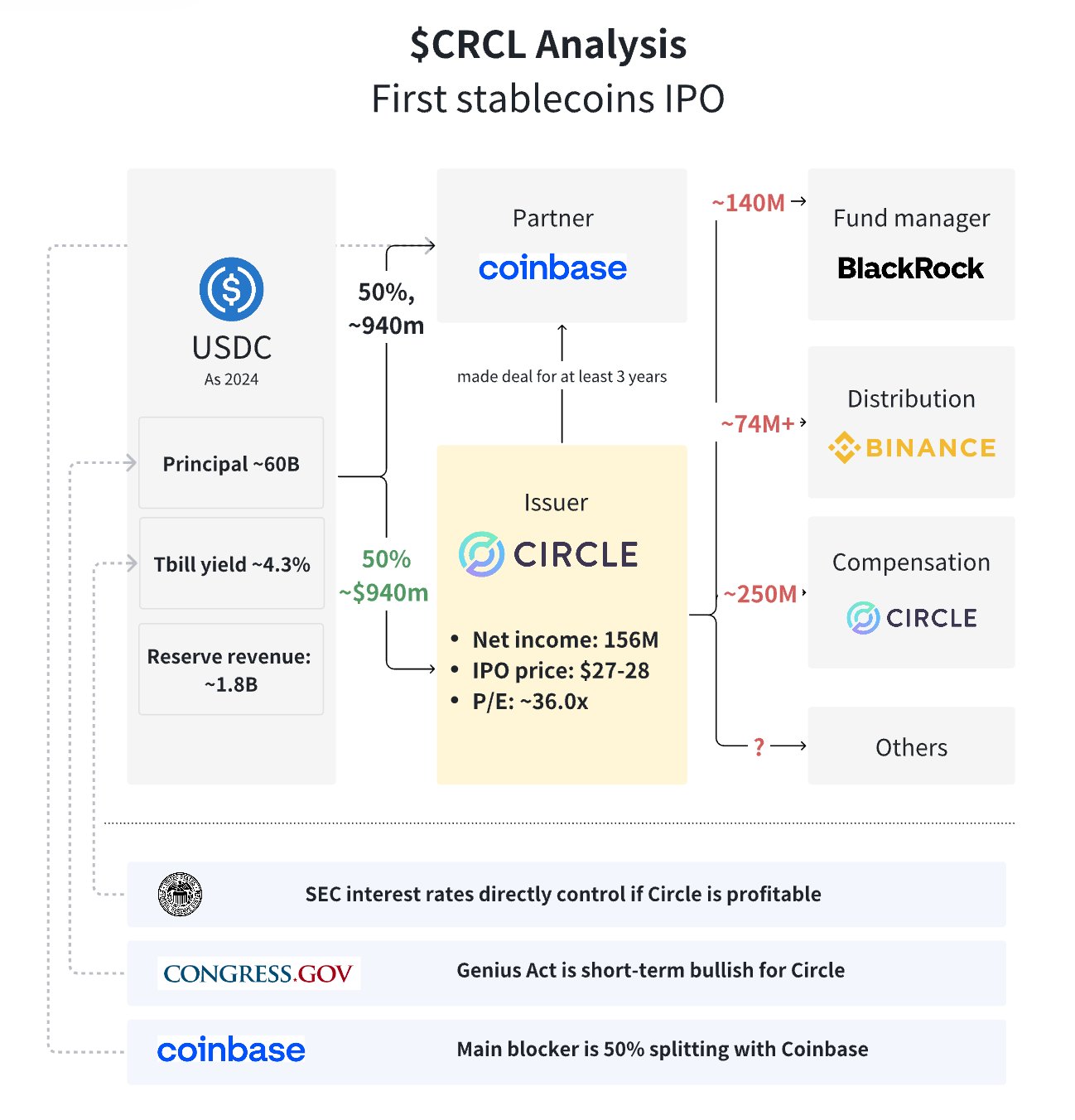

The extremely anticipated second has arrived for Circle. The fintech powerhouse behind the ever-present USDC stablecoin has formally priced its Preliminary Public Providing (IPO) at $31 per share on the NYSE, marking a pivotal step for a significant crypto-native firm coming into conventional public markets. Whereas Circle initially aimed to boost $624 million by way of a 24 million share providing at a goal valuation of $6.7 billion, the ultimate $31 value displays the extraordinary investor demand that reshaped its public debut. That is arguably the highest-profile crypto-related IPO since Coinbase ($COIN) in 2021.

