When Stablecoin L1 Plasma goes dwell, billions in liquidity observe, placing new strain on XPL’s first-month buying and selling vary.

Plasma, a Bitfinex-backed Layer 1 blockchain constructed for stablecoins, launched its mainnet beta and native token XPL on Sept. 25. The rollout included integrations with main DeFi protocols and fast listings on main exchanges, signaling a powerful market entry.

The brand new international monetary system is right here. pic.twitter.com/pkpXia30FS

— Plasma (@PlasmaFDN) September 25, 2025

At launch, XPL traded simply above $1, however worth motion confirmed sharp swings as early patrons examined liquidity.

(Supply: Coingecko)

Stablecoin inflows on the chain picked up shortly, spreading exercise throughout Uniswap, PancakeSwap, and centralized exchanges reminiscent of Binance, OKX, Bitget, and Bitfinex.

Plasma’s positioning is exact: it needs to be a high-throughput, low-cost “cash chain” designed to host stablecoin exercise at scale. By securing each DeFi and centralized trade companions on day one, the challenge set the stage for fast adoption.

Why Are Merchants Linking Plasma to Tether’s Development Story?

Plasma’s mainnet debut got here with heavy backing from the stablecoin sector. The challenge says billions in liquidity are already dedicated by way of companions like Aave, Ethena, Fluid, and Euler.

On the identical time, tokenomics set a transparent framework: There’s a whole provide of 10 billion XPL, with about 1.8 billion circulating at launch. Public-sale patrons who paid $0.05 earlier this 12 months briefly noticed 20x paper good points as buying and selling opened.

