International cryptocurrency buying and selling volumes have surged considerably in recent times. The business has grown regardless of regulatory pressures, market fluctuations, and shifting investor sentiment. However the place is most of this buying and selling taking place? This examine, performed by CryptoNinjas and Storible, delves into international buying and selling tendencies, inspecting which areas and international locations dominate each centralized trade (CEX) and decentralized trade (DEX) buying and selling.

Key Findings

In 2025, international cryptocurrency buying and selling quantity is predicted to exceed $297 trillion.The US leads as essentially the most lively crypto buying and selling nation, surpassing $4 trillion.Europe dominates the market, accounting for half of the world’s whole crypto transaction worth.Turkey and Korea rank 2nd and third globally, with every exceeding $1 trillion in buying and selling quantity.

How Did We Do?

We ranked the highest crypto-trading international locations in 2025 by analyzing buying and selling quantity on centralized (CEX) and decentralized (DEX) exchanges. Information was collected from CoinGecko, Ahrefs, SimilarWeb, and Wikipedia to estimate country-wise buying and selling quantity.

For CEXs, rankings had been based mostly on net visitors (90% weight), supported languages, headquarters, and buying and selling time zones. Solely exchanges with a belief rating above 6 had been included.

For DEXs, buying and selling quantity was decided utilizing net visitors (90% weight), search quantity, and language help. Solely platforms with excessive 7-day buying and selling quantity and a minimal 24-hour quantity of $5M had been thought-about.

Information was collected and analyzed from Feb 2nd to Feb twentieth, 2025.

*Detailed methodology is described on the finish of this text.