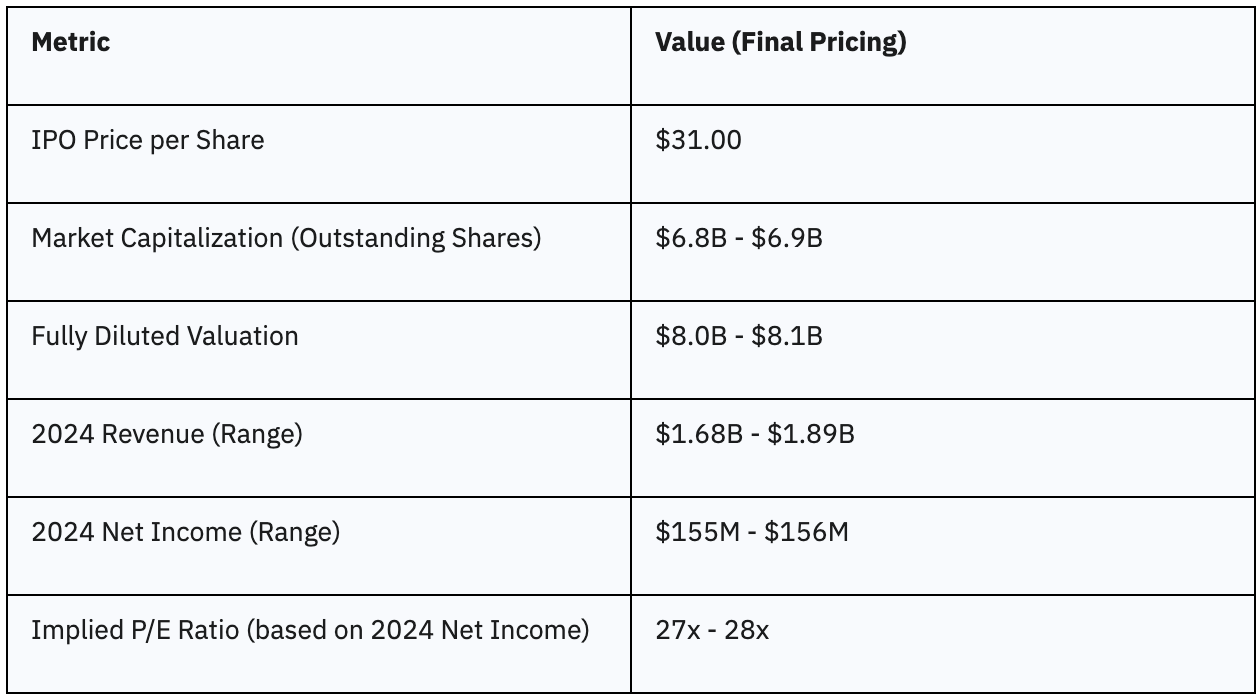

Circle (CRCL) IPO Key Statistics (as of June 5, 2025):

Last Circle IPO Itemizing Value: $31.00 per sharePreliminary Market Valuation (at IPO Value): Roughly $6.9 billionTotally Diluted Valuation (at IPO Value): Roughly $8.1 billionWhole Shares Supplied in IPO: 34 million shares of Class A typical inventoryShares provided by Circle: 14.8 millionShares provided by promoting stockholders: 19.2 millionIPO Oversubscription Price: Reportedly over 25x oversubscribedNotable Institutional Curiosity: ARK Make investments and BlackRock reportedly taken with buying roughly 10% of the shares provided.

