A UAE-backed funding car reportedly purchased a 49% stake within the Trump-linked crypto startup World Liberty Monetary for $500M simply earlier than Trump returned to the White Home in January 2025.

A 12 months on from this funding, we check out what impact it has had on World Liberty Monetary and the broader Trump-linked crypto ecosystem.

Senior UAE royal secretly bought 49% stake in Trump’s World Liberty Monetary for $500m pic.twitter.com/xi8ByzJcyf

— db (@tier10k) February 1, 2026

It additionally comes at a time when world funds are pushing deeper into DeFi and the broader crypto area, betting that continued friendlier US coverage will unlock extra progress.

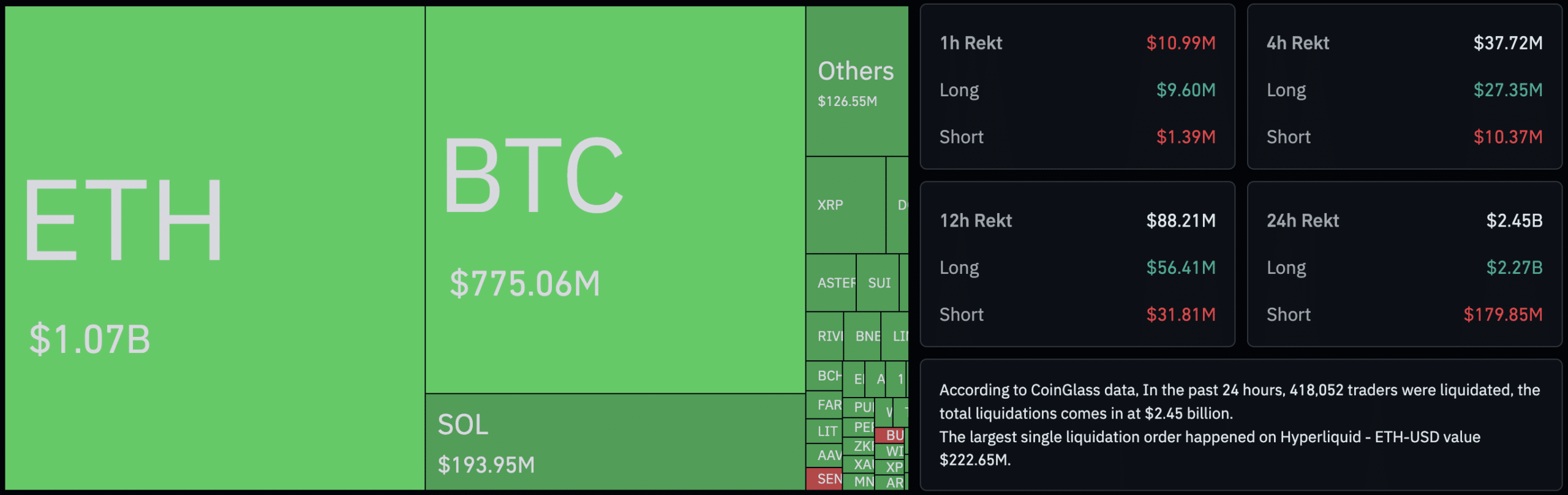

The crypto market has taken a battering over this weekend, with over $300Bn wiped off the entire market cap because the Bitcoin

value crashed under $80,000 and is at present buying and selling at $78,250.

(SOURCE: CoinGlass)

What’s the Significance of Abu Dhabi’s $500M Funding into Trump-Backed World Liberty Monetary?

The Wall Road Journal experiences that Aryam Funding 1, an Abu Dhabi car backed by Sheikh Tahnoon bin Zayed Al Nahyan, agreed to purchase a 49% stake within the firm simply days earlier than Donald started his second time period as US President.

Half the cash arrived upfront. About $187M flowed to Trump family-controlled entities, with extra paid to teams tied to the venture’s founders. Donald’s son, Eric Trump, reportedly signed the settlement.

The cope with World Liberty Monetary, which hasn’t beforehand been reported, was signed by Eric Trump, the president’s son. A minimum of $31M was additionally slated to move to entities affiliated with Steve Witkoff’s household, a World Liberty co-founder who, weeks earlier, had been named US envoy to the Center East, the WSJ mentioned.

Sheikh Tahnoon’s involvement is important because the Abu Dhabi royal has reportedly been pushing the US for entry to tightly guarded synthetic intelligence chips. Tahnoon is the brother of the United Arab Emirates’ president, the federal government’s nationwide safety adviser, and the chief of the oil-rich nation’s largest wealth fund.

He oversees an empire valued at greater than $1.3 trillion, funded by his private fortune and state cash, spanning every part from fish farms to AI to surveillance, making him some of the highly effective single buyers on the planet.

The deal marked one thing unprecedented in American politics: a overseas authorities official taking a significant possession stake in an organization linked to the incoming US President.

So… a bribe?

Trump obtained $500 Million and U.A.E. obtained “tightly guarded” A.I. chips. How is that this not a bribe, precisely? https://t.co/eedXsUQ19Z pic.twitter.com/ZS9Pt9Ippn

— The Tennessee Holler (@TheTNHoller) February 1, 2026

DISCOVER: The 12+ Hottest Crypto Presales to Purchase Proper Now

Why Does Large UAE Cash Matter Right here?

This isn’t retail hypothesis. That is state-linked capital entering into crypto on a big scale. For on a regular basis buyers, that indicators confidence that crypto will sit nearer to the monetary mainstream underneath Trump.

