Be part of Our Telegram channel to remain updated on breaking information protection

Solana is poised for “an epic end-of-year run” as doable Solana ETF launches and a $1.65 billion company treasury dedication present the firepower for a rally.

That’s in response to Bitwise’s Chief Funding Officer (CIO) Matt Hougan, who stated in a Sept. 9 memo to buyers that “Solana season” may echo the dynamics that drove Bitcoin and Ethereum to a number of new all-time highs.

“When demand exceeds provide, costs usually go up,” he wrote.

A number of main issuers, together with Grayscale, VanEck, Constancy, and Franklin Templeton, have filed for spot Solana ETFs, with the Securities and Alternate Fee (SEC) rulings due by October 10.

On the identical time, Galaxy Digital, Leap Crypto, and Multicoin Capital have pledged $1.65 billion to Ahead Industries, a brand new publicly traded Solana treasury firm that may purchase and stake SOL at scale.

Ahead Industries has additionally named Multicoin co-founder Kyle Samani as chairman, positioning him to champion SOL publicly as one in all its “most articulate and constant promoters,” just like what Michael Saylor has accomplished for Bitcoin and Tom Lee for Ethereum, Hougan stated.

With Solana’s $121 billion market cap a fraction of BTC’s $2.2 trillion and Ethereum’s $529 billion, even modest inflows may transfer the needle on SOL in outsized vogue, he steered.

Largest cryptos by market cap (Supply: CoinMarketCap)

He estimated that Ahead Industries’ deliberate $1.65 billion SOL purchase would have the identical impact as shopping for $33 billion value of Bitcoin.

“My suggestion? Preserve your eye on Solana within the coming months,” he stated.

The Recipe That Propelled BTC And ETH

Bitcoin soared from round $40K in January 2024, when spot Bitcoin ETFs have been launched, to a brand new all-time excessive of virtually $125K, he stated, earlier than including that the ETH value additionally virtually tripled between April and August this yr below the identical circumstances.

There was a surge in demand throughout that interval as properly. In these months, the Bitcoin community produced 322,681 BTC, whereas ETPs (exchange-traded merchandise) purchased over 1.1 million BTC.

In the meantime, the Ethereum community produced 388,568 ETH, whereas ETPs and companies acquired 7.4 million ETH, the Bitwise CIO famous.

“It’s no shock that the recipe works,” he stated. “It’s basic provide and demand.”

🏛️ Sector Strikes:

🔹 Ahead Industries raises $1.65B in report Solana treasury deal (shares +128%)🔹 SOL Methods permitted for @NasdaqExchange itemizing (ticker: STKE)🔹 Galaxy Digital tokenizes SEC-registered shares on Solana🔹 @Gemini rolls out Solana staking + USDC…

— CoinMarketCap (@CoinMarketCap) September 10, 2025

However Solana Could Want A Catalyst To Match Bitcoin And Ethereum

Hougan warned although that company SOL purchases and doable ETF launches alone gained’t be sufficient to propel the altcoin’s value to new all-time highs.

“There must be a basic cause for buyers to be inquisitive about these autos,” he wrote.

Hougan stated Ethereum solely took off when it grew to become clear that its community can be the primary beneficiary of the stablecoin increase.

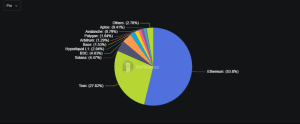

Stablecoin market share by chain (Supply: DeFiLlama)

For Solana, Hougan believes the foremost draw will likely be its a lot larger speeds and considerably decrease charges in comparison with each Bitcoin and Ethereum.

He known as the Solana blockchain a programmable community constructed for stablecoins, tokenized belongings, and decentralized finance (DeFi).

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection