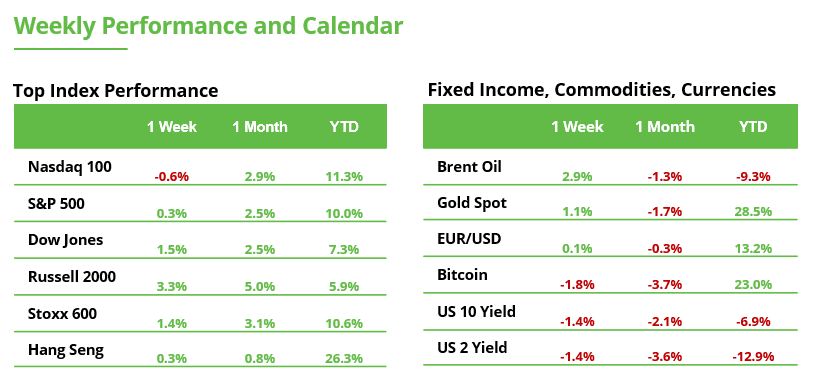

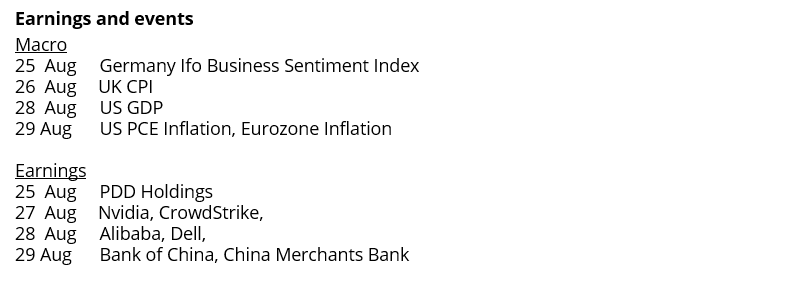

Analyst Weekly, August 25, 2025

Charge Minimize Now in Play

Fed Chair Jerome Powell used his Jackson Gap speech to sign a shift: a fee lower is again on the desk, probably as quickly because the September FOMC assembly. The tone was much less about inflation, extra about rising dangers to jobs. Powell flagged that unemployment may rise “shortly,” making labor market deterioration a prime concern.

That risk-management framing mattered. Powell stated “the stability of dangers is shifting,” signaling the Fed’s focus is transferring from combating inflation to managing draw back dangers. Markets bought the message: after a five-day shedding streak, the S&P 500 surged on renewed fee lower hopes.

On inflation, Powell acknowledged that tariffs at the moment are clearly pushing up costs however referred to as it a “one-time” stage shift—transitory, in Fed-speak. Inflation pressures are nonetheless brewing underneath the floor (e.g., producer costs), however except long-term expectations, like 5yr5yr forwards, transfer increased, the Fed is prone to look via it.

If inflation expectations keep anchored, the Fed has cowl to ease. Now it’s Nvidia’s flip. If AI demand holds up, tech may give this rate-cut rally one other leg increased.

Nvidia Earnings Preview: Narrative Management Is the Actual Take a look at

Nvidia reviews earnings on August 27 towards a backdrop of elevated expectations and renewed market momentum following dovish Fed commentary. Whereas consensus forecasts second-quarter income at simply over $46B and EPS at $1.01, up 54% and 48% year-over-year, respectively, latest intra-quarter information suggests a top-line nearer to $47-$48B, with gross margins exceeding 72%. But the important thing check will likely be steering and whether or not Nvidia can credibly meet the market’s $54B hopes for the subsequent quarter.

China stays a fabric danger. Experiences of manufacturing halts for the H20 chip, following Beijing’s pushback on US-approved exports, complicate the narrative. Any progress, or lack thereof, on this entrance may sway sentiment. In the meantime, Blackwell GPU shipments are ramping sooner than anticipated, underpinned by strong hyperscale funding and early adoption amongst enterprise and sovereign patrons.

That broadening demand base is crucial. Nvidia’s long-term edge relies upon not simply on cloud management however on full-stack AI integration, spanning networking, software program, and packaging. Falling element prices and higher yields assist margin sturdiness whilst capex scales.

With Nvidia now the biggest weight within the S&P 500, its outcomes carry market-wide implications. Choices markets are pricing in a 6% transfer in both path. Its valuation leaves little room for disappointment. The larger query is whether or not Nvidia can reaffirm its roadmap, led by Blackwell and Rubin, as central to the subsequent leg of AI infrastructure. If it does, the funding case stays intact. If not, the market’s focus danger comes sharply into focus.

AI’s Knowledge Centre Gold Rush

Meta’s Prometheus and Hyperion, Musk’s Colossus, and OpenAI’s Stargate are grabbing headlines as $100B+ AI supercomputer initiatives. However the actual capital burn isn’t the flashy machines, it’s the info centres to accommodate them, in what’s shaping as much as be one of many largest capital deployments in trendy historical past.

The Spending Spree

Huge Tech is on tempo to spend $350B this yr and $400B+ in 2026 simply on information centres. By 2029, Morgan Stanley estimates the world will pour almost $3T into AI infrastructure. Right here’s the kicker: hyperscalers (AMZN, MSFT, GOOG, META) can solely self-fund about half. That leaves a $1.5T hole for personal fairness, sovereign funds, and debt markets to fill.

Debt financing has already doubled this yr to $60B, with companies like Apollo, KKR, and Blackstone racing to underwrite mega-projects.

New Fashions, Previous Dangers

Meta tapped $29B (largely debt) for brand new websites in Ohio and Louisiana.

Oracle is leasing a $15B Texas centre constructed by Crusoe and Blue Owl, then reselling capability to OpenAI for $30B/yr.

CoreWeave, as soon as a crypto miner, is now a $65B AI information centre participant, financed with $10B in GPU-backed loans.

The Dangers

Overcapacity: Demand forecasts assume “AI all over the place.” If adoption slows, stranded property loom.

Obsolescence: Nvidia’s speedy chip cycles and new cooling tech may make at this time’s multi-billion-dollar centres outdated quick.

Hypothesis: Some initiatives lack anchor tenants, echoing the Nineties telecom fibre bubble.

Investor Takeaway: AI information centres have gotten a $3T asset class — half actual property, half tech, half utilities. Hyperscalers with sturdy stability sheets can take in dangers. Overleveraged builders and speculative financiers? Not a lot. The winners will likely be these securing long-term leases with investment-grade tenants and dependable energy entry.

World Container Index continues to fall – Margin strain on transport traces will increase

The Drewry World Container Index fell by 4% final week to $2,250 per 40-foot container, confirming its downward development (see chart). The index displays freight charges for container transport. A yr in the past, the worth was nonetheless above $5,300.

For transport corporations similar to Maersk, COSCO Transport, or Hapag-Lloyd, this implies ongoing margin strain. Income per container is declining, whereas prices for gas, personnel, and port prices stay excessive. This was additionally mirrored in Hapag-Lloyd’s latest half-year outcomes. Though group income rose by 10%, internet revenue fell by 3.1%.

Container transport corporations are additionally extremely depending on financial situations and commerce coverage. New tariffs improve the price of exports and will weigh on commerce volumes and bookings. Logistically, new challenges are additionally rising. Rerouted shipments drive up prices and uncertainty, whereas the variety of empty sailings may rise. For patrons, planning safety decreases, and long-term contracts could also be concluded much less often. This makes investments similar to fleet growth or port modernization harder.

Relying on the commerce route and market place, transport corporations are affected to various levels. A sustainable enchancment would primarily rely on extra secure commerce coverage situations. Buyers can use the WCI as a further indicator on this tariff-driven market section.

World Container Index, 1-year growth. Supply: Drewry

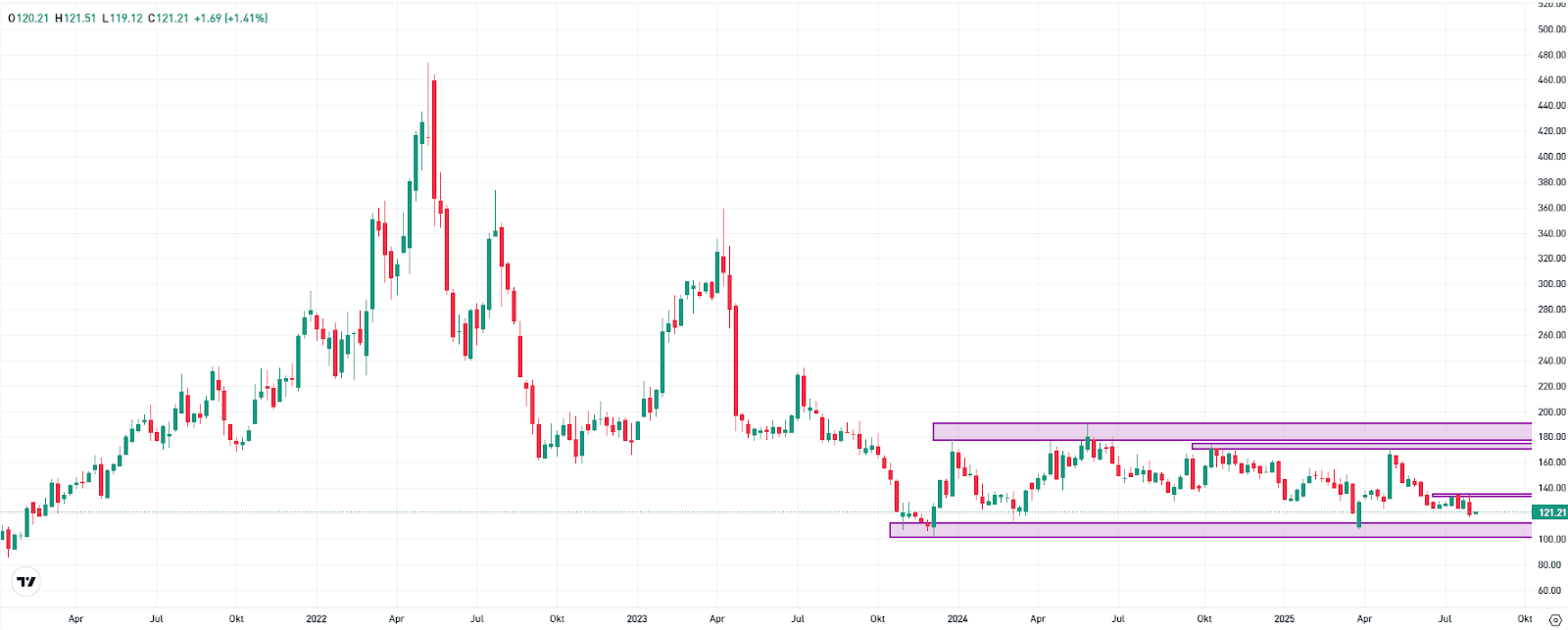

Hapag-Lloyd: Lengthy-term sideways vary

The Hapag-Lloyd share has been transferring in a broad sideways vary for nearly two years. The decrease boundary of this zone lies between €102 and €113, whereas the higher boundary is between e177 and €190. Inside this vary, resistance has additionally shaped, as the value has repeatedly marked decrease highs round €170.

At the moment, the share worth is as soon as once more approaching the decrease boundary of this consolidation zone. A break to the draw back may set off additional downward momentum, which is why technical warning is warranted. A primary optimistic step, alternatively, can be a transfer above the short-term interim excessive at €135.50, which would offer an preliminary technical restoration sign.

Hapag-Lloyd within the weekly chart. Supply: eToro

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any explicit recipient’s funding aims or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product are usually not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.