MEXC and OKX are international crypto exchanges that provide spot, futures, and different primary and superior buying and selling instruments to inexperienced persons and skilled merchants alike. Since these exchanges have related product choices, it may be difficult to find out which one is healthier.

So, on this MEXC vs OKX assessment, we are going to spotlight every platform’s key options, charges, execs and cons, safety features, referral program, and extra. Then examine each crypto exchanges side-by-side that can assist you determine on the higher trade on your buying and selling wants.

MEXC vs OKX: Overview Comparability

StandardsMEXCOKXFinest ForBig selection of altcoins, excessive leverage, and superior buying and selling options.Deep liquidity and high-volume derivatives buying and selling.Launch 12 months20182017Key OptionsZero-fee pairs, Kickstarter, MEXC launchpad, demo buying and selling, and duplicate buying and selling.Algorithmic bots, OKX Pockets, copy buying and selling, demo buying and selling, and institutional companies.Buying and selling ChoicesSpot buying and selling and futures/perpetual contracts.Spot, margin, futures/perpetuals, choices buying and selling.Supported Cryptocurrencies3,000+400+Buying and selling Charges (maker and taker)Spot: 0.00% and 0.05%

Futures: 0.08% and 0.10%

Spot: 0.00% and 0.02%

Futures: 0.02% and 0.05%

Safety MeasuresChilly storage, 2FA, insurance coverage fund, and multi-signature pockets.Chilly storage, 2FA, insurance coverage fund, and multi-sig pockets.Native TokenMX Token (MX)OKBCellular AppiOS and AndroidiOS and Android

What’s MEXC?

MEXC is a worldwide cryptocurrency trade based in 2018. The trade has a low profile by way of founder identification, however it was launched and is at the moment led by a group of pros with backgrounds in blockchain know-how, finance, and cybersecurity.

The platform provides a wide selection of companies, together with spot buying and selling, futures, margin buying and selling, launchpad, demo buying and selling, and staking, giving customers entry to over 3,000 digital property and buying and selling pairs. MEXC Change is widespread for its high-performance buying and selling engine able to processing 1.4 million transactions per second.

Merchants additionally select MEXC for its extraordinarily low buying and selling charges, deep liquidity, and dedication to itemizing rising tokens early. This dedication is one cause MEXC has gained reputation worldwide, serving over 40 million customers throughout greater than 170 nations and amassing $6+ billion in every day buying and selling quantity in keeping with CoinMarketCap.

Professionals & Cons of MEXC

ProsConsLarge choice of cryptocurrencies, together with new and trending tokensRestricted fiat on-ramp choices in comparison with bigger exchangesLow buying and selling charges for each spot and futures marketsThe interface can really feel advanced for inexperienced persons, particularly with the in depth merchandise the trade providesThe verification course of is fast, permitting customers to register with solely an e mail and a password.MEXC is restricted in some areas, together with the US.Excessive leverage choices of as much as 500x for futures buying and sellingQuick commerce execution and deep liquidityFrequent token listings and promotional campaigns

MEXC is greatest for:

Merchants who need entry to all kinds of cryptocurrencies and new token listingsFutures and derivatives merchants who want excessive leverage of as much as 500x leverage and superior buying and selling instrumentsRookies and high-volume merchants who need to profit from low buying and selling charges.Rookies and superior merchants alike, due to its user-friendly interface and professional-grade options

What’s OKX?

OKX, previously generally known as OKEx, is a number one cryptocurrency trade launched in 2017 by Mingxing “Star” Xu. Headquartered in Seychelles, the trade was created to supply a complete digital asset ecosystem that features spot buying and selling, futures, perpetual swaps, choices, and DeFi merchandise.

OKX is among the most generally used crypto exchanges globally, serving hundreds of thousands of customers in over 100 nations and recording over $5 billion in every day buying and selling quantity in keeping with CoinMarketCap.

Whereas OKX provides trade companies, together with buying and selling bots, spot buying and selling, and derivatives merchandise, what units it aside is its strong buying and selling infrastructure, multi-chain pockets, and dedication to Web3 improvement by merchandise like OKX Pockets and OKX Chain.

Professionals & Cons of OKX

ProfessionalsConsSuperior buying and selling instruments and a professional-grade interfaceDoesn’t supply trade companies in the US. Sturdy safety infrastructure and clear operationsOccasional excessive community charges throughout peak occasionsBroad product vary together with spot, futures, choices, and DeFiRestricted fiat buying and selling choicesBuilt-in Web3 pockets and multi-chain ecosystemAdvanced and superior options might overwhelm new merchantsAggressive buying and selling charges and excessive liquidityThe corporate has its personal native blockchain (X Layer), which ensures sooner and cheaper transactions.

