Analyst Weekly, February 16, 2026

Software program simply had its worst non-recession stoop in 30 years. Over the previous 12 months, the group has fallen greater than 30% at its worst level which is the deepest drawdown exterior of a recession in three many years. Roughly $2 trillion in market worth has been erased, and Software program’s weight within the S&P 500 has dropped from 12% to eight.4%.

What spooked the market?

Two forces hit without delay:

AI anxiousness. Traders started pricing in a state of affairs the place new giant language fashions would cannibalize conventional software program quicker than incumbents may adapt.

Technical capitulation. De-risking accelerated. Brief curiosity in large-cap software program moved towards cycle highs. Sentiment turned decisively bearish. Promoting grew to become broad: high quality names and speculative progress alike had been hit.

The market successfully priced in a “worst-case AI disruption” narrative.

However, fundamentals didn’t collapse

Consensus expectations for 2026 nonetheless name for:

~16% gross sales progress; ~17% earnings progress

Slight margin enlargement

Latest earnings help that resilience:

Each S&P 500 Software program firm reporting thus far beat earnings.

Income beats are operating above latest averages.

Development stays stable double-digit.

In the meantime, valuations have compressed materially:

Ahead P/S multiples have fallen by roughly 4 turns.

Ahead P/E has dropped by greater than 10 factors.

Present multiples sit close to ranges seen throughout prior market stress episodes.

In different phrases, costs have reset quicker than fundamentals.

Supply: Bloomberg. Knowledge as of February 15, 2026.

AI: menace or tailwind?

In our view, the near-term actuality is extra nuanced than the headlines.

Enterprise software program is embedded in multi-year contracts with excessive switching prices. AI instruments are more and more being layered into workflows relatively than changing them outright. In lots of instances, AI seems to be additive, creating cross-sell and upsell alternatives, and never instantly disruptive.

Long term, the construction of the trade might evolve. However over the following 3 to six months, the market might have discounted a disruption curve that’s too aggressive.

Why this issues for buyers

For buyers, this setup creates two angles:

Tactical rebound potential: Excessive pessimism & brief positioning & earnings season suggest a fertile floor for sharp reversals if outcomes or steering problem the bearish narrative.

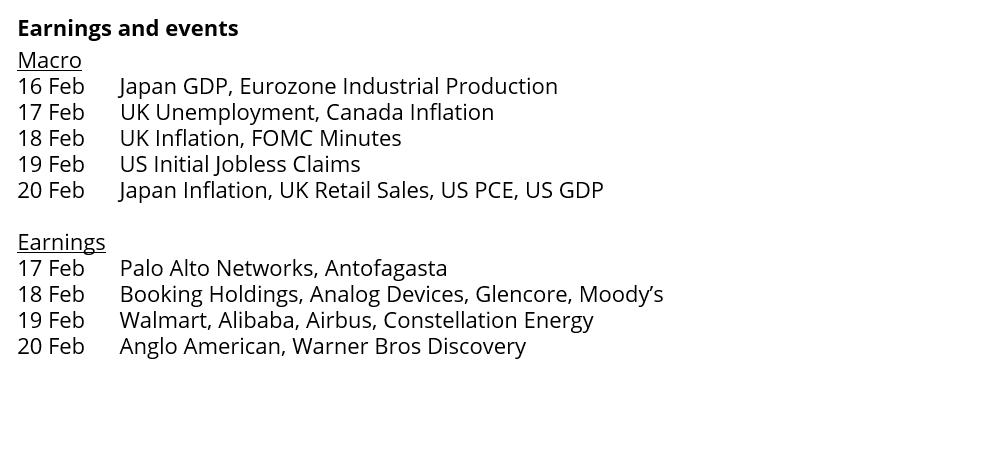

We’re watching upcoming catalysts:

A busy calendar of software program earnings within the coming weeks.

Investor days the place administration groups can instantly handle AI issues.

If positioning resets, rebounds might be swift, particularly in higher-quality segments like cybersecurity and mission-critical enterprise platforms.

Longer-term high quality publicity at decrease entry factors: Many large-cap software program corporations nonetheless generate sturdy free money move, keep sturdy buyer bases, and are growing buybacks. Actually, buyback execution in software program has grown meaningfully over the previous two years, which may present further help at depressed valuations.

Some corporations are seen to be comparatively extra insulated on account of their positioning inside enterprise methods, safety infrastructure, or vertical niches. Right here’s how that panorama breaks down.

Enterprise & Mission-Essential Platforms

These platforms sit on the heart of enterprise structure. Their merchandise are sometimes tied to multi-year contracts, mission-critical workflows, and excessive switching prices; elements that may average near-term displacement danger. Right here, we have now corporations equivalent to:

Microsoft (MSFT): Azure continues to scale as a foundational cloud and AI infrastructure layer.