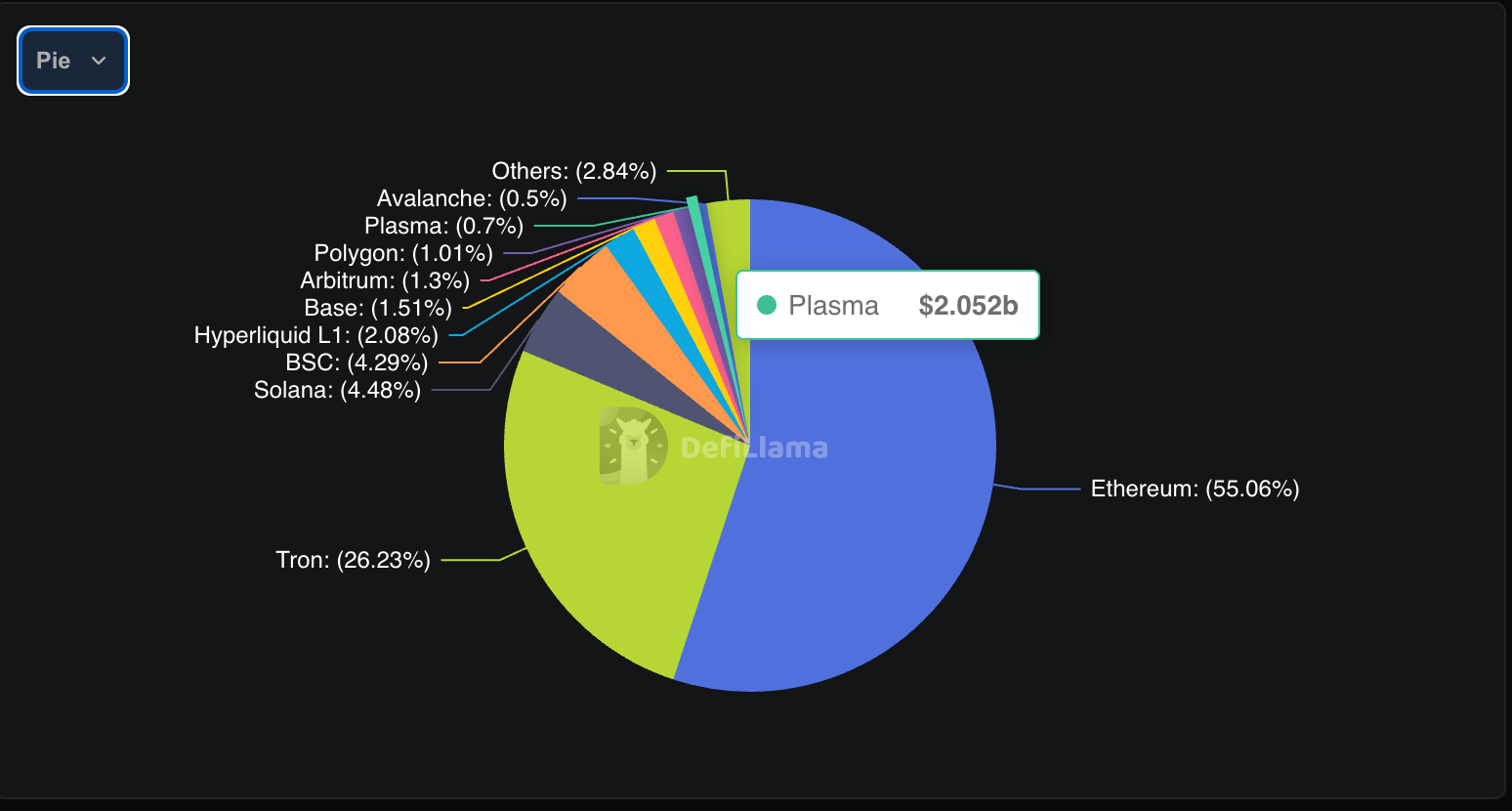

On-chain information highlights how Plasma is leaning right into a “liquidity first” technique. DefiLlama reveals roughly $2.05Bn in stablecoins lively on the community, whereas decentralized trade exercise stays gentle.

(Supply: DeFiLlama)

(Supply: DeFiLlama)

Day by day charges had been modest, round $4,200, underscoring that utilization past stablecoin rails will take time to develop.

To widen its attraction, the ecosystem launched merchandise designed to create demand. Swarm, a regulated DeFi platform, plans to listing 9 tokenized equities, together with Apple, Microsoft, Tesla, and MicroStrategy, for twenty-four/7 buying and selling in opposition to stablecoins.

Plasma additionally launched Plasma One, a “stablecoin-native neobank” focusing on areas such because the Center East, the place dollar-backed digital property already see heavy use.

Introducing Plasma One: the one app in your cash. pic.twitter.com/5IgcCon5g8

— Plasma (@PlasmaFDN) September 22, 2025

Nonetheless, valuation and float stay key factors of debate. The launch implied a $10Bn absolutely diluted worth, however not all reported circulating tokens shall be obtainable instantly.

US sale individuals, for instance, received’t obtain allocations till July 2026, that means the near-term float is tighter than headline figures counsel.

Analysts say the challenge’s concentrate on stablecoins positions it as a proxy for broader market developments.

“Giant crypto alternatives like stablecoins at all times draw consideration,” one Delphi Digital researcher famous, including that merchants view Plasma as a option to faucet into Tether’s rising function in digital finance.

Tomorrow $XPL goes dwell with nearly poetic timing

(Tether elevating $20B at a $500B valuation, a number of onchain runners, and speculative capital apeing into new launches regardless of a shaky broader market.)

I believe Plasma has an opportunity to be a large cook dinner.

Let me break down why I…

— Simon (@simononchain) September 24, 2025

XPL Worth Prediction: Can XPL Realistically Attain $3–$5 as Some Analysts Predict?