OKX is greatest for:

Skilled and institutional merchants searching for superior buying and selling instruments, derivatives merchandise, and deep liquidityDeFi and Web3 fans who need to discover decentralized apps, staking, and NFTs by way of the OKX PocketsBuyers searching for numerous incomes alternatives like financial savings, staking, and twin funding merchandiseRookies in search of an all-in-one platform for spot, futures, and passive revenue merchandise, in addition to entry to the web3 ecosystem and powerful instructional help.

MEXC vs OKX: Buying and selling Options

FunctionMEXCOKXBuying and selling ChoicesSpot and futures/perpetualsSpot, margin, futures/perpetuals, and choicesLeverage (futures/perpetuals)As much as 500x on main cash/pairs.As much as 125x on choose pairs.Margin Modes Cross and remoted margin; helps Hedge mode (holding lengthy and brief in the identical contract).Has single-currency cross margin, multi-currency cross margin, and so forth.Buying and selling BotsSureSureToken Launch PlatformSure, MEXC launchpad. Customers can take part by the MEXC launchpool and Kickstarter.Sure, Jumpstart.StakingSureSureCopy Buying and sellingSureSureDemo Buying and sellingSureSure

MEXC vs OKX: Platform Merchandise and Companies

MEXC and OKX have some key options that make them appropriate for various merchants. Let’s discover these options intimately.

What MEXC Gives:

