Key Takeaways:

A dormant whale pockets holding Bitcoin since 2010 has simply transferred 8,500 BTC (≈ $1 billion) to Galaxy Digital.That is the primary recognized motion of funds from this tackle in over 14 years, sparking intense hypothesis throughout the crypto neighborhood.The huge switch, probably an OTC deal, coincides with heightened market volatility and renewed consideration on long-lost Satoshi-era wallets.

A sleeping large within the crypto world has stirred. A whale pockets, untouched since Bitcoin’s earliest days, has made its first transaction in over a decade, sending $1 billion price of BTC to Galaxy Digital. This sudden transfer is fueling debate about market implications, possession origin, and potential shifts in institutional crypto technique.

Whale Pockets Sends Shockwaves By means of the Market

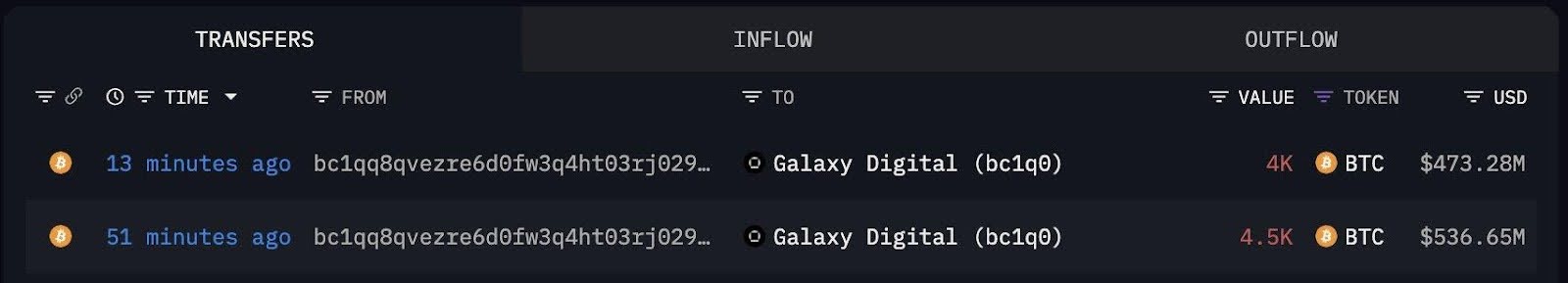

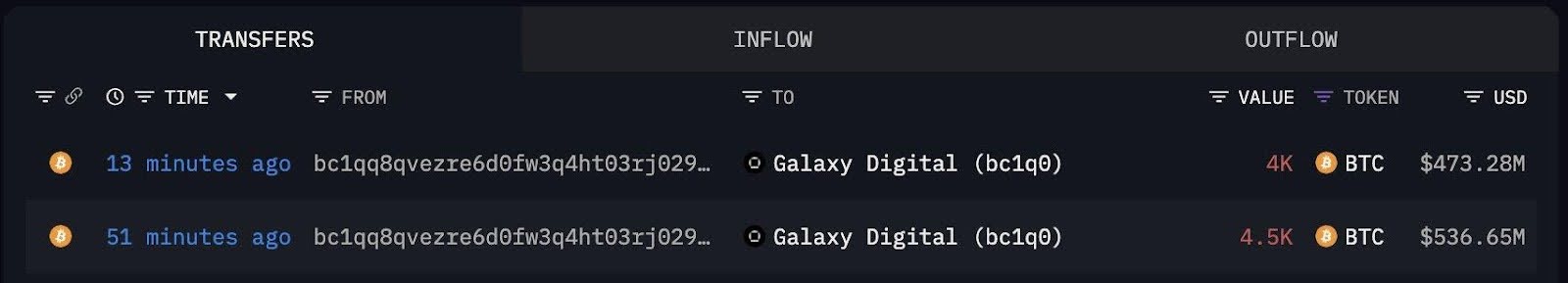

On July 15, blockchain analytics platform Spot On Chain flagged an enormous on-chain switch: 8,500 BTC (roughly $1 billion) was despatched from a Satoshi-era pockets to Galaxy Digital, a widely known crypto funding agency based by Mike Novogratz.

Learn Extra: Galaxy Raises $175M to Supercharge Early-Stage Crypto Startups Amid Market Headwinds

The pockets tackle out of which they had been transferred has been inactive greater than 14 years, which means that the cash had been obtained or mined on the first years within the lifespan of Bitcoin. Spot On Chain says that that is the first-time this tackle ever despatched out any Bitcoin because it was activated.

The transaction appears to be included in OTC (over-the-counter) deal, because it has a construction and route. Whales and establishments therefore often use OTC trades to stop slippage, and preserve their footprint out there small. This enables massive transactions to be carried out with out shifting market costs abruptly.

Satoshi-Period Cash: Why It Issues

Dormant Wallets and Market Psychology

The Satoshi period Bitcoin dormant wallets courting again to earlier than 2011 have a legendary mark within the crypto. Anytime they do that, the suspicions rise about who really created Bitcoin within the first place, with rumors of Satoshi Nakamoto and his or her enigmatic persona or the priority that outdated insecure storage techniques have had their keys hacked into.

Though there is no such thing as a direct testimony to the truth that this pockets belonged to Satoshi, himself, the actual fact that it was left unspoiled after over 14 years has given it the cloak of thriller. The cash of the pockets had been little doubt mined when the worth of Bitcoin was lower than $0.10 and it’s a good reminder of the fortunes that early lovers have earned

Related exercise was just lately noticed in Coinbase govt Conor Grogan who mentioned that deserted wallets of greater than a billion {dollars} might be attributable to stolen keys. However right here, a direct motion to Galaxy Digital signifies the organized in all probability authorized sale as an alternative of legal exercise.

Who Is Behind the Switch?

Though the precise proprietor of the pockets continues to be not recognized, there are indications that the proprietor is extremely succesful and related affair. Engagement of a licensed and professional-grade crypto firm, Galaxy Digital, means that this was not an on-the-fly choice by some unknown early crypto fanatic, however a deliberate attractor of liquidity.

Galaxy Digital Galaxy Digital, based by ex-hedge fund supervisor Mike Novogratz, is making extra strikes within the OTC Bitcoins markets and caretaking endeavors. This sale will be a sign that Galaxy might be a liquidity supplier to these holders of legacies who wish to exit or rebalance their portfolio.

Learn Extra: Galaxy Digital acquires crypto custody and asset infrastructure supplier BitGo

At this level, analysts consider that the whale is promoting out of crypto, after a protracted interval of appreciation, or getting ready of one other important funding cycle.

Market Alerts from a Dormant Big’s Transfer

The timing of this transfer is critical. Bitcoin has been buying and selling within the $115,000 – $123,000 vary, and up to date inflows and outflows from whale wallets have been carefully tied to short-term value volatility.

Whereas this switch didn’t occur on a public alternate, thus not instantly impacting order books, it nonetheless holds psychological weight. The crypto market typically reacts strongly to old-wallet exercise, particularly when it entails such massive volumes.

If extra dormant wallets change into lively, it might result in:

Elevated promote stress if massive holders resolve to money out at present valuations.Renewed narratives round long-term holders exiting the market.Heightened safety considerations if there’s any suspicion of personal key compromise.

To this point, nonetheless, Bitcoin has remained comparatively steady following the switch, indicating restricted panic, and presumably even rising confidence that these cash are being absorbed by institutional patrons.

The Dormant Pockets Nonetheless Holds $1.3 Billion

The opposite pockets taking part within the transaction proceed to have greater than 11,000 BTC, which is price over $1.3 billion, primarily based on the on-chain information supplied by Arkham Intelligence. This implies the $1B switch pun supposed, really may simply be the start.

That creates a possibility if the holder desires to money out their total place, probably a multi-billion-dollar liquidity occasion. However, if the transfer was merely for strategic relocation (like for custody, property planning, or an make investments partnership) the remainder of the fortune will not be touched in the interim.