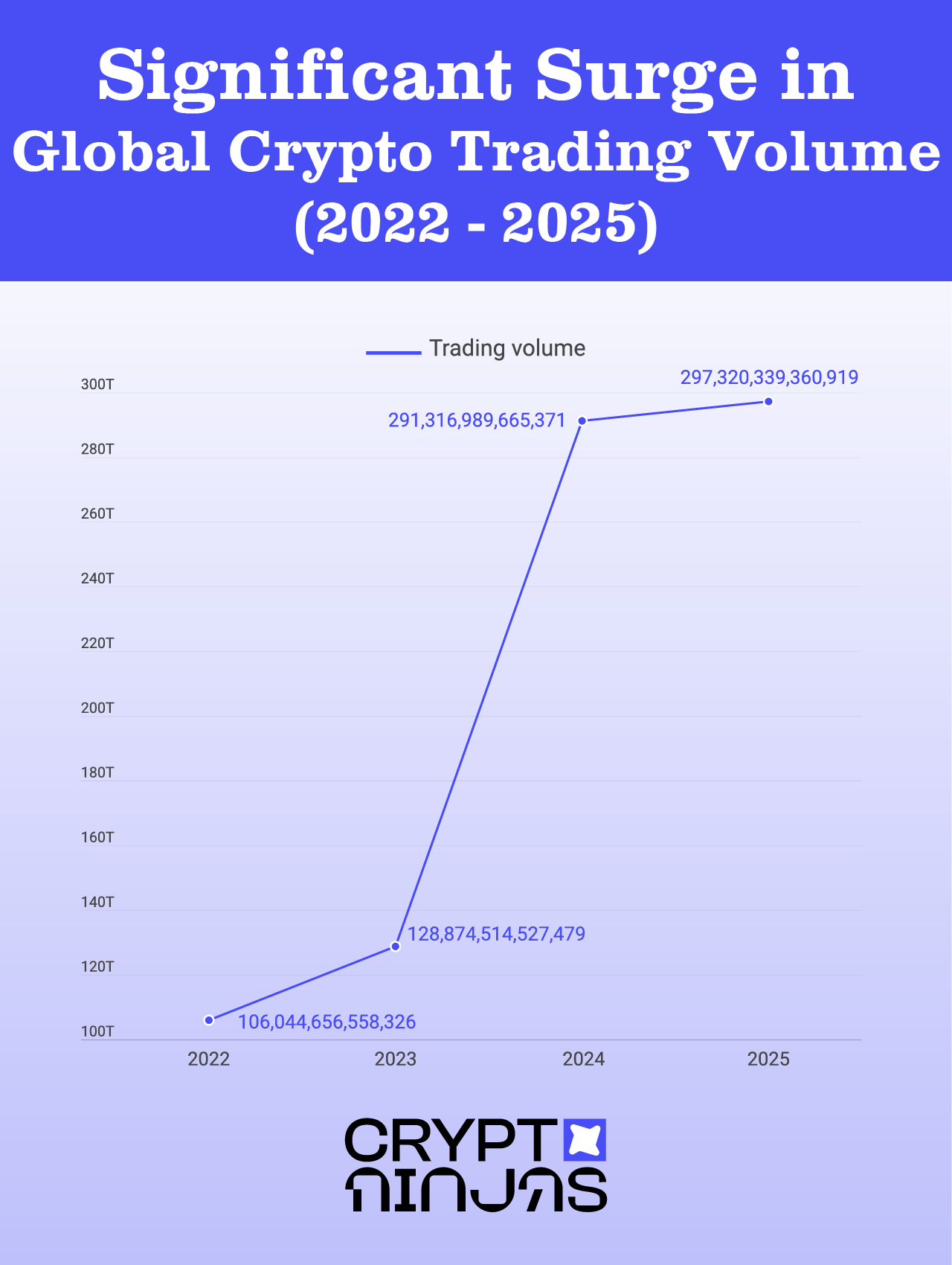

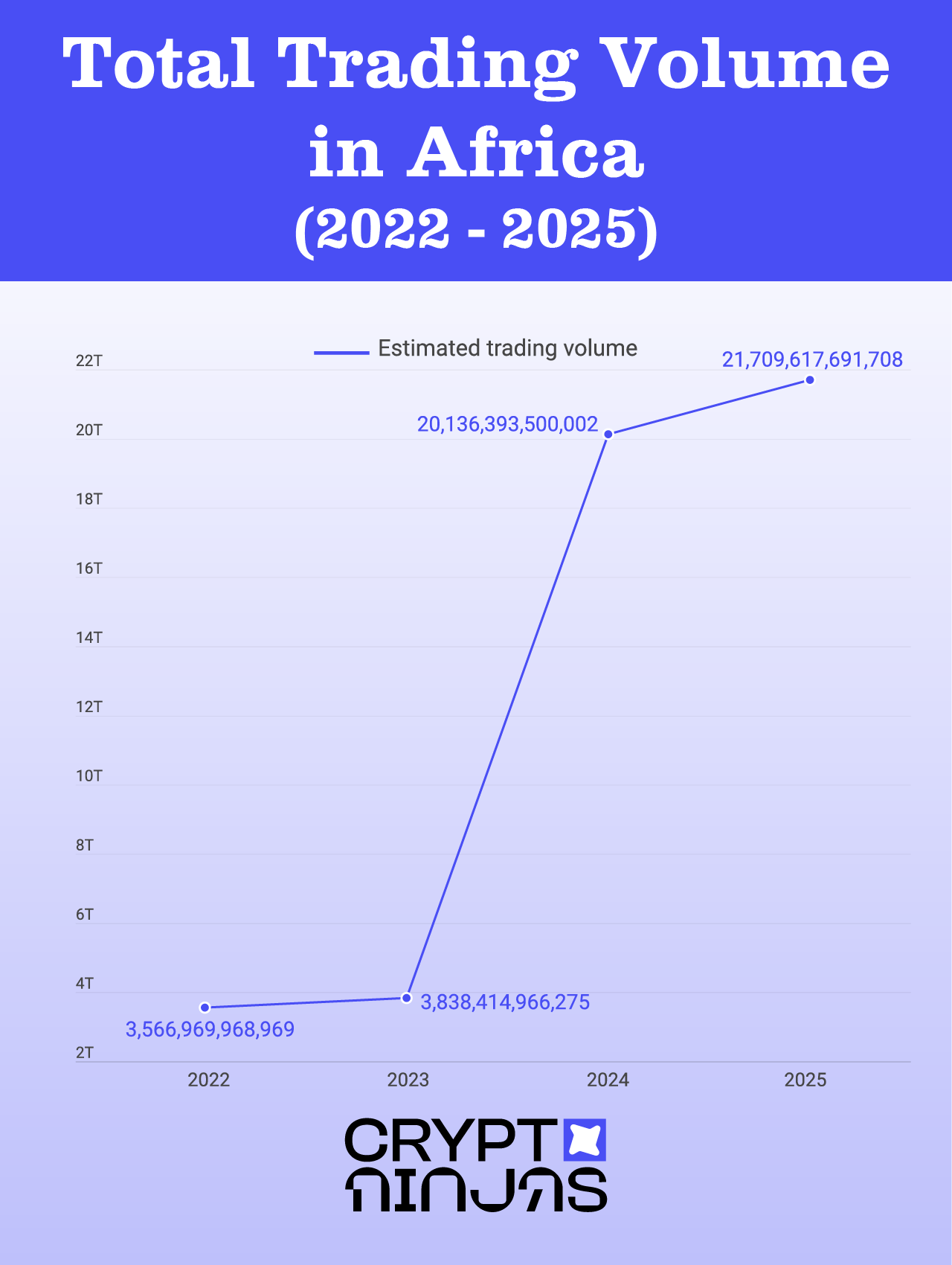

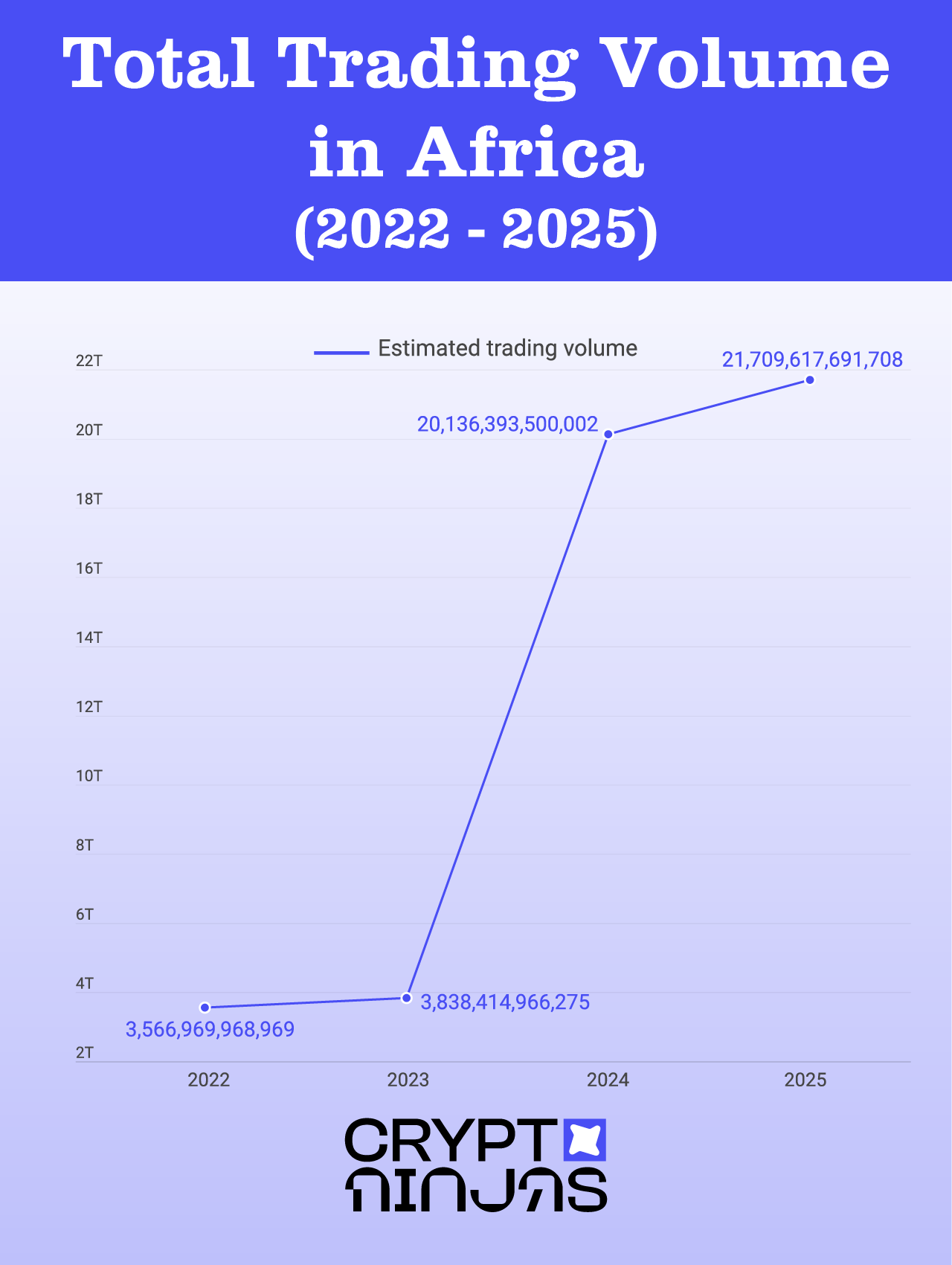

Vital Surge in International Crypto Buying and selling Quantity (2022-2025)

Cryptocurrency buying and selling quantity has steadily elevated, exhibiting resilience and rising adoption. Since 2024, international buying and selling quantity has risen by 2.06%, with an general 180.37% improve over 4 years.

This enlargement indicators rising curiosity in digital belongings worldwide, with some areas rising as main buying and selling hubs. Regulatory readability, financial instability, and rising institutional adoption are a number of the key drivers behind this rising buying and selling exercise.