ServiceNow (NOW): Workflow automation platform embedded throughout giant enterprises.

Oracle (ORCL): Database and cloud infrastructure spine with AI capabilities layered in.

SAP: Core ERP methods deeply built-in into world company operations.

Cybersecurity

Safety spending is usually considered as important relatively than discretionary. AI instruments are more and more being integrated into menace detection and response, suggesting integration relatively than alternative within the close to time period. Right here, we have now corporations equivalent to Palo Alto Networks (PANW);CrowdStrike (CRWD); Zscaler (ZS); Okta (OKTA); SentinelOne (S).

Knowledge & Infrastructure

As AI adoption expands, demand for knowledge storage, processing, monitoring, and safe connectivity stays central to enterprise operations. Infrastructure layers typically scale alongside application-level innovation. Right here, we have now corporations equivalent to Snowflake (SNOW); Datadog (DDOG); Twilio (TWLO); Examine Level (CHKP)

Utility & Vertical Software program

Vertical software program suppliers typically function in specialised industries with regulatory complexity and customised workflows. Lengthy contract durations and domain-specific integration can contribute to income visibility. Right here, we have now corporations equivalent to:

Tyler Applied sciences (TYL): Public sector software program supplier.

Guidewire (GWRE): Insurance coverage core methods.

SailPoint (SAIL):Identification governance options.

JFrog (FROG): DevOps and software program provide chain tooling.

Q2 Holdings (QTWO): Digital banking software program.

CoStar (CSGP): Actual property knowledge and analytics platform.

Throughout all these classes, the frequent thread is structural embeddedness: methods that enterprises depend on day by day. Whereas AI is reshaping software program broadly, the diploma and pace of disruption might differ considerably relying on how central a platform is to operational infrastructure.

Funding Takeaway: The market is pricing in extreme AI disruption. The info, thus far, exhibits resilient progress and earnings beats. Additional draw back can’t be dominated out as volatility stays elevated. However in our view, the danger/reward profile has shifted. When sentiment is that this damaging and fundamentals stay intact, the stability of dangers typically begins to favor restoration relatively than continued collapse. For retail buyers, the important thing query just isn’t whether or not AI modifications software program: it’ll, however not uniformly. The query is whether or not right this moment’s costs already assume an excessive amount of injury, too quickly.

Large in Japan: The Comeback Commerce No one’s Crowded Into

For years, Japan was the market equal of “seen at 9:41pm.” Traders glanced… then went again to the S&P 500.

However 2026? Totally different vibe.

Begin with valuations. Whereas US shares commerce north of 20x earnings, Japan’s sitting nearer to the mid-teens. Not distressed. Not bubbly. Simply… cheaper. And earnings are literally enhancing.

Then there’s reform vitality. The Tokyo Inventory Alternate has been nudging corporations buying and selling beneath guide worth to form up: increase returns, enhance governance, unlock worth. In different phrases, company Japan is being pushed to behave extra shareholder-friendly.

Coverage’s shifting too. Japan is lastly exiting ultra-easy cash mode. Which means increased yields and a firmer yen; which sounds dramatic, however actually alerts one thing more healthy: normalization. After many years of deflation fears, Japan is reflating.

Lastly, positioning. Home buyers are nonetheless underweight equities. Add in world provide chains diversifying away from China, and Japan all of the sudden seems to be strategically related once more.

So no, we don’t suppose this can be a late-cycle melt-up story.

It’s a reform, reflation, and cheap valuation story.

