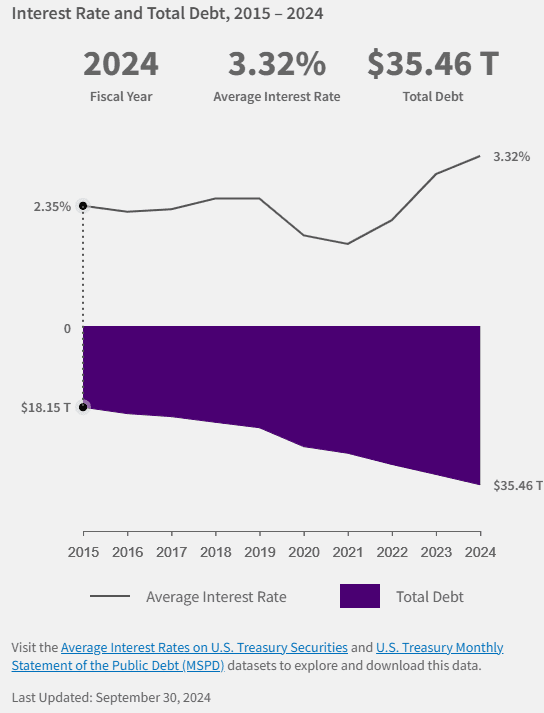

The USA is hurtling towards a monetary reckoning. With the nationwide debt now exceeding $35 trillion rising by almost $1 trillion each 100 days the nation faces an unprecedented fiscal disaster. Curiosity funds alone have surpassed $1 trillion yearly, consuming an ever-larger share of federal revenues. Because the 2024 election looms, former President Donald Trump may proposed a radical answer: a dramatic shift towards short-term borrowing mixed with aggressive Federal Reserve price cuts. However will this technique save America from fiscal collapse or speed up its demise?

The Debt Lure: Why America’s Funds Are on Shaky Floor

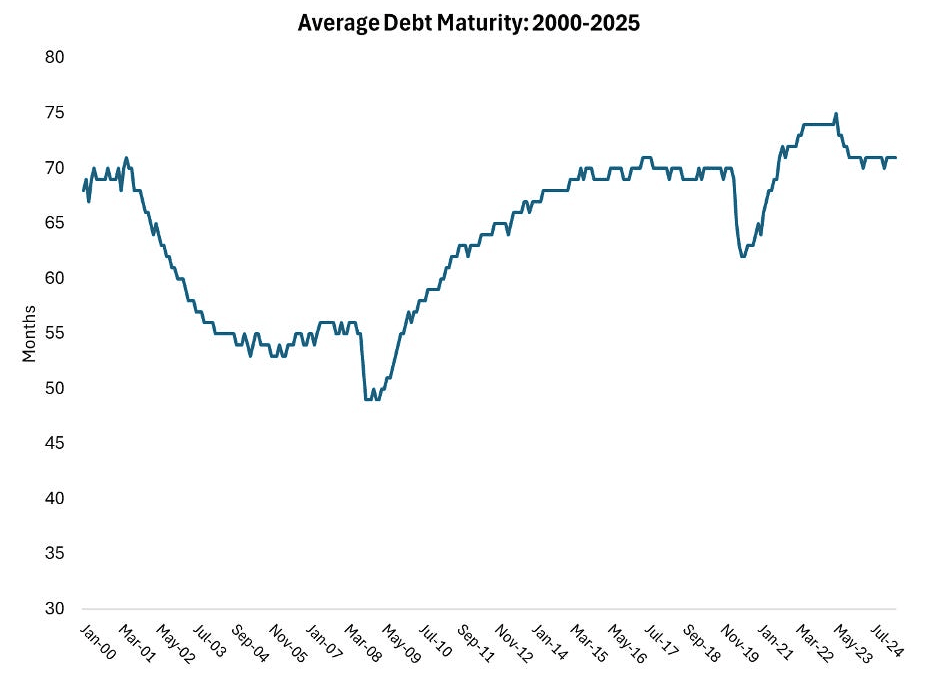

America’s debt disaster isn’t simply concerning the staggering $35 trillion determine it’s about how that debt is structured. With a mean maturity of simply six years, the U.S. Treasury should consistently refinance its obligations. In as we speak’s high-rate surroundings, every refinancing operation turns into dearer, pushing curiosity prices towards unsustainable ranges. The Congressional Price range Workplace warns that, with out drastic motion, debt servicing may quickly surpass protection spending, crowding out essential investments in infrastructure, healthcare, and training.