It additionally matches an even bigger sample. The UAE has pushed laborious into digital property, from exchanges to stablecoins. Current strikes in the UAE’s crypto growth present the nation needs to affect the place finance and tech intersect.

Weeks earlier than the deal surfaced, one other Tahnoon-led agency used World Liberty’s USD1 stablecoin to settle a $2Bn funding into Binance. That connects Trump Crypto, the world’s main crypto alternate, with sovereign capital in a single deal.

Trump Crypto Initiatives are Presently within the Information for All of the Flawed Causes

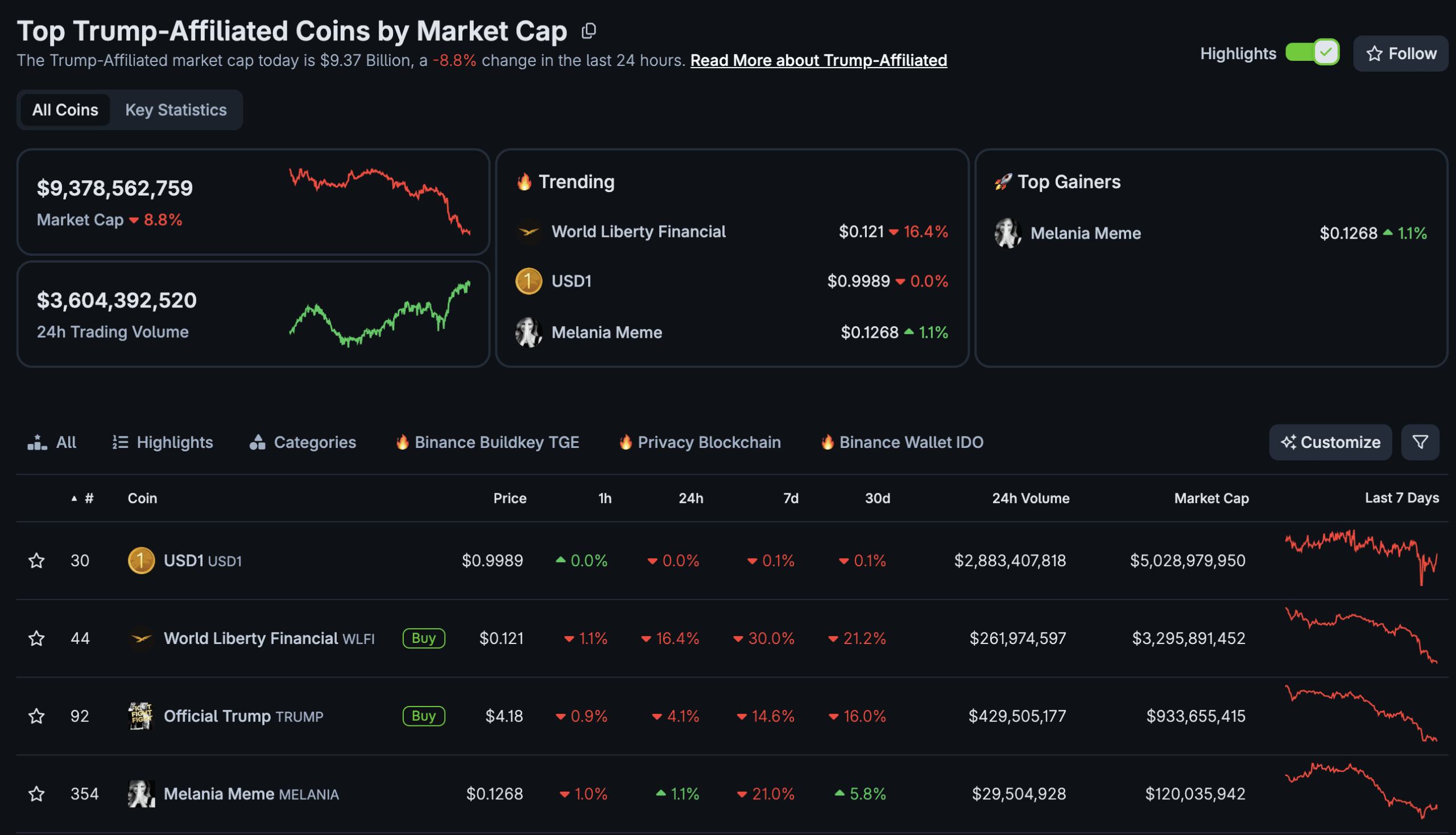

(SOURCE: CoinGecko)

This story, reported by the Wall Road Journal, comes throughout a interval of maximum volatility within the crypto market, particularly for initiatives related to the President.

The Official Trump memecoin is down over -94% from its all-time excessive and is at present buying and selling at simply $4.15, after briefly buying and selling above $40 in January 2025.

Then there may be the President’s spouse, Melania, and her official memecoin. MELANIA is down -99% from its January 2025 excessive of greater than $7 and is buying and selling as we speak for simply $0.12.

Lastly, the native token for Trump’s DeFi platform, World Liberty Monetary, is down -63% from its September 2025 excessive. WLFI is buying and selling for $0.125, down -17% on the day, and its market cap has fallen to $3.2Bn from $6.6Bn simply six months in the past.

EXPLORE:

Comply with 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Every day Professional Market Evaluation.

Why you possibly can belief 99Bitcoins

Established in 2013, 99Bitcoin’s crew members have been crypto consultants since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Professional contributors

2000+

Crypto Initiatives Reviewed

Comply with 99Bitcoins in your Google Information Feed

Get the newest updates, developments, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now