Be a part of Our Telegram channel to remain updated on breaking information protection

US President Donald Trump’s crypto-friendly picks Mike Selig and Travis Hill will lead two key monetary regulators after receiving Senate affirmation yesterday.

The Senate accredited Selig and Hill as a part of a broader package deal of nominees in a 53–43 vote, clearing the way in which for Selig to take over as Chair of the Commodity Futures Buying and selling Fee (CFTC) and for Hill to steer the Federal Deposit Insurance coverage Company (FDIC).

Selig To Take Over From Performing CFTC Chair Caroline Pham

As soon as sworn in, Selig will take over from the CFTC’s present Performing Chair Caroline Pham, who has performed a key position shaping US crypto coverage this yr and is about to hitch crypto funds agency MoonPay as soon as Selig is sworn in.

Selig has been engaged on digital asset coverage on the US Securities and Change Fee (SEC).

I’m wanting ahead to a profitable affirmation of Mike Selig because the @CFTC’s subsequent chairman and a easy transition as soon as he’s sworn in. The longer term is shiny. Onward and upward 🚀

— Caroline D. Pham (@CarolineDPham) December 17, 2025

Selig will turn into the CFTC’s sole commissioner after the company’s five-member fee shrinks to only one, eradicating friction for him to steer the regulator’s selections on coverage whereas elevating potential uncertainty over due course of.

Hill No Longer An Performing Chair At The FDIC

Hill, in the meantime, will take the FDIC’s helm after serving as performing chair. It regulates stablecoin issuers and performs a key position in figuring out how crypto firms entry the US banking system, making Hill’s affirmation intently watched by the trade.

He’s burdened that banks face “no prohibitions” on serving crypto corporations so long as security and soundness dangers are correctly managed, and at a Dec. 2 listening to on the Home Monetary Providers Committee advised lawmakers that the company “undid the coverage of the previous few years.”

That refers back to the anti-crypto coverage pursued by Joe Biden’s administration, which many within the digital asset trade say made it troublesome for crypto corporations to function. One key theme throughout Biden’s administration was the “debanking” of crypto firms, also known as Operation Chokepoint 2.0.

“Banks are anticipated to handle the security and soundness danger, however in any other case don’t have any prohibitions to serving these industries,” Hill stated through the listening to. He has additionally taken a number one position in addressing complaints about debanking.

Trump Says Chris Waller Is “Nice,” Will Announce Fed Chair Decide Inside Weeks

The Senate confirmations of Selig and Hill come after Trump put in new leaders on the Securities and Change Fee (SEC), Workplace of the Foreign money, and the US Treasury.

He’s additionally bent on changing Jerome Powell on the Federal Reserve with a frontrunner extra attuned to his want for decrease rates of interest. Trump interviewed Christopher Waller on Wednesday and stated, “I believe he’s nice. I imply, he’s been a person who’s been there a very long time.”

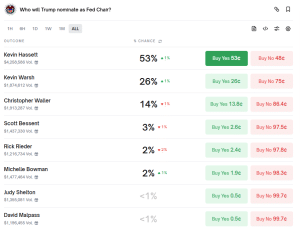

Contract asking who Trump will choose as subsequent Fed Chair (Supply: Polymarket)

Waller presently has the third-highest odds on the decentralized prediction markets platform Polymarket, with merchants seeing a 14% probability that he can be picked. Crypto-friendly White Home financial adviser Kevin Hassett leads with 53% odds, whereas former Fed Governor Kevin Warsh is available in at second with 26% odds.

Trump stated the listing of attainable candidates has been narrowed down to 3 or 4 individuals, including that “each certainly one of them can be a good selection.”

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection