Counter to in style discourse, we argue that upgrades to Bitcoin — such because the BitVM, OP_CAT or OP_CTV — will stabilize Bitcoin consensus. By opening up new miner charges and decreasing reliance on extractive pooling schemes, additions to Bitcoin will create community sustainability, push miners away from extra harmful types of expressivity and assist Bitcoin keep its lead in stability with out injecting rivalrous or centralizing types of income.

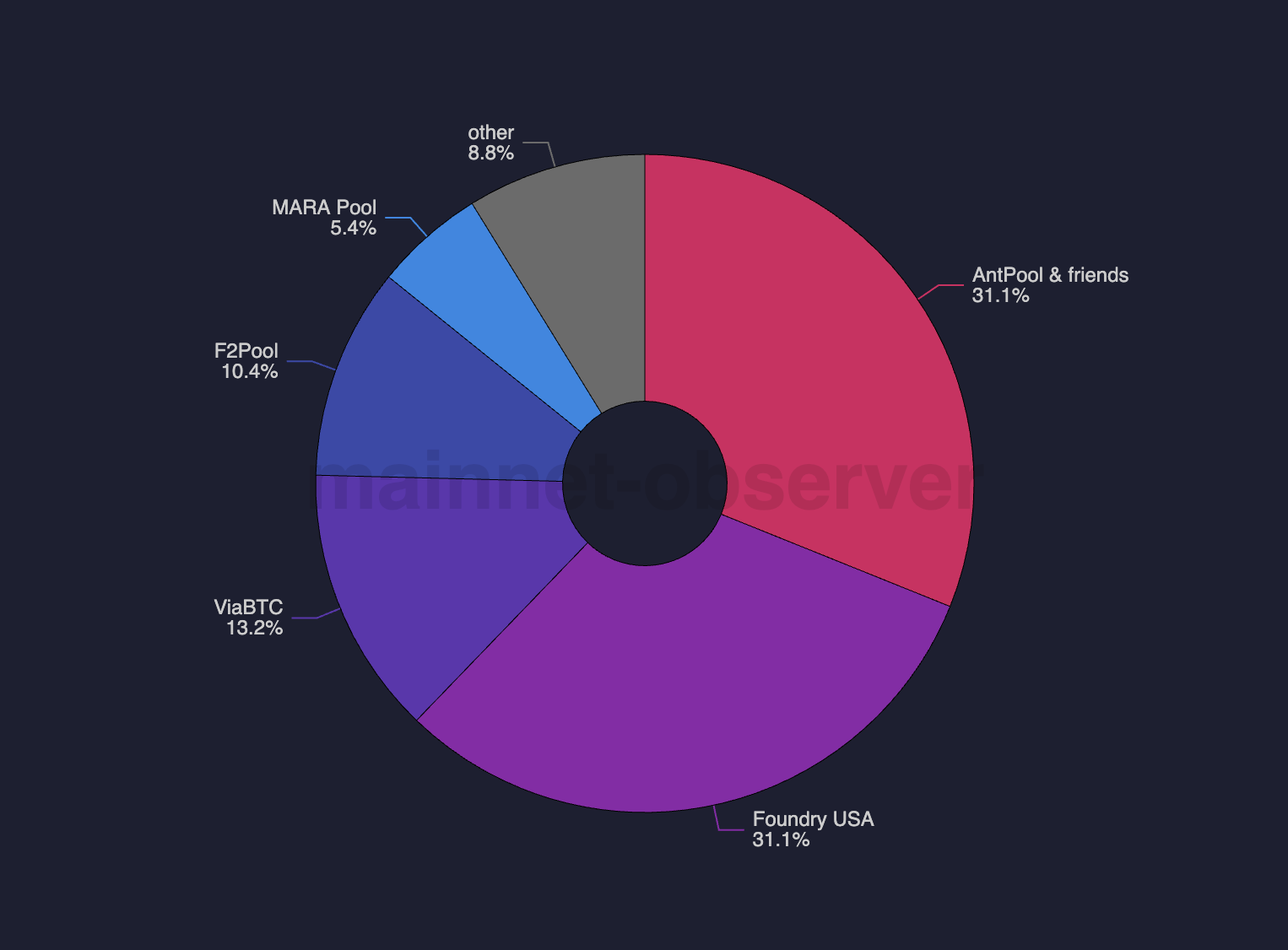

A wholesome mining market is important to the longevity of Bitcoin. Final 12 months, amid low blockspace demand, Bitcoin’s greatest miners started to merge mine for further charges. Whereas exploration has its place, this hints that with out issuance, miners in want of income will destabilize Bitcoin by embracing worse types of expressivity. Given this, we discovered ourselves asking: How would completely different types of expressivity alter Bitcoin’s prospects for stability? Specifically, how would expressivity and costs change its mining market, which is dominated by simply 5 swimming pools?

Maybe the strongest argument to not add expressivity to Bitcoin is the irreducible dangers related to extra opcodes: in different phrases, that covenants might “Ethereum-ize” Bitcoin. Nonetheless, when rightly grasped, we imagine nonlinear and ephemeral charges, Bitcoin consensus and proof of labor’s (PoW) race situations will protect it from the worst types of entrenchment.

Going ahead, we imagine sure opcodes can truly degree the miner taking part in area, stewarding Bitcoin’s core properties and shutting the door to the unhealthy expressivity being adopted.Within the following, we evaluation and set up primary miner and person wants. We rapidly evaluation classes from Ethereum’s historical past with expressivity, then study miner pool economics and, lastly, utilizing OP_CAT as a proxy, we discover the way forward for mining when Bitcoin is expressive.

What Do Bitcoin Miners and Bitcoin Customers Want?

Miners Want feeeeeees