Underlying Enterprise Metrics (as per latest evaluation, primarily 2024 knowledge):

USDC Circulation (Principal Reserves): Roughly $60 billionYield on Treasury Invoice Reserves: Round 4.3%Estimated Reserve Income: Roughly $1.8 billionInternet Earnings (as per evaluation linked to preliminary IPO vary): ~$156 millionValue-to-Earnings (P/E) Ratio (primarily based on preliminary $27-$28 IPO vary evaluation): ~36.0x

Supply: rui

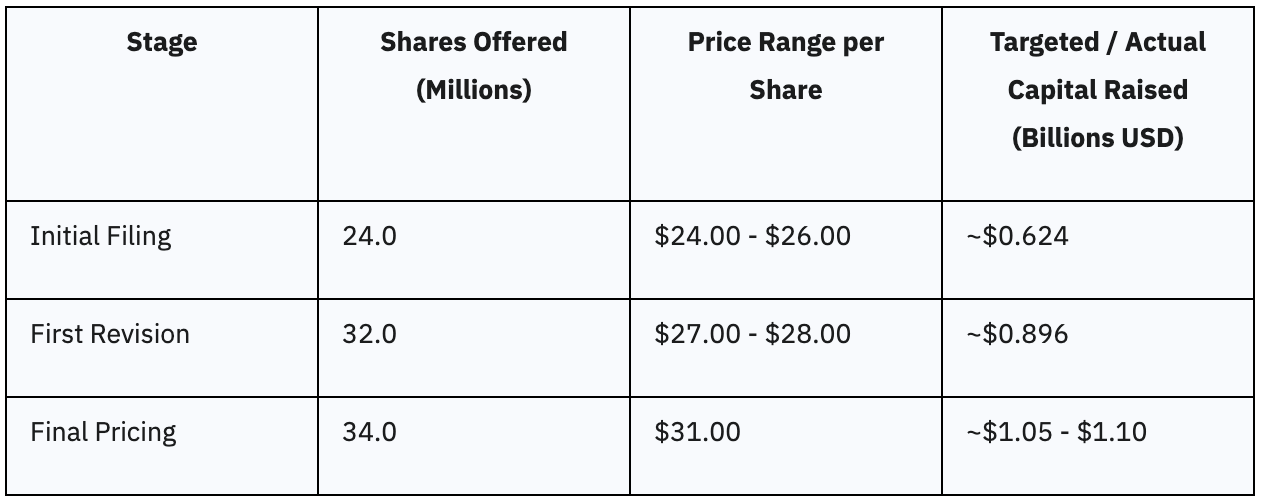

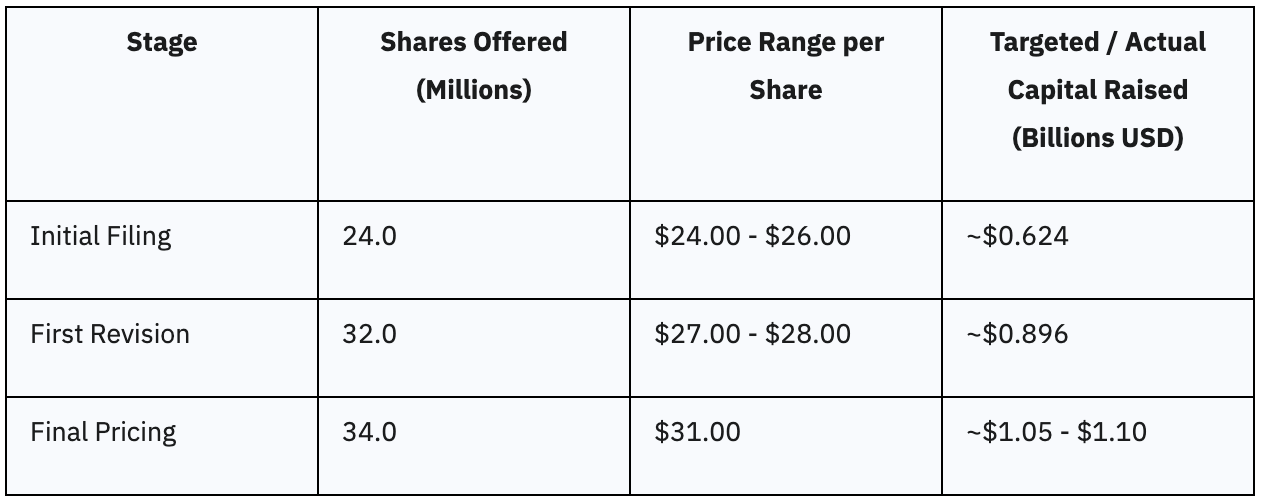

Circle’s IPO Journey: From Preliminary Expectations to Upsized Actuality

Circle Web Group’s path to its public debut was characterised by a collection of upward revisions, demonstrating sturdy market validation at every stage. The corporate’s technique gave the impression to be one among measured re-entry into the general public market, notably given its prior unsuccessful try and go public by way of a SPAC merger in 2021. This cautious method allowed Circle and its underwriters to precisely gauge investor urge for food, enabling the value to be pushed upward by real market demand reasonably than an aggressive preliminary valuation.

Preliminary Circle IPO Value Vary and Shares Supplied

Circle initially launched its IPO with a plan to supply 24 million shares of its Class A typical inventory, setting an anticipated value vary of $24.00 to $26.00 per share. This preliminary providing was projected to boost roughly $624 million. On the midpoint of this vary, $25.00 per share, the corporate’s market capitalization was estimated at almost $6 billion, with a totally diluted valuation doubtlessly reaching about $6.7 billion when accounting for inventory choices and restricted share items. Even at this preliminary, extra conservative valuation, the substantial multi-billion greenback determine underscored Circle’s established place and perceived worth throughout the burgeoning digital asset ecosystem.

Revised Value Vary and Upsized Providing