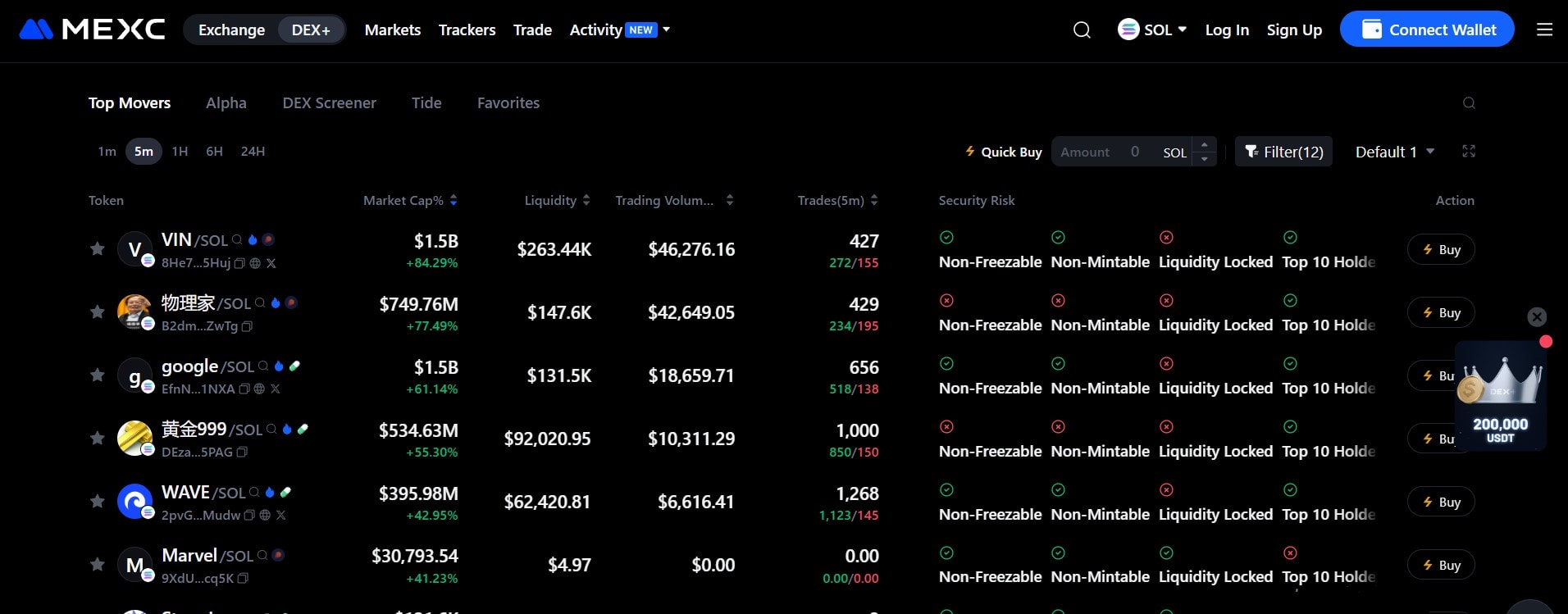

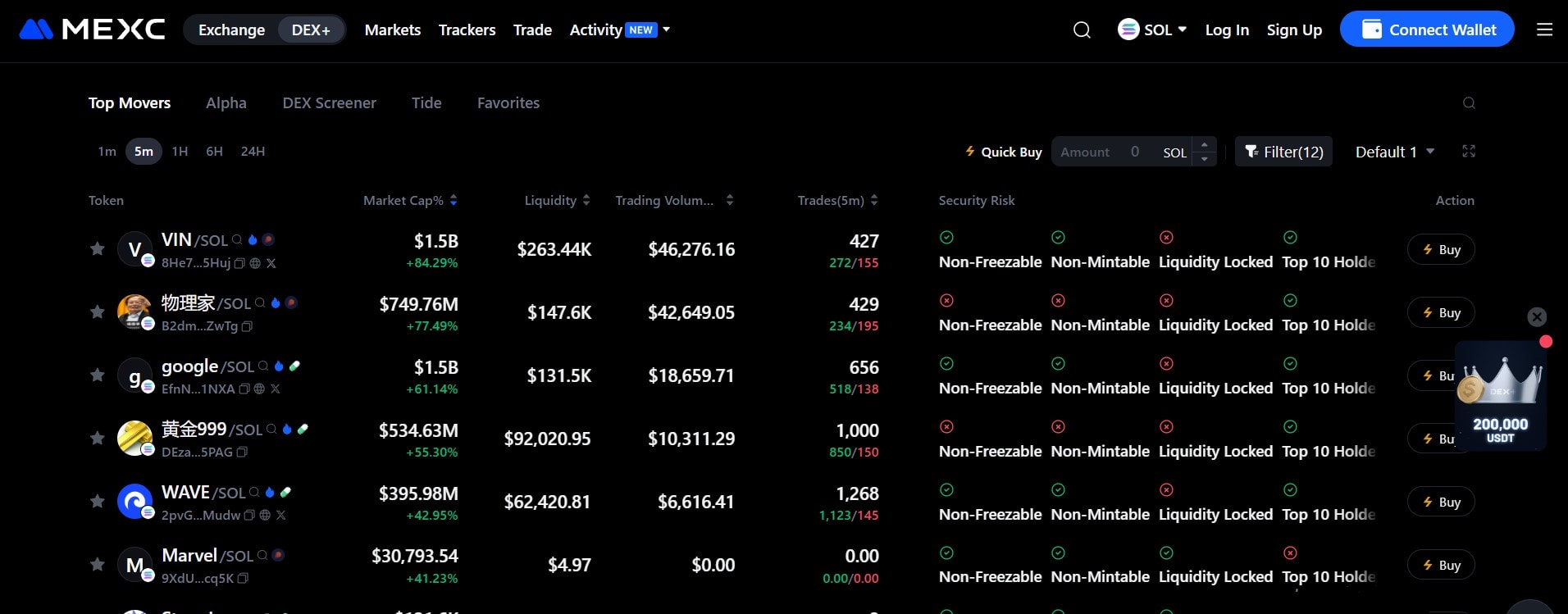

Excessive Leverage: MEXC provides excessive leverage choices, as much as 500x on sure futures contracts, permitting merchants to amplify their positions and potential earnings.DEX+ is MEXC’s decentralized trade integration that enables customers to commerce instantly from their wallets whereas sustaining management of their property. DEX+ combines the safety advantages of DeFi with the liquidity and pace of a centralized platform.

