Decentralized Finance (DeFi) was constructed on a daring promise, giving everybody equal entry to monetary instruments with out the necessity for banks or middlemen. It’s meant to be open, permissionless, and truthful. Anybody with a crypto pockets ought to have the ability to commerce, lend, or earn with out worrying about hidden agendas.

However in actuality, DeFi isn’t at all times the extent taking part in discipline it claims to be. Behind the smooth interfaces of decentralized exchanges (DEXs), there’s a continuing race occurring, one dominated by bots, superior merchants, and methods designed to revenue on the expense of on a regular basis customers. You may discover trades executing at worse costs than anticipated or end up unknowingly funding another person’s acquire.

These points usually stem from DeFi slippage, front-running, and one thing referred to as Miner Extractable Worth (MEV) or, extra not too long ago, maximal extractable worth.

Let’s break down what these hidden prices really imply, how they work, and the way they quietly eat into your positive aspects. Extra importantly, we’ll discover instruments and methods that may enable you to spot and keep away from them, so you may commerce smarter in DeFi.

Understanding Slippage: The First Silent Killer

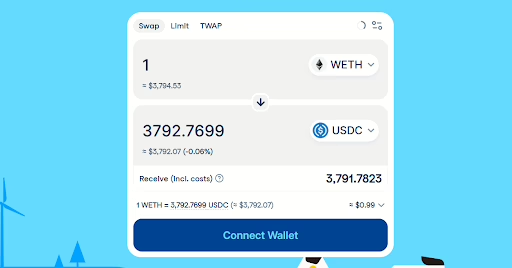

What’s the that means of slippage in crypto? DeFi slippage occurs when the ultimate worth of your commerce is totally different from the worth you anticipated while you hit “swap.” In conventional markets, slippage can happen too, however in DeFi it’s usually worse and extra frequent. That’s as a result of DEXs use automated market makers (AMMs) quite than centralized order books.

Once you commerce on a DEX, you’re not matched with one other individual, you’re buying and selling towards a pool of tokens. And the bigger your commerce, the extra you progress the worth inside that pool.

That is particularly problematic in DeFi as a result of many tokens are thinly traded, costs will be extremely unstable, and liquidity isn’t at all times deep. Even a modest commerce can shift the ratio of tokens within the pool, leading to you getting lower than you thought you’ll.

For instance, for those who’re making an attempt to purchase $2,000 value of a small-cap token, the slippage may trigger you to finish up with solely $1,900 value of tokens based mostly on market worth, simply because your commerce pushed the worth up because it was executed.

What makes DeFi slippage extra harmful is how buying and selling bots make the most of it. Some bots scan the community for incoming giant trades and soar in forward of them, a tactic referred to as front-running.

By putting an analogous commerce earlier than yours, they will drive the worth up barely, then promote on the larger worth after your order completes. This implies you find yourself paying extra, whereas the bot takes a fast revenue. It’s a silent price that may shortly add up for the typical DeFi person.

Entrance-Operating in DeFi: Bots Strike First

What’s entrance operating in crypto? It’s a tactic the place somebody, often a bot, spots your commerce earlier than it’s finalized and jumps forward of it to revenue at your expense. In DeFi, this occurs as a result of transactions aren’t instantaneous.

Once you submit a commerce, it goes right into a public ready space referred to as the mempool earlier than being added to the blockchain. Bots scan the mempool in actual time, looking for giant or worthwhile trades. As soon as they detect one, they race to get their very own transaction confirmed earlier than yours.

Some of the frequent front-running techniques is named a sandwich assault. Right here’s the way it works: a bot sees that you just’re about to purchase a token. It shortly locations a purchase order for that very same token simply earlier than yours, which drives the worth up.

Then, after your commerce goes by means of at this larger worth, the bot sells its newly bought tokens at a revenue. In different phrases, your commerce is sandwiched between the bot’s purchase and promote orders, therefore the identify.

The end result? You pay greater than anticipated in your tokens, whereas the bot earns a fast revenue by manipulating the worth round your commerce. This sort of manipulation isn’t simply irritating, it erodes belief in DeFi platforms and makes the taking part in discipline unfair, particularly for on a regular basis customers who don’t have the instruments or pace to compete with bots.

What’s MEV (Maximal Extractable Worth): A Systemic Problem?

MEV refers back to the additional earnings that miners or validators can earn by reordering, together with, or excluding transactions inside a block. It began gaining consideration on Ethereum, the place block producers realized they might manipulate the sequence of trades of their favor.

As an alternative of simply validating transactions pretty, they started on the lookout for methods to maximise their earnings, usually on the expense of normal customers.

Actual-world examples of MEV embrace issues like liquidations on lending platforms, the place a bot or validator ensures they’re the primary to seize collateral from an undercollateralized mortgage.

Crypto arbitrage is one other frequent tactic, the place bots exploit worth variations throughout DeFi platforms. Sandwich assaults, which we mentioned earlier, are additionally a part of the MEV playbook and are particularly damaging to retail merchants.

The ripple results of MEV are severe. It could drive up fuel charges, as bots compete to outbid one another to get their transactions included first. It additionally results in unpredictable commerce outcomes for customers who might obtain worse costs than anticipated.

Over time, MEV distorts the equity that DeFi goals to supply, creating an uneven setting the place these with technical information and sooner instruments constantly outmaneuver common customers.

Instruments and Protocols Combating Again

Whereas MEV and slippage are persistent points in DeFi, a rising variety of protocols and instruments are being constructed particularly to guard customers and degree the taking part in discipline.

MEV-Resistant DEXs

Some decentralized exchanges are actively redesigning how buying and selling works to stop MEV assaults like front-running and sandwiching. For instance, CowSwap makes use of a novel technique referred to as batch auctions, the place a number of trades are settled collectively, making it tougher for bots to govern the timing.

1inch works by aggregating liquidity from a number of sources and optimizing trades to keep away from being predictable, lowering publicity to dangerous arbitrage.

Osmosis, a non-EVM-based DEX, takes a unique path by designing its personal infrastructure that limits alternatives for MEV extraction. These platforms present that it’s doable to vary core mechanics to make buying and selling fairer.

Privateness-Preserving Buying and selling Instruments

One other main line of protection is privateness. Non-public mempools and encrypted transactions assist hold your commerce intentions hidden till they’re confirmed on-chain.

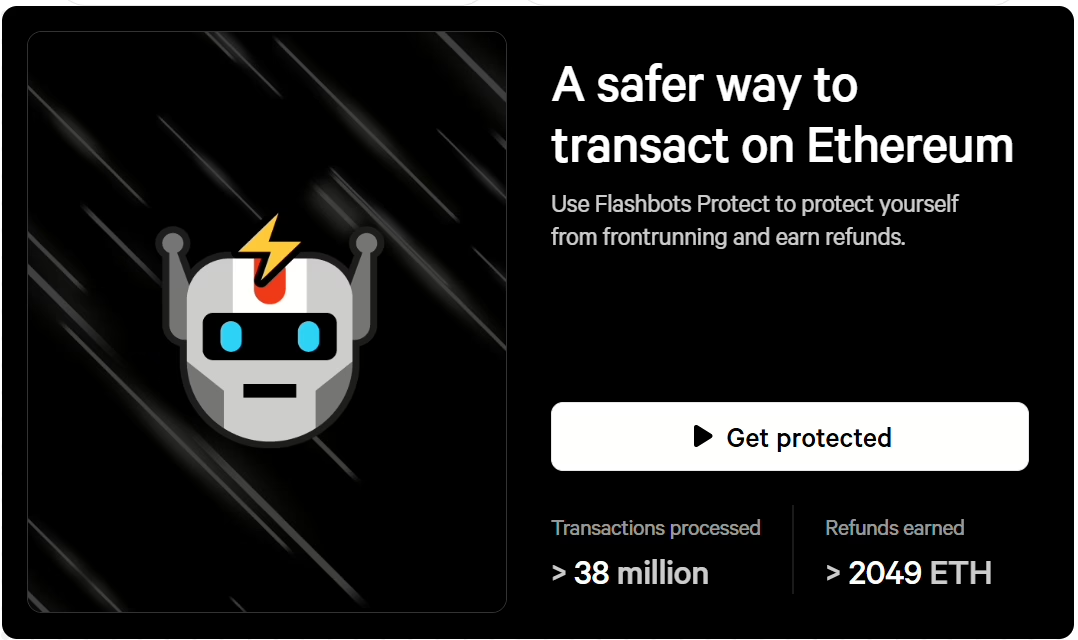

Flashbots Defend is one such software that permits customers to ship transactions on to miners or validators, bypassing the general public mempool the place bots often function.

