At its March assembly, the Fed stored charges regular at 4.25-4.50%. Don’t pop the champagne but, although. The Fed additionally signalled it’s not declaring victory on inflation: officers nudged their inflation forecasts greater and trimmed progress expectations, citing a “extremely unsure” outlook. Translation? The outlook’s nonetheless foggy, and people inflation-fuelling tariffs aren’t serving to.

What It Means For Your Cash:

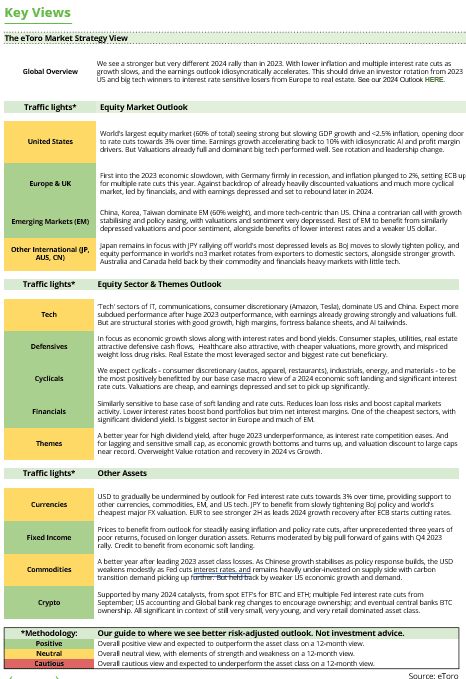

Greater-for-longer charges remind us to be selective in shares – give attention to corporations that may thrive in a moderate-growth, moderate-inflation world.

Banks profit from greater internet curiosity margins (they earn extra on loans vs. what they pay on deposits), and insurers can earn extra from investing premiums.

Shopper staples are inclined to have dependable money movement and might move some inflation on to customers.

Healthcare demand is non-cyclical — folks want meds and procedures no matter charges. Many healthcare corporations have secure money flows and pricing energy.

Not all tech will get punished in a high-rate world. Money-generating companies with robust moats and price management can nonetheless outperform. Cloud, cybersecurity, and AI-infrastructure gamers stay long-term winners.

To keep away from: 1. Excessive-growth, no-profit tech that get hit hardest by greater low cost charges. 2. Actual property (particularly industrial REITs) + greater charges = dearer debt, decrease property values. 3. Extremely leveraged sectors – companies loaded with debt see earnings eaten up by greater curiosity prices.

Earnings Season: Huge Names, Small Surprises

Nike, FedEx, and Accenture all upset—and Wall Road seen.

Nike expects additional income declines, nonetheless untangling final 12 months’s stock overload and seeing weaker demand. Trump’s tariffs on China and Mexico might contribute to a pointy decline in profitability. Nike imports 18% of its Nike-branded footwear from China, which Trump has levied a further 20% tariffs on.

FedEx is navigating greater prices and a dip in world delivery volumes as companies cool their spending.

Accenture? Down 13% year-to-date after company purchasers hit the cancel button on huge contracts (coupled with DOGE-related cancellations)– a doable signal that the company spending frenzy of the previous few years is easing up.

What’s occurring? If folks aren’t snapping up sneakers like they used to, or shippers like FedEx are seeing fewer packages, it factors to a broader financial cooldown on the horizon. However right here’s the silver lining: a gentle slowdown may be precisely what the Fed (and long-term buyers apprehensive about overheating) want to chill inflation with no arduous touchdown. And context is essential: all three corporations have weathered slowdowns earlier than. Every continues to be a dominant participant in its area, with stable long-run prospects. The cautious indicators from Nike, FedEx, and Accenture remind us to keep watch over the broader financial system’s pulse.

Bottomline: For long-term buyers, dips in confirmed names attributable to short-term headwinds may even be alternatives. In the event you’ve executed your homework and consider in an organization’s long-term story, a 5% drop on an earnings miss may be an opportunity to purchase at a reduction. Simply make sure that these short-term points (weak shopper demand, greater prices, and many others.) don’t threaten the corporate’s long-term aggressive edge.