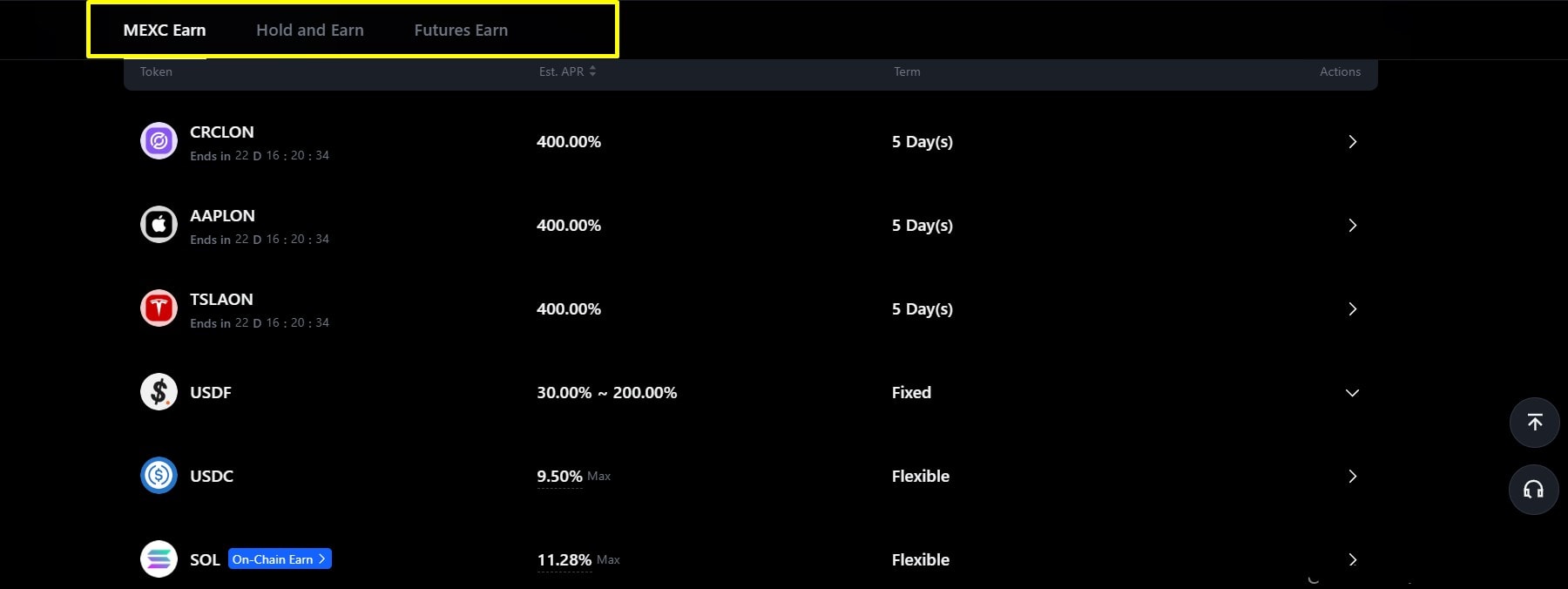

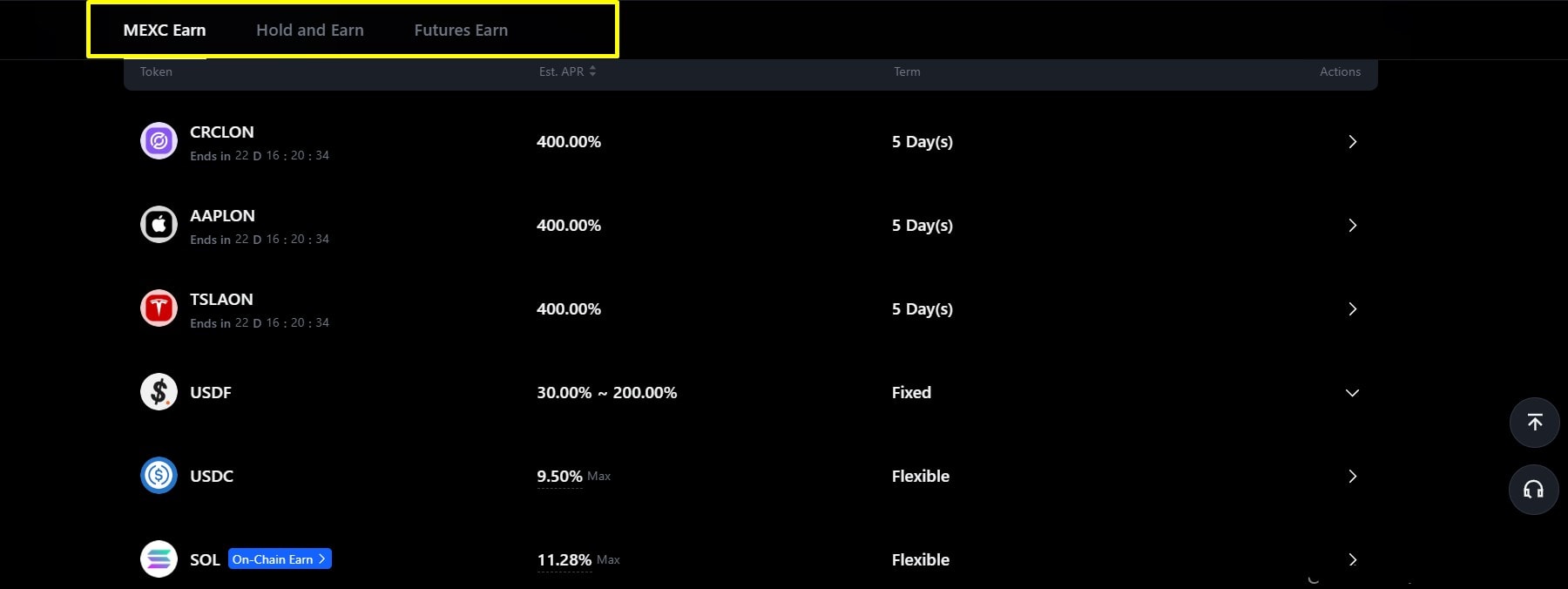

MEXC Launchpad and Launchpool: The Launchpad helps new blockchain tasks introduce their tokens to the market. By MEXC launchpool, merchants can take part in early-stage token gross sales and achieve entry to promising new tasks earlier than they’re listed.MEXC Earn: provides each locked and versatile financial savings merchandise that permit customers earn passive revenue on their idle crypto. Versatile financial savings enable withdrawals anytime, whereas locked financial savings present increased returns for customers who commit their funds for a set interval.

