Key Takeaways:

The Bitcoin plan is rejected by the vast majority of Meta shareholders: Holding Bitcoin within the treasury was chosen by lower than 1% of the inhabitants.As an entire, the board and its members most popular to carry on to the $72 billion in liquid belongings and securities.Regardless of Bitcoin’s success and its mounted provide, crypto stays on the sidelines as a result of establishments are cautious of investing in it.

Shareholders of Meta voted almost unanimously towards a plan to analyze the potential for adopting Bitcoin as a reserve for the corporate’s treasury, aligning with present institutional sentiment on digital belongings. Even when crypto is rising in popularity, large IT corporations like Meta are nonetheless cautious in the case of managing their company treasuries.

Bitcoin Treasury Proposal: Crushed on the Polls

A proposal to analyze the potential benefits of investing a part of Meta’s $72 billion in marketable securities, money, and equivalents into Bitcoin was resoundingly rejected through the firm’s annual shareholder assembly on Could 28, 2025.

Ethan Peck of the Nationwide Middle for Public Coverage Analysis filed the movement, which requested the board to consider Bitcoin as a strategy to shield towards inflation and falling actual charges on conventional investments. Peck stated that Bitcoin could possibly be a greater retailer of worth than authorities bonds and different low-yielding investments because it has a hard and fast provide and has been going up in worth over time.

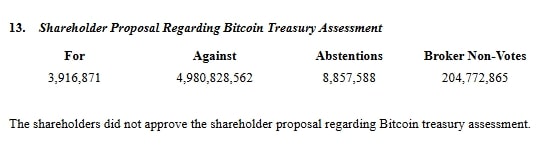

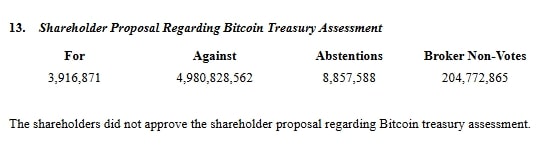

Nonetheless, the vote tally made it clear: institutional buyers and Meta’s management aren’t able to make the leap. In line with SEC filings, solely 3.9 million votes supported the proposal, whereas almost 5 billion votes rejected it, with over 204 million dealer non-votes recorded. The backing for Bitcoin amounted to lower than 0.1% of all votes forged.

Learn Extra: Texas Proposes Strategic Bitcoin Reserve Amid Push for Crypto Sovereignty

Meta’s View: No Want for Bitcoin, But

Meta’s board voted towards the request and gave a transparent purpose: there isn’t any strategic function to get into Bitcoin proper now. The corporate stated that its sturdy money administration procedures and sufficient liquidity framework had been sufficient to fulfill its working and progress wants.

Of their advice towards the proposal, the board said:

“Meta’s treasury technique is designed to protect capital, preserve enough liquidity, and earn a return acceptable to its threat profile. Bitcoin doesn’t align with this technique as a result of its volatility and regulatory uncertainty.”

This posture is in step with the conservative angle noticed at main know-how firms. Take Microsoft and Amazon as examples; in years previous, they too have rejected comparable recommendations.

Learn Extra: Solana’s Titan Meta-DEX Aggregator Launches Beta Platform for ELITE Customers

Institutional Resistance to Bitcoin: Three Core Points

1. Volatility Threat Stays a Dealbreaker

As a result of Bitcoin is so risky, large corporations nonetheless don’t use it. Despite the fact that Bitcoin’s worth has gone up by greater than 130% within the final 12 months, treasurers who’re anxious concerning the security of their cash nonetheless gained’t settle for the massive drops that the cryptocurrency has witnessed, such the 70% drop in 2022.

Bitcoin’s every day returns have an ordinary deviation of greater than 4%, which is way greater than U.S. Treasuries’ customary deviation of lower than 0.5%. Most firm finance departments need issues to remain the identical, not change.

2. Lack of Regulatory Readability

Latest occurrences, just like the debut of U.S. spot Bitcoin ETFs in early 2024, have made the asset class extra respectable, however there’s nonetheless an absence of regulatory readability. The IRS and SEC are constantly modifying the way in which they group crypto belongings. This might make it onerous for companies to maintain observe of their cash and meet the foundations.

3. Conservative Treasury Norms Dominate

Large Tech’s refusal reveals how all of them really feel: Firms gained’t present Bitcoin on their stability sheets till the foundations are clear and the market grows. Regardless of the potential advantages of cryptocurrency, institutional conservatism stays extra fashionable.

Evaluating to Different Tech Giants

Meta is just not alone. Related shareholder proposals had been voted down at Amazon and Microsoft previously two years. Apple, Alphabet, and Nvidia additionally proceed to keep away from digital belongings as treasury choices.

Since 2021, when Tesla made information for including $1.5 billion in Bitcoin on its financial institution sheet, it has bought off a variety of its belongings. The company hasn’t purchased any extra Bitcoin for the reason that first quarter of 2021, and it simply owns a bit quantity proper now.

Bitcoin is price virtually $1.5 trillion, but establishments nonetheless don’t use it as a typical treasury asset. This tendency reveals an even bigger reality concerning the market.

The Crypto Angle: Market Response and Business Response

The vote didn’t have a serious impact on the markets, nevertheless it did spotlight that Bitcoin nonetheless has an extended strategy to go earlier than establishments will undertake it. BTC costs stayed at $68,200 after the vote, which confirmed that merchants had already predicted the decision.

Specialists in cryptocurrency remarked that whereas if Meta’s selection wasn’t a shock, it nonetheless highlights how completely different crypto followers and enterprise persons are.

Some individuals who favor the mission, then again, warn that these conservative concepts might imply lacking out on long-term advantages. Bitcoin has gone up greater than 5,000% since Meta’s IPO in 2012, making it higher than virtually all different conventional monetary belongings.