Following an exceptionally sturdy reception, Circle swiftly revised its providing phrases. The corporate elevated the variety of shares to 32 million and adjusted the value vary upward to $24.00 to $26.00 per share. This revised plan aimed to boost as much as $896 million.

Stories indicated that investor orders for shares exceeded the accessible amount by over 25 instances, demonstrating an exceptionally excessive stage of curiosity and confidence within the providing. This speedy upward revision, explicitly linked to such vital oversubscription, served as a strong market validation of Circle’s enterprise mannequin and future prospects.

This overwhelming demand offered the corporate and its underwriters with the leverage to push for a considerably increased valuation, indicating a powerful pull from the investor group reasonably than a mere push from the issuer. This dynamic urged {that a} broad base of traders, past just some anchor establishments, had been desperate to take part.

Last Pricing and Whole Capital Raised

On June 4, 2025, Circle introduced the definitive pricing of its upsized IPO at $31.00 per share. This last providing consisted of 34 million shares of Class A typical inventory, permitting Circle to efficiently elevate between $1.05 billion and $1.1 billion. Of those shares, Circle itself provided 14.8 million, whereas promoting stockholders provided 19.2 million.

Moreover, Circle granted underwriters a 30-day choice to buy as much as a further 5.1 million shares to cowl over-allotments. The final word pricing at $31, surpassing even the revised vary, signified a extremely profitable IPO execution. This end result mirrored sturdy market acceptance for Circle’s enterprise mannequin and its strategic positioning throughout the evolving digital finance panorama.

The power to extend the providing measurement a number of instances and nonetheless value above expectations indicated deep investor confidence and profitable book-building by the lead underwriters, together with J.P. Morgan, Citigroup, and Goldman Sachs.

The next desk summarizes the evolution of Circle’s IPO pricing and providing:

Desk 1: Circle IPO Pricing & Providing Evolution

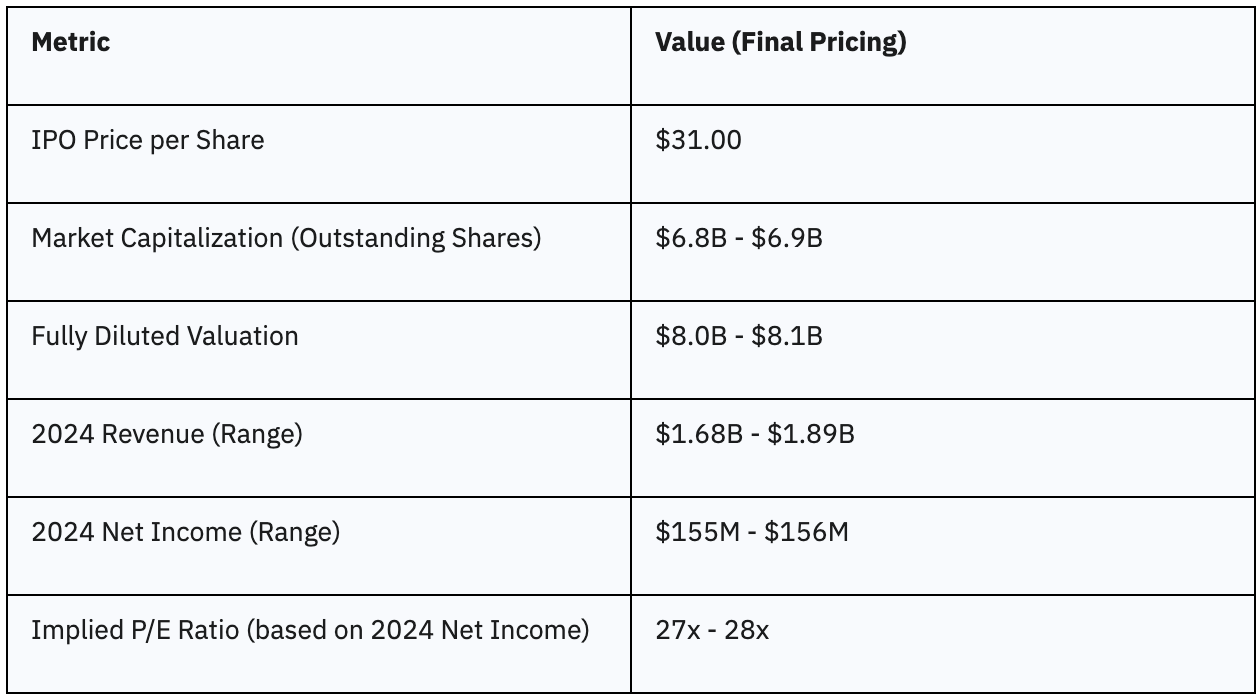

Circle IPO Valuation Evaluation: Understanding the $31 Value Level

The ultimate pricing of Circle’s IPO at $31.00 per share offers a transparent benchmark for its market valuation, providing insights into how the market perceives its present standing and future potential.

Market Capitalization and Totally Diluted Valuation at $31

On the last IPO value of $31.00 per share, Circle’s market capitalization, primarily based on its excellent shares (reported as over 220 million or 222 million), is estimated to be roughly $6.8 billion to $6.9 billion.

Nevertheless, on a totally diluted foundation, which incorporates worker inventory choices, restricted share items, and warrants, the corporate’s valuation is considerably increased, estimated at roughly $8.0 billion to $8.1 billion.

For traders, understanding each the market capitalization (primarily based on presently excellent shares) and the totally diluted valuation is essential. The upper totally diluted determine offers a extra complete view of the corporate’s potential future share depend and the potential affect of dilution on per-share metrics, providing a extra sensible evaluation of the full worth traders are paying for.

Evaluation of Circle’s Financials (Income, Internet Earnings, Profitability)

Circle reported revenues starting from $1.68 billion to $1.89 billion in 2024. Its web earnings for 2024 was reported between $155 million and $156 million. For comparability, in 2023, the corporate generated $1.45 billion in income and a better web earnings of $268 million.

Circle additionally reported $779 million in working earnings in 2024 and $215.92 million in EBITDA during the last twelve months, indicating sturdy operational effectivity. In Q1 2025, Circle noticed a 55% leap in reserve earnings to just about $558 million, though this was offset by a 68% surge in distribution and transaction prices.