What OKX Gives:

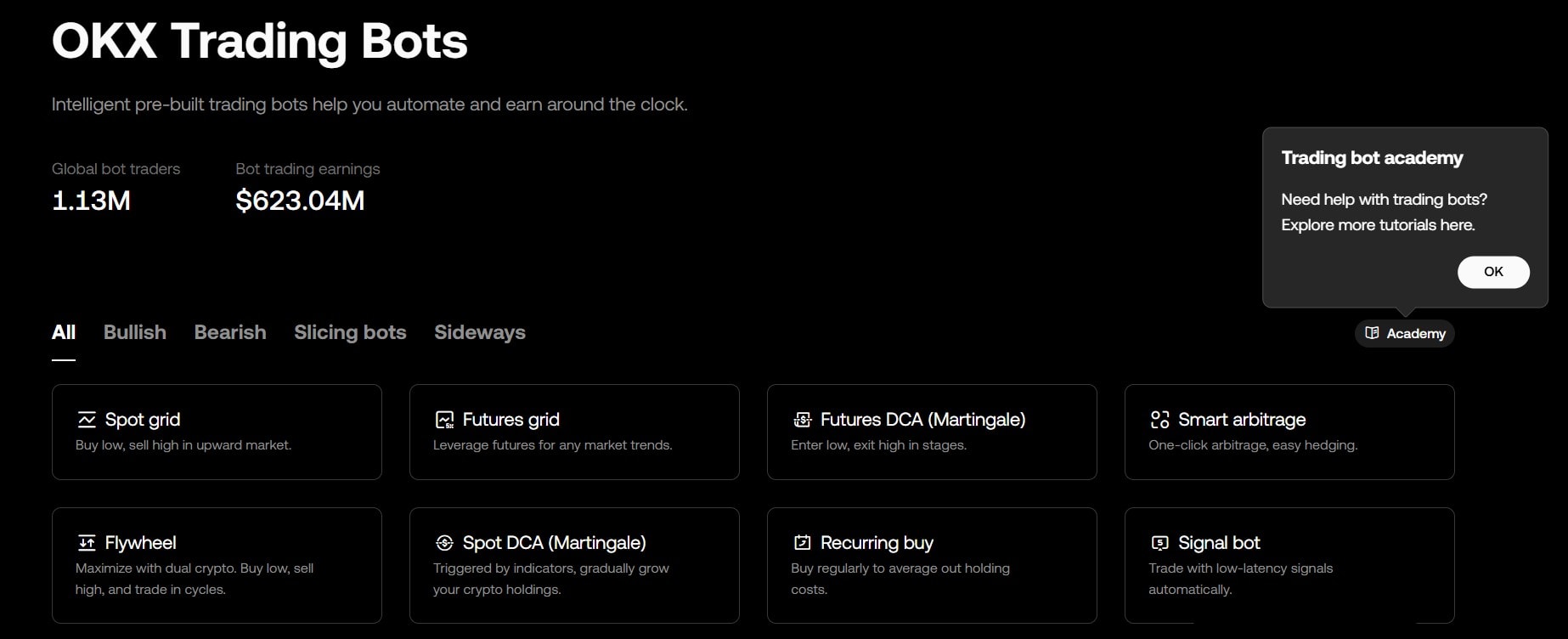

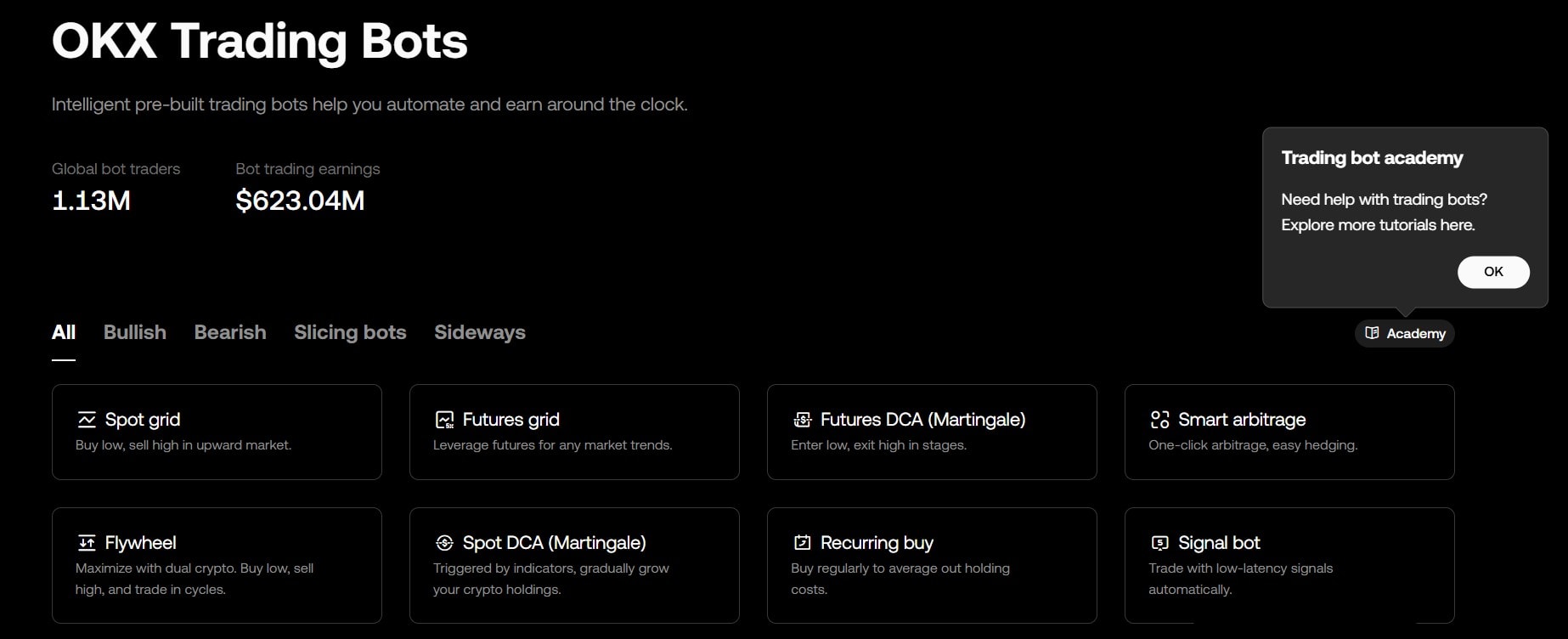

Buying and selling Bots: OKX provides automated buying and selling bots that assist customers execute trades based mostly on pre-set methods with out fixed guide monitoring. These embrace spot grid bots, futures grid bots, DCA (Greenback-Value Averaging) bots, and arbitrage bots.

