It’s straightforward to roll your eyes at crypto today. From rip-off headlines to cost volatility that makes curler coasters jealous, the business hasn’t precisely coated itself in glory. However peel again the noise, and a a lot deeper fact emerges: crypto isn’t excellent, but it surely would possibly simply be our greatest shot at constructing a fairer, sooner, and extra inclusive monetary system.

On this article, we’ll discover how crypto compares to conventional finance, the way it’s reaching the unbanked, the place DeFi is disrupting the established order, and what the house wants to enhance to fulfil its promise really.

Conventional Finance vs. Crypto: Who’s Extra Inefficient?

Let’s be sincere — conventional finance is much from environment friendly. Whereas it’s typically upheld because the gold customary of stability, it’s riddled with frictions that disproportionately have an effect on the individuals who want it most. Cross-border funds are a main instance. Transferring cash from one nation to a different via banks or legacy methods can take wherever from three to 5 enterprise days. That may be acceptable if we had been nonetheless mailing checks, however in a digital age, this delay is indefensible. After which there’s the price: the worldwide common price for sending remittances stood at 6.18% in This fall 2023, in accordance to the World Financial institution. That’s greater than double the G20’s goal of three.

Now distinction that with crypto-powered transfers. Stablecoins for remittances despatched over blockchains can land within the recipient’s pockets inside seconds or minutes, not days. And as a substitute of coughing up 6–7% in charges, customers pay mere cents — and even much less. In keeping with Chainalysis, sending a $200 remittance from Sub-Saharan Africa utilizing stablecoins for remittances might be round 60% cheaper than utilizing conventional fiat-based remittance providers.

If we’re measuring progress by time saved and cash stored in individuals’s pockets, crypto isn’t simply catching up — it’s quietly successful.

Monetary Entry, Not Simply Innovation: Why Crypto Issues The place It Hurts Most

Roughly 1.4 billion adults round the world nonetheless lack entry to a checking account, based on the World Financial institution’s 2021 information. For these people, boundaries akin to missing formal identification, proof of tackle, or perhaps a close by financial institution department are greater than inconveniences; they’re dealbreakers that exclude them from collaborating within the formal monetary system. Conventional finance, with its centralized structure and inflexible gatekeeping, has confirmed each insufficient and inaccessible for the very populations that want it most.

Crypto monetary inclusion is not only a buzzword — it’s a real-world resolution to this international downside. With only a smartphone and web connection, individuals can now ship and obtain cash, retailer financial savings, borrow capital, or make investments — all with out ready for somebody’s approval or submitting paperwork that will not even exist.

Learn Additionally: Monetary Inclusion: Has Crypto Opened the Doorways?

On the heart of this transformation is DeFi. Not like conventional monetary infrastructure, DeFi depends on good contracts, that are strains of self-executing code that mechanically perform transactions. No banks are appearing as middlemen, no brokers are taking a reduce, and no clerks are deciding who will get entry.