All miners want charges to remain hashing. Whereas low charges and undifferentiated {hardware} indicate that mining is a commodity enterprise, huge miners wield actual energy over small ones. Huge miners subsidize mining by market cycles through distinct enterprise strains. Alternate Matrixport and miner Bitdeer are examples of this, as are ASIC maker Bitmain and mining pool Antpool.

This dynamic is pushed by smaller miners leaning on giant ones to easy their usually variable income. Small miners have little management over bigger miners and pool operators and can’t survive with out them at the moment.

Customers Want a Respectable UX

Whereas miners are steered by income, customers want a dependable expertise. This implies each the standard of transacting, in addition to censorship resistance and settlement assurances of bitcoin.

Customers embody DLC-powered lenders, stakechains, Metaprotocols and, after all, merge-mined chains (drivechains). All customers want robust inclusion and settlement assurances from miners. Designs carefully tied to hashrate — together with drivechains — create economies of scale in mining.

Hash-based expressivity creates a reciprocal sport the place customers wanting inclusion ship transactions solely to the miners operating the expressive (however unreliable and sometimes unverifiable) infrastructure. On this hash-based but programmatic world, different miners can compete with their very own expressivity, however feather forks, reorgs and assaults drive consolidation to the biggest miners.

Merely put, hash-based expressivity severely degrades Bitcoin’s defining property of sovereignty by severely centralizing Bitcoin mining.

What’s the Various?

With out embracing safe, egalitarian avenues for miners to earn income, Bitcoin slow-walks towards PoW-based expressivity. At greatest, this implies merge mining and Metaprotocols; at worst, it means the collapse of stability and censorship resistance as re-orgs drive centralization.

Clearly, some fixes (akin to tail issuance) are out of the query. Our view — constructed on Ethereum’s historical past — is that opcodes can strengthen Bitcoin by injecting secure charge variance and new pool-level accountability. The remainder of this piece seems to be at classes from Ethereum earlier than utilizing mining at the moment to color an image the place Bitcoin is steady on account of its expressiveness.

Vectors for Censorship on Ethereum

PBS: How and Why We Obtained Right here

Whereas Ethereum goals to be “moderately egalitarian,” extra charges can be found through Maximal Extractive Worth (MEV). Higher movement, capital, knowledge and infrastructure let savvy actors develop, gaining energy in any respect layers. Issues over this energy led to Proposer Builder Separation (PBS). Underneath this design, resource-heavy constructing (transaction harvesting and ordering) is sandboxed into its personal aggressive market, enabling easy and complicated nodes alike to mine probably the most worthwhile block. PBS goals to make block constructing as aggressive as doable.

Ethereum MEV At present

Atomic MEV (e.g., liquidations, sandwiching, and many others.) is finished completely on-chain, making it extra aggressive. Atomic MEV entails a closed loop, all-or-nothing transaction, with capital sourced on-chain. This lowers dangers and obstacles to entry, making it moderately open.

In distinction, asynchronous MEV is very rivalrous. As outlined in Flash Boys 2.0 — a well known 2019 analysis paper by a workforce of researchers, largely from Cornell College — asynchronous MEV is primarily realized in decentralized exchanges, which “actually current a severe safety danger to the blockchain techniques on which they function.” MEV launched through DEXs is outlined by its exclusivity (and entrenchment).

At present’s Ethereum block constructing is owned by two teams: arbitrageurs (who compete with capital, latency, proprietary fashions and decrease charges) and people with tit-for-tat Unique Order Circulation (EOFs). Fixes proceed to be sought, together with inducing native constructing by altering default staker settings. Moreover PBS-adjacent analysis and work on buildernet, designs that dampen centralization from arbitrage or EOF are restricted.

What’s the Huge Deal?

Centralization at any level undermines censorship resistance of whole networks and opens up verticalization. On Solana, the coupling of liquid staking to a MEV shopper lets Jito dominate MEV.

Very similar to built-in searcher-builders (who internalize prices, and many others), integration of an LST into the MEV market lowers dangers, enhances profitability and creates a constructive loop of unique order movement. With out staking, ASICs and swimming pools stay the looming risk for verticalization in Bitcoin.

Classes from Proof-of-Work Ethereum

Previous to the merge, Ethereum was outlined by PoW. As soon as community charges eclipsed block rewards, front-running of transactions and personal mining swimming pools (with precedence entry) turned frequent.

The priority for PoW Ethereum then is similar for Bitcoin at the moment: App incentives threaten decentralized consensus. Early researchers evened PoW Ethereum through mevgeth, a shopper letting any miner public sale off blockspace to stylish events for egalitarian income.

Given Bitcoin’s restricted expressivity, most points frequent to PoW Ethereum don’t map. Nonetheless, as a result of ongoing expressivity debates round new opcodes, Ethereum’s major perception of retaining mining open and limiting rivalrous financial exercise is pertinent for Bitcoin.

Relevance for Bitcoin Swimming pools: Zooming in

Bitcoin’s pooling market stays understudied. Over the following Halvings, safety will shift from issued cash to charges; to maintain Bitcoin steady, mining should keep aggressive and open.

What Retains Bitcoin Steady?

Ethereum consensus selects proposers every epoch, delegating leaders mounted slots. This absolute monopoly over blockspace permits excessive extraction. In distinction, whereas Bitcoin miners nonetheless management blocks, the slot shouldn’t be mounted and as an alternative ends randomly. Race situations from hashing nonces immediate fast transaction inclusion and quick propagation of blocks to mining friends. Mentioned otherwise, with many contributors, the community all the time races ahead, staying steady and open.

Therefore, solely with a considerable quantity of hashrate consolidation or with centralizing types of expressivity (talked about above), will Bitcoin’s censorship resistance (and worth) degrade.In different phrases, whereas miners nonetheless have a type of monopoly on inclusion, PoW’s race situations make sure that so long as mining is aggressive, inclusion pressures are robust. In our view, this implies the terminal concern for Bitcoin is mining sustainability. All different points, together with worth accrual, reorgs or different assaults, and community stability, are downstream of miner stability and miner economics.