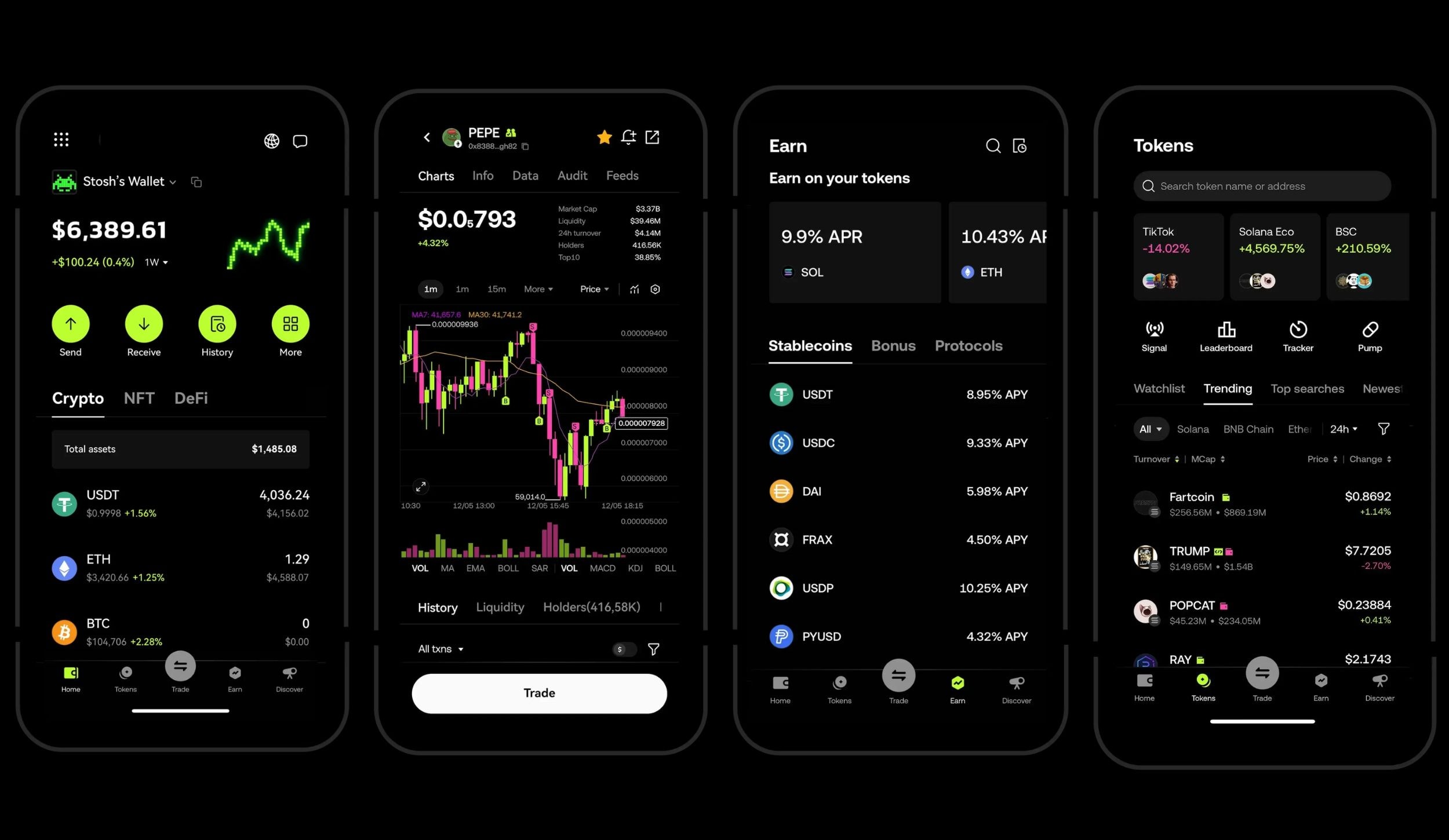

OKX Earn: OKX Earn provides a variety of merchandise, together with financial savings and staking, crypto loans, and entry to an on-chain lending market. You’ll be able to select between versatile or fastened phrases to earn curiosity in your holdings, stake tokens for community rewards, or lend property to debtors for extra yield alternatives.OKX Pockets: The OKX Pockets is a self-custodial, multi-chain pockets that enables customers to retailer, commerce, and handle their crypto and NFTs securely. It helps hundreds of tokens throughout 30+ blockchains, enabling customers to entry DeFi platforms, dApps, and Web3 video games instantly.

Jumpstart: OKX Jumpstart is the platform’s token launch platform that enables customers to take part in early-stage blockchain tasks. It provides customers entry to new token gross sales or airdrops by staking OKB (OKX’s native token).

Among the many related companies OKX and MEXC supply are institutional-grade instruments and options for hedge funds, asset managers, {and professional} merchants. These companies embrace superior APIs, personalized API entry, deep liquidity swimming pools, devoted account managers, and over-the-counter (OTC) buying and selling.

MEXC vs OKX: Payment Buildings

PaymentMEXCOKXSpot (maker/taker)0.0000% and 0.0500%

As much as 50% low cost obtainable for MX token holders.

0.080% and 0.100%

Reductions can be found by way of tiered VIP ranges.

Futures (maker/taker)0.000% and 0.020%

0.020% and 0.050%Deposit ChargesFree

FreeWithdrawal ChargesVaries by token and community

Varies by token and communityZero Payment PairsSure

Sure

ReductionsMaintain 500+ MX tokens and rise up to a 50% charge low cost. The MX token “deduction” additionally provides 20 % off.Tiered reductions based mostly on 30-day quantity plus OKB holdings.

MEXC vs OKX: Cash Supported, Liquidity & Quantity

StandardsMEXCOKXSupported Cash3,000+

400+Buying and selling Pairs2,000+ pairs (spot and derivatives mixed)

500 spot pairs and 400+ derivatives pairsMarket LiquidityDeep liquidity is offered for main pairs, though some smaller tokens might have comparable liquidity.Deep liquidity, particularly on main pairs. Additionally provides a Liquid Market for establishment/block trades to scale back slippage24-hour Buying and selling Quantity (CMC)$6,441,204,299