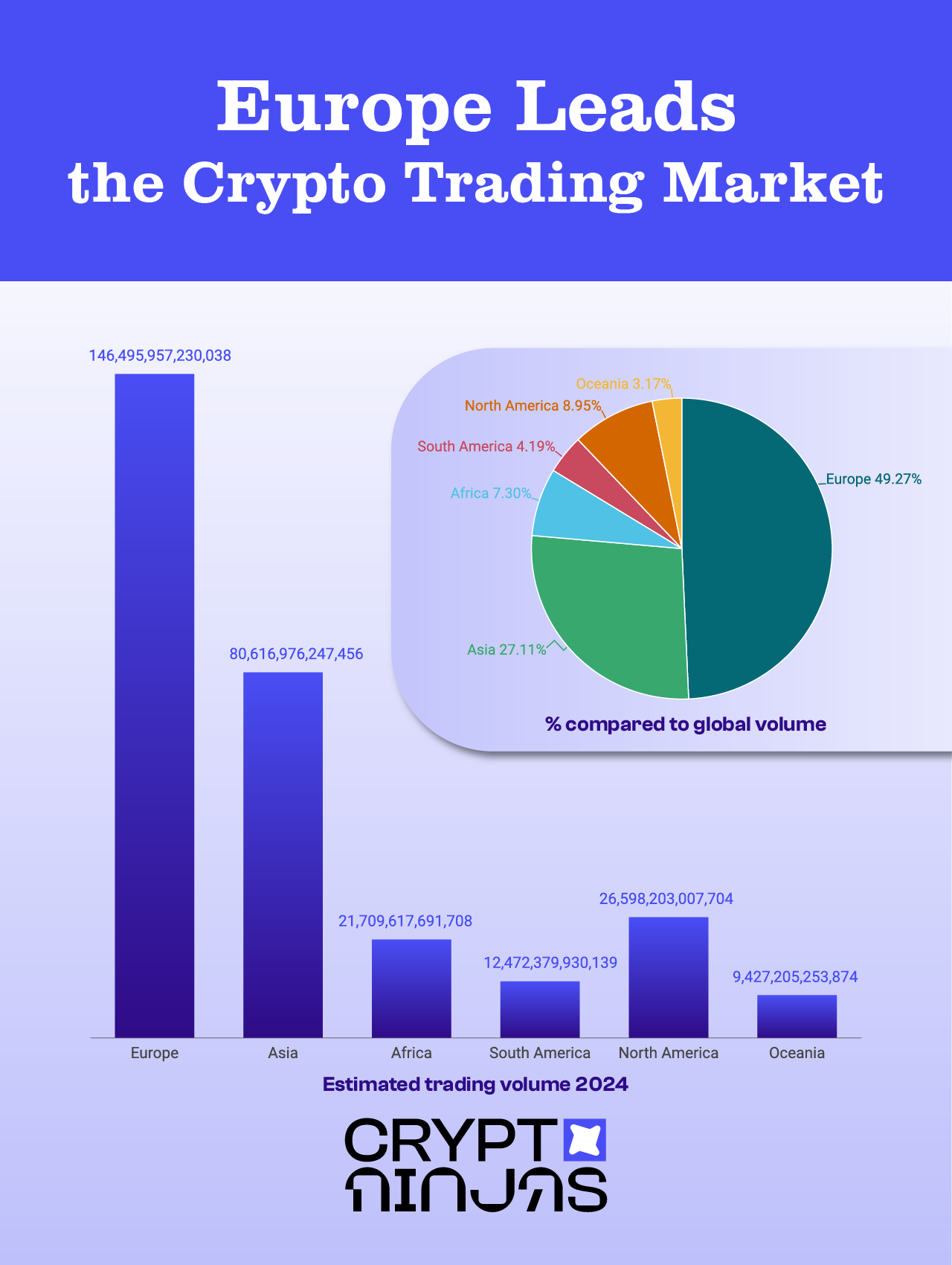

Europe Leads the Crypto Buying and selling Market

Europe accounts for 49.27% of the world’s whole crypto buying and selling quantity, making it the biggest market globally. Asia follows with 27.11%, whereas North America and Africa additionally present robust participation.

Europe’s dominance in crypto buying and selling is basically attributable to progressive rules, robust monetary infrastructure, and rising institutional participation. The Markets in Crypto-Belongings Regulation (MiCA), set to take full impact in 2024, offers a authorized framework that fosters innovation whereas making certain shopper safety. Moreover, main monetary hubs like London and Frankfurt play a key function in driving liquidity into the market.