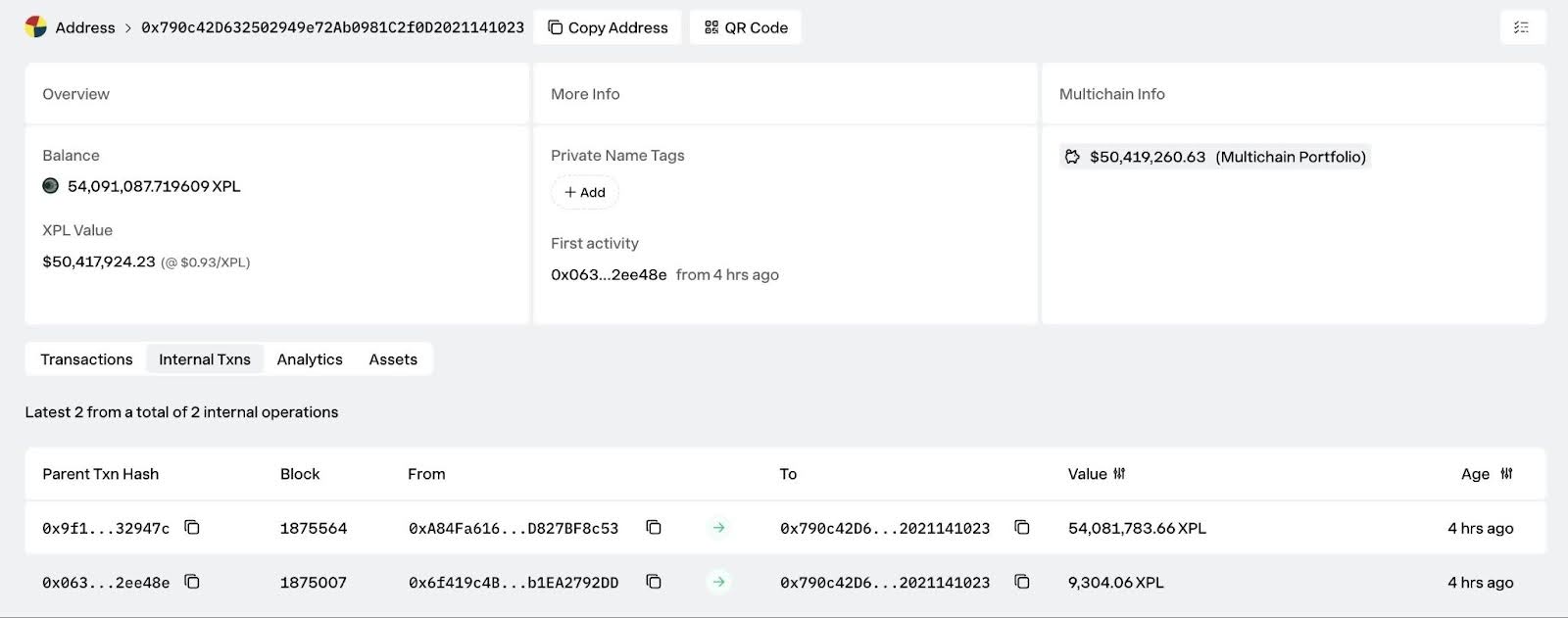

A crypto whale has booked one of many quickest good points of the 12 months on Plasma’s debut. On-chain information from Lookonchain reveals that pockets 0x790c deposited $50M in USDT through the challenge’s public sale, securing a $2.7M allocation at $0.05 per token.

Whale 0x790c deposited 50M $USDT into #Plasma and secured a $2.7M public sale allocation.

He purchased 54.09M $XPL($50.4M now) at $0.05 and is now sitting on an unrealized revenue of over $47.7M!

Tackle:0x790c42D632502949e72Ab0981C2f0D2021141023 pic.twitter.com/PHV45xKpKs

— Lookonchain (@lookonchain) September 25, 2025

The investor obtained 54.09M XPL, now value about $50.4M with the token buying and selling between $0.93 and $1.14, an unrealized revenue of $47.7M inside hours of launch.

The windfall highlights the surge of capital into Plasma as stablecoin liquidity flows into the community. Analysts say whale-sized entries can drive sharp worth swings and replicate early institutional curiosity within the chain.

(Supply: X)

XPL’s perpetual contract chart reveals why merchants are paying consideration. Worth broke out from the $0.70 zone to $1.16 in a single session, with patrons stepping in round $0.75–$0.80.

R4ped by my different longs. Rescued by $XPL. Due to this I believe $3-5 $XPL appears honest. https://t.co/BEuFgYi7GE pic.twitter.com/Y5H7iP54kz

— VikingXBT (@VikingXBT) September 25, 2025

Every resistance degree at $0.90 and $1.00 gave method after brief consolidations, a textbook signal of bullish momentum. Quantity spikes close to the $0.90 breakout counsel massive gamers had been concerned, echoing the sooner $50M whale deposit.

The transfer above $1.00 carried weight as a psychological barrier, confirming development energy. If momentum continues, chart targets are $1.50 and $2.00, with speculative discuss of $3–$5 within the medium time period. Dealer VikingXBT wrote on X: “Rescued by $XPL… I believe $3–$5 appears honest.”

(Supply: X)

Nonetheless, vertical rallies not often run unchecked. Revenue-taking might spark pullbacks, with fast help at $1.00 after which $0.90. Holding these zones would hold bulls in management.

For now, XPL’s breakout displays a mixture of whale backing, contemporary liquidity, and speculative hype round Plasma’s mainnet launch. Volatility is predicted, however the broader development stays firmly upward.

DISCOVER: Finest Meme Coin ICOs to Spend money on 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Why you may belief 99Bitcoins

Established in 2013, 99Bitcoin’s crew members have been crypto specialists since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Professional contributors

2000+

Crypto Initiatives Reviewed

Comply with 99Bitcoins in your Google Information Feed

Get the most recent updates, developments, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now