PMI Knowledge in Focus: Can Main Indicators Rebuild Investor Confidence?

Traders Searching for Path: Market contributors are dealing with many questions within the present setting – and rightly so. Trump stays the largest uncertainty issue, casting a thick fog over the markets. Many buyers really feel at the hours of darkness, trying to find readability and orientation. Volatility has elevated considerably in latest weeks, notably within the U.S.. Based on the RSI, the S&P 500 futures have been as oversold on the day by day chart as they have been final seen in September 2022, following the latest sell-off. Even the just lately robust European inventory market hasn’t been immune. Whereas the swings have been much less pronounced, the STOXX Europe 600 just lately skilled a 5% dip – a transparent signal that world uncertainty is spreading.

Shifting Market Circumstances: Whereas some buyers see latest value weaknesses as shopping for alternatives, others consider the correction is much from over. The Fed’s message final week captured the dilemma buyers presently face: uncertainty makes forecasting extraordinarily troublesome. That doesn’t imply the market is collapsing—however the setting has clearly modified. Volatility is again, and it’s probably right here to remain. Relatively than panicking, buyers ought to adapt and get used to the brand new circumstances. In any case, Trump will stay a serious market issue for practically 4 extra years.

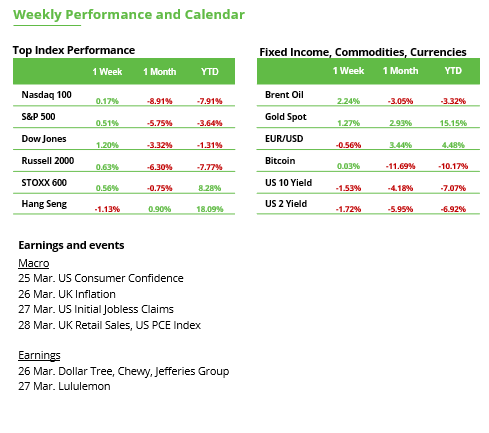

PMI Knowledge as a Actuality Test: Main indicators aren’t the holy grail, however they provide a helpful glimpse into what’s forward. On Monday, the March PMI information for Europe and the U.S. might be launched and will function a well timed actuality verify for buyers. Within the U.S., the image has shifted in latest months (see chart under). The manufacturing sector (52.7) has managed to recuperate from its downturn, whereas the companies sector (51.0) continues to indicate indicators of weak point. The same development could be seen in Europe, although with a key distinction: manufacturing stays in recession territory (47.6), whereas the companies PMI is hovering nearer to the impartial 50 mark (50.6). Traders ought to watch carefully for brand new momentum or vital deviations from expectations. The principle focus stays on inflation dangers, notably these linked to rising tariffs.

Federal Council Approves Germany’s Monetary Package deal: The deliberate €1 trillion in new debt might be financed by way of numerous channels. Infrastructure and local weather investments might be funded by way of a particular fund, whereas protection, safety, and assist for Ukraine might be coated by a relaxed debt brake. The muted market response within the DAX, euro, and German authorities bonds means that the elevated public spending was largely priced in. One factor is obvious: curiosity prices will rise and put long-term stress on the federal price range. A powerful financial restoration might be important to maintain the debt manageable—for now, markets stay hopeful that Germany’s financial system will rebound considerably within the coming years.

Bottomline: Traders ought to take the Trump issue significantly, however not panic. The secret’s to remain calm and suppose long-term. Rising volatility additionally presents new alternatives—those that stay versatile can profit. Consideration must also be paid to the differing dynamics between the U.S. and Europe. The upcoming PMI information might be an vital indicator. Germany’s monetary package deal could present a short-term increase, however what actually issues is whether or not the investments are focused and successfully applied to assist sustainable progress.

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any specific recipient’s funding goals or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.