When President Donald Trump acquires Greenland following this latest wave of Trump tariffs, each market goes to pump like loopy, and metals are going to appropriate considerably. Put together properly.

Polymarket, at the very least, provides this a 21-35% of taking place:

The opposite facet of the coin is that main elements of the Western world are eradicating their affiliation with the USA proper now due to Trump. This time, the US is focusing on eight European nations, together with England, Denmark and France, in opposition to US-Greenland acquisition efforts.

Our bucks have gotten more and more nugatory. Gold, silver, arduous belongings should go up in consequence. So sure, Trump is including volatility to the markets once more, however at what value?

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

What’s Unironically The Greatest solution to Revenue Off Of Trump Tariffs?

Spend money on China? Quick the S&P? It might all be this simple.

Fairness futures slid throughout Europe and the US, whereas we’ve got seen capital rush into conventional havens. Actually, the large standout commerce has been Gold and silver which punched by way of file highs.

Silver, particularly, is up 206% since today final 12 months.

In the meantime, Trump’s tariff proposal is 10% tariff beginning Feb. 1 on items from Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland, escalating to 25% by June absent a deal on Greenland.

“The specter of tariffs in opposition to fellow NATO members provides a recent dose of uncertainty,” – Tim Waterer, Chief Market Analyst, KCM Commerce

DISCOVER: Subsequent 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

What Will Carry out Greatest Underneath Trump? Haven Belongings Surge as ‘Promote America’ Rumors Return

For the reason that Trump tariffs, Gold jumped greater than 1.5% to recent data close to $4,700 an oz.; silver surged previous $94. European equity-index futures dropped about 1.3%, S&P 500 contracts fell close to 1%, and the greenback softened in opposition to main friends.