Trump’s reply? A daring and dangerous restructuring of America’s debt portfolio.

The common weighted maturity of US debt is 72.3 months, that means it will take years for the majority of US debt to roll over at hypothetically greater charges.

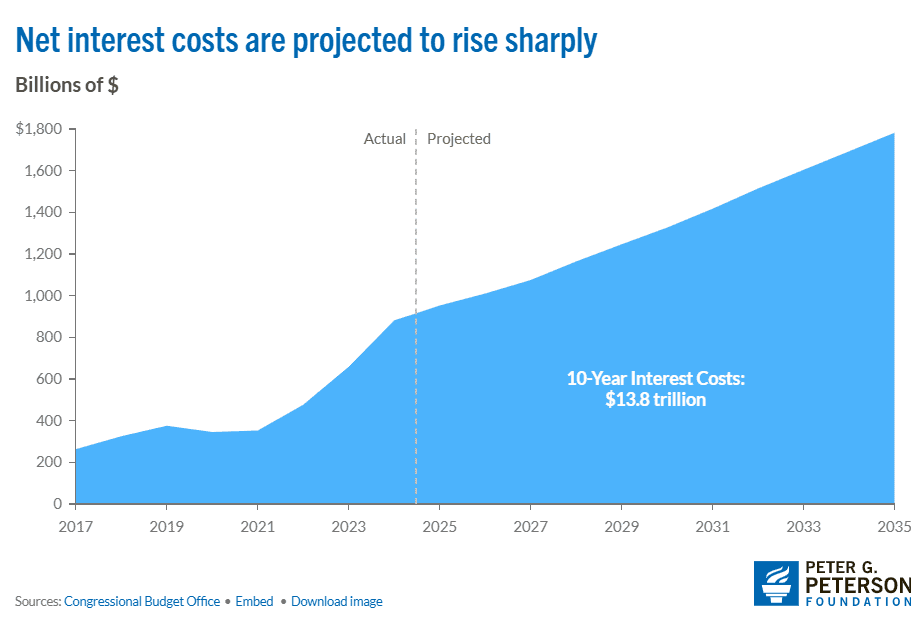

U.S. curiosity funds on nationwide debt are projected to skyrocket 80% by 2035, from $1 trillion to $1.8 trillion yearly, turning into the fastest-growing federal expense.

The Trump Debt Playbook: Quick-Time period Borrowing, Fed Stress, and Market Manipulation

Step 1: Flood the Market with Quick-Time period Debt

The plan requires a pointy discount in long-term Treasury bond issuance (10-year and 30-year notes) whereas dramatically growing the sale of short-term Treasury payments (3-month to 1-year maturities). The objective? Keep away from locking in as we speak’s excessive rates of interest for many years.

Step 2: Sturdy-Arm the Fed Into Chopping Charges

Trump has lengthy criticized the Federal Reserve for conserving charges elevated. He may appoint dovish Fed officers or publicly stress the central financial institution to slash charges, making short-term borrowing cheaper.

Step 3: Artificially Suppress Lengthy-Time period Yields

By decreasing the provision of long-term bonds, the Treasury may create synthetic shortage, driving up bond costs and pushing down yields. The hope? Buyers, starved for long-dated Treasuries, would settle for decrease returns.

Historic Warnings: When Quick-Time period Debt Experiments Failed

Seventies America: Inflation, Fee Hikes, and Catastrophe

Within the Seventies, the U.S. relied closely on short-term borrowing to keep away from excessive long-term charges. However when inflation spiked, the Fed beneath Paul Volcker was compelled to hike charges aggressively, sending short-term borrowing prices hovering and triggering a brutal recession.

Italy’s 2011 Debt Disaster: A Cautionary Story

Italy as soon as financed its deficits primarily with short-term debt. When the European debt disaster hit, buyers refused to roll over maturing bonds, forcing Rome right into a humiliating bailout.

Japan’s “Misplaced Many years”: The Value of Monetary Engineering

Japan’s central financial institution has stored long-term charges close to zero for years, however at the price of financial stagnation and a debt-to-GDP ratio exceeding 260%.

The lesson? Quick-term debt works till it doesn’t.

