Regardless of the market being actually a pink sea, with BTC hovering round $71K and sentiment locked in excessive worry, Tether USDT continues to flex arduous. In This fall 2025 (October–December), the issuer launched its newest BDO-verified attestation, exhibiting USDT hitting document highs whilst altcoins bled and the October 10 liquidation cascade worn out over a 3rd of complete crypto worth.

Tether reported that its USDT stablecoin added 35.2 million new customers within the fourth quarter.

What can we extrapolate from this data? A easy conclusion is that customers and liquidity usually are not fully leaving crypto: they’re shifting towards stablecoins as merchants attempt to catch a possible market backside. And USDT is the favorite selection.

USD₮ This fall 2025 Market ReportLearn extra: https://t.co/xKzGkGTr4k

— Tether (@tether) February 4, 2026

EXPLORE: Greatest New Cryptocurrencies to Put money into 2026

USDT Dominance Hits New Heights: Tether Information Customers, Cap, and On-Chain Exercise

USDT’s market cap climbed to $187.3 billion, up $12.4 billion in simply three months, throughout one of many roughest quarters in current reminiscence.

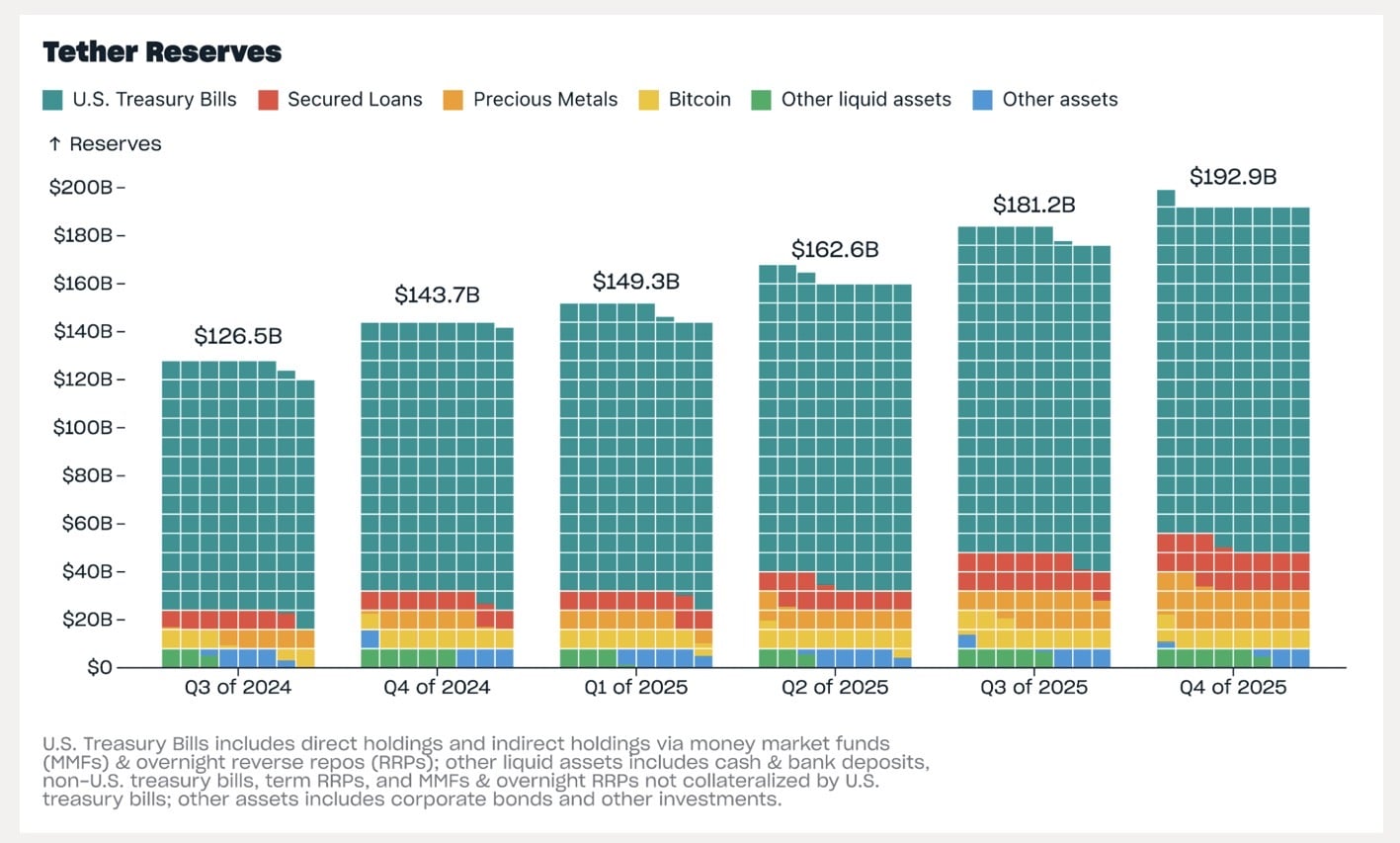

Reserves pumped to $192.9 billion (+$11.7B), delivering $6.3 billion in extra fairness over liabilities: mainly a fats buffer for redemptions. Full-year 2025 income topped $10 billion, principally from juicy yields on huge U.S. Treasury holdings.

Person adoption went parabolic: Tether added 35.2 million new customers in This fall alone, pushing the estimated world complete to 534.5 million (eighth straight quarter smashing 30M+ provides).

On-chain holders (wallets holding USDT ≥24h) climbed to 139.1 million, controlling ~70.7% of all stablecoin wallets. Month-to-month energetic on-chain customers reached a document 24.8 million, securing roughly 68.4% of the market share. This fall switch quantity hit $4.4 trillion with billions of on-chain txs. Pure liquidity dominance.

In the course of the October crash, USDT really grew +3.5% whereas opponents shrank or stagnated.

DISCOVER: Greatest Meme Coin ICOs to Put money into 2026

Reserves Stacked for the Lengthy Recreation: Treasuries, BTC, and Huge Gold Accumulation

On the reserves combine: $141.6 billion in U.S. Treasury publicity, making Tether a top-20 world holder if ranked as a rustic, larger than Saudi Arabia or Germany in some metrics. They stacked extra BTC too: 96,184 cash (up ~9,850 in This fall).

However the true flex is gold: 127.5 metric tons bodily (up 21.9 tons QoQ), saved in ultra-secure Swiss vaults.

This ties into Tether’s broader gold tactic. Past backing USDT reserves for diversification (hedging fiat/debt dangers amid greenback skepticism and geopolitical chaos), they aggressively ramp up bodily gold buys: $24B at peaks.

XAUT dominates gold-backed tokens (~60% share), with devoted backing separate however synergistic to USDT’s general reserve technique.

Tether’s scale, community results, emerging-market remittances, and now gold diversification preserve it undefeated.

DISCOVER:

Comply with 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Every day Knowledgeable Market Evaluation.

Why you possibly can belief 99Bitcoins

Established in 2013, 99Bitcoin’s group members have been crypto consultants since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Knowledgeable contributors

2000+

Crypto Tasks Reviewed

Comply with 99Bitcoins in your Google Information Feed

Get the newest updates, tendencies, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now