Ripple is shifting deeper into the plumbing of the worldwide monetary system, positioning XRP as a essential software for institutional settlement relatively than only a speculative asset.

The corporate’s newest technique outlines how XRP is transitioning right into a core infrastructure layer for funds and liquidity.

DISCOVER: Prime 20 Crypto to Purchase in 2026

What This Means for XRP and Institutional Adoption

In case you are new to crypto, the time period “institutional settlement” would possibly sound dry, however it’s extremely necessary. Consider it because the second cash truly modifications arms between large banks or monetary companies. Proper now, this course of is sluggish and costly.

Ripple goals to repair this through the use of XRP as a bridge, permitting worth to maneuver in seconds relatively than days.

Simply in: @Ripple outlines institutional DeFi blueprint for XRPL with compliance-focused infrastructure positioning $XRP as settlement and bridge asset. pic.twitter.com/j7m5o4ADQy

— CoinDesk (@CoinDesk) February 6, 2026

This isn’t about retail buyers buying and selling cash on an app; it’s about regulated monetary giants utilizing blockchain know-how to clear transactions. This idea is commonly referred to as “Institutional DeFi” (Decentralized Finance).

It brings the velocity of crypto to the safety-obsessed world of conventional banking. By embedding XRP into this workflow, the community strikes away from relying solely on market sentiment and towards important each day utility.

DISCOVER: Greatest New Cryptocurrencies to Put money into 2026

How Ripple Is Constructing the Infrastructure

To make this imaginative and prescient work, the know-how must be extra than simply quick—it needs to be helpful for advanced monetary merchandise. **Ripple** just lately launched an perception detailing how the XRP Ledger (XRPL) is evolving to help these wants. The technique focuses on particular “constructing blocks” like cost processing, liquidity, and on-ledger credit score.

Based on the report, new options are being rolled out to help these workflows. These embrace “Single-Asset Vaults” and a brand new Lending Protocol (XLS-66), which permit establishments to borrow and lend straight on the blockchain. As an alternative of those options appearing alone, they’re designed to work collectively.

“Every function just isn’t a silo, it’s a constructing block for composable monetary ecosystems, tied collectively by XRP.”

XRP is rising because the spine for real-world monetary infrastructure.

Check out the Institutional DeFi roadmap under. It lays out precisely how the XRP Ledger is evolving right into a each day use layer for establishments, with XRP powering settlement, FX, collateral, and on-chain…

— Reece Merrick (@reece_merrick) February 6, 2026

Moreover, latest strikes within the area underscore this institutional focus. For instance, partnerships in custody and safety are paving the way in which for banks to carry and use these property safely. XRP is used to pay transaction charges and fulfill reserve necessities on this ecosystem, creating a continuing, purposeful demand for the token.

Why Utility Issues Extra Than Value Hypothesis

Why must you care about settlement layers in case you are simply holding XRP? The reply lies in sustainability. Within the crypto world, costs usually spike primarily based on hype or rumors. Nevertheless, hype finally fades. Utility: precise folks and companies that want the token to make their software program work create a worth ground.

If Ripple succeeds in making XRP the usual for institutional settlement, demand for the token turns into tied to world financial exercise relatively than simply investor temper. Nevertheless, you must also pay attention to the dangers. Institutional adoption is a sluggish, bureaucratic course of.

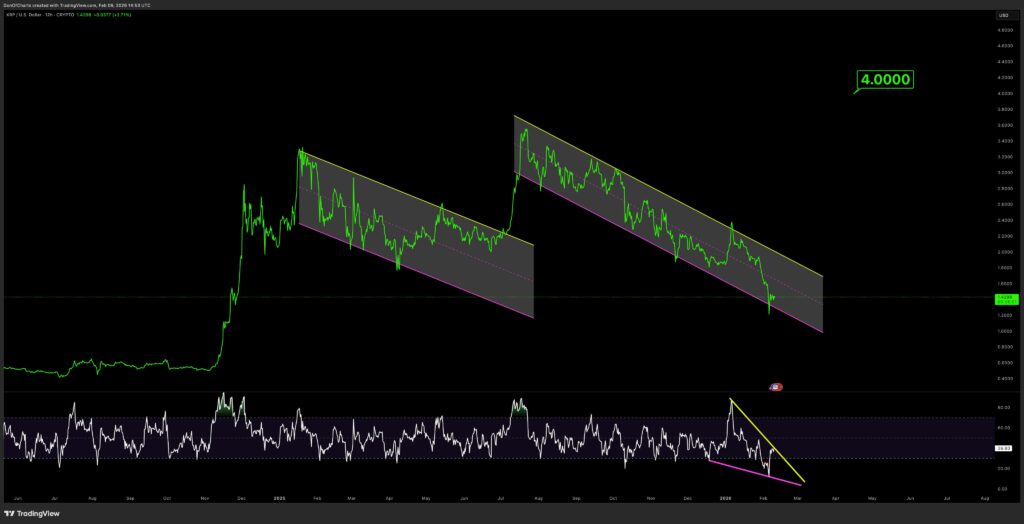

(Supply: XRPUSD / TradingView)

Not like a viral meme coin, this technique performs out over years, not weeks. It requires persistence and a perception that conventional finance will proceed emigrate onto the blockchain.

DISCOVER: Prime Solana Meme Cash to Purchase in 2026

Observe 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Day by day Knowledgeable Market Evaluation

Why you possibly can belief 99Bitcoins

Established in 2013, 99Bitcoin’s workforce members have been crypto consultants since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Knowledgeable contributors

2000+

Crypto Initiatives Reviewed

Observe 99Bitcoins in your Google Information Feed

Get the most recent updates, tendencies, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now