The Domino Impact: How This Might Backfire Spectacularly

1. The 2027 Refinancing Cliff

If charges rise once more, rolling over trillions in short-term debt may turn into prohibitively costly.

2. Overseas Buyers Flee

China, Japan, and different main Treasury holders may dump U.S. debt, sending yields hovering.

3. Pension Funds Panic

With fewer long-term bonds accessible, retirees may face profit cuts as funds battle to match liabilities.

4. The Fed’s Inconceivable Selection

If inflation resurges, the Fed would face a nightmare: Maintain charges low and let inflation run wild, or hike charges and set off a debt disaster.

5. The Greenback’s Decline

A lack of confidence in U.S. debt may weaken the greenback, fueling inflation and additional destabilizing markets.

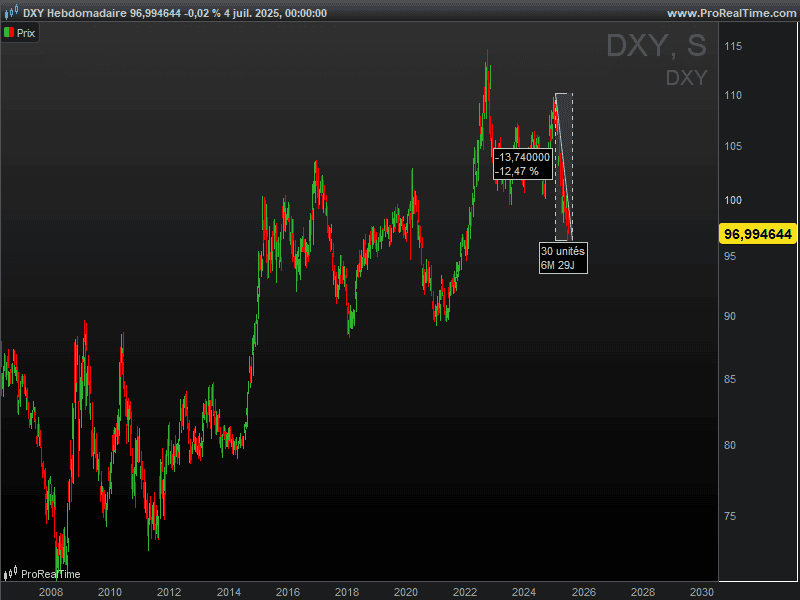

Furthermore, this DXY chart reveals the greenback has already misplaced 12.5% of its worth since Trump’s election

How One Would possibly Method Buying and selling a Lengthy-Time period Fee Decline Situation Utilizing TLT, IEF, or TMF

If an investor have been to anticipate a possible decline in long-term rates of interest (for instance, attributable to potential Fed easing, financial softening, or moderating inflation), sure ETFs may theoretically present publicity to this situation:

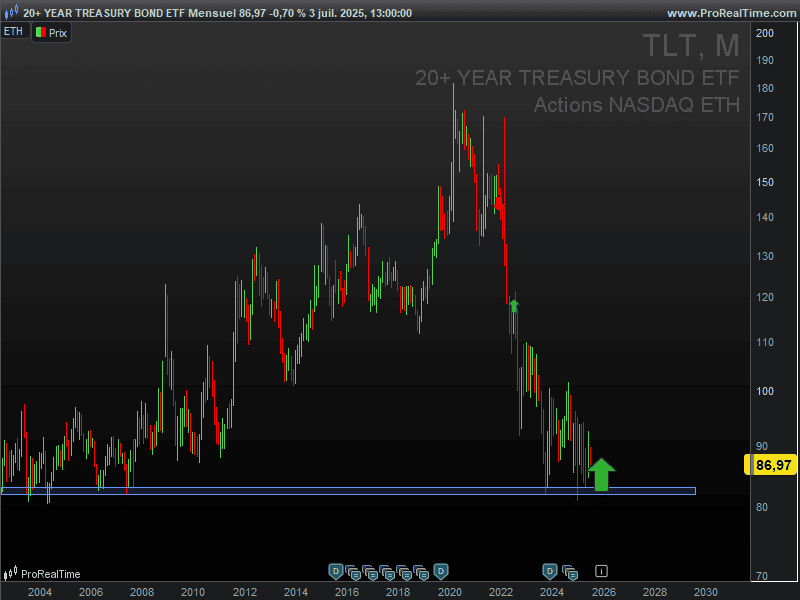

TLT (iShares 20+ 12 months Treasury Bond ETF): This ETF tracks long-duration U.S. Treasuries (20+ years). In concept, if long-term yields have been to fall, TLT’s worth may rise considerably attributable to its sensitivity to rate of interest modifications.