Key Gamers in Europe

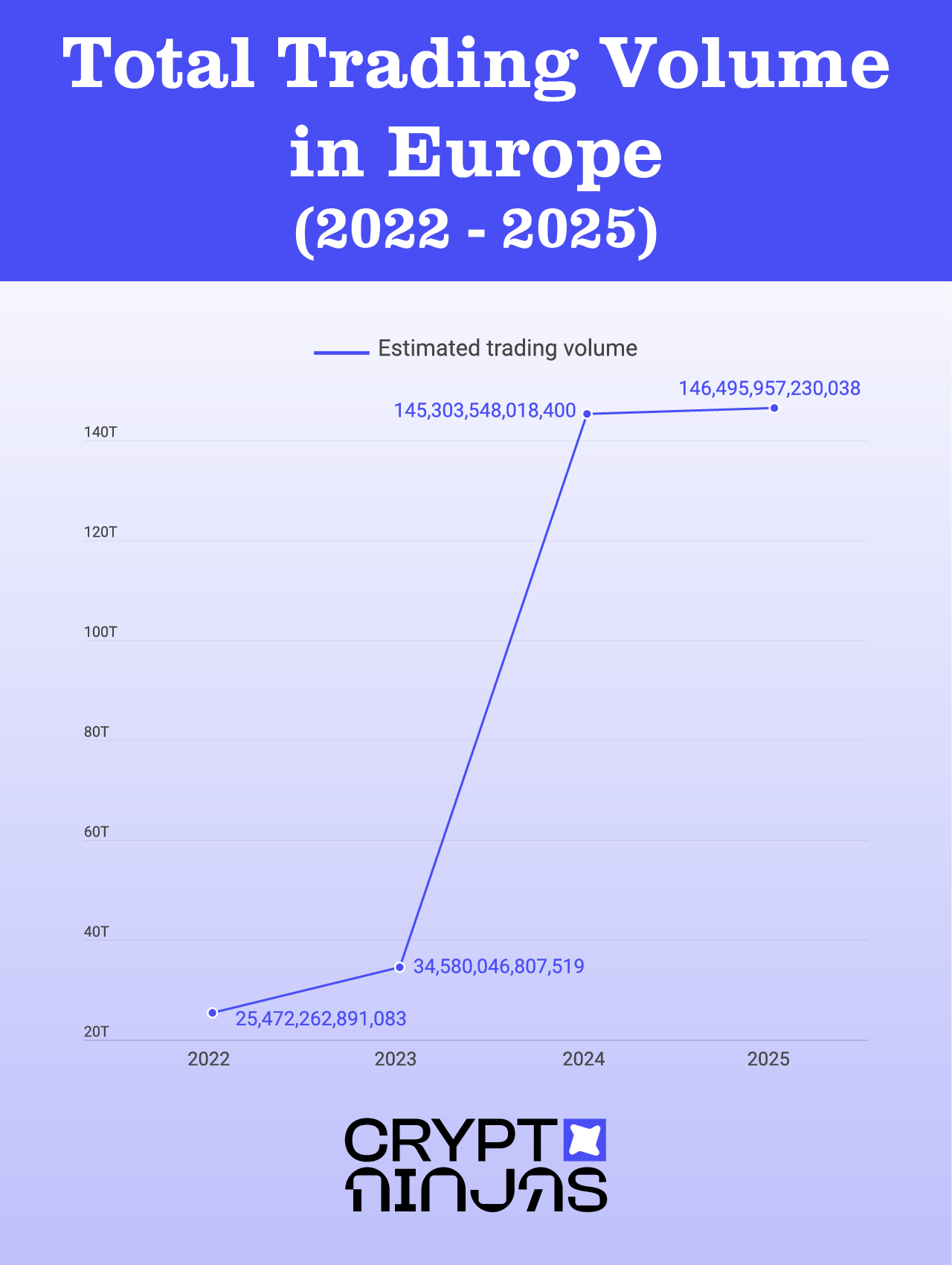

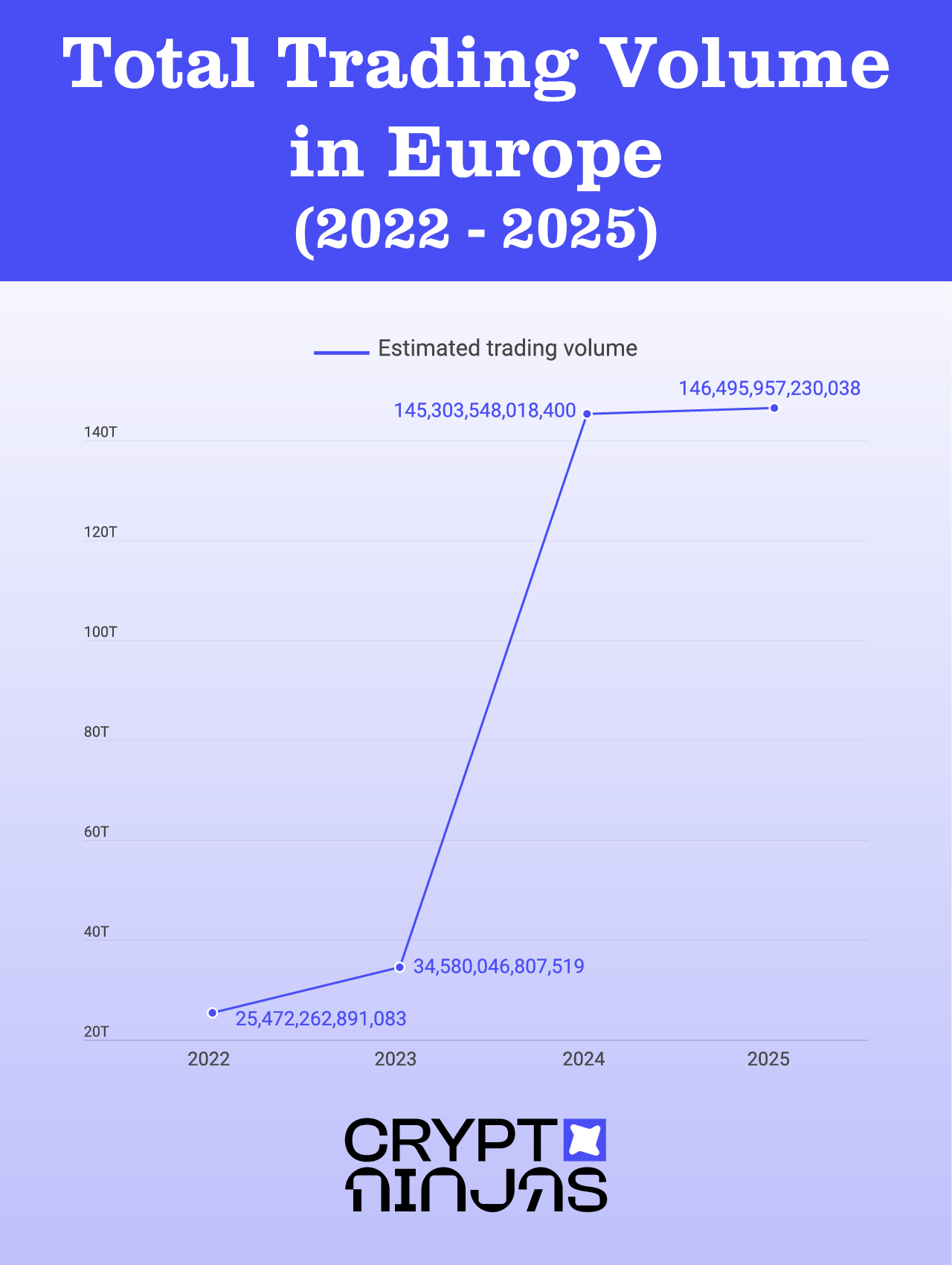

Complete Buying and selling Quantity in Europe (2022-2025)

Russia leads European crypto buying and selling, with an estimated quantity surpassing $1.38 trillion, rating it among the many high 5 buying and selling nations globally. The UK follows with $1.36 trillion, pushed by London’s standing as a key monetary hub. Notably, Slovenia and Ukraine stand out for his or her excessive particular person crypto expenditures, with residents spending greater than 3-4 instances their month-to-month lease on digital belongings.

