Ethereum Layer-2 community Starknet reportedly suffered contemporary mainnet downtime, including one other outage to a rising checklist of reliability scares in 2025. Whereas Starknet’s token value information stayed restricted at press time, the community nonetheless secures round $548 million in worth, so each hour offline traps actual cash and freezes actual trades.

This comes as Ethereum scaling options race to draw customers and builders, whilst outages remind everybody that sooner and cheaper doesn’t all the time imply safer.

DISCOVER: High Ethereum Meme Cash to Purchase in 2026

What Simply Occurred to Starknet, And Why Ought to On a regular basis Customers Care?

Starknet is a so‑referred to as Layer‑2 community for Ethereum. Consider it as an categorical lane constructed on prime of the Ethereum freeway that batches many transactions collectively, then settles the end result again to Ethereum for safety. It makes use of a know-how referred to as a ZK‑rollup, which depends on superior cryptography to show that batched transactions are legitimate with out exhibiting each step on Ethereum itself.

In 2025, that categorical lane stored stalling. Starknet’s personal incident report, earlier outages tied to its Grinta (v0.14.0) improve prompted sequencer failures and points with older Cairo0 code. The sequencer is the piece of software program that orders transactions on Starknet, much like a site visitors cop deciding who goes first at a busy junction.

When that site visitors cop fails, all the pieces backs up. In September 2025, Starknet’s downtime lasted so long as 9 hours and even pressured two transaction reorganizations that erased roughly an hour of community historical past.

Throughout a reorg, the chain “rewinds” to a earlier state and builds a brand new model, which may cancel trades and transfers that customers thought had been last. Which means a swap you made or a mortgage you repaid on Starknet would possibly vanish and wish a second attempt.

🚨 STARKNET OUTAGE UPDATE

Starknet has been down for two+ hours and the community is at the moment experiencing downtime.

• The group has acknowledged the problem• Investigation is ongoing• Restoration efforts are in progress• Worth is holding nicely to date

Monitoring for updates.… pic.twitter.com/pJAu2uahen

— Clever Recommendation (@wiseadvicesumit) January 5, 2026

Starknet now ranks amongst Ethereum’s bigger Layer‑2s with about $548 million locked on it. That cash sits in DeFi apps, NFT markets, and wallets that each one rely on the community staying dwell.

So when Starknet goes darkish, customers can not transfer funds, shut positions, or react to cost swings, whereas markets elsewhere on Ethereum maintain transferring with out them.

If you would like a refresher on how Ethereum scaling works extra broadly, 99Bitcoins lined it intimately when Ethereum stablecoin transfers hit $8 trillion in quantity on the Ethereum Community. That big-picture view helps you see why these layers matter a lot.

How Does This Outage Change the Layer‑2 Race on Ethereum?

Starknet competes with different Ethereum Layer‑2s like Arbitrum, Optimism, zkSync, and Coinbase’s Base. Every presents decrease charges and sooner confirmations than the Ethereum mainnet, however each continues to be an impartial community with its personal dangers.

Customers select them like they select banks or brokers: whoever feels safer and smoother over time wins deposits and quantity.

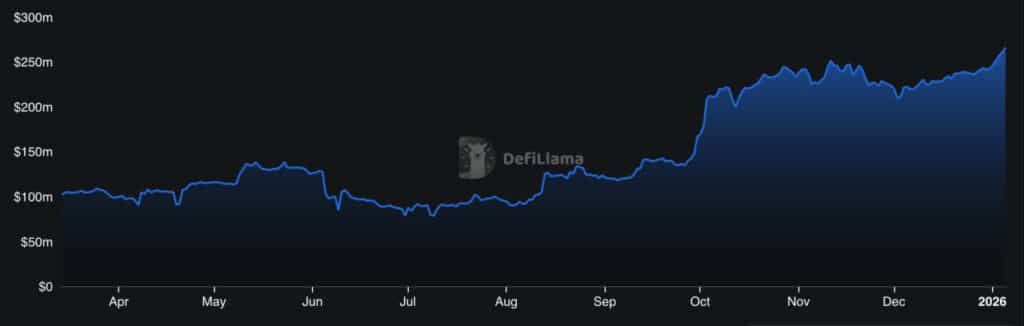

(Supply: Starknet Complete Worth Locked Rise Prior To The Incident / DefiLlama)

Repeated outages chip away at Starknet’s reliability story. Whereas it markets superior cryptography and robust Ethereum safety, customers expertise one thing less complicated: “Can I ship my cash after I have to?” Networks like Arbitrum and Optimism have problems with their very own, however they didn’t undergo the identical sample of lengthy downtimes in 2025. That distinction shapes the place builders launch new apps and the place customers park funds.

In the meantime, the ZK‑rollup sector retains altering. ZKsync Lite will retire in 2026 as groups migrate to newer variations. When base infrastructure modifications that quick, outages remind everybody that this tech continues to be younger.

Even when Ethereum’s personal upgrades, like those we lined in our information to approaching Ethereum upgrades, purpose to make the primary chain extra environment friendly, the Layer‑2s on prime nonetheless have to show they’ll keep on-line.

Starknet additionally pushes towards decentralizing its sequencer in order that one entity not controls transaction ordering. Current incidents raised doubts about whether or not the community can safely make that bounce. A rushed or buggy decentralization may unfold instability as an alternative of lowering it, particularly whereas billions in worth rely on that infrastructure.

For Ethereum itself, these hiccups minimize each methods. On the one hand, they spotlight the dangers of constructing on contemporary infrastructure. Then again, they present the demand for scaling and the strain on groups to enhance rapidly, which strains up with the long-term targets Vitalik Buterin set for the community’s development that we mentioned in our piece on Ethereum.

DISCOVER: High Ethereum Meme Cash to Purchase in 2026

What Ought to Starknet And Ethereum Customers Truly Do Now?

Earlier than you bridge funds into Starknet, ask three easy questions. One: Do I perceive the danger that my cash may be briefly caught? Two: Do I really need the decrease charges for this commerce or yield technique? Three: Is that this cash I can afford to go away alone if one thing breaks for just a few hours or perhaps a day?

Merchants and DeFi customers also needs to watch incident stories just like the one Starknet posted on its weblog. If I had been an investor, I’d watch carefully how the group handles this incident over the subsequent few days.

Groups that publish clear timelines, fixes, and observe‑up plans often deal with issues higher over time than groups that keep quiet. However transparency doesn’t take away threat. It solely helps you decide how critically a challenge treats your deposits.

(Supply: STRKUSD / TradingView)

For learners selecting the place to start out with Ethereum DeFi, a easy rule helps: favor stability first, pace second. Learn the way Ethereum mainnet, main Layer‑2s, and DeFi apps work earlier than you stretch for further yield on much less‑examined networks.

Starknet’s subsequent strikes, how rapidly it stabilizes the sequencer, how brazenly it stories fixes, and the way it handles decentralization, will resolve whether or not customers belief it with extra of their ETH. As Layer‑2 competitors heats up, these reliability tales will matter as a lot as APY and costs.

DISCOVER: High Solana Meme Cash to Purchase in 2026

Observe 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Each day Skilled Market Evaluation

Why you possibly can belief 99Bitcoins

Established in 2013, 99Bitcoin’s group members have been crypto consultants since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Skilled contributors

2000+

Crypto Tasks Reviewed

Observe 99Bitcoins in your Google Information Feed

Get the most recent updates, tendencies, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now