One of many Metropolis’s greatest banks has reframed Ethereum’s sharp ETH USD value pullback from its all-time excessive as a golden entry level. Customary Chartered’s head of digital belongings, Geoffrey Kendrick, instructed purchasers this week that ETH USD stays structurally undervalued, setting a $7,500 year-end goal on the again of rising institutional demand and a wave of treasury allocations.

Kendrick’s word highlighted that Ethereum-focused exchange-traded funds and company treasury companies have accrued 4.9% of circulating provide since June, a determine he expects to hit 10% by year-end.

That regular absorption of tokens has been the decisive issue behind ETH’s run to $4,953 on Sunday, eclipsing the report set in November 2021 earlier than retracing -11% within the following classes.

Crypto ETFs then Treasuries? How Legit is Customary Chartered’s ETH USD Value Prediction?

24h7d30d1yAll time

What issues to Customary Chartered just isn’t the correction however the structural bid. “ETH and the ETH treasury corporations are low-cost at at this time’s ranges,” Kendrick wrote, stressing that company treasuries achieve twin benefits in staking rewards and DeFi yield alternatives unavailable to ETF buyers.

In his view, ETH treasuries make extra sense than Bitcoin treasuries, which provide yield choices restricted to passive holding.

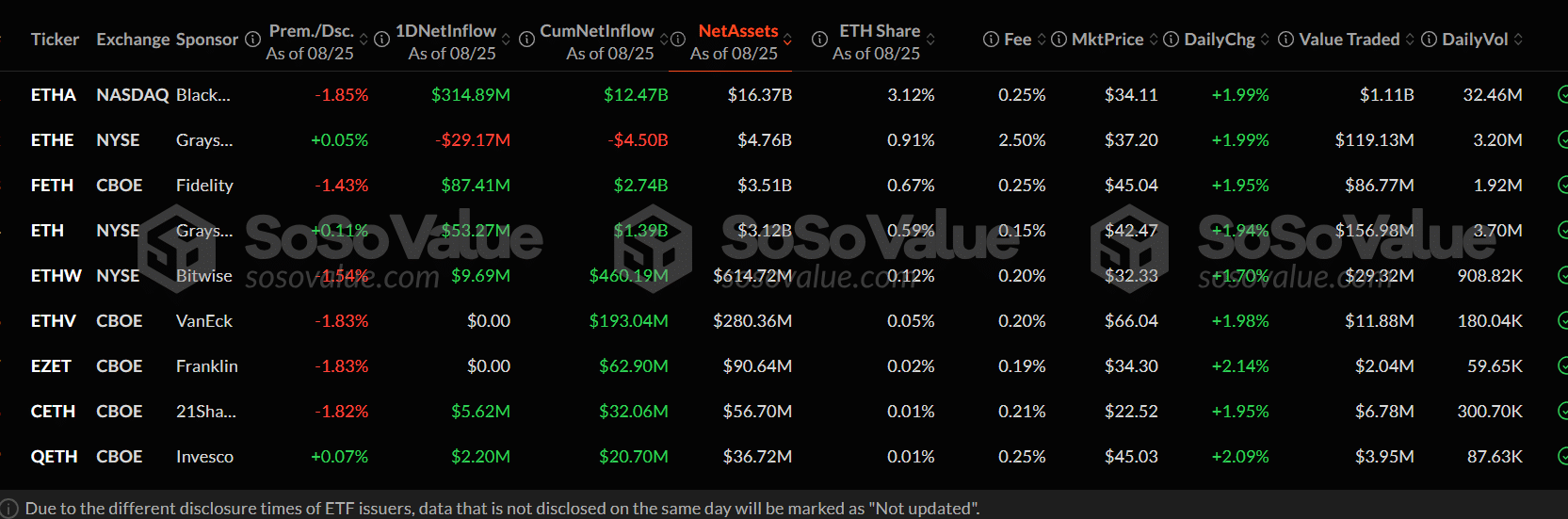

Flows affirm the thesis. Information from SoSoValue reveals Ethereum ETFs pulled in $443.9M on Monday alone, greater than double the $219M that went into Bitcoin equivalents.

(Supply – Ethereum ETF Dashboard, SoSoValue)

Throughout Thursday and Friday final week, ETH funds attracted $628M in recent capital whereas Bitcoin merchandise registered outflows. On a year-to-date foundation ETH USD is up +32.6%, almost double Bitcoin’s +17.3%.

The divergence underscores how shortly conventional finance is reshaping the crypto market. Because the SEC accredited spot ETFs in January 2024, Wall Avenue has turn out to be the one largest marginal purchaser of digital belongings, driving value cycles beforehand dominated by retail hypothesis.

Now issuers are pushing to broaden the menu past Bitcoin and Ethereum

DISCOVER: Finest Meme Coin ICOs to Spend money on 2025

Bitwise Tarket LINK Value Progress With New Spot Chainlink Crypto ETF

On Tuesday, Bitwise Asset Administration filed an S-1 for a spot Chainlink ETF, with Coinbase Custody Belief named as custodian and Coinbase, Inc. as execution agent.

The product will mirror LINK’s spot value however exclude staking, regardless of Could’s SEC steering clarifying that staking rewards don’t represent a securities transaction.

Bitwise’s cautious construction suggests issuers are prioritizing regulatory approval pace over potential yield enhancements.

The transfer follows Grayscale’s utility to transform its Avalanche Belief right into a spot AVAX ETF, a part of an escalating race to safe listings for mid-cap altcoins tied to real-world adoption narratives.

Bitwise CIO Matt Hougan has already described Chainlink as one of many “cleanest” performs on the tokenization pattern, with LINK powering oracle infrastructure for DeFi and institutional pilots alike.

DISCOVER: 9+ Finest Excessive-Danger, Excessive-Reward Crypto to Purchase in 2025

What Does This TradFi Information Imply For Retail Crypto Merchants?

Collectively, these developments spotlight a decisive shift: the ETF pipeline is now not confined to Bitcoin and Ether.

As an alternative, TradFi is laying rails for publicity to the broader altcoin spectrum, with liquidity flows more and more dictated by institutional asset managers slightly than Telegram teams or celeb endorsements.

For retail merchants, the message is stark. The market is being financialized at pace. Ethereum’s path to $7,500, if Customary Chartered’s name proves right, is not going to be pushed by meme-fuelled hype however by steadiness sheet allocations and ETF inflows.

And as new single-token ETFs for Chainlink, Avalanche, and others come on-line, the subsequent altcoin rotation could also be dictated not in Discord however on Wall Avenue buying and selling desks.

The one query left is how shortly retail can adapt to a market now being steered by TradFi capital, and whether or not the volatility cycles of previous will survive this structural change.

DISCOVER: Prime Solana Meme Cash to Purchase in 2025

Why you possibly can belief 99Bitcoins

Established in 2013, 99Bitcoin’s workforce members have been crypto specialists since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Skilled contributors

2000+

Crypto Initiatives Reviewed

Observe 99Bitcoins in your Google Information Feed

Get the newest updates, traits, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now