A crucial remark for traders is the lower in web earnings from 2023 to 2024, regardless of a rise in income. This means that whereas Circle is efficiently increasing its prime line, its price of operations, notably distribution and transaction prices as highlighted in Q1 2025, are rising at a sooner price, impacting total profitability and margin sustainability. This development warrants cautious monitoring by traders to evaluate whether or not the corporate can enhance its operational effectivity and profitability going ahead.

Implied Valuation Multiples and Trade Context

Based mostly on its 2024 web revenue, Circle’s IPO pricing implies a P/E ratio of roughly 27-28. Nevertheless, monetary analysts observe this valuation is “not notably low-cost.” This holds true for a younger, unsure market. Particularly, if rates of interest keep excessive or investor enthusiasm for crypto wanes post-IPO.

Thus, a P/E a number of of 27-28 suggests the market assigns a major premium. This displays Circle’s future progress prospects. This consists of its potential to achieve extra of the regulated stablecoin market. It additionally anticipates increasing its monetary companies.

Primarily, traders are betting closely on the corporate. They count on it to execute its progress technique. Additionally they anticipate improved profitability. Subsequently, any deviation from these excessive expectations might strain the inventory downwards. Certainly, the inventory is priced for perfection.

The next desk presents a concise comparability of Circle’s key monetary and valuation metrics at its IPO pricing.

Desk 2: Circle Valuation Metrics (Preliminary vs. Last)

Implications for CRCL Buyers: Alternatives and Dangers

For traders contemplating CRCL, the IPO’s success and the corporate’s strategic positioning current a novel mix of alternatives and dangers that warrant cautious consideration.

Alternatives for CRCL Buyers:

Enhanced Credibility and Institutional Adoption: Itemizing on the NYSE boosts Circle’s credibility. This comes from strict regulatory compliance and transparency. Such “legitimacy” attracts risk-averse establishments. This consists of conventional banks and governments. It positions Circle as a “monetary utility layer of the web.” This elevated belief can increase USDC’s market attain.

Potential for Market Share Beneficial properties: Circle strongly emphasizes regulatory compliance. Additionally they give attention to clear reserve administration for USDC. This instantly challenges Tether’s opaque strategies. This distinction attracts institutional shoppers. It might develop USDC’s market share from 27% to 40% as regulatory readability emerges.

Entry to Deeper Capital Markets: The IPO raised over $1 billion. This offers substantial capital for brand spanking new product growth. It additionally funds international enlargement and enhanced compliance infrastructure. Strategic acquisitions are doable too. This capital infusion accelerates Circle’s progress ambitions. It additionally strengthens their aggressive benefit.

Dangers for CRCL Buyers:

Excessive Valuation Issues and Profitability Outlook: Circle’s valuation seems stretched to some analysts. Its totally diluted valuation reached $8.1 billion. The P/E ratio is 27-28. Internet earnings dropped from $268 million in 2023 to $155-$156 million in 2024. This occurred regardless of income progress. It raises questions on profitability margins and value administration.

Enterprise Mannequin Focus on USDC: Circle’s income nearly totally depends on USDC. This focus creates vital threat. If USDC loses market share, is delisted, or faces belief points, the corporate is susceptible. Diversification choices are restricted.

Persistent Regulatory Uncertainty: Regardless of optimistic legislative indicators, U.S. stablecoin laws are nonetheless evolving. Unexpected strict guidelines might closely affect Circle’s operations. This consists of reclassifying stablecoins.

Volatility of the Broader Cryptocurrency Market: Circle’s enterprise hyperlinks to total crypto market well being. That is true even for a stablecoin issuer. Downturns in risky cryptocurrencies can have an effect on stablecoin demand. Consequently, Circle’s transaction volumes and income could endure.

Circle IPO Lock-up Interval:

Whereas the particular lock-up interval for Circle’s IPO was not explicitly detailed in publicly accessible supplies, IPOs sometimes have a 90-180 day lock-up. A notable level is that 19.2 million of the 34 million shares provided had been from current “promoting stockholders,” that means a considerable portion of insider shares had been already liquidated. Buyers ought to search additional readability on any remaining lock-up restrictions to grasp future provide dynamics.