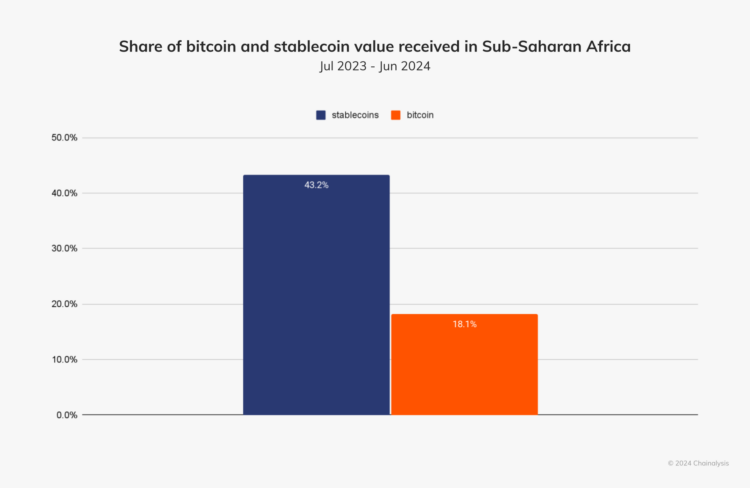

By way of DeFi platforms like Aave and Compound, customers can lend their cryptocurrency belongings and earn curiosity, or borrow funds immediately, with out filling out kinds or present process credit score checks. These platforms supply pace, borderless entry, and neutrality — attributes that conventional monetary methods battle to ship. Equally, decentralized exchanges akin to Uniswap and SushiSwap enable individuals to commerce immediately with one another utilizing liquidity swimming pools and automatic algorithms, eliminating the necessity for custodians or trusted third events. And for these residing in international locations with unstable currencies or experiencing hyperinflation, crypto as an inflation hedge turns into greater than idea — it turns into a matter of survival. In areas akin to Sub-Saharan Africa, the place U.S. {dollars} are briefly provide and inflation is a each day concern, stablecoins now account for practically 43% of the area’s cryptocurrency transaction quantity, serving as a lifeline for cross-border commerce, remittances, and financial savings.

The influence of those instruments isn’t hypothetical. Crypto Adoption in Nigeria has surged not out of speculative mania, however out of financial necessity. Between July 2023 and June 2024, the nation acquired an estimated $59 billion in crypto worth, underscoring how DeFi and stablecoins are serving to people sidestep overseas trade crises and rising inflation.

Associated: From Bans to Licenses: Nigeria’s Crypto Journey in 2024

In El Salvador, the federal government’s adoption of Bitcoin has sparked a world debate. Nonetheless, the info are clear: over 4 million individuals have signed up for its Chivo pockets, greater than the full variety of Salvadorans with conventional financial institution accounts. No matter one’s view on the implementation, the demand for digital monetary options is unmistakable.

Learn Additionally: Classes Realized from El Salvador’s Bitcoin Experiment

This wave of adoption isn’t remoted. Crypto adoption in creating international locations is surging throughout lower-middle-income nations, the place utilization has outpaced that of wealthier economies. In 2023, these areas led the world in adoption, and 2024, the pattern is extending even additional, chopping throughout socioeconomic courses. The reason being easy: crypto doesn’t require monetary historical past, pristine credit score scores, or banking relationships. It simply affords entry.

The Tech and Moral Gaps: Let’s Be Sincere

Let’s not romanticize crypto; it has some extreme rising pains, and pretending in any other case doesn’t assist anybody. For all its guarantees of decentralization and monetary liberation, the fact is that crypto nonetheless struggles with the fundamentals: scale, safety, and belief.

Take scalability, for instance. Ethereum — the spine of DeFi — has confronted main congestion points, particularly throughout bull markets. Certainly, we’ve seen enhancements due to Layer 2 options like Optimism and Arbitrum, which assist alleviate the load on Ethereum’s main community. However let’s be actual, adoption continues to be patchy, and lots of customers don’t absolutely perceive find out how to bridge belongings or navigate these new layers.

Then there are the so-called “Ethereum killers” — Solana, Avalanche, Polkadot — which boast sooner speeds and cheaper charges. And sure, they’re spectacular. However these good points typically include trade-offs in decentralization or community reliability. Solana, for example, has confronted a number of outages that increase critical questions on its long-term dependability.

