Be a part of Our Telegram channel to remain updated on breaking information protection

Pantera Capital is planning to lift $1.25 billion to transform a Nasdaq-listed firm into a number one SOL treasury agency that’s tentatively known as Solana Co.

That’s according to a report from The Info, which mentioned the crypto fund supervisor goals to lift an preliminary sum of $500 million, adopted by one other $750 million through warrants.

Warrants are agreements that give a capital supplier the precise to purchase firm inventory sooner or later at a worth established when the warrants have been issued.

If the $1.25 billion is raised and Solana Co. is created, it will mark the biggest devoted effort to date towards making a SOL treasury agency.

Pantera Capital is making ready a large $1.25B elevate to create a Solana-focused treasury agency, beginning with $500M in fairness and $750M in warrants. If profitable, this entity may maintain extra SOL than all present public company treasuries mixed.

On the similar time, corporations like… pic.twitter.com/vGHv47vypK

— ApeWitch (@ape_witch) August 26, 2025

“Digital Asset Treasury firms are an amazing instance of the unbelievable demand in public markets to get publicity to this dynamic house,” mentioned founder Dan Morehead, a former Goldman Sachs and Tiger International Administration dealer, on the Wyoming Blockchain Symposium final week.

Pantera Capital Has Already Deployed $300M Into Crypto Treasury Firms

This isn’t the primary crypto treasury associated growth made by Pantera Capital, which manages about $5 billion in belongings.

Earlier this month, the fund supervisor disclosed that it deployed roughly $300 million into digital asset treasury (DAT) corporations.

Within the disclosure, Pantera Capital mentioned that “proudly owning a DAT may supply the next potential in comparison with holding tokens immediately via an ETF.” It is because DATs are capable of generate yield via staking, which will increase their respective web asset worth per share.

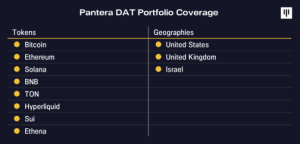

Among the firms that Pantera has added to its portfolio embody Twenty One Capital, DeFi Improvement Corp, and SharpLink Gaming, giving it publicity to cryptos that embody Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Binance Coin (BNB), Toncoin (TON), Hyperliquid (HYPE), Sui (SUI) and Ethena (ENA).

Pantera DAT portfolio (Supply: Pantera Capital)

The primary funding by the Pantera DAT Fund was in BitMine, which it mentioned has “a transparent strategic roadmap and the management to execute it.”

This week, Pantera additionally joined ParaFi Capital in backing Sharps Know-how, one other SOL-focused treasury agency concentrating on greater than $400 million in capital.

A number of Nasdaq-Listed Firms Creating Their Personal SOL Treasuries

Pantera’s transfer is the most recent in a rising variety of Nasdaq-listed corporations which might be turning their consideration to Solana with plans to construct their very own treasuries across the crypto.

Firms akin to Upexi, DeFi Improvement Corp and BitMining have all been accumulating SOL in latest months.

Knowledge from CoinGecko reveals that there are at present 5 firms throughout two international locations that collectively maintain 3,715,814 SOL valued at greater than $700 million. This equates to round 0.69% of SOL’s whole provide.

Upexi is the biggest of those Solana treasuries, with its holdings of two,000,518 SOL. This whole is after the corporate purchased one other 98,709 SOL within the final 30 days.

DeFi Improvement is the subsequent largest company SOL holder, with its holdings of 1,270,259 tokens. Just like Upexi, it additionally purchased extra SOL within the final 30 days, including one other 291,769 tokens to its reserves.

The one different firm to purchase extra SOL prior to now month is Exodus Motion, which is at present ranked because the fifth-biggest SOL treasury after its first buy of 34,578 SOL, in line with CoinGecko.

Regardless of the continued shopping for stress from public firms, the value of SOL has dropped barely over the previous month.

Whereas increasingly firms are beginning to create their very own SOL treasuries, the variety of these firms remains to be low in comparison with the 305 entities that at present maintain Bitcoin (BTC) on their steadiness sheets.

It’s additionally lower than the 70 firms that at present have an Ethereum (ETH) treasury and collectively maintain round 4.3 million tokens valued at over $19.12 billion.

Pantera Not The Solely Firm Trying To Make A $1B SOL Treasury Guess

Pantera’s $1.25 billion SOL Treasury play additionally follows on the heels of an identical transfer by crypto trade giants Galaxy Digital, Multicoin Capital, and Bounce Crypto.

In line with Bloomberg, the three crypto trade titans are in talks to lift $1 billion to construct their very own SOL treasury firm. Cantor Fitzgerald has been tapped because the lead banker, with the Solana Basis backing the deal as effectively. The deal may shut in early September.

The three firms plan to take an identical method to Pantera, changing an already-listed public firm right into a treasury entity.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection