Regardless of a serious outflow only a day earlier, Spot XRP ETFs have defied bearish sentiment, setting file buying and selling volumes and attracting contemporary inflows. This resilience and surge in investor demand is especially shocking given the current crash within the XRP worth and the general downturn within the broader crypto market.

Associated Studying

XRP ETFs Defy Developments And Hit File Quantity

XRP is making headlines after its ETF skilled contemporary inflows following a big outflow. In response to knowledge from SoSoValue, XRP ETFs noticed a file $92.9 million drop on January 29, 2026. This marked the most important discount since their launch on November 13, 2025.

Since changing into out there for buying and selling, XRP ETFs have registered solely three outflows, with the current $92.9 million lower being the third. This withdrawal was primarily pushed by Grayscale’s GXRP, which noticed a whopping $98.39 million go away the fund, partially offset by inflows into Franklin Templeton’s XRPZ, Bitwise’s XRP ETF, and Canary’s XRPC.

On the time of the outflow, the whole internet property of XRP ETFs fell to $1.21 billion from $1.39 billion the day earlier. The decline coincided with a drop in XRP’s worth, which fell from $1.92 to $1.80 over 24 hours. Unexpectedly, XRP ETFs picked up only a day after the $92.9 million withdrawal. They recorded a day by day complete internet influx of $16.79 million, though complete internet property nonetheless declined barely to $1.19 billion.

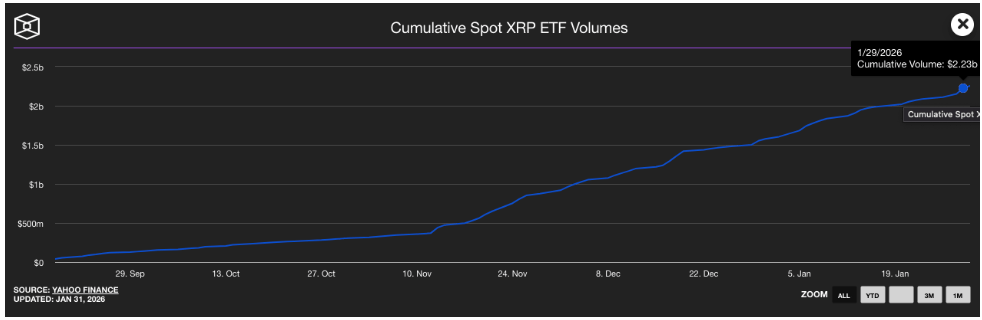

Extra impressively, Spot XRP ETFs achieved file buying and selling volumes regardless of the general downtrend. Information from The Block reveals that XRP ETFs noticed their cumulative quantity rise to $2.23 billion from $2.15 billion simply in the future after the $92.9 million day by day outflow. Studies indicated that Bitwise’s XRP ETF had the best buying and selling quantity on the time, adopted by Grayscale’s GXRP, Franklin Templeton’s XRPZ, Canary’s XRPC, and 21Shares TOXR, in that order.

By way of complete Property Below Administration (AUM), XRP ETFs declined barely, falling from $1.48 billion to $1.32 billion following the January 29 outflow.

XRP Worth Continues Slide Amid Market Uncertainty

Whereas XRP ETFs are recovering from current outflows, the cryptocurrency’s worth continues to say no, extending its losses from earlier this 12 months. In response to CoinMarketCap, XRP has dropped by greater than 11% over the previous week and a little bit over 3% within the final 24 hours. Following this decline, its worth now sits round $1.69, representing a greater than 15% fall from its $2 stage seen just some weeks in the past.

Associated Studying

XRP’s day by day buying and selling quantity can be down by greater than 26.6% on the time of writing, indicating a possible decline in dealer confidence and rising uncertainty available in the market. Supporting this development, XRP’s Worry and Greed Index has fallen into the “Worry” zone. The broader crypto market is displaying related weak point, with the index signaling excessive concern throughout main digital property.

Featured picture from Unsplash, chart from TradingView