By Heleen Wright

Apr 7, 2025

Govt Abstract:

Occidental Petroleum (OXY) delivered a standout efficiency in 2024, showcasing operational excellence that transcends mere numbers. File-breaking oil and gasoline manufacturing, coupled with a major surge in proved reserves, underscores OXY’s strategic prowess and dedication to maximizing shareholder worth.

Key Highlights: Operational Excellence in Motion

OXY’s 2024 achievements spotlight its operational energy:

Unprecedented U.S. Oil Output: 571,000 barrels per day, demonstrating superior extraction effectivity.

File-Breaking Whole Manufacturing: 1.33 million BOE per day, illustrating OXY’s substantial operational scale.

Surge in Proved Reserves: 4.6 billion BOE, a 15% year-over-year improve, signalling sturdy future manufacturing potential.

Progress Catalysts: Strategic Acquisitions and Monetary Power

OXY’s development trajectory is fuelled by strategic acquisitions, notably CrownRock, which expands its precious Permian Basin footprint. Robust free money circulation allows debt discount, constant dividends, and share buybacks, mitigating the influence of crude oil worth volatility.

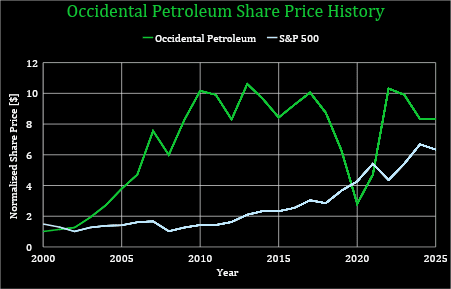

Knowledge: https://www.macrotrends.internet/shares/charts/OXY/occidental-petroleum/stock-price-history

Enterprise Mannequin: A Diversified Power Chief

Upstream Excellence: OXY excels in oil and gasoline acquisition, exploration, and growth throughout the U.S., Center East, and North Africa.

Chemical Innovation (OxyChem): A key producer of chlor-alkali merchandise and PVC/VCM, supplying important industrial inputs.

Built-in Midstream Operations: OXY manages vital pure gasoline and CO2 processing and pipeline infrastructure.

Strategic Partnerships: Supplying refineries, petrochemical crops, and different trade leaders.

Business Evaluation: Navigating Market Dynamics

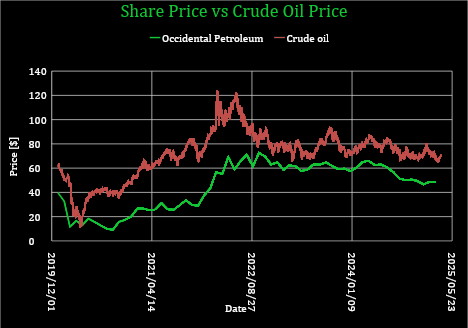

Crude Oil Worth Sensitivity: OXY’s income is intently tied to world oil costs. Current developments recommend potential upward momentum.

Macroeconomic Issues: Financial pressures and rate of interest fluctuations pose challenges, however Warren Buffett’s stake alerts robust market confidence. Geopolitical dangers stay an element.

Aggressive Positioning: OXY’s management within the Permian Basin, notably in Enhanced Oil Restoration (EOR), and its diversified portfolio within the DJ Basin and Gulf of Mexico, present a aggressive edge.

Opponents

Market Cap [$Billion]

PE

BP PLC (BP)

90.87

411.92

Chevron Company (CVX)

292.42

17.13

ConocoPhillips (COP)

130.25

13.12

EOG Sources (EOG)

70.12

11.26

ExxonMobil Company (XOM)

510.85

15.01

Shell (SHEL)

168.42

13.81

TotalEnergies (TTE)

134.09

9.1

Occidental Petroleum (OXY)

45.89

21.63

Common

180.36

64.12

Be aware: A one-time environmental legal responsibility impacted This fall 2024 earnings, affecting the P/E ratio.

Funding Thesis: Constructing Shareholder Worth

Monetary Resilience: OXY’s This fall earnings demonstrated operational resilience, with effectivity good points and debt discount offsetting income declines. Sturdy free money circulation helps strategic investments and shareholder returns.

Strengthened Monetary Place: Rising money reserves and asset development bolster OXY’s monetary stability, with fairness development projected for 2025.

Rising Dividend Attraction: The dividend, at present yielding 1.97%, is poised for additional development, enhancing investor returns.

Strategic CrownRock Acquisition: Enhances Permian Basin presence, with non-core asset divestitures to mitigate danger.

Operational Effectivity: Changing higher-cost reserves with lower-cost, higher-volume reserves demonstrates portfolio energy.

OxyChem’s Progress Initiatives: Plant enhancements and modernization initiatives are set to spice up money circulation.

Management and Recognition: CEO Vicki Hollub’s management and OxyChem’s security and environmental awards underscore robust administration.

Valuation:

Present valuations recommend a possible upside of 26%. Beneath the sensitivity of the inventory worth with decrease development charges. Market sentiment is constructive and strengthens the worth.

Progress

LT-growth

WACC

Honest worth

Vs present

Excessive

15.0%

3.98%

9.28%

$ 61.76

26%

Medium

13.0%

3.98%

9.28%

$ 57.96

19%

Low

8.0%

3.98%

9.28%

$ 49.26

1%

Common

$ 56.33

15%

E-book worth

$ 28.13

Present

$ 48.83

Danger Components: Navigating Business Challenges

Market Volatility: Oil and gasoline worth fluctuations pose vital dangers. See the robust correlation between the OXY inventory and oil costs within the graph beneath.

Regulatory Pressures: Rising environmental laws and legislative adjustments can influence prices.

Aggressive Panorama: Intense competitors can erode market share.

Knowledge: https://www.macrotrends.internet/1369/crude-oil-price-history-chart

Conclusion: A Compelling Funding Alternative

OXY’s strategic acquisitions, operational effectivity, and monetary energy place it for long-term development. Whereas market and regulatory dangers exist, OXY’s proactive administration and diversified portfolio make it a compelling funding.

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any specific recipient’s funding aims or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.