MEV Blocker is one other browser-friendly resolution that reroutes your transaction by means of a community of validators dedicated to minimizing MEV extraction.

On the protocol facet, zkSync is engaged on options that permit customers to submit non-public transactions utilizing zero-knowledge proofs, lowering the chance of front-running completely.

Higher UX for Slippage Management

Person expertise is bettering too. Many DeFi platforms now let merchants set customized slippage tolerance ranges, in order that they’re not compelled to simply accept giant worth actions throughout a transaction.

For instance, Uniswap permits customers to manually modify DeFi slippage tolerance based mostly on their danger desire. Paraswap supplies real-time worth impression estimates earlier than confirming a commerce.

Some platforms additionally provide clearer warnings or visible previews when a transaction is more likely to be front-run or endure main slippage. These options could appear small, however they offer customers extra management and consciousness, lowering the possibility of strolling into a nasty commerce unknowingly.

Greatest Practices for Retail DeFi Merchants

Whereas DeFi provides thrilling alternatives, navigating it safely requires sensible habits. Listed below are some greatest practices that on a regular basis merchants can undertake to cut back losses from DeFi slippage, front-running, and MEV.

Set reasonable slippage tolerance

At all times customise your slippage tolerance as an alternative of utilizing the default setting. A decrease tolerance (e.g., 0.1–0.5%) helps stop main worth shifts, particularly when buying and selling unstable or low-liquidity tokens. Nonetheless, if the tolerance is ready too low, your transaction may fail. Regulate in line with token liquidity, commerce measurement, and urgency.

Use MEV-protecting platforms and wallets

Instruments like Flashbots Defend or MEV Blocker can route transactions by means of non-public mempools, shielding them from front-running bots. Some wallets and aggregators additionally provide direct integration with these instruments, guaranteeing your trades don’t get exploited earlier than they land on-chain.

Break giant trades into smaller ones

Splitting large trades into a number of smaller ones can cut back DeFi slippage and make it tougher for bots to focus on your transaction. This technique is very useful for illiquid pairs or throughout instances of low community exercise.

Monitor mempool or use transaction privateness instruments

Superior merchants can monitor the general public mempool to identify potential front-running exercise. For many customers, utilizing privacy-focused instruments or platforms with encrypted transaction choices, equivalent to zkSync Period or CowSwap’s batch settlement, may help hold trades hidden from predatory bots.

Conclusion: DeFi Can Be Empowering However Keep Alert

Decentralized finance is constructed on the concept of open entry and person management. It removes the middlemen, provides you full custody of your property, and lets anybody take part in world markets. However that very same openness additionally creates a playground for bots and complex actors who exploit weaknesses like DeFi slippage, MEV, and front-running.

These hidden prices usually go unnoticed by learners, however they will considerably impression commerce outcomes. Each time you swap tokens with out adjusting DeFi slippage settings or use a public mempool with out safety, you danger shedding worth to sooner, smarter actors. Recognizing how these dangers work is step one in avoiding them.

The excellent news is that you just don’t have to be a professional to defend your self. Through the use of MEV-resistant platforms, setting correct commerce parameters, and studying how transaction movement works underneath the hood, you may shield your trades and make higher selections. DeFi is empowering, however solely for individuals who keep knowledgeable.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein needs to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of economic loss. At all times conduct due diligence.

If you need to learn extra articles like this, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”

The publish Slippage, Entrance-Operating, and MEV: The Hidden Prices of DeFi Buying and selling appeared first on DeFi Planet.