$4,911,631,568

Notice: All knowledge above replicate knowledge obtainable on the time of writing. Cryptocurrency market volumes and liquidity fluctuate often resulting from market volatility and buying and selling exercise. Please confirm present knowledge instantly on the respective trade web sites or crypto monitoring software program earlier than making any buying and selling choices.

MEXC vs OKX: Safety Comparability

Each MEXC and OKX prioritize safety by implementing strong safety measures to safeguard customers’ property.

MEXC Safety Measures

Chilly Storage: The Majority of person funds are saved in offline chilly wallets, minimizing publicity to on-line threats.Two-Issue Authentication (2FA): Provides a second layer of safety for login and withdrawals by Google Authenticator or SMS verification.Safety Insurance coverage Fund: MEXC has launched a $100 million “Guardian Fund” meant to supply person safety in opposition to main safety breaches, technical failures, and different extreme incidents. The fund is publicly disclosed on-chain in order that its stability and transactions are clear.Futures Insurance coverage Fund: The trade’s Futures Insurance coverage Fund (for derivatives/liquidation threat) exceeds USD 540 million, which is used to cowl losses when a person’s liquidation exceeds their margin, “damaging stability” occasions.

OKX Safety Measures

Chilly Storage: OKX shops 95% of person funds offline in extremely safe, air-gapped chilly wallets with encrypted personal keys and multi-signature approval processes for any actions.Account Safety: Person accounts profit from obligatory two-factor authentication (2FA) and withdrawal handle whitelisting, which requires pre-approval earlier than you’ll be able to ship funds to new addresses.AI-powered risk detection scans for fraudulent exercise, deepfakes, and faux profiles below the OKX Eagle Eye program.Semi-Offline Multi-Gadget Authorization: OKX shops its personal keys throughout a number of safe gadgets that aren’t related to the web (semi-offline). These gadgets use encrypted communication channels to signal transactions offline, that means the personal keys themselves by no means depart their protected setting or get uncovered on-line.