Technical Perspective on TLT’s Lengthy-Time period Assist Stage

When analyzing TLT’s month-to-month chart, a notable help stage seems round $84, which has held for over twenty years. This historic flooring may doubtlessly function a reference level for buyers contemplating a long-term guess on declining U.S. rates of interest, as:

Historic Significance: The $84 stage has repeatedly acted as a reversal zone because the early 2000s.

Threat/Reward Context: A hypothetical bounce from this stage would possibly align with a situation the place long-term yields peak and reverse, given TLT’s inverse relationship to charges.

Caveats:

Breakdown Threat: A sustained drop beneath $84 may invalidate the sample, signalling structural bearishness for bonds.

Macro Dependence: Even at help, TLT’s efficiency would depend upon inflation traits and Fed coverage shifts.

Key Takeaway: Whereas the $84 stage might provide a technical entry reference, its efficacy would probably hinge on broader macroeconomic situations confirming a long-term price decline.

IEF (iShares 7-10 12 months Treasury Bond ETF): Specializing in intermediate-term Treasuries, this ETF is perhaps much less risky than TLT however may nonetheless profit from a possible decline in charges.

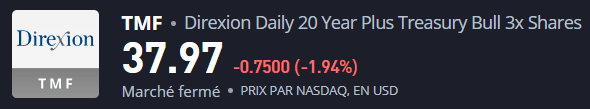

TMF (Direxion Each day 20+ 12 months Treasury Bull 3x Shares): As a leveraged ETF, TMF seeks to ship 3x the day by day return of TLT. Whereas this might amplify positive factors in a falling-rate surroundings, it will additionally enlarge losses if charges moved unfavorably.

Potential Dangers to Think about

Curiosity Fee Reversals: Ought to long-term yields rise unexpectedly (attributable to persistent inflation or a extra hawkish Fed stance, as an example), bond ETFs like TLT and IEF may decline in worth. TMF’s leveraged construction may exacerbate these losses.

Leverage Decay (TMF): Given its day by day reset mechanism, holding TMF over prolonged intervals would possibly result in efficiency erosion, particularly in risky markets. It is perhaps extra suited to short-term buying and selling methods.

Period Sensitivity: Longer-duration bonds (resembling these in TLT) are usually extra reactive to price modifications, which may result in heightened volatility.

Coverage Misinterpretation: If market expectations for price cuts have been overstated, bond costs would possibly underperform and even lower.

Liquidity and Monitoring Variations: Whereas Treasury ETFs like TLT and IEF are usually liquid, leveraged merchandise like TMF won’t completely observe their underlying index over time.

Strategic Issues

ETF Choice: Buyers would possibly weigh the trade-offs between the relative stability of TLT/IEF and the amplified (however riskier) publicity of TMF.

Hedging Prospects: In a extra cautious method, some would possibly contemplate pairing these positions with inverse ETFs (resembling TMV) to offset potential losses from rising charges.

Macroeconomic Monitoring: Key indicators like inflation knowledge, Fed communications, and financial development metrics may assist inform any changes to such a technique.

In abstract, whereas ETFs like TLT, IEF, or TMF may, in concept, be used to precise a view on declining long-term charges, they arrive with materials dangers significantly in leveraged or long-duration merchandise. Any such technique would require cautious threat evaluation and ongoing monitoring of market situations.

The Verdict: A Excessive-Stakes Wager With No Straightforward Exit

Trump’s technique would possibly quickly scale back debt prices, nevertheless it does nothing to deal with the basis reason behind America’s fiscal woes: runaway spending. Worse, it may amplify monetary fragility, leaving the U.S. weak to a catastrophic debt spiral.

Greatest-case situation? A brief-term reprieve adopted by years of stagnation (see: Japan).Worst-case situation? A full-blown debt disaster that makes 2008 look gentle.

Ultimate Thought:The bond market punishes reckless fiscal coverage, as was seen throughout Liz Truss’s temporary UK premiership. If America gambles flawed, the results may echo for generations.

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any specific recipient’s funding goals or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.