Bitcoin has been combating decrease lows in latest weeks, leaving many buyers questioning whether or not the asset is getting ready to a significant bear cycle. Nevertheless, a uncommon knowledge level tied to the US Greenback Energy Index (DXY) suggests {that a} vital shift in market dynamics could also be imminent. This bitcoin purchase sign, which has solely appeared 3 times in BTC’s historical past, might level to a bullish reversal regardless of the present bearish sentiment.

For a extra in-depth look into this subject, take a look at a latest YouTube video right here:Bitcoin: This Had Solely Ever Occurred 3x Earlier than

BTC vs DXY Inverse Relationship

Bitcoin’s value motion has lengthy been inversely correlated with the US Greenback Energy Index (DXY). Traditionally, when the DXY strengthens, BTC tends to wrestle, whereas a declining DXY usually creates favorable macroeconomic circumstances for Bitcoin value appreciation.

Regardless of this traditionally bullish affect, Bitcoin’s value has continued to retreat, lately dropping from over $100,000 to under $80,000. Nevertheless, previous occurrences of this uncommon DXY retracement recommend {that a} delayed however significant BTC rebound might nonetheless be in play.

Bitcoin Purchase Sign Historic Occurrences

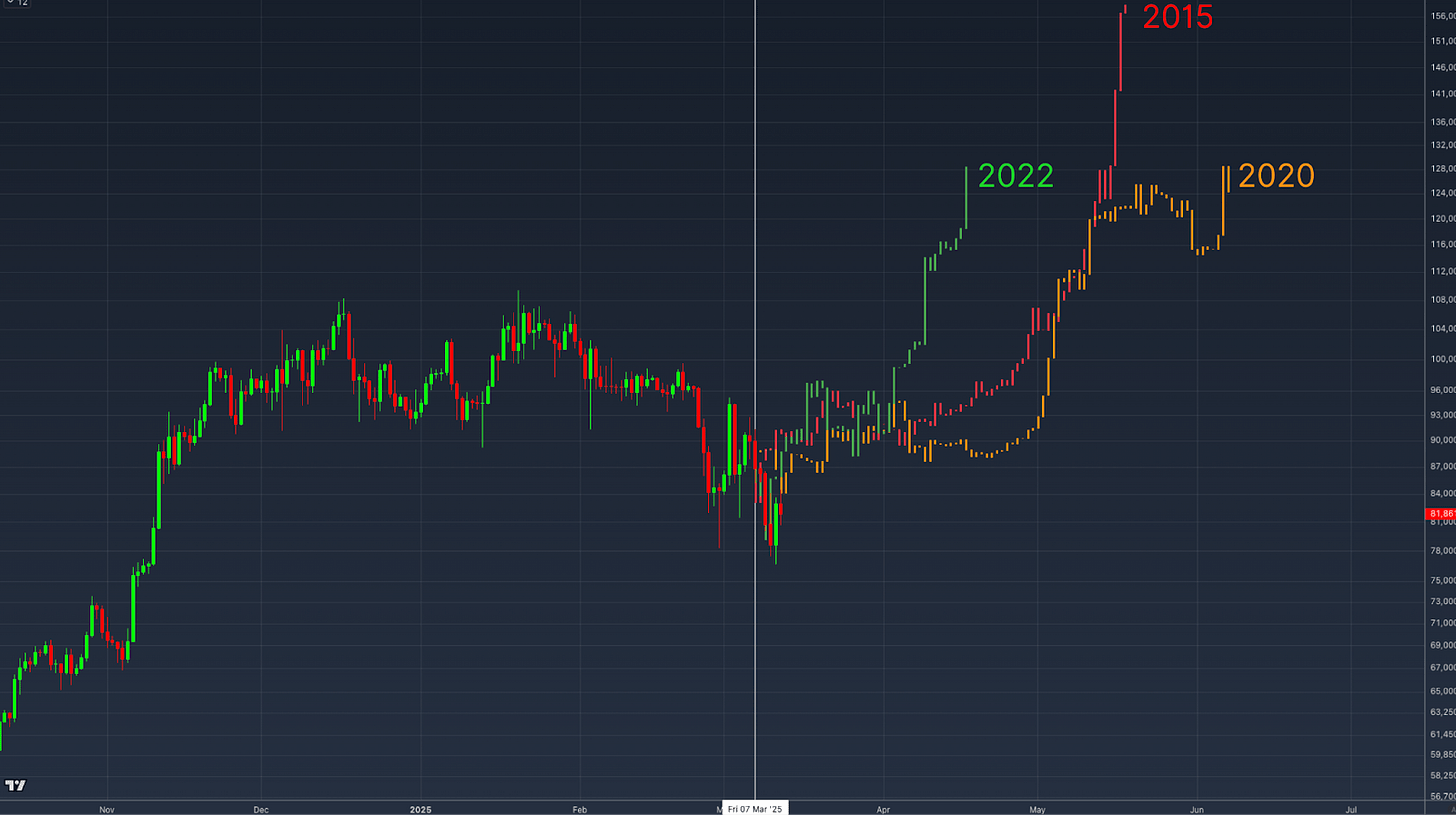

Presently, the DXY has been in a pointy decline, a lower of over 3.4% inside a single week, a charge of change that has solely been noticed 3 times in Bitcoin’s total buying and selling historical past.

To know the potential affect of this DXY sign, let’s look at the three prior cases when this sharp decline within the US greenback energy index occurred:

2015 Put up-Bear Market Backside

The primary incidence was after BTC’s value had bottomed out in 2015. Following a interval of sideways consolidation, BTC’s value skilled a big upward surge, gaining over 200% inside months.

The second occasion occurred in early 2020, following the sharp market collapse triggered by the COVID-19 pandemic. Much like the 2015 case, BTC initially skilled uneven value motion earlier than a speedy upward development emerged, culminating in a multi-month rally.

2022 Bear Market Restoration

The newest occasion occurred on the finish of the 2022 bear market. After an preliminary interval of value stabilization, BTC adopted with a sustained restoration, climbing to considerably increased costs and kicking off the present bull cycle over the next months.

In every case, the sharp decline within the DXY was adopted by a consolidation section earlier than BTC launched into a big bullish run. Overlaying the value motion of those three cases onto our present value motion we get an thought of how issues might play out within the close to future.

Fairness Markets Correlation

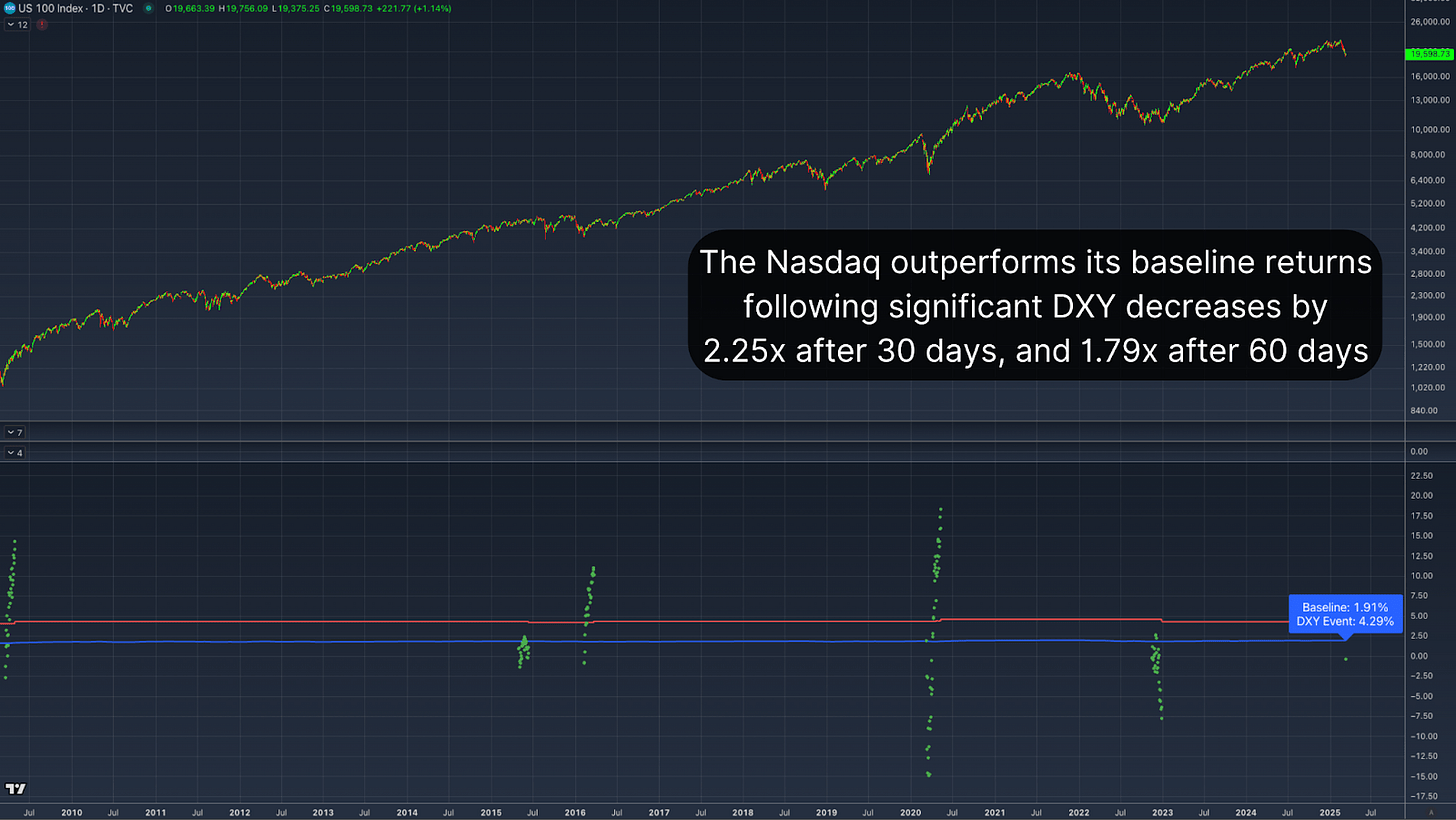

Curiously, this sample isn’t restricted to Bitcoin. An identical relationship will be noticed in conventional markets, significantly within the Nasdaq and the S&P 500. When the DXY retraces sharply, fairness markets have traditionally outperformed their baseline returns.

The all-time common 30-day return for the Nasdaq following an identical DXY decline stands at 4.29%, nicely above the usual 30-day return of 1.91%. Extending the window to 60 days, the Nasdaq’s common return will increase to almost 7%, practically doubling the everyday efficiency of three.88%. This correlation means that Bitcoin’s efficiency following a pointy DXY retracement aligns with historic broader market developments, reinforcing the argument for a delayed however inevitable constructive response.

Conclusion

The present decline within the US Greenback Energy Index represents a uncommon and traditionally bullish Bitcoin purchase sign. Though BTC’s instant value motion stays weak, historic precedents recommend {that a} interval of consolidation will possible be adopted by a big rally. Particularly when strengthened by observing the identical response in indexes such because the Nasdaq and S&P 500, the broader macroeconomic setting is establishing favorably for BTC.

Discover stay knowledge, charts, indicators, and in-depth analysis to remain forward of Bitcoin’s value motion at Bitcoin Journal Professional.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. At all times do your personal analysis earlier than making any funding selections.