MEXC vs OKX: Affiliate & Referral Applications

StandardsMEXCOKXReferral Bonus (Join)As much as 10,000 USDTAs much as 10,000 USDT Buying and selling Payment Low cost (Referrals)50%30%Affiliate Commissions70% in your referrals’ buying and selling charges30% in your referrals’ buying and selling chargesFurther Perks for Associates10% fee for sub-affiliates and customized charges for high associates.Further rewards for high-volume associates, together with a 20% improve in fee.Payout Frequency for AssociatesDay by dayWeeklyPresent Referral Codemexc-NFTP98973395Necessary KYCSureSure

Professional Tip: Discover ways to use the MEXC referral code and OKX referral code to unlock as much as 10,000 USDT in welcome rewards.

MEXC vs OKX: Person Expertise

From our MEXC Evaluation, we discovered that onboarding on the crypto trade is fast and easy. You’ll be able to join with simply an e mail or cellphone quantity and a password. Whereas finishing KYC isn’t obligatory to discover MEXC’s merchandise, verified customers get increased withdrawal limits.

The cell app mirrors the options on the internet platform, supporting each spot and derivatives buying and selling, though the interface can really feel barely cluttered in comparison with OKX. MEXC’s buying and selling interface consists of customary order varieties, TradingView charts, and superior charting instruments. Customers additionally get entry to demo buying and selling, fiat on-ramps, and incomes merchandise.

Then again, our OKX assessment revealed that the platform has a extra structured onboarding course of that features KYC and extra safety setup, making it barely slower than MEXC however extra compliant. The interface is fashionable and not too long ago upgraded, providing a number of modes: Easy, Superior, and Web3. The cell app for iOS and Android is secure, responsive, and well-designed in comparison with the MEXC cell app.

OKX’s buying and selling interface provides superior order varieties, in-depth analytics, and complete instruments for derivatives, together with margin, futures, and choices. It additionally provides automated buying and selling bots, incomes merchandise, Web3 pockets integration, fiat on-ramps, and cross-chain options.

MEXC vs OKX: Buyer Help

MEXC offers 24/7 buyer help by stay chat, e mail, and a ticketing system, responding inside minutes by way of chat and inside 24-48 hours for e mail inquiries. Its Assist Middle options detailed buying and selling guides, safety sources, and API documentation, complemented by lively regional Telegram communities for casual help. It’s additionally one of the crucial language-friendly exchanges on the market, supporting over 40 languages throughout main areas.

Equally, OKX provides 24/7 help by chat and tickets, and a complete Assist Middle. Customers can start with automated responses and escalate to stay brokers, with common wait occasions of seconds for chat and about 10–quarter-hour for tickets.

The trade offers clear documentation on buying and selling, safety, and platform navigation, together with product tutorials. OKX at the moment helps round 15 main languages, giving international merchants quick access to assist at any time when they want it.

Conclusion

MEXC and OKX supply highly effective buying and selling and decentralized ecosystems that serve merchants in a different way. If you wish to discover new tokens and high-leverage buying and selling, MEXC offers primary and superior buying and selling instruments, in addition to a strong token launch platform that can assist you catch new/trending tasks earlier than they hit the general public.

Nevertheless, in case your focus is on high-volume derivatives buying and selling and clean navigation, OKX is a extra balanced selection. On the finish of the day, the perfect platform is the one which aligns along with your objectives and buying and selling fashion, so take time to discover their instruments.

FAQs

What Change is Higher Than MEXC?

To find out which trade is healthier than MEXC, it’s necessary to think about components like buying and selling charges, buying and selling pairs, liquidity, safety, person expertise, and regulatory compliance. Prime options to MEXC are OKX, Binance, Bybit, Bitget, and Coinbase.

Which Cryptocurrency Change has Decrease Charges: MEXC vs OKX?

MEXC has decrease charges in comparison with OKX. Though each exchanges cost low charges and supply zero charge pairs, MEXC expenses much less, inserting it among the many exchanges with the bottom transaction prices within the crypto market.

Which Change is Extra Newbie-friendly: MEXC or OKX?

MEXC is extra beginner-friendly. Whereas each exchanges supply numerous primary options for inexperienced persons, we think about MEXC extra beginner-friendly resulting from its easy-to-use interface, instructional content material, low charges, and enormous coin choice.

Which Crypto Change is Safer: MEXC vs OKX?

Each exchanges implement strong safety measures to maintain customers’ property secure. MEXC and OKX each retailer nearly all of person property in chilly/offline wallets with multi-sig approval, encouraging numerous account safety measures. Moreover, they each have an insurance coverage fund to reimburse merchants in case of breaches.

Which is Finest for Superior Merchants: MEXC vs OKX?

OKX is greatest for superior merchants. OKX and MEXC each supply merchandise and a platform which might be appropriate for seasoned merchants, however OKX is a stronger decide for skilled derivatives merchants.