Fundamentals of Mining Pool Abuse

At present, giant miners and swimming pools skim income, maintain templating opaque, and even conduct assaults to maintain smaller miners subservient. Once more, small miners solely use swimming pools to scale back luck inherent in PoW. Inside a pool, a centralized server templates blocks and pushes them to miners. ASICs hash the template for a golden nonce (a legitimate block).

Most swimming pools have closed supply mining firmware and pay out rewards primarily based on issuance, not charges inside a given block. Just a few completely different pool schemes are used, together with:

Pay-Per-Share (PPS): Miners get much less variance by incomes their share of the anticipated worth of the pool’s issuance rewards. Swimming pools can lose cash below PPS however also can develop bigger by having adjoining companies (ASIC manufacturing, and many others.).

Full-Pay-Per-Share (FPPS): Miners earn the PPS rewards in addition to their share of transaction charges upfront (e.g., no matter whether or not the pool discovered a block). Charge income shouldn’t be auditable — charges are taken as a mean and primarily based on belief within the pool operator.

Pay Per Final N Shares (PPLNS): Miners earn charges primarily based on the quantity of hash they contribute over a given variety of rounds. PPLNS swimming pools pay solely after successful a block.

There are a number of deviations from vanilla mining, with Marathon operating Slipstream, a notable personal channel for bypassing mempool requirements, and Ocean providing open templating to customers.Exterior of Slipstream and Ocean, swimming pools primarily use FPPS. Makes an attempt to make use of others have failed, as decrease per-hash income harms miner economics and centralizes Bitcoin. Wanting forward, miners will want visibility into templating as charges turn into extra vital to their companies. To maintain Bitcoin steady and decentralized, smaller miners will want a aggressive but auditable pool.

What’s the Form of Bitcoin Charges?

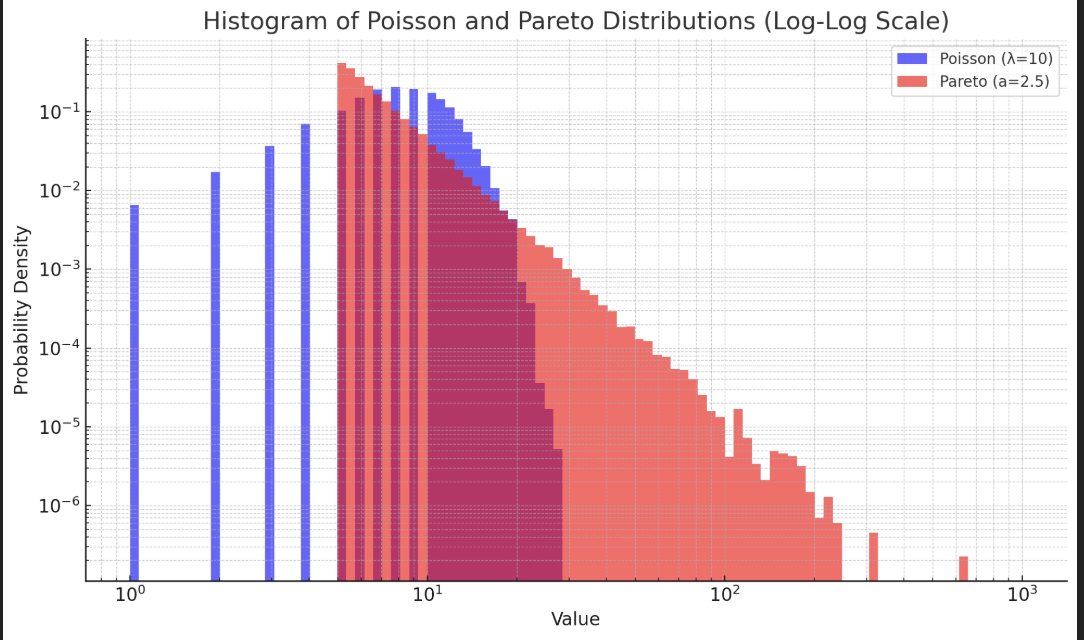

At present, Bitcoin has low charges. Most blocks are empty or just include vanilla UXTO spends or inscriptions. When charges do exist, they’re “spikey.”

In an setting with common demand (charges), there are scant incentives to reorg because the subsequent block additionally has charges. Nonetheless, deployments of recent contracts, ordinal mints or basic volatility (e.g., an change collapse) may cause large charge spikes, incentivizing reorgs.

Whereas Nakamoto consensus will finally finalize, it’s probably miners privately mine giant charges and try to reorg Bitcoin to steal high-fee blocks from different miners.

In both case (e.g., common charges or low common charges), these spikes in demand will result in hashrate consolidation as customers will more and more depend on bigger miners and swimming pools, pushing small miner to work for bigger ones.

Nonetheless, in our view, spikey charges might at some point be captured by smaller miners, lessening entrenchment. Particularly, below the correct payout and accountability scheme, small miners can band collectively to provide customers higher settlement assurances than bigger solo miners. Within the subsequent sections, we lay out this thesis and argue why we imagine Bitcoin ought to due to this fact embrace spikey charges.

Can and Will Mining Swimming pools Share Spikey Charges?

As talked about above, small miners at the moment depend on huge miners and/or swimming pools for charges. Designing an open or egalitarian pool that ensures charges are cut up pretty is tough within the absence of auditability. Whereas Bitcoin has and can keep away from most types of unauditable charges (e.g., arbitrage, personal order movement), out-of-band transactions stay unauditable.

In concept, strain from rivals might induce charge sharing — however in follow, dangerous knowledge, switching prices and verticalization push small miners to belief giant ones.

It’s price noting reordering of blocks is heightened by charges. Whereas Nakamoto consensus will finally finalize (uncling feather-forks), it’s probably miners privately mine giant charges and try to reorg Bitcoin to steal high-fee blocks from different miners. Customers could face delays as miners maintain transactions, whereas smaller miners may have a fair tougher time getting auditability.

What Can Stabilize Bitcoin Consensus With out Charges?

One potential repair is tacking accountability onto a federated pool. Accountability brings financial finality, decreasing reorg danger and bettering affirmation ensures. Critically, miners can nonetheless mine outdoors this pool with Bitcoin Core, guaranteeing liveness is preserved and letting the community progress and be validated by as many contributors as doable.

On this mannequin, miners cut up charges and supply joint, accelerated but accountable entry to Bitcoin. Customers would undergo this pool over a non-public one like SlipStream as a result of its reorg resistance and entry to extra miners, yielding increased inclusion and affirmation ensures. Whereas solo channels for nonstandard or susceptible transactions can persist, preserving race situations through accountability would give customers a aggressive but decentralized various.

Since finality is a helpful property for monetary apps and requires collaboration between miners, this pool will see a significant chunk of transactions. Accountability between its brokers will create fairer economics, driving rival swimming pools to share charges as effectively. In a phrase, we imagine expressivity rightly formed will stabilize Bitcoin through financial finality, quelling issues over community stability and making mining extra egalitarian.

Having checked out mining, we now flip to how expressivity might impression community stability.

Poolin’ in OP_CAT’s World

There are lots of proposed Bitcoin tender forks; utilizing OP_CAT as a proxy and starting with an AMM, we analyze how new opcodes could alter mining and the community extra broadly.

Be aware to reader: Within the following, we theorize about the way forward for Bitcoin during which Bitcoin has a local automated market maker (AMM) — a mathematical perform encoded on blockchains which permits decentralized buying and selling. AMMs are the primary supply of MEV (or MEVil) on blockchains, enabling each rivalrous arbitrage and recurring EOFs agreements.

A lot of the writing on this part attracts from “Unity is Energy” and “Balrogs and OP_CATs.”

State of affairs 1 (no AMM unlocked from tender fork)

On this situation, the community wouldn’t face the perils of arbitrage or EOF; with out an AMM, most MEV can be atomic or one-off (e.g., posting rollup knowledge, Ordinals). Whereas miners could verticalize, transactors will largely maximally broadcast transactions to get higher inclusion charges.

Once more, decrease issuance would break up bigger swimming pools, whereas new ones would want to offer higher auditability for use by small miners. Whereas untenable, mining might be an operational value for verticalized companies. As Matt Corallo factors out in “Cease Calling it MEV,” with out an AMM, MEV can be sandboxed into increased layers.

State of affairs 2 (tender fork additionally powers an AMM; leakage is minimal)

On this situation, an AMM is native to Bitcoin’s base layer. Because of the Bitcoin block time variance, dangerous costs are intrinsic, and orders are reorged and off typically. Furthermore, different complicated assaults and extra performant alternate options will make the AMM largely unused.

Merchants should commerce on the L1 for ideological or memantic causes, however with out substantial modifications to Bitcoin, it’s unlikely a Bitcoin AMM can be durably used and therefore create MEVil.

State of affairs 3 (AMM on L1; excessive leakage)

Whereas the world the place Bitcoin hosts its personal in style DEX appears unlikely, it’s price contemplating.

On this world, arbitrage and EOF agreements produce verticalization and aggregation of hashpower right into a superpool. The reliability of a bigger pool and the unique nature of each forms of extraction will create a tit-for-tat relationship between miner and extractor, making them primarily one actor. Most miners would be part of this pool, however have little management over its economics.

Nonetheless, this miner will face some limits on its measurement; Bitcoin’s worth is based on decentralization, so at a sure measurement, the actor would hurt itself. Moreover, PoW can let different miners outrace the pool, whereas geographic frictions counsel a number of exchanges or a number of EOF can thrive. Nonetheless, an AMM with any utilization would markedly worsen community well being.

We discover this unlikely:

Even when a DEX turns into possible, it will be extraordinarily restricted and reorg danger, variability in block occasions, and poor costs would maintain utilization low (for extra, see “The Spectre of MEV on Bitcoin”).

Bridge MEVil and Different Assaults

Past an AMM, some potential opcode-driven assaults are price highlighting. These embody:

51% assault on optimistic rollup: 51% of hashrate can induce assaults from optimistic rollups and BitVM bridges. A well-capitalized attacker might lease hash and brief bitcoin futures to revenue from censorship and bridge assaults. Any attacker would want to build up a excessive variety of ASICs, forgo future income and brick their machines. Notably, a zk-verification opcode (or probably simply OP_CAT) makes this assault infeasible.

Oracle assault: At present’s Bitcoin lenders self-host their very own oracles. Whereas presigned transactions make sure the oracle can not steal funds, if {the marketplace} additionally was the lender, they may liquidate collateral unfairly. Censorship of liquidations can also be doable.

After all, different assaults (akin to mass exit or loot assaults) exist and mapping all a priori is not possible. Few appear to worsen the numerousways Bitcoin may be poisoned at the moment, however different opcodes (like an opcode for zk-verification) can truly restrict assaults.

What Ought to We Assume About Different Opcodes?

Past OP_CAT, there are a bunch of paths for upgrading Bitcoin. Whether or not for Lighting, Ark, covenants, discrete log contracts or one thing else, opcodes like OP_CTV, OP_VAULT, unlock expressivity. Bitcoin can embrace opcodes so long as it grows charges with out creating economies of scale or exclusivity, and thereby maintain out the worst types of expressivity.

It’s our view that the majority expressivity — akin to a BitVM attestation chain or a Bitcoin rollup — will profit safety long-term with out true entrenchment. No fork is ideal, however by limiting extra rivalrous types of charge variance and creating new methods for the community to pay for its personal safety (with open types of MEV or with a type of income smoothing), Bitcoin can guard towards a decline in safety over the following few halvings whereas sustaining and even enhancing sovereignty.

There are a number of designs that may open income to miners:

Decentralized Alternate: With a SNARK verification opcode, miners might collectively function a fast-finality, BTC-denominated change, incomes settlement and buying and selling charges.

Rollup: A general-purpose, trustless, and verifiable sidechain, a Bitcoin-based rollup would pay for knowledge availability, in addition to finality. Miners can construct their very own rollups or work collectively. Whereas one miner might verticalize and dominate, geographic frictions counsel a number of miners can compete. Furthermore, with higher opcodes the rollup may be absolutely noncustodial, making the sidechain a greater various to centralized platforms (e.g., Celsius, FTX). Miners might even offset PoW prices with rollup charges.

Funds Chains: statechains or designs like Ark may have on-chain prices paid to miners and may additionally be a candidate for precedence finality through an accountable pool.

Notably, any of those designs tied to Bitcoin will want higher finality as issuance declines. By opening the door to accountable pooling, the door to egalitarian miner income widens. Once more, we imagine the choice to embracing verifiable and democratic miner income is bigger miners adopting hash-based types of expressivity (or clunkery, abominable work-arounds). As such, it appears prudent to prioritize designs that push miners away from dangerous types of expressivity.

The Mining World of Tomorrow

The siloed nature of personal channels and the shortcoming of miners to behave independently of or confirm giant swimming pools suggests pooling will fracture as issuance zeros. In tandem, with out inflation (no, tail issuance shouldn’t be a repair) and with out democratic charge sharing, hashrate will drop and consolidate.

In our view, this makes restricted, secure expressivity and egalitarian charges a key pursuit. Ought to expressivity develop, verticalized miners throughout distinct geographies can be greatest geared up to outlive as issuance dwindles. And with developments in accountable pooling, apps, rollups and others can bid for quick finality, giving miners income and stabilizing Bitcoin in return for different events getting safe, precedence entry to at the moment’s most pristine asset.

Going ahead, we count on to see a market considerably much like mevgeth to evolve. Underneath this market, bundles of transactions which symbolize “spikey income” (e.g., Ordinals mints, knowledge from rollups, and many others) may be submitted to miners through a pool. The diploma of openness of this pool to abnormal miners, together with its accountability, will, in lots of respects, decide Bitcoin’s sturdiness.

Neither rejecting nonstandard transactions (charges) nor personal channels (which produce large hashrate focus) is a solution to Bitcoin’s dwindling safety finances.

If Bitcoin needs to cross the chasm from digital retailer of worth or gold equal to digital peer-to-peer money, opening the door to utility that unlocks even-handed satsflow to miners is vital. As long as charges unlocked by a tender fork end in atomic transactions, one-shot off-chain agreements, and self-referential MEV from miner-supported apps (and, extra critically, not unique or entrenching), income can be moderately open and easy for miners, permitting bitcoin’s distinctive shortage to compound right into a digital medium of change through its personal functions and trust-minimized sidechains.

Maybe most significantly, failure to evolve secure expressivity implicitly embraces much less worthy types. With out dependable miner charges, much less safe, much less sustainable and fewer democratic types of expressivity will proliferate among the many greatest miners, whereas smaller ones merely shut store.

BM Huge Reads are weekly, in-depth articles on some present subject related to Bitcoin and Bitcoiners. If you’ve gotten a submission you suppose suits the mannequin, be happy to succeed in out at editor[at]bitcoinmagazine.com.

Walt Smith is a visitor writer and associate at Customary Crypto. Lively in Bitcoin since 2019, Walt beforehand led U.S. ventures at Cyberfund and labored at Galaxy in New York Metropolis. A Colorado native, he studied Austrian Economics at Grove Metropolis Faculty in Pennsylvania.

Opinions expressed are completely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.