The Each day Breakdown digs into the upcoming jobs report, in addition to valuable metals as silver units up for a significant breakout to multi-year highs.

Earlier than we dive in, let’s ensure you’re set to obtain The Each day Breakdown every morning. To maintain getting our every day insights, all you should do is log in to your eToro account.

Thursday’s TLDR

Silver hits 13-year excessive

Jobs report in focus

TSLA hits a pace bump

What’s Occurring?

If the S&P 500 rallied 3%, it could hit new report highs. That’s a fairly beautiful actuality given the volatility traders endured in March and April. And at the least within the brief time period, the roles market could possibly be a key catalyst as to whether we get to these highs — or not.

Tuesday’s JOLTS (job openings) report was stronger than anticipated, a welcome growth for nervous traders. Nonetheless, the ADP report was notably weaker than anticipated. This report is nowhere close to as vital because the one we’ll get tomorrow, which is the month-to-month non-farm payrolls report.

Recognized extra casually because the “month-to-month jobs report,” it is going to make clear the unemployment fee (presently 4.2%) and inform us what number of jobs had been added or misplaced in Could. Presently, economists count on about 125K jobs had been added final month. It’ll additionally replace the prior report (for April) for a extra correct image of the labor market.

However earlier than we get these figures, we’ll obtain the weekly jobless claims report, which measures the variety of people who filed for unemployment advantages for the primary time throughout the earlier week, serving as a well timed indicator of labor market well being.

This determine confirmed an uptick final week to 240K, however fortunately, spikes to this space have usually been short-lived outlier weeks over the previous yr (as proven above). In that sense, it could be good to see it lose some momentum this week.

By the best way, 5 extra cryptocurrencies simply grew to become out there for buying and selling on eToro. Discover them right here or click on the banner beneath.

Wish to obtain these insights straight to your inbox?

Enroll right here

The Setup — Silver

We’ve talked about gold quite a bit these days, and I even posted about it on the eToro feed this morning. However silver is the one making an enormous transfer in pre-market buying and selling.

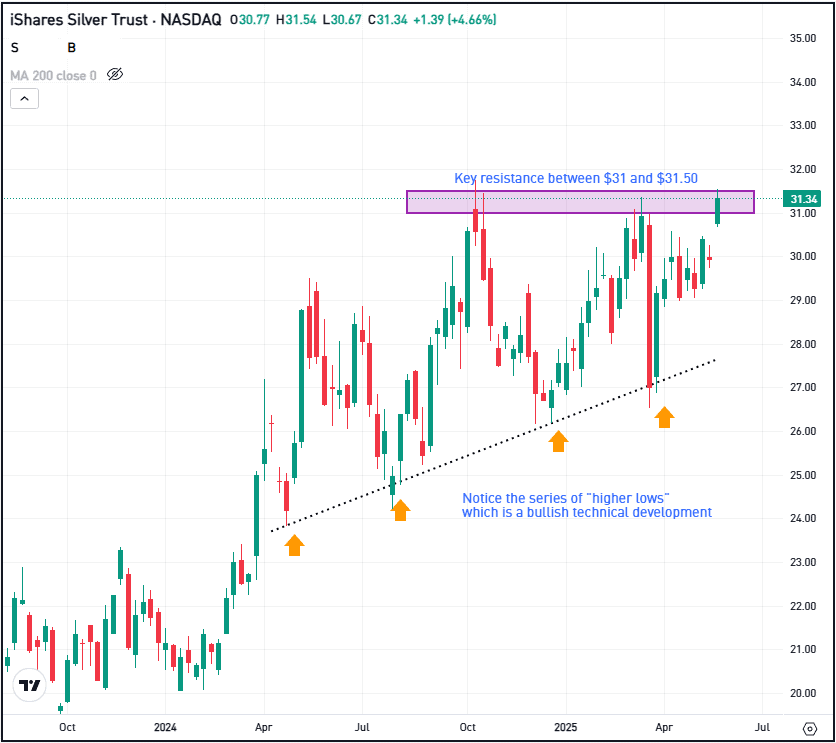

Whereas the GLD ETF is up modestly this morning, the SLV ETF, the most important silver-based ETF, is up nearly 4%. If it opens close to present ranges, will probably be properly above its present 52-week excessive of $31.80 and can mark the fund’s highest value in additional than a decade.

As of 8:00 a.m. ET, the SLV ETF is buying and selling close to $32.50 in pre-market buying and selling. If these positive aspects maintain into the open, will probably be properly above the important thing resistance space of $31 to $31.50. If immediately’s rally holds up, bulls will need to see this former resistance stage turn out to be help.

If that occurs, it may act as a significant technical catalyst, serving to organising for the subsequent potential leg increased in silver. Nonetheless, if SLV breaks again down beneath $31, it may lose fairly a little bit of its present momentum and will commerce decrease within the brief to intermediate time period.

Choices

For some traders, choices could possibly be one different to take a position on SLV. Bear in mind, the chance for choices consumers is tied to the premium paid for the choice — and shedding the premium is the complete danger.

Bulls can make the most of calls or name spreads to take a position on additional upside, whereas bears can use places or put spreads to take a position on the positive aspects really fizzling out and SLV rolling over.

For these trying to study extra about choices, take into account visiting the eToro Academy.

What Wall Road is Watching

TSLA

Shares of Tesla fell 3.6% yesterday and are down once more in pre-market buying and selling. European gross sales stay pressured for Tesla, at the same time as general EV gross sales proceed to leap. Additional, there’s a fear that Musk’s public criticism of the present Republican-led tax invoice may create political rifts. Observe the information on Tesla proper right here.

CRWV

Shares of CoreWeave — an organization that Nvidia owns a 7% stake in — have been on hearth. Whereas the inventory jumped greater than 8% yesterday, CRWV is up greater than 40% to this point for the week. And from its April twenty first low, the inventory is up nearly 400%. Be at liberty to trace the chart for CRWV.

MDB

MongoDB inventory is flying increased this morning, up greater than 15% in pre-market buying and selling after the agency reported earnings. Earnings of $1 per share got here in properly forward of analysts’ expectations of 67 cents a share, whereas income of $549 million topped estimates for $528 million. It’s value stating that MDB shares tumbled greater than 25% in March following a disappointing report.

Disclaimer:

Please notice that on account of market volatility, a number of the costs could have already been reached and eventualities performed out.