Asia’s Crypto Dominance: Turkey, India, and South Korea

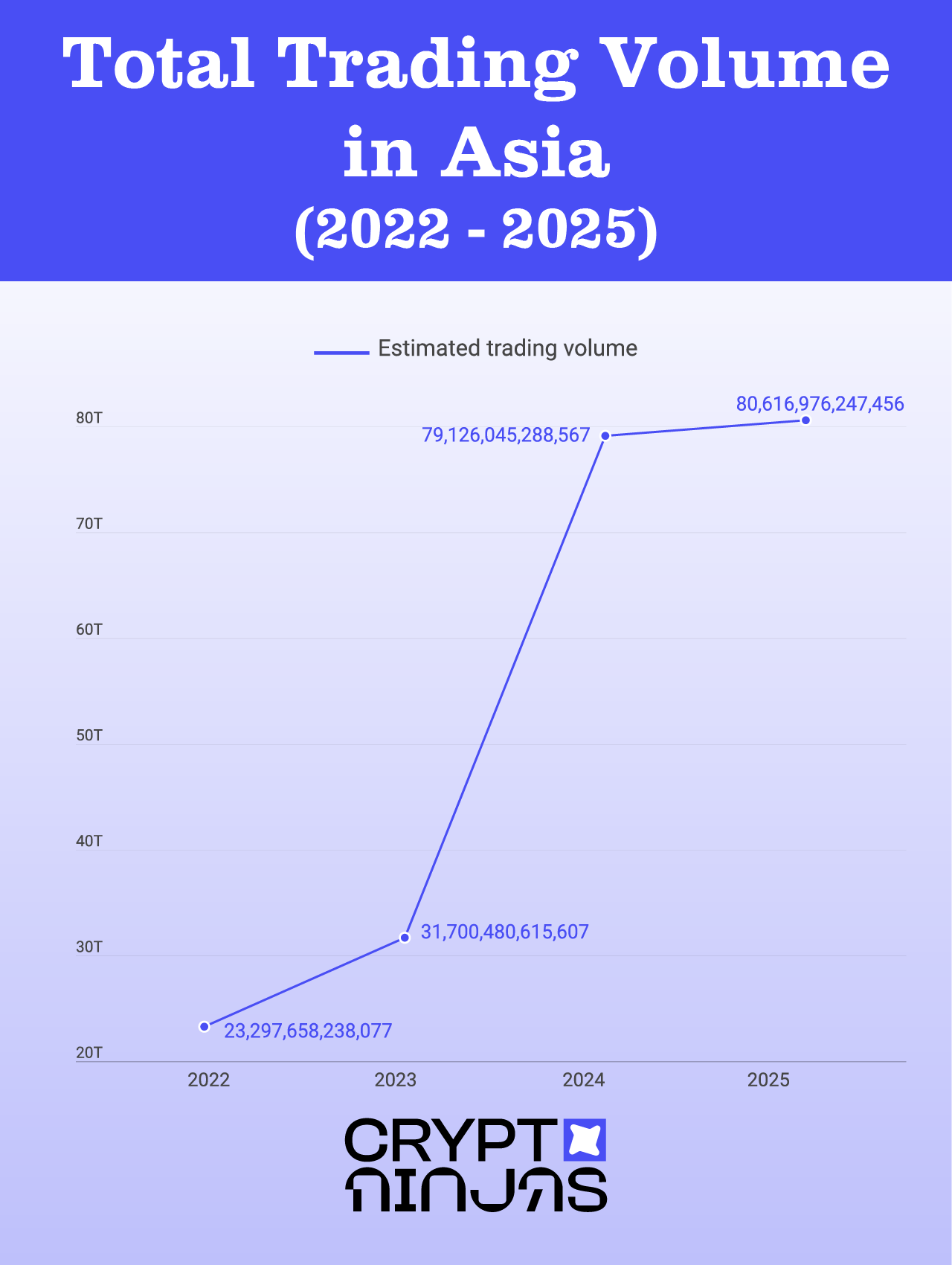

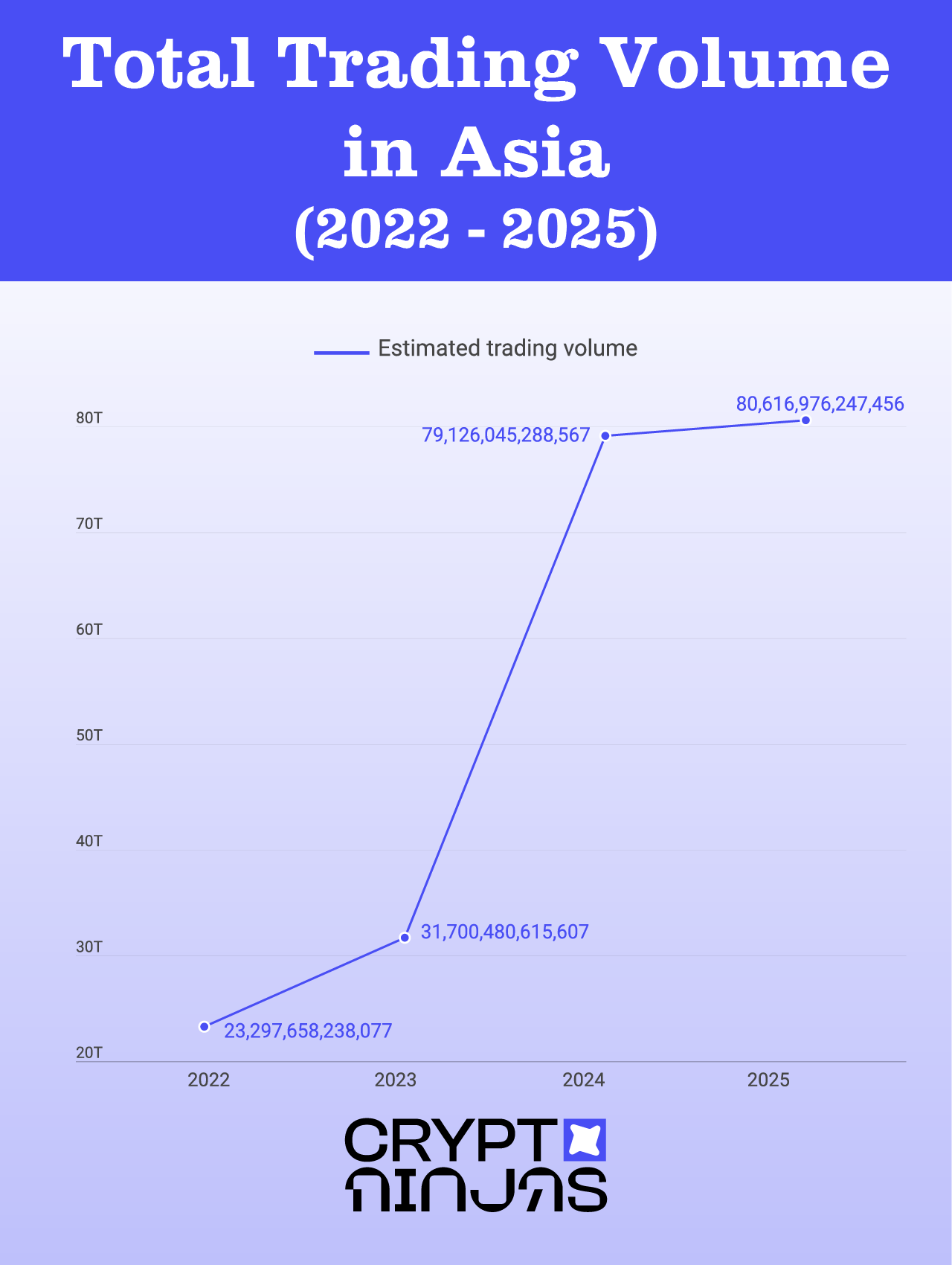

Complete Buying and selling Quantity in Asia (2022-2025)

Asia holds a 27.11% market share, led by Turkey, India, and South Korea. Turkey is the area’s largest buying and selling hub, with a 2024 quantity of over $1.5 trillion. In the meantime, Singapore sees the very best per-capita spending on crypto, averaging $4,981 per 30 days per dealer.

A number of components contribute to Asia’s robust buying and selling exercise, together with inflation considerations, foreign money devaluation, and a tech-savvy inhabitants. International locations like Turkey and Pakistan have witnessed financial instability, main residents to make use of crypto as a hedge towards inflation. In distinction, South Korea and Vietnam have thriving crypto gaming and DeFi communities, pushing up buying and selling volumes.

