Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ripple chief know-how officer (CTO) David “JoelKatz” Schwartz used a late-Wednesday publish on X to border a surge of funds and stablecoin corporations launching their very own base-layer networks as validation of blockchain’s position in finance—and to restate how the XRP Ledger’s design differs from the brand new entrants.

“We’ve been seeing increasingly more gamers within the funds and stablecoins house launch their very own blockchains. To me, that’s a transparent signal the market sees blockchain as core monetary infrastructure — one thing we’ve believed in and have been constructing towards on the XRP Ledger for over 13 years,” he wrote, including, “Launching a blockchain is difficult. Constructing an ecosystem with builders, liquidity, belief, and real-world utilization is even tougher.”

Competitors For Ripple And The XRP Ledger?

Schwartz located XRPL’s posture within the long-running debate over community governance. “Some blockchains are constructed with permissioned validator units managed by one entity or a small group. This may present management and compliance for particular, closed-network eventualities, nevertheless it limits attain, resilience, and the power for anybody to contribute to securing and rising the community,” he wrote.

Associated Studying

“As lots of you recognize, the XRPL is public and permissionless at its core, with non-obligatory permissioned options for regulated use circumstances.” He argued that the ledger’s open base “makes it adaptable, interoperable, and well-positioned to function essential infrastructure for the world’s monetary system — connecting belongings, markets, and members seamlessly throughout borders.”

The remarks arrive as two US fintech heavyweights transfer into L1 territory. Circle this week unveiled Arc, an EVM-compatible Layer-1 it says is “purpose-built for stablecoin finance,” with dollar-denominated charges (USDC as native gasoline), opt-in privateness, a built-in RFQ-style FX engine, and “deterministic sub-second settlement finality” through the Malachite consensus engine. Circle says Arc will enter non-public testnet within the coming weeks, goal public testnet within the fall, and a mainnet beta in 2026.

Individually, Stripe is creating Tempo, a high-performance, payments-focused L1 being inbuilt partnership with crypto VC agency Paradigm. Tempo is designed to run code appropriate with Ethereum, is presently in stealth with a small group, and it stays unclear whether or not it can have a local token.

Schwartz additionally highlighted particular XRPL design selections he sees as aligned with financial-grade settlement. “It’s encouraging to see some newer chains undertake design selections which have lengthy been a part of the XRPL’s structure, like deterministic finality … It reveals there’s rising alignment within the business on the significance of predictable, dependable settlement for monetary functions with out costly validation,” he wrote.

He reiterated that XRPL charges are supposed to keep “low and predictable, simply fractions of a cent, and not using a separate gasoline token,” noting that “each transaction on the XRPL makes use of/burns XRP.” XRPL’s technical documentation specifies that every transaction destroys a small quantity of XRP as an anti-spam charge, and describes consensus guidelines aimed toward deterministic ordering and finality.

Associated Studying

The place Schwartz drew a line was on governance flexibility. He acknowledged that permissioned validator units could make sense for “particular, closed-network eventualities,” however underscored XRPL’s method: a public, permissionless core with opt-in controls for compliance wants.

The ledger’s native options embrace Licensed Belief Traces, Deposit Authorization/Preauthorization, and issuer-level freeze tooling for issued belongings—not for XRP itself—permitting regulated token issuers to gate or police flows with out changing your complete community right into a walled backyard. XRPL’s personal FAQ emphasizes that it’s a decentralized, public blockchain the place adjustments require supermajority validator approval.

The strategic distinction with the brand new fintech chains is already seen. Arc explicitly facilities USDC—making charges dollar-denominated and embedding Circle’s funds stack—whereas XRPL retains XRP for charges and settlement whereas supporting issued belongings via trust-line mechanics. If Tempo proceeds as reported, Stripe could be pursuing an Ethereum-compatible L1 optimized for predictable funds efficiency, probably mirroring Arc’s enterprise-centric pitch however with a broader merchant-services integration floor.

Schwartz closed on a intentionally expansive be aware in regards to the aggressive set: “Trying ahead to the following part of XRPL improvements, bringing extra programmability, compliance-grade capabilities, and deeper liquidity for institutional use,” he wrote—earlier than welcoming rivals: “And to these simply getting began… Welcome to the occasion! The crypto tent is barely getting larger.”

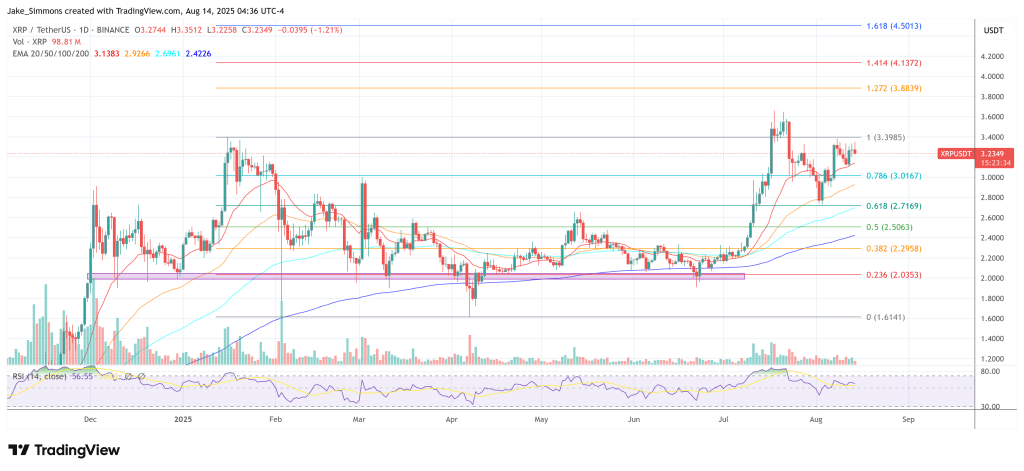

At press time, XRP traded at $3.23.

Featured picture created with DALL.E, chart from TradingView.com