Software or Illicit Mixer?

Twister Money launched in 2019 as a option to restore transaction privateness on Ethereum, the place it randomizes public ledger entries in order that cash can’t be traced again to their house owners. However as governments investigated, they argued that it had “acted as an enormous washer” for illegally obtained crypto, together with funds from the North Korean Lazarus Group and numerous scams.

This was then adopted by the authorized hammer, the place Twister Money was sanctioned in August 2022, that means People had been barred from utilizing or supporting it and in March 2025, a court docket dominated that OFAC overstepped its authority by sanctioning pure code, that’s, the good contracts themselves. The sanctions had been lifted, however the struggle was removed from over. Now, a felony trial is exploring whether or not a developer might be held legally answerable for how another person used their code.

Censorship Creep in a Permissionless World

One in every of blockchain’s greatest strengths is its censorship resistance, permitting anybody to construct or use decentralized programs freely. However forcing instruments like Twister Money offline challenges the very core of this concept.

The New York Fed discovered that after Twister Money was sanctioned, many Ethereum validators turned hesitant to incorporate its transactions, although the community itself operates brazenly. A research printed by employees on the Federal Reserve Financial institution of New York documented intimately a rising unwillingness by contributors in Ethereum’s settlement chain to course of transactions made by way of the Twister Money privateness software. This demonstrates how crypto sanctions can affect decentralized networks from the within, even with out direct authorized management.

If contributors begin censoring transactions to keep away from regulatory threat, the blockchain stops feeling actually open, and that may be a slippery slope for anybody who values blockchain’s core qualities.

Balancing Privateness and Compliance

Privateness is vital, and identical to a locked checking account protects your monetary data, privateness on blockchains might help defend customers, particularly in oppressive locations or for whistleblowers. Nonetheless, the obvious draw back is that privateness may also protect criminals.

Specialists are wanting into cryptography options like zero-knowledge proofs, as a few of these instruments purpose to maintain transaction particulars personal whereas nonetheless permitting authorities to test who’s sending or receiving massive quantities, balancing monetary privateness with compliance wants. Such applied sciences might let regulators confirm suspicious behaviour with out undermining privateness normally, a typical center floor that could be essential for blockchain’s future privateness.

The place Regulation May Be Headed

Crypto sanctions are increasing, and regulators are vigorously looking for out tips on how to apply guidelines designed for banks and cash companies to decentralized programs, however this raises robust questions like :

Can governments legally ban or censor open-source code?Who will get held accountable: the creator, platform, or person?How a lot compliance ought to crypto firms construct into their programs?Can blockchain nonetheless be absolutely open with these guidelines?

Some imagine we’ll see extra guidelines, particularly round public ledgers and blockchain analytics. Others hope for revolutionary authorized frameworks that respect each decentralization and public security.

Why This Issues to You

You would possibly suppose this debate doesn’t have an effect on you. Nonetheless, it in all probability does, and in case you care about utilizing crypto freely, whether or not for investing, supporting open-source initiatives, or defending your privateness, you could be affected by guidelines that restrict what you possibly can construct or entry.

If good contracts begin getting censored, or if sure crypto instruments change into unlawful, the open nature of Web3 might shrink, and that would change the whole lot from how DAOs function to how common folks work together with cash programs. Think about not having the ability to use a DeFi lending platform simply because it wasn’t permitted in your nation, or getting blocked from a crypto pockets as a result of it was linked to a instrument like Twister Money.

Even builders might discover themselves in bother for writing code that’s seen as too personal or too free as a result of the road between innovation and regulation is getting thinner. Which means the way forward for monetary privateness may not be as much as tech alone; it should additionally depend upon authorized programs, politics, and the crypto group’s response.

On the flip facet, stronger privateness protections might open new doorways to freedom and use instances. Nonetheless, in addition they threat misuse by criminals hiding behind them, thereby making governments extra desirous to clamp down. It’s fairly a tough steadiness: construct instruments that defend good folks with out by chance serving to dangerous actors, and that’s the reason conversations round compliance and regulation are so advanced.

The way forward for public ledgers, monetary privateness, and blockchain censorship will most certainly be formed by on a regular basis customers as a lot as by lawmakers, and it’s a path we should all stroll collectively. And so the extra we perceive what’s at stake, the higher probability we have now of shaping a good, open, and safe Web3 future.

In Conclusion,

The Twister Money state of affairs reveals that whereas public ledgers create transparency by giving each transaction visibility, they don’t resolve the deeper rigidity between monetary privateness and regulation. Crypto sanctions would possibly defend safety, however they’ll additionally trigger blockchain censorship and threaten decentralized beliefs.

The longer term could lie in intelligent know-how, higher legal guidelines, and good design, but it surely’s additionally a reminder that regulation doesn’t all the time cease on the code; it usually reaches behind it, connecting digital freedoms to real-world management.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein needs to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of monetary loss. All the time conduct due diligence.

If you wish to learn extra market analyses like this one, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”