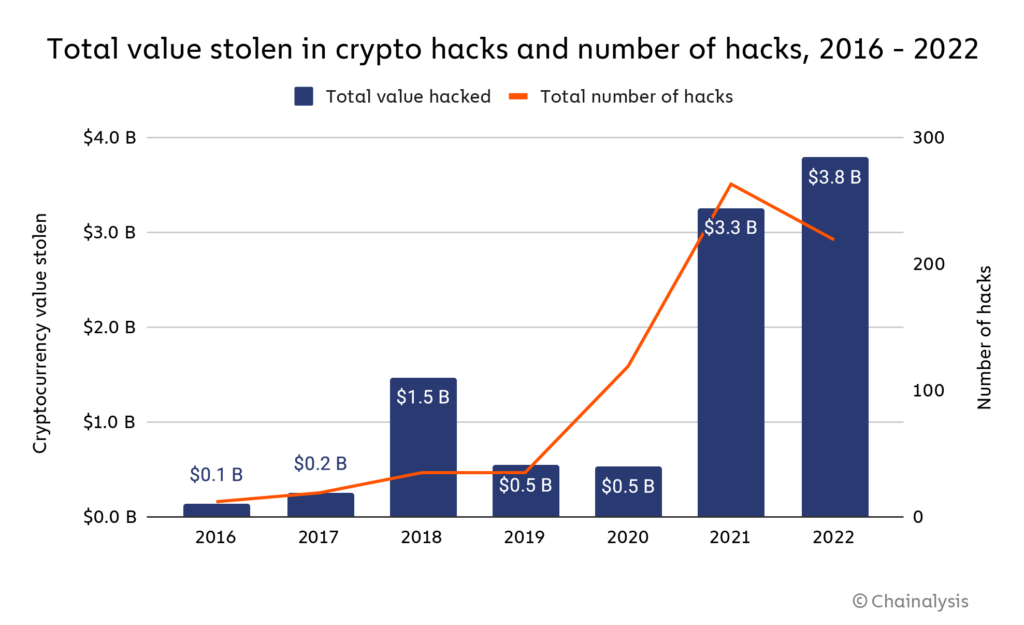

Safety stays an pressing and rising concern, as DeFi platforms have change into prime targets for malicious actors. 2022 marked the worst 12 months on report for crypto hacks, with a staggering $3.8 billion stolen from cryptocurrency companies.

The elemental vulnerability lies in good contracts: highly effective but fragile, they’re solely as safe as their underlying code. One unnoticed flaw or loophole can result in the irreversible lack of funds. Not like conventional finance, there isn’t any recourse, no security web, and no institutional backstop to soak up the fallout.

Moral and environmental points additional complicate the narrative. Bitcoin, with its energy-intensive proof-of-work consensus, continues to eat as a lot electrical energy yearly as total international locations, akin to Sweden, sparking international debates round sustainability.

In the end, acknowledging these gaps just isn’t an act of defeat however a step towards legitimacy. Crypto’s future relies upon not simply on its technological brilliance but additionally on its willingness to confront onerous truths and construct methods that aren’t solely open but additionally reliable, safe, and honest.

What Crypto Must Do Higher (And How It Can Get There)

Regardless of its disruptive potential, the crypto business nonetheless has important work to do if it hopes to transition from a distinct segment innovation to mainstream infrastructure. One of the crucial obtrusive challenges is usability. The common individual shouldn’t must decode technical jargon simply to ship digital belongings or safe a pockets. To bridge that hole, the business should prioritize consumer expertise—simplifying interfaces, offering real-time buyer help, and investing in accessible instructional content material. Cell-first platforms, akin to Valora, constructed on the Celo blockchain, are already demonstrating how intuitive design can carry Web3 into the arms of on a regular basis customers. Nonetheless, there’s nonetheless an extended highway forward.

Regulation is one other space the place crypto should shift its strategy. Relatively than resisting oversight, the business ought to embrace the chance to assist form regulatory frameworks that defend shoppers with out stifling innovation. Nations like Switzerland and Singapore have already laid out clear, forward-thinking insurance policies that function fashions for the way regulation and blockchain innovation can coexist. A collaborative mindset, one which views policymakers as companions relatively than adversaries, will probably be essential in fostering belief and selling long-term stability available in the market.

Interoperability can also be important to crypto’s subsequent chapter. Proper now, the ecosystem is fragmented into remoted chains, every with its personal guidelines, requirements, and communities. True scalability and consumer adoption would require seamless motion of belongings and knowledge throughout platforms. Protocols like Cosmos, Polkadot, and LayerZero are pioneering options to allow safe cross-chain communication, laying the groundwork for a extra related and coherent Web3 expertise.

However most significantly, crypto must rediscover its moral core. The house can not revolve solely round hypothesis and fast income. It should champion values akin to inclusivity, environmental accountability, and human-centered growth. Encouragingly, a number of tasks are already main the best way—Gitcoin is fostering open-source funding, ImpactMarket is addressing monetary inclusion, and Toucan Protocol is constructing on-chain infrastructure for carbon offsetting. These efforts show that crypto can serve extra than simply markets; it might probably additionally serve individuals.

If the business can align its expertise with a renewed sense of function, crypto received’t simply survive, it’ll thrive as a pressure for significant, international transformation.

Closing Thought: Crypto Isn’t the Reply — However It May Be the Query

Nobody’s saying crypto is ideal. It’s messy. Generally reckless. Typically complicated. Nonetheless, it’s a reside experiment with international potential, and one of many few tech actions actively attempting to handle what finance has ignored for many years.

If we wish a system that’s sooner, fairer, and open to all, crypto is our greatest shot. The true query isn’t “will it succeed?” however “how will we make it value succeeding?”

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein needs to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of economic loss. At all times conduct due diligence.

If you wish to learn extra market analyses like this one, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”