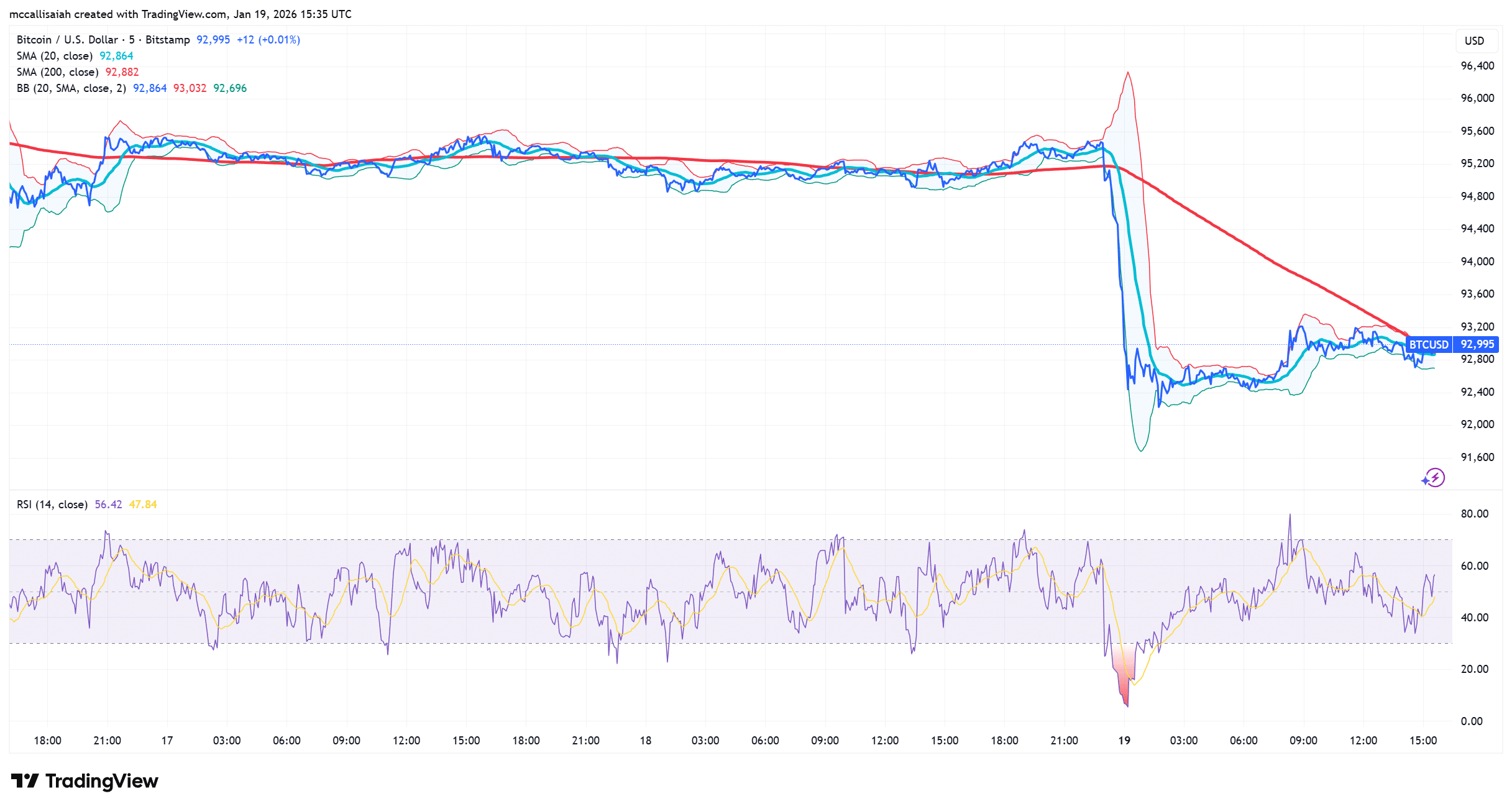

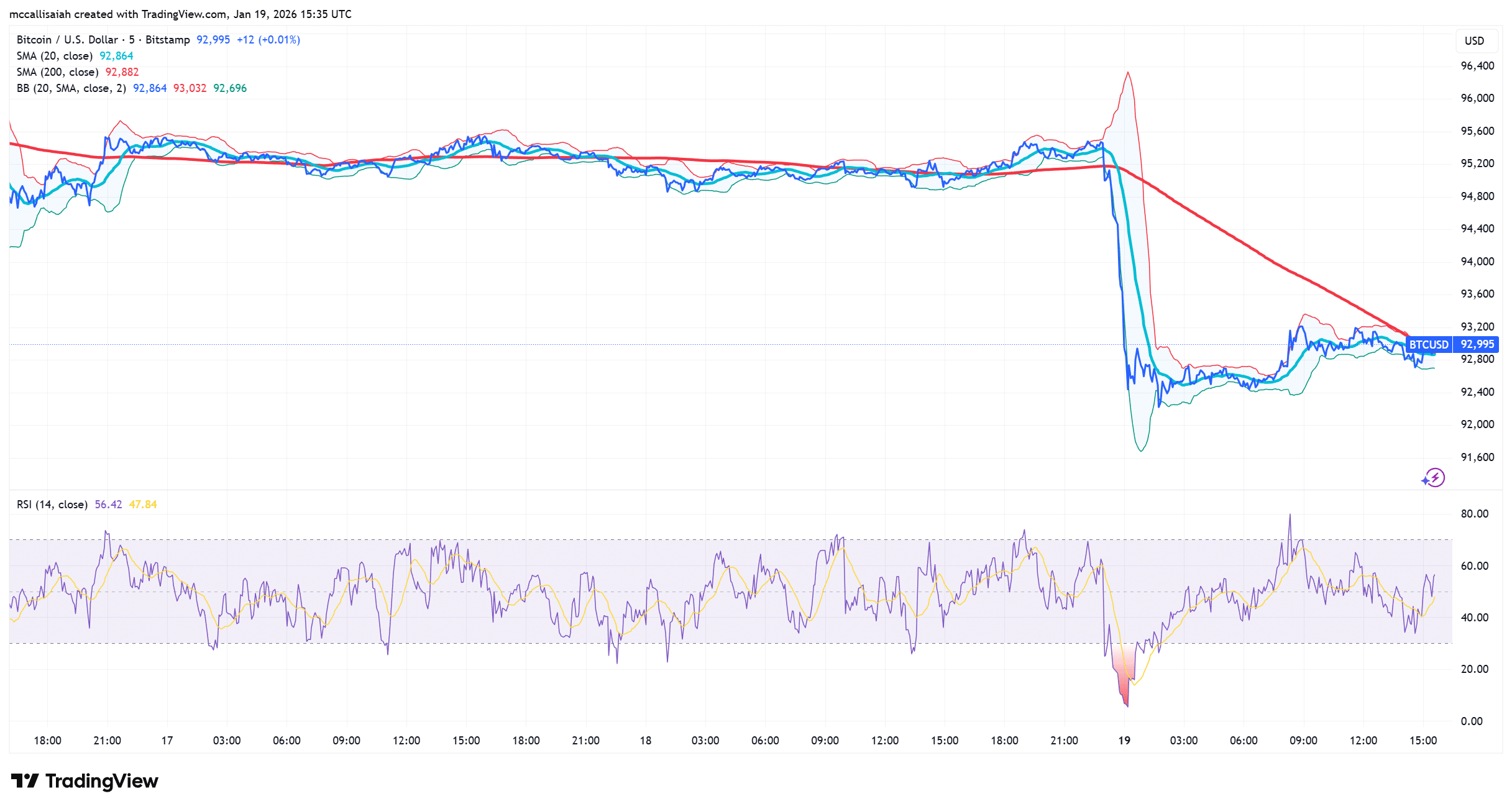

Bitcoin slipped as liquidity sought certainty over volatility:

Gold: FRED information reveals bullion up over 60% year-on-year, pushed by rate-cut expectations and central-bank shopping for.

Crypto: CoinGecko reveals bitcoin retracing amid tariff headlines, in step with short-term risk-off flows regardless of sturdy structural demand.

Charges: Treasury futures gained on the holiday-thinned tape, whereas European bonds rallied.

European leaders rebuked the transfer, with France signaling potential activation of the EU’s anti-coercion instrument. A full commerce struggle could be mutually harmful; Europe holds roughly $8T in US bonds and equities, practically twice the remainder of the world mixed.

“There isn’t a such factor as commerce certainty anymore,” stated Carsten Brzeski, World Head of Macro, ING

Ought to You Sit On Your Fingers Or Promote? (Our Trustworthy Opinion)

Crypto Worry and Greed Chart

All time

1y

1m

1w

24h

One little bit of constructive information: Asian markets have remained regular. South Korea rose on AI optimism; China hit its 5% progress goal and the Japanese Yen/USD pairing has remained steady. The strain now’s whether or not tariffs overwhelm earnings momentum or turn into one other negotiating feint.

What we’ve seen in America is that capital itself has turn into the state.

Assume feudal Japan: The president and his administration are the emperor, the Lord regent of the land whose phrase is an absolute and closing mandate from heaven itself. The fact behind this surface-level fiction is that executives, companies, donors, and a really small elite of personal pursuits dictate overseas and home coverage in the identical approach the shogun had.

Trump can rattle the markets short-term, however he can’t derail the trajectory. Crypto, AI, and the S&P are all shifting on fundamentals larger than govt orders. The true catalyst remains to be loading: decrease charges, QE. It’s not right here but, however it’s coming.

EXPLORE: King of The Decade? Analyst says Bitcoin Worth Returns Will Beat Gold and Silver

Comply with 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Every day Skilled Market Evaluation

Key Takeaways

When President Donald Trump acquires Greenland following this latest wave of Trump tariffs, each market goes to pump like loopy.

The true catalyst remains to be loading: decrease charges, QE. It’s not right here but, however it’s coming.

Why you may belief 99Bitcoins

Established in 2013, 99Bitcoin’s crew members have been crypto specialists since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Skilled contributors

2000+

Crypto Tasks Reviewed

Comply with 99Bitcoins in your Google Information Feed

Get the most recent updates, traits, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now