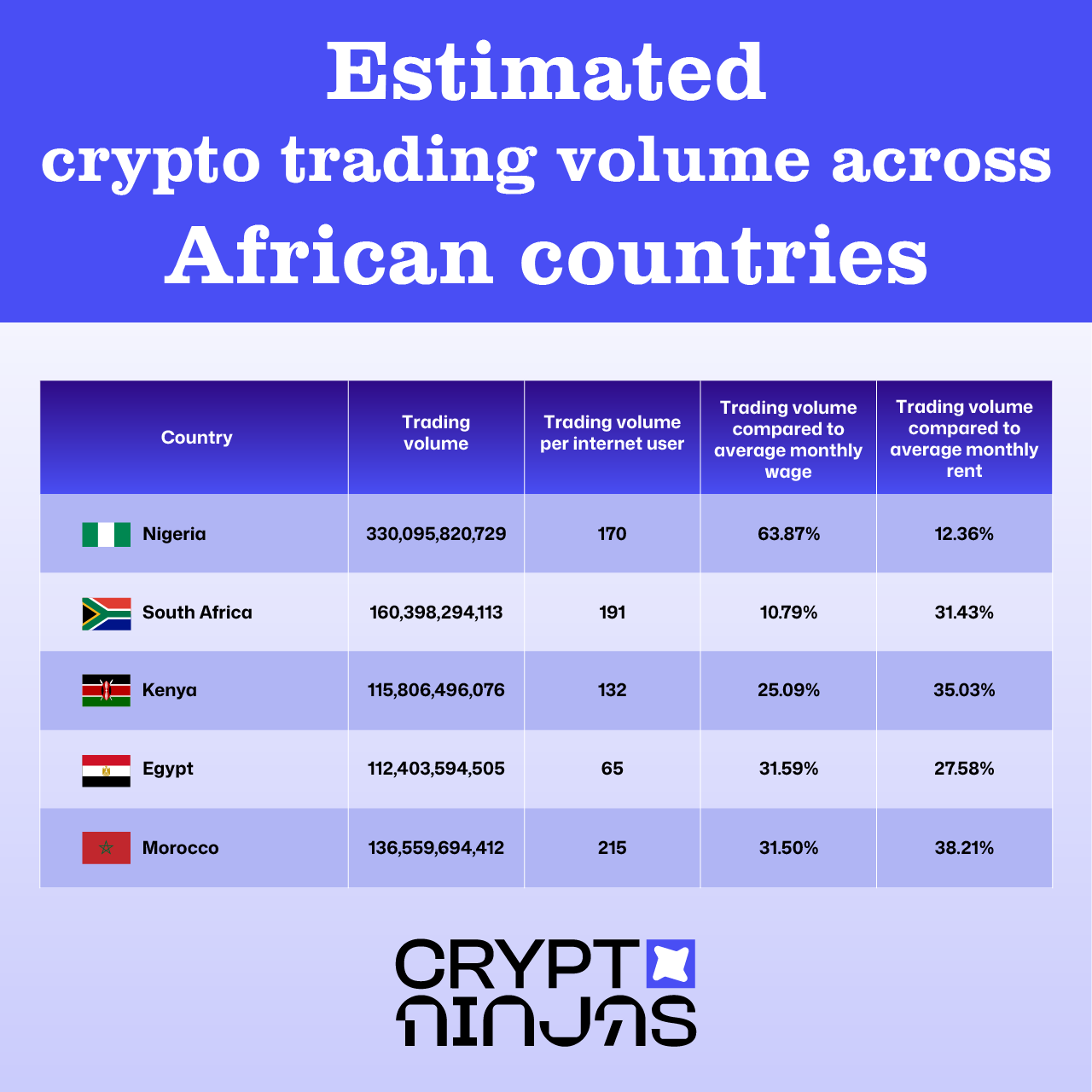

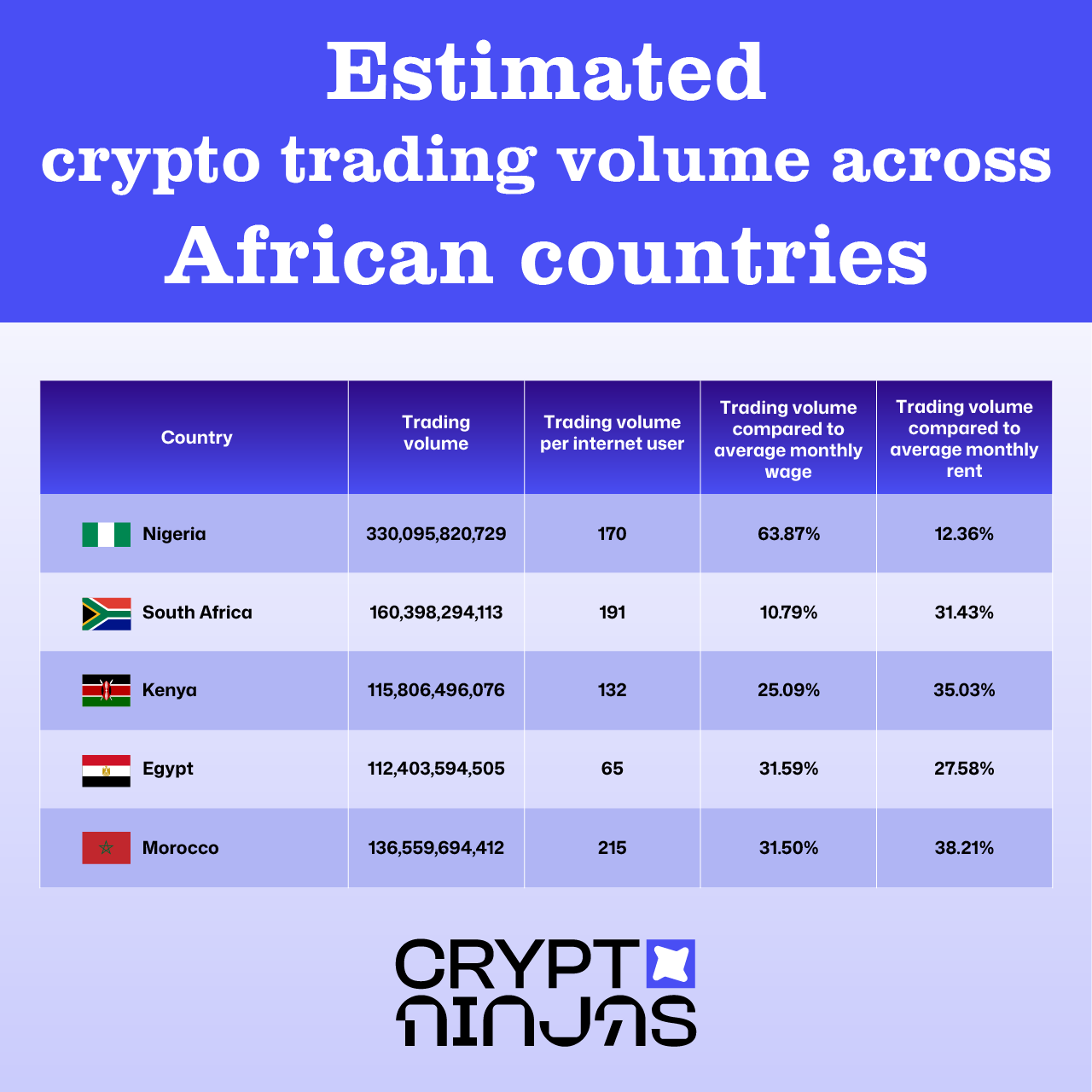

Africa: A Rising Crypto Powerhouse

Complete Buying and selling Quantity in Africa (2022-2025)

Africa is experiencing the quickest crypto buying and selling progress, with volumes anticipated to be 5 instances greater in 2024 than in 2022. Nigeria leads the continent, with a buying and selling quantity exceeding $330 billion in 2024. Moreover, Nigerians allocate a good portion of their earnings to crypto, with spending surpassing 63.87% of their month-to-month wage.