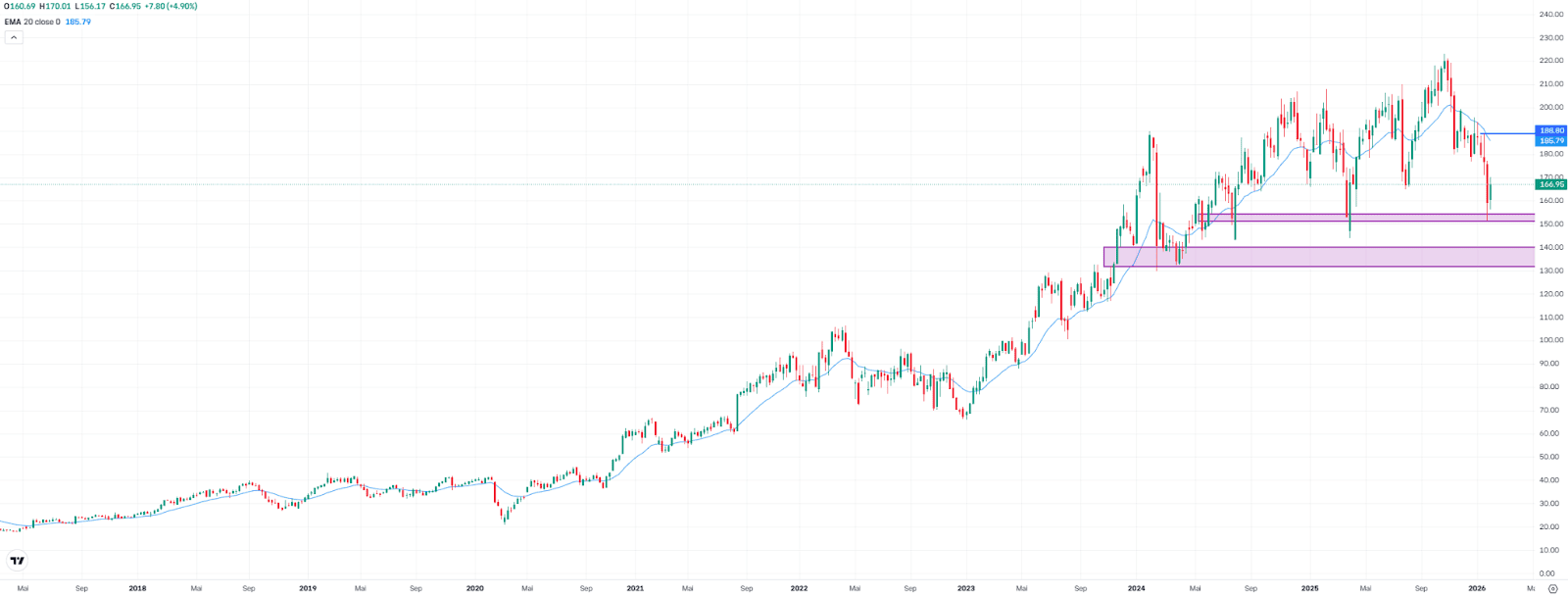

Palo Alto Networks Defends Assist – Earnings in Focus

Palo Alto Networks shares recovered 4.9% final week to $166.95. The technical set off was the profitable protection of the help zone (Honest Worth Hole) between $151.20 and $154.40 within the prior week. This space has already acted as a help zone twice over the previous two years.

The rebound diminished the space to the document excessive to round 25%, after the drawdown had briefly widened to 32%.

Quarterly earnings are due after the shut on Tuesday. They’re prone to decide whether or not the restoration continues or whether or not the long-term help zone will face one other check.

To sustainably enhance the chart image, a transfer above the interim excessive at $188.80 could be required – that is the place the newest promoting wave started. The 20-week shifting common, at present close to $186, can also be situated on this space. A break again above this degree may entice further consumers, however each resistance ranges would have to be cleared decisively.

On the draw back, the following related help zone lies between $133.80 and $140.10.

Palo Alto Networks, weekly chart. Supply: eToro

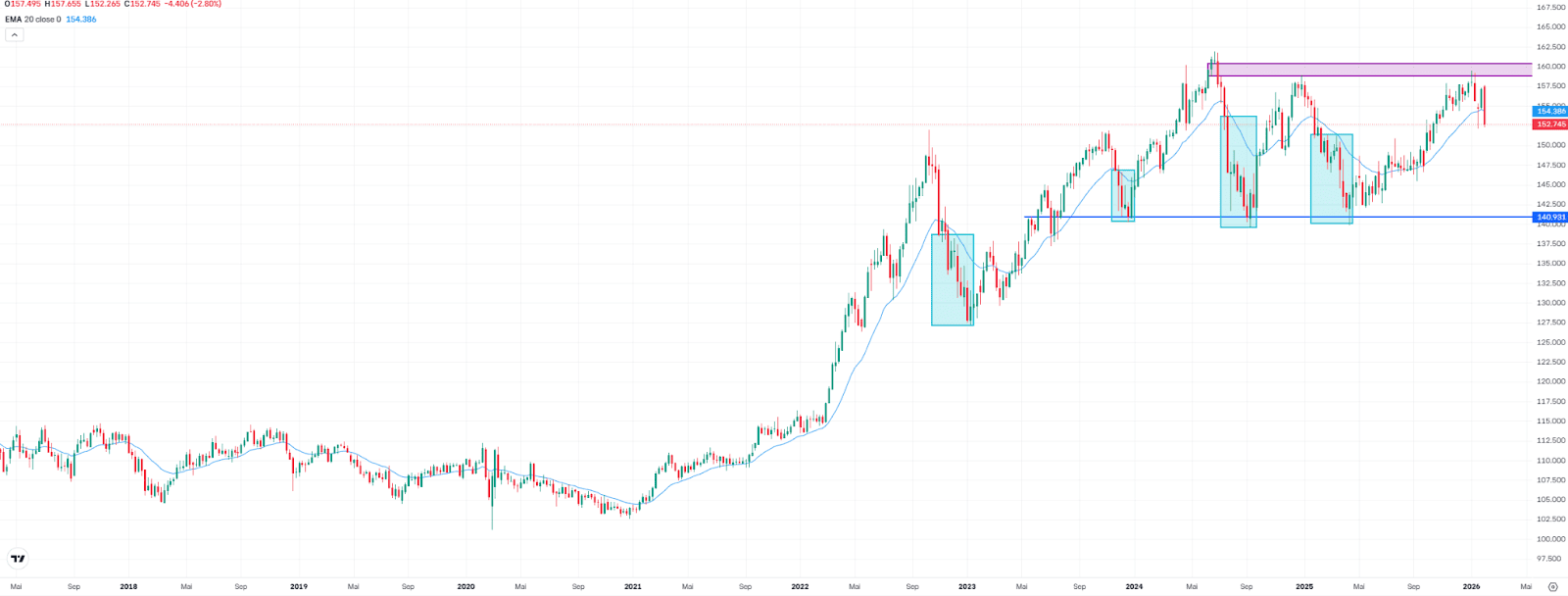

USDJPY Posts Strongest Weekly Decline Since November 2024

USDJPY fell 2.8% final week to 152.75, marking its strongest weekly decline since November 2024. Again in January, consumers had already failed at a long-term resistance zone, a Honest Worth Hole between 158.85 and 160.33. An analogous sample occurred in early 2024.

Final week, the pair not solely reversed decrease but in addition dropped beneath the 20-week shifting common, at present at 154.39. This alerts a short-term shift in route and will increase the probability of additional declines (see blue rectangles within the chart).

From a broader perspective, the realm round 141 comes into focus as a possible draw back goal. Since 2023, this zone has been examined a number of occasions and repeatedly acted as help.

Nevertheless, if the pair climbs again above the 20-week shifting common, one other check of the resistance zone between 158.85 and 160.33 could be doable. For now, the technical setup factors to continued promoting stress.

USDJPY, weekly chart. Supply: eToro

BTC in a Delicate Adjustment Section

Bitcoin enters a brand new week in a fragile part. The correction from the October highs is round 50%, and though we have now seen technical rebounds from the $60,000–62,000 USD space, structural knowledge nonetheless don’t present clear indicators of a definitive backside.

Essentially the most hanging transfer occurred on February 5, when the market recorded roughly $5.4 billion in realized losses in a single day. It was the biggest loss realization occasion since March 2023. At first look, it could possibly be interpreted as capitulation. Nevertheless, when the lens is widened, the context modifications.

Cumulative losses measured in BTC phrases are round 0.3 million. Through the 2022 bear market, that determine exceeded 1.1 million BTC. In different phrases, the adjustment has been important, however it nonetheless doesn’t attain structural cleaning ranges corresponding to earlier cycle bottoms.

Traditional cycle metrics reinforce that studying. MVRV has not entered excessive undervaluation territory. NUPL doesn’t mirror unrealized loss ranges typical of deep capitulation. Roughly 55% of complete provide stays in revenue, whereas at historic lows that proportion approached 45–50%. As well as, worth continues to commerce above the realized worth (the typical buy worth of all BTC holders), situated round $55,000 — a degree that in earlier cycles was clearly breached earlier than a base was shaped.

Market bottoms are not often remoted one-day occasions. They’re processes that require time, volatility compression, and emotional exhaustion.

On the similar time, the macro surroundings stays decisive. Expectations of upper charges for longer proceed to restrict danger urge for food. Till there are clear indicators of financial easing, it’s troublesome for flows to return with sustained energy to the property most delicate to liquidity, equivalent to bitcoin.

On the institutional entrance, ETFs have recorded weekly outflows of roughly $360 million. It’s not a disorderly determine nor corresponding to systemic panic episodes, however it confirms that structural shopping for flows haven’t but returned decisively. Nor are we seeing huge liquidations from long-term buyers, suggesting the market is in an adjustment part relatively than a collapse. All of this paints a transparent image: the market has corrected sharply, cleaned a part of the surplus, however nonetheless doesn’t show the basic signs of a mature backside.

This doesn’t essentially suggest that one other abrupt decline should happen. It means the method might lengthen over time. Consolidation phases following main bull cycles are usually extended and require gradual rebuilding of confidence and flows.

For the investor, the message is extra strategic than tactical. It’s not about anticipating the precise backside, however about understanding the context. Within the absence of clear structural capitulation alerts and with a still-restrictive macro surroundings, prudence stays coherent within the brief time period.

On the similar time, the correction has already considerably diminished valuations from the highs, which begins to open home windows for gradual accumulation on longer horizons, offered one assumes volatility will stay current.

The week forward will doubtless not outline the cycle. However it might present clues in regards to the pace of the adjustment and the resilience of help across the $60,000 space. In markets like this, self-discipline and endurance are sometimes extra worthwhile than the push to anticipate the flip.

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any explicit recipient’s funding aims or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.