Africa’s speedy crypto progress is fueled by remittance wants, monetary exclusion, and cellular cash integration. Many African nations have restricted entry to conventional banking companies, making crypto a beautiful different. Nigeria and Kenya, for instance, see heavy use of stablecoins for cross-border funds and financial savings.

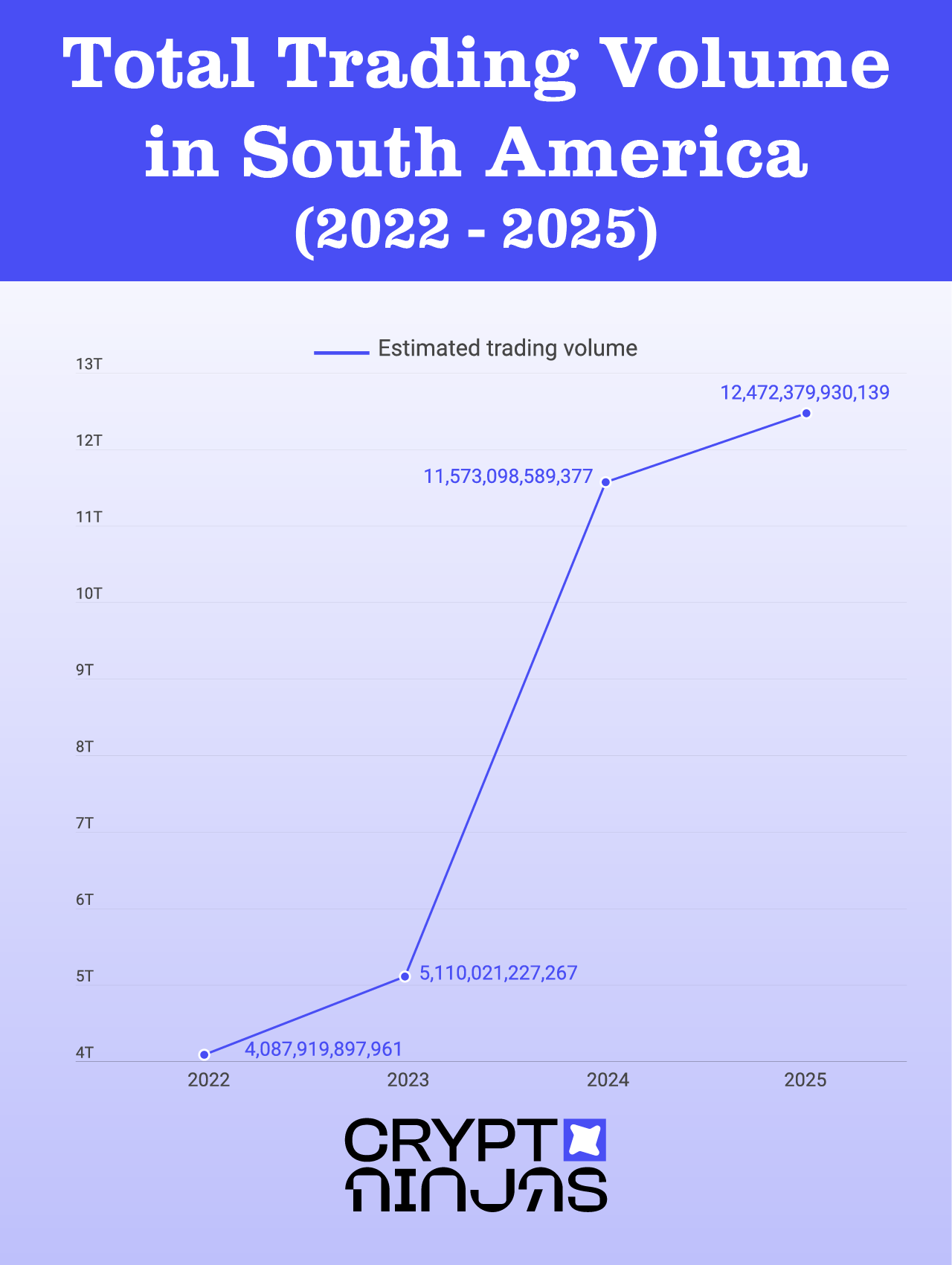

South America: Inflation Hedge

Complete Buying and selling Quantity in South America (2022-2025)

South America’s rising adoption of crypto is primarily pushed by hyperinflation and financial instability.

Argentina and Venezuela’s Foreign money Disaster – Residents flip to Bitcoin and stablecoins to flee hyperinflation and foreign money controls.Brazil’s Institutional Development – Brazil has developed a powerful regulatory framework, resulting in greater institutional participation.Chile and Peru’s Rising Adoption – Elevated fintech integration has pushed crypto adoption for on a regular basis transactions.

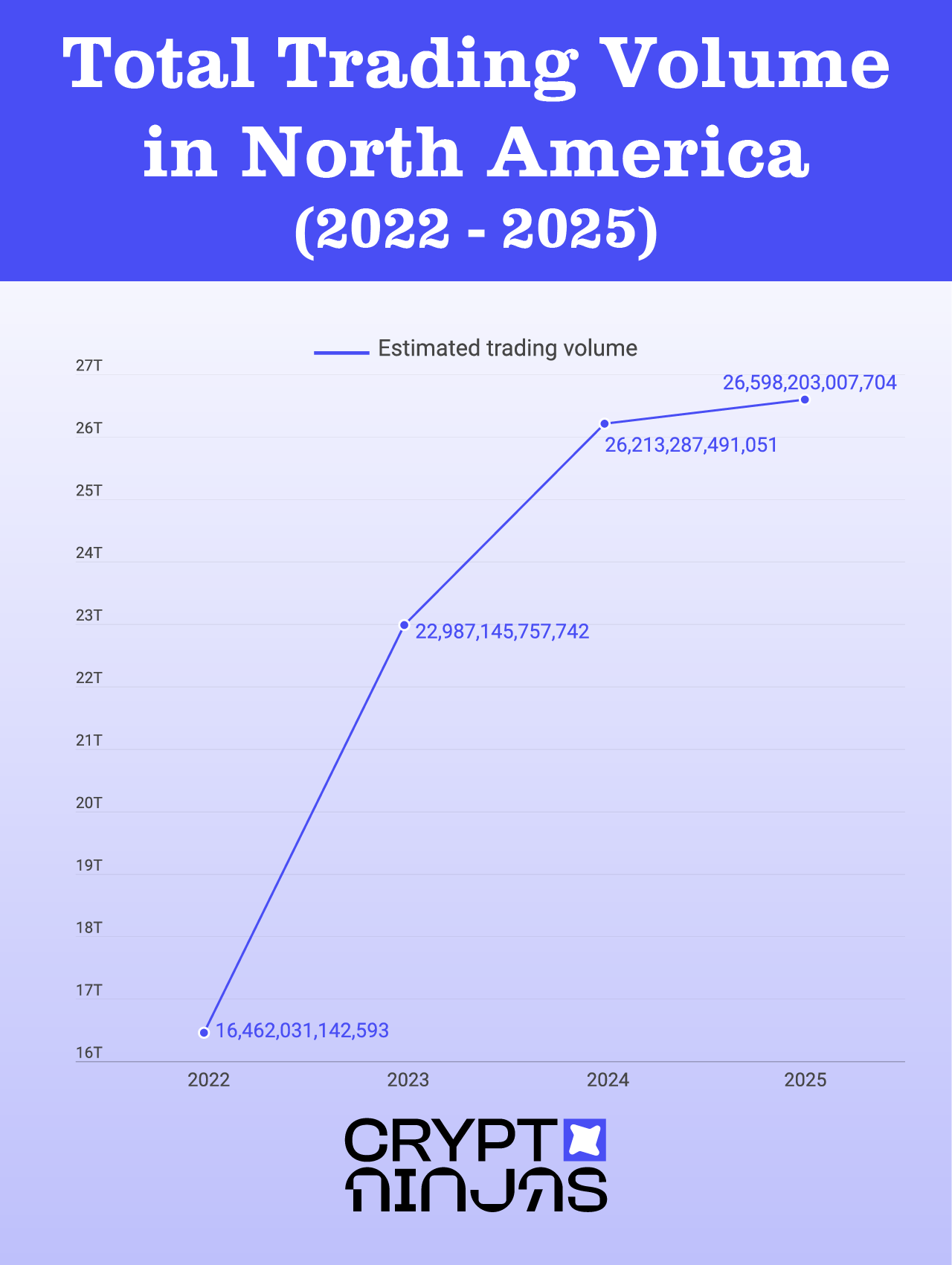

North America: The U.S. Leads the International Market

Complete Buying and selling Quantity in North America (2022-2025)

The US stays the worldwide chief in crypto buying and selling, with an estimated $4.46 trillion in 2025. Canada follows, recording a quantity of over $662 billion. Curiously, whereas U.S. residents commerce essentially the most in absolute phrases, their month-to-month crypto spending is comparatively low at $958 per individual.

The U.S. advantages from excessive institutional involvement, a mature buying and selling ecosystem, and regulatory discussions that form the worldwide market. Regardless of uncertainty, establishments like BlackRock and Constancy are exploring Bitcoin ETFs, additional legitimizing the business.

CEX vs. DEX: The place Are Folks Buying and selling?

Prime 10 International locations Buying and selling the Most on CEXs

United States – $2.6 trillionTurkey – $1.7 trillionIndia – $1.3 trillionSouth Korea – $1.2 trillionRussia – $811 billionUnited Kingdom – $799 billionPakistan – $660 billionVietnam – $556 billionUkraine – $536 billionJapan – $452 billion

Prime 10 International locations Buying and selling the Most on DEXs

Turkey – $1.2 trillionUnited States – $1.8 trillionIndia – $758 billionSouth Korea – $858 billionRussia – $545 billionUnited Kingdom – $583 billionPakistan – $516 billionVietnam – $528 billionUkraine – $465 billionJapan – $377 billion

Breaking down CEX vs. DEX buying and selling, the US, Turkey, and India are essentially the most lively merchants on each platforms, adopted carefully by Korea, Russia, and the UK. Whereas CEX buying and selling nonetheless dominates, DEX exercise is steadily rising, particularly in international locations going through regulatory restrictions. The rise of decentralized finance (DeFi) and peer-to-peer transactions is driving this shift. Greater than 40% of Turkey’s crypto transactions in 2024 occurred on DEXs, as residents moved away from centralized exchanges attributable to inflation considerations and capital controls.

Conclusion

The worldwide crypto market is witnessing unprecedented progress, with Europe main in transaction quantity, Asia as a rising powerhouse, and Africa experiencing speedy enlargement. The US stays the dominant participant, however decentralized exchanges proceed to realize traction. Because the panorama evolves, merchants worldwide are more and more adopting digital belongings, shaping the way forward for finance.

Methodology

This examine aimed to find out which international locations are buying and selling essentially the most cryptocurrency in 2025, specializing in each Centralized Exchanges (CEX) and Decentralized Exchanges (DEX). The methodology adopted a data-driven strategy by amassing key metrics from varied sources to estimate country-wise buying and selling quantity precisely.

Centralized Alternate (CEX) Information Assortment

Choice Standards for CEXs:A listing of CEXs was obtained from CoinGecko.Solely exchanges with a belief rating higher than 6 had been included to make sure reliability.Collected Information Factors:Internet visitors by nation (Supply: Ahrefs)Peak buying and selling time zone for every nation (Supply: CoinGecko)Supported languages on CEX platforms (Supply: CEX web sites)Headquarters location of every CEX (Supply: Wikipedia)Buying and selling Quantity Calculation for CEXs:The buying and selling quantity distribution was decided based mostly on the next issue weights:

The buying and selling quantity for every nation was calculated utilizing the next system:Buying and selling Quantity by Nation = Buying and selling Quantity of CEX × (Internet Visitors × 0.9 + Web site Language × 0.001 + Headquarters × 0.008 + Buying and selling Timezone × 0.001)

Decentralized Alternate (DEX) Information Assortment

Choice Standards for DEXs:DEXs had been sourced from CoinGecko, filtered based mostly on:The best 7-day buying and selling quantity rating.Minimal 24-hour buying and selling quantity of $5M.Collected Information Factors:Internet visitors distribution per nation (Supply: SimilarWeb)Search quantity for DEX-related phrases (Supply: Ahrefs)Supported languages on DEX platforms (Supply: DEX web sites)Buying and selling Quantity Calculation for DEXs:The buying and selling quantity distribution was decided utilizing the next issue weights:

The buying and selling quantity for every nation was calculated utilizing the next system:Buying and selling Quantity by Nation = Complete Buying and selling Quantity of DEX × (Internet Visitors × 0.9 + Search Quantity × 0.05 + Web site Language × 0.05)

Supporting Information Sources

To contextualize and normalize buying and selling quantity throughout totally different international locations, further information factors had been collected:

Nation Inhabitants (Supply: Wikipedia)Price of Dwelling Index (Supply: Numbeo)Common Earnings per Nation (Supply: WorldSalaries)

These components offered insights into the affordability and accessibility of crypto buying and selling in several areas, serving to refine the ultimate evaluation.

Limitations

Whereas this system offers an correct estimate of crypto buying and selling quantity by nation, just a few limitations exist:

CEX and DEX net visitors doesn’t at all times immediately replicate buying and selling exercise, as VPNs and cross-border buying and selling can distort location information.Regulatory adjustments could influence buying and selling quantity mid-year, resulting in fluctuations in nation rankings.Restricted direct on-chain evaluation was carried out, because the examine depends on exchange-reported quantity metrics.

FULL DATA OF THIS STUDY CAN BE FOUND AT: